Subsection 212(2) - Tax on dividends

Cases

Placements Serco Ltee v. The Queen, 84 DTC 6098 (FCTD), aff'd 88 DTC 6125 (FCA)

The withholding tax is exigible inter alia on the payment of amounts that are deemed by Part XIII (e.g., S.212.1(1)) to be dividends. S.212(2) refers only to Parts I and XIV, not Part XIII, because Parts I and XIV contain provisions which deem amounts to have been paid as dividends in situations where there has not in fact been a payment. This contrasts with S.212.1 which only deems an amount to be a dividend in situations where there has already been, as a factual matter, a payment (i.e., an "amount ... received").

The Canada Southern Ry. Co. v. The Queen, 82 DTC 6244, [1982] CTC 278 (FCTD), rev'd 86 DTC 6097, [1986] 1 CTC 284 (FCA)

Where the taxpayer agreed with an American parent ("Penn Central") that annual rentals, which Penn Central was in effect obligated to pay to the taxpayer, would be paid by Penn Central waiving its right to receive dividends from the taxpayer, the taxpayer was treated as crediting dividends to Penn Central (although a S.215(4) exemption applied).

Administrative Policy

21 February 2011 T.I. 2010-038715

On the redemption of shares of a non-resident which are taxable Canadian property, any resulting deemed dividend that is subject to Part XIII tax under s. 212(2) will not reduce the amount of withholding required under s. 116(5) where no s. 116 certificate is obtained.

October 1992 Central Region Rulings Directorate Tax Seminar, Q. G (May 1993 Access Letter, p. 230)

The unreasonable portion of salaries or bonuses paid to non-resident shareholder-managers will be subject to Part XIII tax under ss.15(1), 214(3)(a) and 212(2).

20 July 1992 T.I. 5-921355

S.212(2) does not apply to a distribution of paid-up capital by a Canadian corporation to which s. 84(4.2) applies, because s. 84(4.2) does not deem the dividend to be paid by the Canadian corporation.

4 March 1992 T.I. (December 1992 Access Letter, p. 20, ¶C82-106, Tax Window, No. 17, p. 23, ¶1778)

The deemed dividend arising on the reduction of paid-up capital of term preferred shares of a Canadian-controlled private corporation held by a foreign specified financial institution will be subject to withholding tax under s. 212(2), because it applies to amounts paid on account of a dividend to a foreign shareholder.

4 October 1991 T.I. (Tax Window, No. 10, p. 16, ¶1498)

Where a public corporation plans to distribute, as a dividend in kind, all the shares of a wholly-owned subsidiary which have a fair market value to it of $1 per share but which, because of minority discounts, will have a fair market value of 80¢ per share after the distribution, the amount of the dividend will be $1 per share.

Articles

Todd Miller, Ryan Morris, "Canadian Subsidiary Guarantees for Foreign Parent Borrowings", Tax Notes International Vol. 34, No. 1, 5 April 2004, p. 63.

Subsection 212(3) - Interest — definitions

Fully exempt interest

Administrative Policy

2012 Ruling 2011-0431891R3 - XXXXXXXXXX

A financial institution (the "Issuer") will accumulate a pool of mortgages [presumably CMHC-guaranteed in most cases] and sell an undivided interest in the mortgages to investors (the "Investors"). The mortgages will be sold, on a fully-serviced basis, by the Issuer for a single aggregate consideration, with respective undivided beneficial ownership interests in such pool represented by written instruments.

The ruling summary states that:

The interest paid is considered to be 'fully exempt interest' as defined in subsection 212(3) of the Act for the purposes of subparagraph 212(1)(b)(i) of the Act.

Participating debt interest

Administrative Policy

2014 Ruling 2014-0539791R3 - Paragraph 212(1)(b)

CDS trust entered into credit default swaps with a counterparty (a non-resident Bank) desiring credit protection for its bond portfolios and funded its purchase of the required collateral for its CDS obligations by issuing short-term notes. It defaulted on the notes in the 2008 financial crisis.

It settled litigation with the bank under a compromise which was voted on and approved by the Noteholders under a CCAA plan. Under this settlement, the Bank (which in the meantime had acquired some of the Notes directly and through non-resident subsidiaries) made payments under the CDS, which were applied by the Trust to repay all of the unpaid Note principal but only a portion of the unpaid interest (with recourse for such interest obligations being specified in the CCAA plan to be only to the Trust assets.)

CRA ruled that the payments of interest by the Trust to the Bank (and non-resident subsidiaries of the Bank) will not be "participating debt interest," stating:

The fact that interest would be paid by the Trust based on the available cash in the Trust…(i.e., the fact that the Trust will not be able to pay all the interest it owes…) does not impact the conclusion that the interest on the Notes is not being computed by reference to revenue, profit, cash flow, commodity price or any other similar criterion.

See more detailed summary under s. 212(1)(b).

2014 Ruling 2014-0523691R3 - Non-Viable Contingent Capital

Aco, a public corporation, will issue (at no discount or only a shallow discount) the "Notes" which: will rank equally with its other unsecured debt; will bear interest at specified fixed or floating rates, will not (in the case of the fixed rate Notes) be redeemable before the first interest reset date (except on the occurrence of specified events) and will be automatically converted into common shares based on a predetermined conversion formula (presumably at the point of non-viability as defined by OSFI, subject to regulatory discretion), so that there is no assurance that the conversion formula would result in the issuance of common shares having a fair market value at least equal to the principal.

