DeeThree/Boulder/Granite Oil

Overview

Under an Alberta Plan of Arrangement, DeeThree will transfer its Brazeau Belly River assets (the "Spin-Off Assets") on a rollover basis to Boulder in connection with a butterfly spin-off of Boulder to its shareholders. DeeThree (renamed Granite Oil) will retain its assets in the Bakken formation. No tax ruling was sought, no indemnities were given respecting post-Arrangement actions that might cause the butterfly to be taxable and no Canadian tax risks were disclosed. The reorganization is expected to be treated as a qualifying Code s. 355 distribution on the basis of the form of the transactions being disregarded.

DeeThree

A TSX-listed Alberta oil and gas company with a market cap of $600M.

Boulder

A newly-incorporated Alberta subsidiary of DeeThree. A TSX listing application has been made.

Plan of Arrangement

- DeeThree common shares held by validly dissenting shareholders will be transferred to DeeThree.

- Out-of-the money options will be terminated and in-the-money options will be exchanged for replacement options on (post-spin off) DeeThree and Boulder shares.

- The articles of DeeThree will be amended to redesignate the DeeThree common shares as Class A common shares and to create DeeThree Special Shares.

- Each DeeThree shareholder will exchange its Class A common share for 1/3 of a DeeThree common share and 0.5 of a DeeThree special share.

- Each DeeThree Special Share will be transferred to Boulder in consideration for one Boulder common share, with the stated capital for the Boulder common shares increasing by the paid-up capital of the transferred DeeThree Special Shares.

- DeeThree will transfer the Spin-Off Assets to Boulder in consideration for assumption of liabilities and for Boulder Special Shares, with a joint s. 85(1) election being made.

- Boulder will purchase the Boulder Special Shares for cancellation in consideration for a non-interest-bearing promissory note.

- DeeThree will purchase the DeeThree Special Shares for cancellation in consideration for a non-interest-bearing promissory note.

- The promissory notes issued in 7 and 8 will be set off.

- The full amount of the deemed dividend arising upon the redemptions in 7 and 8 will be deemed to have been designated by Boulder or DeeThree, as the case may be, as an eligible dividend.

Canadian tax consequences

The exchange of Class A common shares for DeeThree common and Special Shares in 4 will occur on a rollover basis. The exchange of DeeThree Special Shares for Boulder common shares in 5 will occur on a rollover basis. (No reference is made to a potential income inclusion at the transferor's option under s. 85.1(1)(a).) Following the Arrangement, DeeThree will advise holders of an appropriate proportionate allocation of the adjusted cost bases between the DeeThree and Boulder common shares.

U.S. tax consequences

DeeThree expects that (i) the mechanics of the Arrangement will be disregarded and treated as if DeeThree had transferred the Spin-Off Assets to Boulder in exchange for Boulder common shares and the assumption of liabilities, and DeeThree had distributed all of the Boulder shares to its shareholders. (ii) DeeThree and Boulder each has been engaged in an "active trade or business' as defined in Code s. 355 for at least five years immediately prior to the Arrangement and such trade has produced income, and (iii) as a result the Arrangement will qualify as a tax-free transaction under Code ss. 355 and 368(a)(1)(D). On this basis, no gain or loss will be recognized upon the receipt by U.S. holders of DeeThree and Boulder common shares under the Arrangement.

FirstService/Collier

Overview

Under a spin-off s. 55(3.02) butterfly reorganization occurring under an OBCA Plan of Arrangement, the residential real estate and property services business of FirstService will be spun-off as New FSV (to be renamed FirstService), and (old) FirstService following its amalgamation with FCRESI will carry on the (retained) commercial real estate services division, with the amalgamated corporation to be called Colliers. Colliers and (spun-off) FirstServices will have pro forma opening equity of $65.5M and $158.7M, respectively, and will be highly levered. Completion of the arrangement is conditional inter alia on a Canadian tax ruling (respecting rollover treatment for FirstService, New FSV and most Canadian-resident shareholders) and a U.S. tax opinion of PWC respecting treatment as a Code s. 355 spin-off. Arrangements for a purchase of the shares of minority shareholders of FCRESI in exchange for Colliers shares will be entered into before the Arrangement, but will be timed to occur immediately after the butterfly distribution so as not to run afoul of s. 55(3.1)(a).

