Corporate Liquidations

Deans Knight

For a summary of the 2009 transactions challenged by CRA, see under Other – Loss Utilizations.

Overview

The Corporation, which had accumulated investment tax credits of $7M, non-capital losses of $19.4M and undeducted SR&ED expenditures of $34.4 as a life sciences company, disposed of the assets of that business in a 2008-2009 reorganization which was intended to avoid an acquisition of control of the Corporation, and then issued $100M of shares in an April 2009 IPO, so that it now was mostly owned by the new investors. The shares were required to be redeemed by the Corporation after five years (i.e., in April 2014). The proceeds were used to acquire a portfolio of high-yield corporate bonds. CRA is now proposing to reassess the Corporation $22.7M by denying use of the pre-2009 tax attributes. The Corporation will distribute most of its assets as a stated capital distribution of cash, net of a holdback to deal with the tax dispute.

Proposed reassessment

On 21 January 2014 the Corporation received a proposal letter from CRA:

In the Proposal Letter, the CRA stated that it intends to reassess the Corporation and deny the deduction of certain non-capital losses and other tax attributes in the Corporation's taxation years ending in 2009 to and including 2012… .[CRA] intends to deny the use of certain tax attributes by the Corporation on the basis that an acquisition of control of the Corporation occurred and on the basis of the General Anti -Avoidance Rule… . The Corporation, in consultation with its legal advisors, remains of the view that its tax filing position is appropriate… . The Corporation estimates the potential tax liability to be approximately $21.7 million… .

Distribution

Out of its assets of approximately $130M, the Corporation is planning to hold back $22.7M to satisfy the expected reassessment, a further $1.2M to pursue a tax appeal and to keep the Corporation going for up to four years, and to distribute all but $4M (in respect of remaining securities) of the remainder as a distribution of capital to its shareholders. The Corporation will then no longer satisfy the TSX listing requirements and will voluntarily delist.

Canadian tax consequences of distribution

The Corporation expects that the distribution will not give rise to a deemed dividend under the "Winding-Up Exception" in s. 84(2).

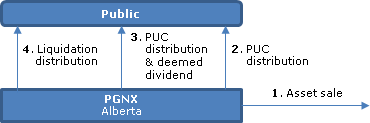

PGNX

Overview

The Corporation (an Alberta corporation listed on the NEX Board of the TSXV) sold substantially all its assets to Shoppers Drug Mart Inc. on May 22, 2012 for gross proceeds of $73.5M, and has or will distribute the net proceeds in three tranches: a stated capital distribution; a distribution that will only partly be a stated capital distribution; and a distribution pursuant to liquidation proceedings.

PUC distribution

On November 15, 2013, the Corporation made a $0.45 per share distribution as a return of capital pursuant to a special resolution to reduce the Corporation's stated capital.

Mixed distribution

On November 21, 2013, the Corporation's Board approved a distribution to the shareholders of $0.17 per share (the "Cash Distribution"). The shareholders are being asked to pass a special resolution (the "Capital Reduction Resolution") to authorize the Corporation to reduce its stated capital by the equivalent of $0.095 per share. This resolution "is intended to establish a portion of the Cash Distribution…as a return of capital." "Due bills" (see explanation on p. 4) will attach to the shares from two days before the record date (expected to be December 11, 2013) until the end of the payment date (expected to be December 19, 2013).

Liquidation Distribution

. A "Liquidation Resolution" would authorize a delisting of the shares from the NEX, the payment of remaining obligations, the distribution of remaining cash (the "Liquidation Distribution") of approximately $0.02 to $0.04 per share dependent inter alia on obtaining a CRA clearance certificate, and the Corporation's voluntary dissolution.

Canadian tax consequences

. Capital Reduction Resolution. If the Capital Reduction Resolution is approved by the shareholders, the distribution is anticipated to result in a deemed dividend of $0.075 per share ($0.17 -$0.095). Depending on a shareholder's adjusted cost base, the paid-up capital distribution of $0.095 could result in a (negative ACB) s. 40(3) gain. If the Capital Reduction Resolution is not approved, s. 84(4.1) may deem the entire distribution to be a dividend. Alternatively, "it is also possible, but there can be no certainty" that s. 84(2) will still apply to deem the applicable portion ($0.095 per share, being the estimated remaining PUC per share) to be a capital reduction.

Liquidation

Assuming that the Capital Reduction Resolution is approved, there is anticipated to be no remaining PUC at the time of the Liquidation Distribution, so that all of it would be a deemed dividend. There will be a disposition on the cancellation of shares on the final dissolution of the Corporation.

Trust liquidations

Dixie Energy

Overview

The Trust will sell all or substantially all its assets at the end of 2014, being oil and gas assets held indirectly by it, and distribute the remaining cash in at least two distributions in 2015 after settling liabilities.

The Trust

An Alberta unit trust trading on the TSXV which was established in June 2012 as a cross border energy trust (holding U.S. oil and gas assets through U.S. subsidiaries) and which has incurred losses.

Sale

An asset sale (apparently by U.S. subsidiaries although the Trust is party) is expected to close on 29 December 2014 for a sale price of U.S.$47.5M. Purchaser: Pine Energy Partners, LP. These gross proceeds will be reduced by U.S.$7.5M of U.S. dollar Trust liabilities including taxes, sales expenses and winding-up expenses, and applied next to Cdn$17.5M of Canadian dollar denominated liabilities (including loan repayments, taxes , sale transaction expenses and winding-up expenses.)

Distributions/Winding-up

After settlement of liabilities, the Trust will have distributable cash of between $0.46 and $52 per unit ($26.1M to $29.6M0. The initial distribution will be within 90 days of the closing of the sale and the remaining distribution(s) may occur within 12 months as part of the Trust winding-up.

Canadian tax consequences

The particular combination of capital and income paid on a particular distribution will be determined by the Trustee in its discretion. Description of flow-out of capital gains and income. Upon the disposition of Trust units in the course of the winding-up, the unitholder generally will be considered to have received proceeds of disposition equal to the amount distributed in excess of the amount which is distributed out of income or net capital gains of the Trust for that year.