Rulings

: Interest is not participating debt interest; s. 20(1)(c) deductibility of interest (subject to standard conditions);.

2014 Ruling 2013-0514551R3 - Convertible Debentures and Paragraph 212(1)(b)

- mature XX years from the issue date

- bear fixed interest payable semi-annually, at the option of Aco, in cash or in class A shares ("common shares") calculated by dividing each interest amount by the current market price on the date falling XX days prior to the interest payment date

- convertible into common shares at the option of the holder until shortly before maturity at a fixed conversion price (subject to anti-dilution protection)

- on conversion holders will receive accrued but unpaid interest and a "Make-Whole Amount" (payable in common shares or in cash where the Exchange limits payment in shares) in respect of lost future interest, but with a reduction of XX% for each XX% that the current market price at the time of conversion exceeds the conversion price

- Aco has the right to require conversion following the X anniversary

Concurrently with the above public offering Aco makes placement of subscription rights by private placement to "USco" comprising "Private Debentures" and warrants with "substantially similar" terms (but with expanded ability to pay the make-whole in cash). The Private Debentures and warrants may not be converted or exercised if that would result in USco holding more than XX% of the common shares.

Rulings

The payments made by Aco to the Debenture holders are not "participating debt interest." S. 212(1)(b) of the Act will not apply to the conversion of any of the Public Debentures or Private Debentures held by a non-resident of Canada or by virtue of any interest payment or any Make-Whole Amount under the Public Debentures or the Private Debentures, provided that the holder of the debenture deals at arm's length with Aco.

26 November 2013 Annual CTF Roundtable Q. , 2013-0509061C6

[R]egular periodic interest payments made by public corporations pursuant to the terms and conditions of standard convertible debentures do not generally constitute "participating debt interest"… .

[T]he deemed payment of interest on standard convertible debentures under subsection 214(7) of the ITA that arises because of a transfer or assignment of standard convertible debentures by a non-resident person to a person resident in Canada (including the issuer of the debenture), does not generally constitute "participating debt interest". …

CRA is not inclined at this time to take the position that standard convertible debentures would in general constitute "excluded debt obligations" pursuant to paragraph 214(8)(c) of the ITA.

18 March 2014 T.I. 2013-0515631E5 - Criteria for Standard Convertible Debentures

"CRA cannot provide certainty concerning the application of Part XIII tax to the very broad range of situations in which convertible debentures can be issued" and taxpayers are encourage to seek advanced income tax rulings to resolve any concerns.

2013 Ruling 2013-0475701R3 - MIC deemed interest & participating debt interest

The Corporation, a "mortgage investment corporation" under s. 130.1(6), pays dividends which take into account, inter alia, its income and financial conditions. Such dividends are deemed by ss. 130.1(2) and 214(3)(e) to be paid to the shareholders "as interest on a bond." In refusing to rule that the interest was not participating debt interest, CRA stated:

[T]he dividends paid from the Corporation, which are deemed to be interest, were computed by reference to the income, profit, cash flow or other similar criterion described in the definition of PDI. Accordingly, the deemed interest payments would meet the condition that they are interest paid on an obligation and that they are of a participatory nature described in the definition of PDI.

2012 Ruling 2011-0418721R3 - Convertible Notes

amendments made by 2014-0532411R3 shown in red italics

PUBCO, which is a listed public corporation and a taxable Canadian corporation, completed an offering of Convertible Notes, including Convertible Notes ("Class XX Notes") purchased on behalf of ACO, which is a non-resident corporation which deals at arm's length with PUBCO.

The Class XX Notes:

- were not issued at a discount and pay no premium

- are payable in US dollars

- have a specified maturity date for payment of the aggregate principal together with accrued interest

- bear interest of XX% payable semi-annually, subject to a gross-up clause

- are convertible into common shares (having a stated capital equal to the converted principal) at the option of the holder at the conversion price at any time prior to the earlier of the maturity date and the business day preceding the date which PUBCO has specified for their redemption (see below)

- a cash payment is made in lieu of the issuance of a fractional share on conversion

- accord PUBCO, in the case of a conversion request received from the BCO group, to elect to satisfy its obligations by delivering common shares in its capital stock at the Conversion Price or the cash equivalent thereof (based on their then market price)

- are redeemable by PUBCO for their principal and accrued interest at any time before maturity provided that the current market price of the PUBCO common shares is at least x% of the conversion price

- do not give PUBCO the right to pay the redemption price with common shares

Rulings

that the regular semi-annual interest payments will not be "participating debt interest" and that their payment to ACO will not be subject to Part XIII tax provided PUBCO deals at arm's length with ACO at the time of the payments. Supplementary ruling that "any amount deemed to be a payment of interest on a Class XX... Note under subsection 214(7) as a result of a conversion of the ... Note into Common Shares ... will not be subject to Part XIII withholding tax under paragraph 212(1)(b)" on the same arm's length assumption.

Opinion.

[On] a disposition of a Class XX... Note by ACO to a person resident in Canada (other than PUBCO) for proceeds of disposition payable in cash, any amount deemed to be a payment of interest on a Class XX...Note under subsection 214(7) would not in general constitute "participating debt interest"... .