FirstService

An OBCA corporation whose (34.6M outstanding) FirstService Subordinate Voting Shares ("SVS"), which are listed on the TSX and NASDAQ, carry one vote per share and whose (1.3M outstanding) FirstService Multiple Voting Shares ("MVS") carry 20 votes per share and are convertible on a one-for-one basis into the FirstService SVS. It is controlled by Jay S. Hennick, the founder and CEO indirectly holding 6.6% of the SVS and 100% of the MVS, who provides management services through "Jayset." Minority shareholders hold 8.8% of a commercial real estate services subsidiary (FCRESI).

Pre-Arrangement transactions

The assets and liabilities associated with the residential and property services business of FirstService were transferred by it to FSV Holdco, a new B.C. subsidiary in exchange inter alia for a U.S.$187.5M note, which upon completion of the Arrangement will be repaid by New FSV drawing down under a line of credit and by the assumption of U.S.$150M of 2025 Notes. Outside of the Plan of Arrangement, the FCRESI Arrangements will be entered into under which, upon their becoming effective immediately after the commencement of FSV Holdco's dissolution under the Plan of Arrangement, FCRESI will become wholly-owned by FirstService and with the former minority shareholders of FCRESI holding Colliers Subordinate Voting Shares.

Plan of Arrangement

- FirstService Shares held by dissenting shareholders will be deemed to be transferred to FirstService;

- concurrently with the FirstService Share Exchange described below the FirstService stock options will be disposed of to New FSV and FirstService for replacement options, with the exercise prices being allocated based on the relative net fair market value of the property distributed to New FSV compared to the net fair market value of all property owned by FirstService immediately before the distribution;

- under the "FirstService Share Exchange" each FirstService Multiple Voting Share (after being amended to increase the votes to 40 per share) and FirstService Subordinate Voting Share (after being amended to increase the votes to two per share) will be exchanged respectively for one FirstService New Multiple Voting Share (having 20 votes per share) and one FirstService MV Special Share, and for one FirstService New Subordinate Voting Share (having one vote per share) and one FirstService SV Special Share, with a proportionate allocation of the stated capital of the exchanged shares occurring;

- each outstanding FirstService MV Special Share and FirstService SV Special Share will be transferred to New FSV (on a s. 85 rollover basis if so requested within 120 days by a shareholder that is a taxable resident Canadian, a non-resident whose shares are taxable Canadian property or a partnership with such a partner) in exchange for one New FSV Multiple Voting Share or one New FSV Subordinate Voting Share, with the stated capital of the new shares not exceeding any applicable s. 85 elected amount;

- FirstService will transfer the common shares of FSV Holdco to New FSV in consideration for 1,000,000 New FSV Special Shares having an aggregate redemption amount equal to the fair market value of the Distribution Property and with FirstService and New FSV to elect under s. 85(1) and with the stated capital of the New FSV Special Shares to be limited accordingly;

- New FSV will redeem the New FSV Special Shares for the New FSV Redemption Note;

- FirstService will redeem all the FirstService MV Special Shares and FirstService SV Special Shares held by New FSV in consideration for the FirstService Redemption Note;

- each Note will be repaid through the transfer to the creditor of the other Note;

- New FSV will resolve to voluntarily dissolve FSV Holdco under the BCBCA in accordance with s. 88(1);

- the stated capital of all the FCRESI shares will be reduced to $1;

- FirstService and FCRESI will amalgamate under the OBCA to continue as Colliers, with the Certificate of Arrangement deemed to be the certificate of amalgamation of Colliers and with each share of FCRESI held by FirstService cancelled.

Butterfly covenants

Acts of FirstService or New FSV listed on p. 61 that would cause the above butterfly to be taxable would trigger an indemnity obligation. In particular FirstService (which will then be Colliers) and New FSV, for a period of three years after the Effective Date of the Arrangement, will not (and will cause their subsidiaries to not) take any action, omit to take any action or enter into any transaction that could cause the Arrangement or any transaction contemplated by the Arrangement Agreement to be taxed in a manner inconsistent with that provided for in the Tax Ruling and U.S. Tax Opinion. With respect to Canadian income taxation, in addition to various transactions that the respective parties are prohibited from undertaking prior to and after the implementation of the Arrangement, after the implementation of the Arrangement, neither Colliers nor New FSV will be permitted to dispose of or exchange property having a fair market value greater than 10% of the fair market value of its property or, among other things, undergoing an acquisition of Control.