23 May 2013 IFA Round Table, Q. 9

- What is the CRA's current position with respect to the application of Part XIII tax to convertible and exchangeable debentures owned by foreign lenders (s. 212(1)(b), the definition of "participating interest" in s. 212(3), s. 214(7) and their qualification as an "excluded obligation" under s. 214(8)(c) of the ITA)?

- Is there anything new to report?

Response

:

Convertible Debentures

In June 2012, the Directorate issued 2011-0418721R3, stating that the regular periodic interest payments on a convertible debt issued by a taxable Canadian corporation to a non-resident would not be "participating debt interest." The Joint Committee would like CRA to establish guidelines that would apply to "standard convertible debentures." The Directorate has written to Finance for guidance respecting the tax policy of ss. 212(1)(b), 214(7), 214(8)(c) and the definition of "participating debt interest." Although CRA's analysis is substantially advanced, it is important to obtain the views of Finance. CRA is unable to provide any guidance as to when it will respond to the Joint Committee.

Exchangeable Debentures

Exchangeable debentures have been used in the past in the context of the "monetization" of shares of the capital stock of public corporations owned by the issuers of debentures. The interest paid on exchangeable debentures could be a proxy for the dividends paid on the shares into which the debentures are convertible. Accordingly, it may be relevant to determine whether the interest paid on exchangeable debentures constitutes "participating debt interest." The Directorate is not prepared to provide additional comments (outside the context of any ruling request) concerning the potential application of Part XIII tax with respect to exchangeable debentures without knowing all the relevant facts in relation to particular situations (including the terms and conditions of the exchangeable debentures).

1 May 2009 IFA Roundtable Q. 12, 2009-0320231C6

Traditional convertible debentures are: unsecured subordinated obligations of a public corporation issued in Canadian dollars for their face value; bear interest (payable at least annually) at a fixed rate; provide a fixed conversion price (or ratio) in excess of the current market price on the issue date; and are redeemable by the issuer at the face value, plus accrued and unpaid interest, on the specified maturity date. CRA stated:

Where there is a conversion of a traditional convertible debenture by its original holder for common shares of the issuer, … in general there would be no Excess under subsection 214(7)… . Accordingly, no amount is deemed to be a payment of interest by the issuer (person resident in Canada) to the non-resident person for the purposes of Part XIII. For the purpose of paragraph 214(7)(d) of the ITA, the price for which the traditional convertible debenture is assigned on the conversion, is the amount determined by multiplying the fixed conversion price by the number of shares received on the conversion, that is, an amount corresponding to the face value of the traditional convertible debenture.

Income Tax Technical News, No. 41, 23 December 2009 Under "Convertible Debt", Q. 2

If a particular premium on a convertible debt obligation represented participating debt interest, all interest on the obligation would be participating debt interest under an initial analysis of the CRA.

29 May 2009 T.I. 2008-030139

Where (in order to reflect the resulting increased credit worthiness of the borrower) the interest on a loan decreases as the ratio of debt to EBITDA of the Canadian borrower decreases, such interest will not be considered to be participating debt interest.

2006 Ruling 2006-020800 -

Where holders of notes receive at maturity a return linked to the performance of three mutual funds, the post-amble under s. 212(1)(b) will not apply so as to deny the availability of exemption in s. 212(1)(b)(vii). The issuer was not related to the mutual funds nor were the profits of the mutual funds linked to the issuer.

2005 Ruling 2005-016152

An interest rate under a term facility intended to qualify for the exemption under s. 212(1)(b)(vii) was equal to LIBOR plus a spread which decreased as the leverage (measured by the ratio of funded debt of the borrowers to EBITDA) decreased. CRA ruled this arrangement did not cause the post-amble to s. 212(1)(b) to apply. Although the interest payable varied as a result of changes in EBITDA, the extra amounts payable simply used EBITDA as a tool to assess creditworthiness and, as the borrower became more profitable, payments decreased, which was the opposite of participating debt.

8 January 2003 T.I. 2002-017313 -

"A loan agreement that contains a provision for increased payments to the lender that are based on the ratio of certain debt to EBITDA ... of the borrower may fall within the ambit of the broad wording in the postamble ... ."

9 October 2001 T.I. 2001-009665

CCRA "would not generally consider interest that is computed by reference to a stock index as satisfying the exception conditions described in the postamble to paragraph 212(1)(b) ... as long as the Agency is satisfied that the particular index chosen is not influenced by the inclusion in that index of the shares of the issuing corporation, corporations related to the issuing corporation or a corporation or corporations whose primary business is substantially similar to that of the issuing corporation ... [O]ur response is predicated on the understanding that the return on the obligation does, in fact, represent 'interest' on the obligation."

22 November 2000 T.I. 2000-004941 -

The Agency would not generally consider the return computed by reference to a foreign stock index to be "computed by reference to revenue, profit, cash flow, commodity price or any other similar criterion" as long as the Agency is satisfied that the particular index chosen is not influenced by the inclusion in that index of the shares of the issuing corporation, corporations related to the issuing corporation or a corporation or corporations whose primary business is substantially similar to that of the issuing corporation. "Also, the Agency would want to be satisfied that the debt obligation is not used by a non-resident of Canada as a substitute for direct investment in the underlying securities in an index where dividends or gains on those securities will be subject to tax in Canada if held directly by that non-resident."

16 May 2000 T.I. 2000-001101

Before concluding that it generally would be acceptable for the interest rate on a debt instrument to vary in accordance with the value of a foreign currency, the Directorate stated "although foreign currency can be bought and sold and as such could be considered a commodity, it is our position that in the context of the paragraph 212(1)(b) postamble, 'commodity price' should not be considered to include foreign currency fluctuations, but rather in general is to be limited to, for example, prices for tangible commodities ... ."

To date the Directorate has not adopted a position that would extend the position in ITT in No. 11 to debt linked to a stock index such as the Dow Jones Industrial Average.

Articles

Daniel Lang, Larissa Tkachenko, "Withholding Tax Implications of Participating Interest in Convertible Debt", CCH Tax Topics, No. 1916, November 27, 2008, p. 1.

Paragraph 212(3.1)(c)

Articles

Mark Coleman, "Treaty Shopping and Back-to-Back Loan Rules", Power Point Presentation for 28 May 2015 IFA Conference in Calgary.

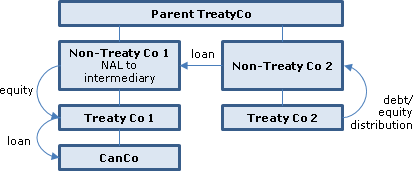

Where CanCo receives an interest-bearing loan from its immediate parent (Treaty Co 1), which is funded by equity from the parent (Non-Treaty Co 1) of Treaty Co 1 residing in a non-Treaty county which, in turn, is funded by a loan from a non-Treaty affiliate of Non-Treaty Co 1, this latter loan will be described in s. 212(3.1)(c)(i)(B) as a loan owing by a person (Non-Treaty Co 1) who does not deal at arm's length with the intermediary (Treaty Co 1).

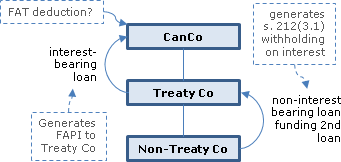

Non-Treaty Co makes a non-interest-bearing loan to its parent (Treaty Co) to fund an interest-bearing loan to the Canadian-resident parent of Treaty Co (CanCo). The interest on the latter loan will be subject to 25% withholding tax on the basis that it is deemed by s. 212(3.1) to be paid to a non-arm's length person (Non-Treaty Co). The interest received by Treaty Co will be foreign accrual property income to it. Quaere whether CanCo will be entitled to a foreign accrual tax deduction under s. 91(4) for the s. 212(3.1) withholding tax which is factually applicable to the interest received by Treaty Co but which may be considered to be payable by Non-Treaty Co under s. 212(1)(b).

Steve Suarez, "Canada Releases Revised Back-to-Back Loan Rules", Tax Notes International, October 27, 2014, p. 357.

Introduction of requirement for strong causal connection (p. 361)

Two aspects of the revised secondary obligation definition merit further comment. First, both the Creditor Party [intermediary] debt and Creditor Party [specified] right elements of the revised definition now use the term ''because'' to delineate what causes a secondary obligation [intermediary debt] to exist. This represents a significantly higher standard than was the case under the August 29 version of the term, and the concept appears to have been imported from another ''indirect loan'' rule in the ITA [in s. 17(2)].

[I]n AG of Canada v. Hoefele ... [fn 15: 95 DTC 5602 (FCA)…] the Federal Court of Appeal interpreted the ''because'' standard as implying a ''strong causal connection''… .

Expansion of permitted security rights under s. 18(5) - "specified right"(p. 362)

Second…[t]he revised ''specified right'' definition appears to have been improved in two ways, both of which in general seem to accommodate normal course secured guarantees and similar security arrangements typically found in commercial lending agreements. First, the party holding the security can pledge the secured property to secure the repayment of other debts, as is sometimes provided for in secured property legislation and some derivatives agreements….

Second, earlier versions of the ''specified right'' definition seemed to cause an event of default under the Canco debt (which typically gives a Creditor Party the immediate right to sell the secured property) to itself result in a specified right,…[whereas] the revised definition seems to prevent this if it can be shown that the Creditor Party must use any sale proceeds from the secured property to repay the Canco debt (or certain related debts)….

Steve Suarez, "An Analysis of Canada's Latest International Tax Proposals", Tax Notes International, September 29, 2014, p. 1131.

29 August revised version of description of intermediary ("secondary") debt (pp. 1134-5)

[T]he revised proposal deletes a requirement in the original proposal that the secondary obligation has been entered into as part of the same series of transactions that includes the creation of the Canco debt. Moreover, the scope of Creditor Party debt that can constitute a secondary obligation is actually greater under the revised proposal compared with the original version, since under the revised version now a secondary obligation will exist if:

- recourse under the Creditor Party debt is limited to the Canco debt in whole or in part;

- the Canco debt was entered into on condition that the Creditor Party debt be entered into; or

- it is merely reasonable to conclude that if the Creditor Party debt did not exist, some or all of the Canco debt would not be outstanding or its terms and conditions would be different.

The last of these is especially troubling because there are many benign circumstances imaginable in which the presence of the Creditor Party debt might conceivably have affected the terms and conditions of the Canco debt in some way or another. As a result, very little nexus between two debts is required to create a secondary obligation, particularly with (1) the removal of the requirement in the original version that the Canco debt and the Creditor Party debt be part of the same series of transactions, and (2) the absence of any materiality threshold for the Creditor Party debt's effect on the terms and conditions of the Canco debt….