Canadian tax consequences

Increase in voting rights. The increase in voting rights for the FirstService Subordinate Voting Share and FirstService Multiple Voting Shares will not result in their disposition.

FirstService Share Exchange

The exchange of FirstService Subordinate Voting Shares for FirstService New Subordinate Voting Shares and FirstService SV Special Shares will result in a disposition at Adjusted cost base, with the allocation thereof between the FirstService New Subordinate Voting Shares and FirstService SV Special Shares to be based on relative fair market values of the shares immediately after the exchange – and similarly for the multiple voting shares. FirstService will post its estimate of the proportionate allocation by press release or on its website following the Arrangement.

Transfer to New FSV

The transfer of FirstService MV Special Shares and FirstService SV Special Shares to New FSV will occur on a rollover basis under s. 85.1 unless the transferor shareholder chooses to elect capital gains or capital loss treatment on the transfer or jointly elects under s. 85(1) or (2).

Amalgamation

No capital gain or loss will be recognized by a shareholder as a result of the amalgamation.

Dissenting shareholders

May be deemed subject to s. 55(2) to have received a dividend based on the paid-up capital of their shares.

RRSP eligibility

The Colliers Subordinate Voting Shares are expected to be listed when issued but, in any event, it will make the election under the postamble of s. 89(1) - public corporation from the beginning of its first year.

U.S. tax consequences

Code s. 355 is intended to apply to the transfer of the New FSV Shares to U.S. holders (notwithstanding that the form of the transactions is not a distribution), so that in general no gain or loss will thereby be recognized, and with the former tax basis being allocated on a relative fair market value basis.

Dundee/DREAM

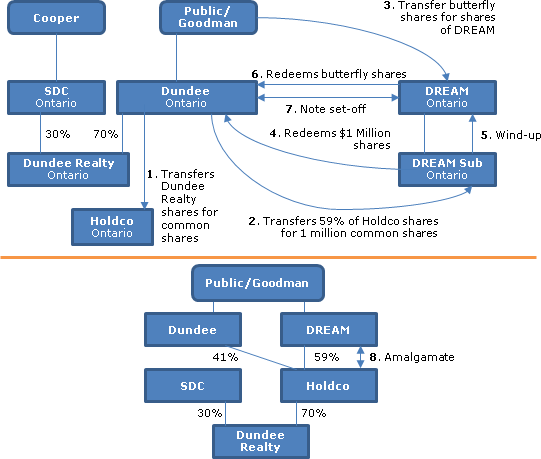

Overview

Dundee, which has a 70% interest in Dundee Realty, and is controlled by Ned Goodman due to a multiple voting share structure, will spin-off an approximate 50% interest in Dundee Realty to its shareholders through a butterfly reorganization, so that such shareholders will hold comparable common and subordinate voting shares of a new Ontario public company, DREAM - and so that DREAM also will be controlled by Ned Goodman. Dundee will retain an approximate 20% indirect interest in Dundee Realty by virtue of holding approximately 28.57% of the total subordinate voting and common shares of DREAM. Following the spin-off, Dundee will continue to engage in diverse business activities including asset management, capital markets and personal advisory services and private equity investments. Based on the anticipated relative liquidation amount of the preferred shares to be held in reorganized Dundee ($18.67 per share) and in DREAM ($6.33), approximately 25% of the shareholders' equity will become equity of DREAM.

Existing structure

The issued share capital of Dundee, an Ontario corporation, consists of 74.4M subordinate voting shares (3.34% owned or directed by Ned Goodman, and the balance by the public), 3.1M common shares (99% owned or directed by Ned Goodman) which carry 100 votes per share and are convertible on a one-for-one basis into subordinate voting shares, and 6M Series 1 preference shares with a liquidation amount of $25 per share. Dundee owns 70% of the common and Class C preferreed shares, and 100% of the Class D preferred shares, of Dundee Realty, an Ontario corporation, with 30% being owned by Sweet Dream Corp. ("SDC"), an Ontario corporation controlled by Michael Cooper, the CEO. In addition to its real estate assets, Dundee Realty is the asset manager of Dundee REIT, Dundee International REIT and Dundee Industrial REIT.