Paragraph 212(3.1)(d)

Articles

Mark Coleman, "Treaty Shopping and Back-to-Back Loan Rules", Power Point Presentation for 28 May 2015 IFA Conference in Calgary.

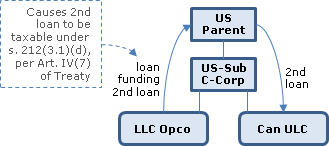

If a loan by U.S. Parent to its "grandchild" Canadian ULC sub (held e.g.,, through a C-Corp sub) is funded by a loan by an LLC sub ("Opco") of U.S. Parent, 25% withholding tax will apply under s. 212(3.1)(d) given that a direct loan by Opco to ULC would be subject to the hybrid entity rule (Art. IV (7) of the Canada- U.S. Treaty).

Michael N. Kandev, "Canadian Interest Anti-Conduit Rule Soon to Be Law", Tax Notes International, December 15, 2014, p. 1027

Back-to-back ("B2B") rule in s. 212(3.1) is anti-conduit rule (p. 1028)

The absence of a safe harbor for non-resident non-arm's-length intermediaries shows that the withholding tax B2B rule goes beyond being a specific anti-avoidance rule intended to protect the domestic withholding tax exemption on arm's-length nonparticipating interest. This is because a non-arm's-length non-resident intermediary would not enjoy such domestic exemption. This missing carve-out transforms the rule in section 212(3.1) into a broader anti-conduit rule targeting cases when the intermediary, though not eligible for the domestic interest withholding tax exemption, may still enjoy a better treaty rate than would the non-resident parent.

Effect on cash pooling (p. 1029)

The… anti-conduit rule in the withholding tax B2B regime is… purely mechanical in its operation and, therefore, may adversely affect either non-tax-driven structures or transactions that have a tax motivation but that arguably are not abusive.

First, cash pooling/treasury companies may be subject to the rule if the 25 percent de minimis rule does not apply and an incidental treaty benefit would otherwise be present.

B2B rule causes U.S. Treaty anti-hybrid rule to apply (p. 1029)

Second, the rule may have a perverse application in the context of the Canada-U.S. tax treaty. Picture two U.S. residents and qualifying persons forming a joint venture limited liability corporation. Assume the LLC borrows from an unrelated bank to make various investments. One of the investments is in Canada and is made for U.S. tax purposes through a Canadian unlimited liability corporation (ULC). The LLC would like to ‘‘push down'' the bank debt into the ULC by lending to it in accordance with Canada's thin capitalization ratio.

…Article IV(7)(b) of the treaty… den[ies] the treaty exemption… . To avoid this effect, assume the two U.S. partners form a parallel financing LLC through which the debt financing is routed to the ULC. [V]arious Canada Revenue Agency rulings… suggest that such planning is acceptable... . However, the new rule in section 212(3.1)ff would push this structure right back into Article IV(7).

Application to indirect loan from 15% Treaty jurisdiction (p. 1029)

Third, the B2B rule would deny simple treaty self-help, which arguably is not abusive. For example, assume a Spanish multinational has borrowed from an unrelated local financial institution and would like to use some of its capital to finance a Canadian subsidiary. If it borrowed directly, a 15 percent Canadian withholding would apply under the current treaty [cf. announced Protocol]. However, if the Spanish company routed the debt financing through a Luxembourg company, it would lower this tax cost to 10 percent…. [S]ection 212(3.1)ff would now bring back the 15 percent withholding... .

Paragraph 212(3.1)(e)

Articles

Edward A. Heakes, "The Proposed Revisions to Back-to-Back Loan Rules", International Tax Planning (Federated Press), Vol. XIX, No. 4, 2014, p. 1357.

Narrowness of aggregation rule in s. 212(3.1)(e)(ii)(B) (p.1359)

[T]he basic thrust of this [de minimis] rule is that if the amount that is provided to the intermediary (i.e., for example, the fair market value of property in which there is a specified right or the amount of the limited recourse obligation of the intermediary or non-arm's length person[f.n. 3 The actual proposed wording refers to a security interest being provided to the intermediary in respect of an intermediary debt. … [I]t is not clear…why the intermediary would ever be granted a security interest in respect of its own obligation]) is less than 25% of the amount owing by the Canadian taxpayer to the intermediary, the back-to-back rule will not apply. In addition, if certain requirements are met, the amount of indebtedness to the intermediary owing by persons that do not deal with the taxpayer at arm's length can also be included in the 25% threshold. Basically, the requirements are that the other amounts be outstanding under an obligation that is connected to the agreement and that any security provided secures all of the obligations under the arrangements. This aggregation rule is relatively narrow. For example, it does not appear to extend to situations where there are multiple related lenders, nor does it appear to accommodate situations in which for valid non-Canadian-tax reasons, certain assets are not provided as security under all of the obligations. For example, in situations where there is a U.S. parent and there are secured loans to both the parent and the Canadian subsidiary, it is often the case that, because of U.S. tax considerations, the Canadian assets are provided as security for the Canadian obligation but not as security for the U.S. obligation.

Steve Suarez, "Canada Releases Revised Back-to-Back Loan Rules", Tax Notes International, October 27, 2014, p. 357.

Narrow 25% safe harbour (p. 363)

There are two basic scenarios in which the de minimis exception is intended to provide relief. The first is when the amount of any secondary obligations in respect of the Canco debt is relatively small so as to be less than 25 percent of the Canco debt….

The second situation is when the Canco debt is one of a number of debts owing by a group of related debtors to the same creditor, and the same secondary obligations that secure the Canco debt also secure the other debts owing by those group members….

[F]or other group debts to be included within item B [i.e., s. 18(6)(d)(i) and (ii), or 212(3.1)(e)(i) and (ii)], above:

- the creditor must be Creditor itself, rather than any Creditor Party;

- the security interests relating to the various debts and the Canco debt must correspond quite closely; and

- the other group debts must arise under the agreement creating the Canco debt or an agreement that is ''connected'' to that agreement.

It is not obvious why such a high degree of interconnectivity between the Canco debt and other Canco Party debts is necessary to include the latter in the denominator for purposes of the de minimis exception….

Steve Suarez, "An Analysis of Canada's Latest International Tax Proposals", Tax Notes International, September 29, 2014, p. 1131.

De minimis rule in s. 212(3.1)(d)

While Finance is to be commended for trying to accommodate typical multinational group borrowing arrangements, unfortunately the de minimis test as proposed is at best only a partial solution. Fundamentally, the 25 percent de minimis threshold is too low, and the conditions required for another debt owing by a Canco Party to be included in the denominator of the 25 percent test…are too strict:

- the creditor must be Creditor itself, as opposed to any Creditor Party;

- the security interests relating to the different debts must correspond quite closely for a Canco Party debt to be included in the denominator; and

- the different debts must arise under the agreement creating the Canco debt or an agreement that is connected to that agreement.

There is no obvious reason to require such a high degree of interconnectivity between the Canco debt and other Canco Party debts to include the latter in the denominator for purposes of the de minimis test, particularly given how much lower the degree of connectivity is between the Canco debt and the amount owing to Nonresident to create a Creditor Party debt and thereby trigger the rule….

Subsection 212(3.3)

Articles

John Lorito, Trevor O'Brien, "International Finance – Cash Pooling Arrangements", draft version of paper for CTF 2014 Conference Report.

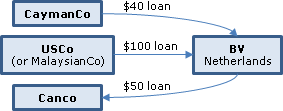

Unavailability of s. 212(3.3) where Canco owes $50 to Netherlands intermediary, which owes $40 to Caymanco and $100 to USCo – because U.S. withholding rate is 0% (p. 7)

At first glance, it seems [in this example] that the rule in subsection 212(3.3) may apply as there would appear to be two intermediary debts and, therefore, two non-residents to which interest is deemed to be paid, namely, USCo and CaymanCo. …[H]owever, the back-to-back loan rules do not apply in respect of the intermediary debt owing to USCo because the fourth condition [that the withholding tax would be greater if the interest was paid directly to USCo] does not apply.

…[If] USCo is replaced with a corporation resident in Malaysia…the withholding rate would be 15% [rather than 0%]. As a result…subsection 212(3.2) would apply to allow the taxpayer to designate amounts such that interest on 80 per cent of the Canco debt is deemed to be paid to the Malaysia corporation. …[S]ubstituting the Malaysian corporation for USCo has reduced the withholding tax… .

It seems to be a somewhat incongruous result that subsection 212(3.3) can be applied to reduce the withholding tax payable in a situation in which the second intermediary lender is resident in a jurisdiction in respect of which the withholding tax rate is higher than that of the jurisdiction of the intermediary but not if the second intermediary lender is resident in a jurisdiction in respect of which the withholding tax rate is lower than that of the jurisdiction of the intermediary.

Subsection 212(4)

Paragraph 212(4)(a)

Cases

Windsor Plastic Products Ltd. v. The Queen, 86 DTC 6171, [1986] 1 CTC 331 (FCTD)

The three shareholders of the taxpayer, each of whom was a minority shareholder and one of whom was related to a non-resident corporation ("Kenmar"), were the de facto directors of the taxpayer and from the beginning arrived at all their decisions through consensus, including decisions as to the level of management fees that should be paid to each of the three shareholders. Since the taxpayer was factually subordinate to a group which was acting in concert, the fees paid to Kenmar, being a member of that consortium, were found to have been paid to a person who was not dealing at arm's length with the taxpayer.

It was found that the test in s. 212(4)(a)(i) was met where one of the businesses of Kenmar was the providing of management services.

Administrative Policy

2011 Ruling 2011-0416891R3 -

A US LLC ("Corporation C"), whose sole member was a US corporation qualifying for benefits under the Canada-US Convention, ran a platform for the provision of "Digital Content" (movies, television shows, music videos, documentaries and similar audio-visual content) which it (and affiliated corporations) were permitted to distribute under content licence agreements with the third-party holders of the copyright. Canadian distributors (described as "Customers") created online storefronts for Canadian individual home users, running on Corporation C's platform, with customized design and branding for the Canadian Customers. Although the home users were licensed the right to receive Digital Content by virtue of agreements they entered into only with the Canadian Customers, it was Corporation C which collected the fees from them and operated the "online store," and it was stated in the description of facts to be the beneficial owner of those payments.