Pre-Arrangement steps

On April 9, 2013, each of DREAM, DREAM Sub and Holdco were formed under the OBCA. DREAM did not have any issued share capital; Holdco issued one common share to Dundee; and DREAM Sub issued one common share to DREAM.

Plan of Arrangement

Under the Plan of Arrangement:

- the terms of the stock options to acquire Dundee subordinate voting shares will be adjusted so that there is a right on exercise to also be paid a fraction of a DREAM subordinate voting share

- Dundee will transfer its common shares of Dundee Realty to Holdco in consideration for Holdco common shares (s. 85(1) election)

- REIT Amalco (a subsidiary of Dundee holding Dundee Realty Class C shares) will transfer such shares to Holdco in consideration for Holdco common shares (s. 85(1) joint election)

- Dundee dissenting shareholders will be deemed to have transferred their shares to Dundee

- each Dundee common share, subordinate voting share and Series 1 Preference Share will be exchanged for two shares – one of them a "butterfly" share, and the other corresponding in various attributes to the "old" share; TSX listings become effective

- holders of Dundee DSUs will receive "top-up" DSUs

- each Dundee butterfly share will be transferred by the holder to DREAM in exchange for a DREAM common, subordinate voting or special share (confusingly, also called a butterfly share), as the case may be

- Dundee will transfer to DREAM Sub such number of Holdco common shares as will result in it having, at the completion of the Arrangement, an aggregate 28.57% interest in the DREAM subordinate voting and common shares in consideration for 1,000,000 common shares of DREAM Sub (s. 85(1) joint election)

- DREAM Sub will purchase the 1,000,000 common shares for cancellation in consideration for the DREAM Sub Note, and will be deemed to have designated the resulting deemed dividend to be an eligible dividend

- DREAM Sub will be wound up into DREAM

- Dundee will redeem the Dundee butterfly shares in consideration for the issuance of a demand note (the Dundee Note)

- Dundee will repay the Dundee Note by delivering the DREAM Sub Note; and DREAM will repay the DREAM Sub Note by delivering the Dundee Note

- DREAM and Holdco will be amalgamated, so that the Holdco common shares held by DREAM will be cancelled, the Holdco common shares held by Dundee and REIT Amalco will be converted into DREAM subordinate voting shares (to be listed), the issued and outstanding DREAM subordinate voting and common shares will survive, and each holders of a DREAM butterfly share will receive a DREAM preference share (to be listed)

- the Exchange and Permitted Sales Agreements will become effective

Permitted Sales Agreement

Upon the earlier of a specified triggering event (e.g., the termination of Michael Cooper without cause, incumbent diretors of (amalgamted) DREAM ceasing to constitute a majority or persons other than Goodman/Cooper acquiring control of DREAM), SDC may require DREAM to either (i) purchase all of SDC's shares of Dundee Realty or (ii) cause the sale of all of those shares, or the liquidation of Dundee Realty (the choice among these option's being Dundee Realty‘s). DREAM will have a somewhat similar put right.

Exchange Agreement

(Amalgamated) DREAM, SDC and Dundee Realty will enter into the Exchange Agreement, which will provide SDC with the right to exchange its shares of Dundee Realty for subordinate voting shares of DREAM on a tax-deferred basis under s. 85(1).

Canadian tax consequences

Dundee share exchange. The s. 86 rollover will apply on the exchange of each Dundee share for two shares (one of them, a butterfly share).

Dundee butterfly share transfer

S. 85.1 will govern the transfers of Dundee butterfly shares to DREAM (so that rollover treatment will apply unless a gain or loss is reported on the transfer) unless a joint election under s. 85 is made. Three signed copies of the election must be provided to DREAM within 60 days of the effective date of the Arrangement.

Amalgamation

Rollover.