CRA ruled that monthly fees paid by the Customers to Corporation C for managing and maintaining components of the Customers' storefronts, for continuing access to the sales platform, and related support services, were (to the extent they otherwise could be considered to be management or administration fees or charges) not subject to Part XIII tax under s. 212(1)(a) by virtue of s. 212(4)(a) (as well as ruling that fees collected from Canadian home users were exempt from Part XIII tax under Art. XII(3)(a) of the Convention).

Paragraph 212(4)(b)

See Also

Agricultural and Industrial Corporation v. MNR, 91 DTC 1286 (TCC)

Beaubier J. affirmed the disallowance by the Minister of all but $100,000 per year of amounts paid by a Canadian subsidiary to its U.S. parent which allegedly were reimbursements of expenses incurred by the parent in connection with litigation involving the Canadian subsidiary, and for accounting, administrative and sales services, and for overheads, of the U.S. parent. It was noted that no time were records kept, no working papers respecting the expenses were submitted, no evidence was given as to how the alleged Canadian proportion of the work performed by the various employees of the parent was arrived at, there was no written agreement in evidence between the subsidiary and the parent concerning the payment of expenses, and the subsidiary had passively acquiesced to the charges made to it by the parent. Beaubier J. stated (p. 1290):

"... To be a 'specific expense incurred', it must be an explicit and identifiable expense that has been paid, or in respect to which an obligation to pay has been assumed... ."

Administrative Policy

IT-468R "Management or Administration Fees Paid to Non-residents" (Archived) 29 December 1989

8. The Department considers that the term "a specific expense"...applies to a particular expense item or a portion thereof, a sum of several expense items or a portion of a composite of various distinct expenses such as overhead expense including rent, power, heat, salaries, fringe benefits and other business expenses. A specific expense does not include depreciation, capital costs, reserves or unvouchered amounts. A specific expense is net, after all applicable credits or refunds have been deducted, and is without any mark-up or profit element to the non-resident.

9. ...a service performed by a non-resident would not be considered beneficial to the payer if it was a duplication of services already provided by the payer's own personnel.

10. ...Where an amount paid or credited to a non-resident is based on an allocation or distribution of certain charges or costs among various departments, branches or subsidiary corporations (including the Canadian payer), it is important not only that the expenses themselves are reasonable but that the method or basis of allocation or distribution is appropriate to the Canadian payer and reasonable in the circumstances.

Subsection 212(5) - Motion picture films

Cases

MNR v. Paris Canada Films Ltd., 62 DTC 1338, [1962] CTC 538 (Ex Ct)

The taxpayer, which was a distributor of motion picture films in Canada, made various payments to non-residents for film rights including a lump-sum payment to a Moroccan firm for the exclusive right to exploit certain films. Notwithstanding that the lump-sum payment was made for an outright purchase of film rights, it was subject to tax under s. 106(2) of the pre-1972 Act.

CBS/Fox Co. v. The Queen, 95 DTC 5631 (FCTD)

The plaintiff (a U.S. partnership) provided video tape reproduction masters to a wholly-owned Canadian subsidiary, which was entitled in consideration for royalties payable to the plaintiff to duplicate the masters for distribution within Canada through the sale of video cassettes. In finding that the royalties were subject to withholding tax under s. 212(5) on the basis that the words "motion picture film" include a video cassette of a motion picture film, Rouleau J. stated (at p. 5633):

"Although a video tape may be the method of presentation, the content, nevertheless remains a motion picture film within the ordinary and commonly understood meaning of those words."

MCA Television Ltd. v. The Queen, 94 DTC 6375 (FCTD)

The taxpayer's Netherlands affiliate ("B.V.") was the Canadian distributor of theatrical and television products produced by an American affiliate of the taxpayer. MacKay J. found in light of the terms of an agreement between the taxpayer and B.V. and the character of B.V.'s operations in Canada that B.V. operated on its own account rather than as agent for the taxpayer, with the exception of its role as collection agent for the taxpayer's share of "gross television receipts" received by B.V. as defined in the agreement. In going on to find that payments made by Canadian exhibitors to B.V. did not give rise to a liability of the taxpayer for Part XIII tax under s. 212(5), MacKay J. stated (p. 6385):

"The fact that B.V. had contractual obligations to the plaintiff under its licensing agreement, including the obligation to act as collection agent for the plaintiff in relation to the latter's share of television gross receipts as defined, did not, in my opinion, change the nature of the relationship between B.V. and Canadian exhibitors or create any legal relationship between those exhibitors and the plaintiff. The payments by Canadian exhibitors were to B.V., not to the plaintiff, and the description of B.V. as the plaintiff's collection agent does not change that."

MNR v. Paris Canada Films Ltd., 62 DTC 1338, [1962] CTC 538 (Ex Ct)

The taxpayer, which was a distributor of motion picture films in Canada, made various payments to non-residents for film rights including a lump-sum payment to a New York firm ("Sodak") for the exclusive right to exploit certain films. Notwithstanding that the lump-sum payment to Sodak was made for an outright purchase of film rights, such payment would have been subject to subsection 212(5) but for the application of the old Canada-U.S. Income Tax Convention.