Butterfly

Completion of the Arrangement is conditional on Dundee and DREAM receiving a Canadian tax opinion from Wilson & Partners LLP that the Arrangement should qualify for butterfly treatment. However, the opinion will note that Dundee and/or DREAM will recognize a taxable gain if (i) within three years of the Effective Date, DREAM engages in a subsequent spin-off or split-up transaction under s. 55, (ii) a "specified shareholder" disposes of new Dundee shares or DREAM shares (or property that derives 10% or more of its value from such shares or property substituted therfor) to an unrelated person or partnership as part of the series of transactions which includes the Arrangement, or (iii) there is an acquisition of control of Dundee or DREAM that is part of the series of transactions that includes the Arrangement. If such an event were due to an act of Dundee or DREAM, Dundee or DREAM, as applicable, would generally be required to indemnify the other party under the Arrangement Agreement.

Goodman RRIF

Under existing law (but not under potential amendments referred to in a Finance comfort letter), the new Dundee and DREAM shares to be acquired under the Arrangement by a RRIF of Ned Goodman would be prohibited investments, so that there acquisition may be subject to a 50% tax under Part XI.01. Dundee has agreed to indemnify him in the event that he is assessed for this tax.

U.S. tax consequences

Distribution. A U.S. holder who receives DREAM shares under the Arrangement should be considered to have received a taxable distribution, so that if Dundee is not treated as a PFIC, such U.S. holder generally will be required to include the fair market value of DREAM shares in income to the extent of Dundee's current or accumulated earnings and profits. Discussion of PFIC alternative.

PFIC status

"Based on their projected income, assets and activities, the Company [i.e., Dundee] currently believes that there is a meaningful possibility that the Company and/or DREAM could be treated as PFICs for the current taxable year and taxable years thereafter."

Globex

TSX-listed Globex is proposing a spin-off to its shareholders by way of butterfly reorganization of CIM, a newly-incorporated subsidiary that is proposed to be listed on the TSX-V and that will hold various mining and exploration properties in the Chibougamu mining camp.

Butterfly steps

The butterfly reorganization is implemented through the following steps occurring under a Quebec plan of arrangement:

- Globex common shares of dissenters are purchased for cancellation for their fair value

- Each Globex common share is exchanged for one Globex voting new common share and one Globex voting Butterfly Share

- Each Globex Butterfly Share is transferred to CIM in exchange for one CIM common share –except that holders of fewer than 100 Globex common shares receive a cash payment based on the immediate post-arrangement trading price of CIM common shares

- Each option on a Globex common share is exchanged for one option on a Globex new common share and one option on a CIM common share (with the exercise price on the first option being allocated to the exercise price for the 2nd and 3rd option based on the relative trading prices of the Globex new common shares and the CIM common shares for the 1st five trading days following completion of the plan of arrangement)

- Globex calculates the net fair market value of each of its three types of property (with its only investment property being marketable securities)

- Globex transfers the Chibougamu mining camp properties, along with net cash and marketable securities, to CIM - such that CIM receives the "Butterfly Proportion" of each type of property, namely, the fair market value of the transferred mining properties as a proportion of the net fair market value of all the business property of Globex calculated using the consolidated look-through approach – which proportion in turn is equal to the fair market value of the Globex Butterfly Shares divided by the aggregate fair market value of the Globex Butterfly Shares and the Globex new common shares. In consideration, CIM issues 5M redeemable retractable shares (bearing one vote per share) to Globex (with s. 85(1) elections being made and with such shares having a dollar specified amount for purposes of ITA s. 191(4)). The Chibougamu mining camp properties also are transferred subject to a 3% gross metal royalty in favour of Globex.

- CIM redeems the preference shares held by Globex through the issue of a demand promissory note

- Globex redeems the Globex Butterfly Shares through the issue of a demand promissory note

- Each promissory note is satisfied by the holder of the note transferring it to the obligor in satisfaction of the obligations on the other note owing by it

Implementation of the plan of arrangement is contingent inter alia on a favourable butterfly ruling having been obtained by Globex.

Canadian tax consequences

The exchange of (old) Globex shares for new common and Globex Butterfly Shares will occur on a rollover basis under s. 86; and the exchange of Globex Butterfly Shares for CIM common shares will occur on a rollover basis under s. 85.1 (unless the exchanging shareholder elects to include any portion of the gain or loss otherwise determined in computing income). (Capital gain or loss treatment will result where odd lots are disposed of for cash.)

Deemed dividend treatment will apply to dissenting shareholders (subject to the application of s. 55(2).)

Non-resident shareholders may not hold their shares as taxable Canadian property.