See Also

Vauban Productions v. The Queen, 79 DTC 5186, [1979] CTC 262 (FCA)

The non-resident taxpayer, which had acquired from another film distributor the exclusive right for a limited period of time to show certain films on the CBC French-language network, agreed in consideration for a lump-sum payment to supply copies of those films to the CBC and to grant it for the same period of time the exclusive right to show them on its television network. Such a contract was a lease of a motion picture film rather than an outright sale for purposes of a withholding tax exemption appearing in the former Canada-France treaty because the rights acquired by CBC were not as extensive as those acquired by the taxpayer: CBC acquired only the right to show the films on its own network and not to assign or lease them; and the taxpayer had the right to a return of the films at the end of the term was upheld. The application of s. 106(2) of the pre-1972 Act was conceded.

Administrative Policy

5 November 2014 T.I. 2013-0506191E5 - copyright photographs

A Canadian company pays a non-resident for the use of the photographs in connection with television in Canada (for example in a backdrop to a film clip used in a television program that is to be used or reproduced in Canada). In finding that s. 212(5) would not apply, CRA stated:

[T]he Canadian company would not be paying an amount to the non-resident person for a right in, or to the use of, a motion picture film or Television Product. Instead, the company would be paying the non-resident person for the right to use the photographs which would be incorporated into Television Product.

1 May 2014 T.I. 2013-0514291E5 F - Redevances sur une oeuvre musicale dans un film

Would copyright royalties paid by a resident of Canada to a resident of Belgium respecting the production or reproduction of a musical work to be utilized in a cinematic production be exempted under Part XIII? After confirming that the exemption described in s. 212(1)(d)(vi) generally would apply, CRA stated:

[I]f it is demonstrated…that a payment is specifically paid as or in payment in whole or in part of for copyright respecting the production or reproduction of a musical work, it will be excluded from the field of operation of ITA subsection 212(5) even if the musical work was produced or reproduced as part of a film.

14 December 2011 Memorandum 2011-0424221I7

A licence with a US-resident copyright holder of a musical work enabling the taxpayer to "fix, record, dub and edit the music in synchronized or timed relation to visual and audio elements" for a fixed fee with caps on usage (i.e. a maximum number of video promotions broadcast) is considered to be a royalty for a musical work under s. 212(1)(d)(vi) and is not a payment for a right to use a motion picture film or video product under s. 212(5), notwithstanding that the music is used in "promos" (i.e., promotions of program viewership) aired on Canadian telecasts:

Canco is not paying an amount to US for "a right in or to the use of a motion picture film or video product"; instead, Canco is paying US for the right to use/reproduce copyrighted music which will be incorporated into film or video produced in Canada.

Therefore, the licence fees are not subject to Part XIII tax.

19 April 2011 T.I. 2011-0392761E5

A Canadian-resident company (Canco) uses motion pictures distributed to it by a US and French company by reproducing them in Canada in digitized form and encrypting them, in order that it can provide them to Canadian customers using its specialized software. The fees paid to the US distributor (a qualifying US resident) are subject to Part XIII tax at a Treaty-reduced rate of 10%, and the fees paid to the French distributor are exempt from Part XIII tax if the conditions in Art. XII, para. 4(a) of the Canada-France Convention are satisfied.

19 February 1997 T.I. 961630 [health club videos]

A Canadian corporation that obtains a licence to make videos available to patrons of a health club, who watch videos on installed television sets while they exercise, will pay royalties which are subject to withholding tax under s. 212(5). The phrase "for use in connection with television" is not limited to television broadcasting.

6 March 1995 Memorandum 942876 (C.T.O. "Video Reproduction Rights")

The phrase "in connection with television" would apply to video tapes destined for private home use.

93 C.R. - Q. 30

RC is prepared to exempt the portion of a particular payment that is solely for the right to use a motion picture film or video tape outside Canada.

5 January 1993, T.I. (Tax Window, No. 28, p. 8, ¶2404)

The reproduction of video cassettes for non-commercial use does not generally fall within the purview of s. 212(5)(b) notwithstanding that a television set may be required to use the resulting product.

Subsection 212(11) - Payment to beneficiary as income of trust

Administrative Policy

18 November 2011 T.I. 2011-0422441E5

Shares of a Canadian-controlled private corporation held by the estate were redeemed for cash proceeds, with the resulting deemed dividend paid out of the corporation's capital dividend account. Would this amount when redistributed to a non-resident be subject to Part XIII tax? CRA responded:

Subsection 212(11)… characterizes any amount paid or credited by a trust or an estate to a beneficiary or other person beneficially interested therein as income of the trust or estate for the purposes of paragraph 212(1)(c)… .

Any capital distribution made by a trust or an estate is subject to Part XIII tax to the extent that it is an amount described in subparagraph 212(1)(c)(i) or (ii)… .

Subparagraph 212(1)(c)(ii)… provides that an amount that may reasonably be considered to be a distribution of, or derived from, a "dividend that is not a taxable dividend" (e.g. a capital dividend) received by the trust or estate on a share of the capital stock of a corporation resident in Canada is subject to Part XIII tax. Part XIII tax must be withheld by the payer and remitted on behalf of the non-resident… .

9 October 2009 APFF Roundtable Q. 5, 2009-0327001C6

When a capital dividend (arising from insurance proceeds) received by an estate is used for the payment of estate taxes, would the distribution of the remainder of the estate to the heirs be excluded from the application of ss. 212(11) and 212(1)(c)? CRA responded:

[A]lthough an amount paid in favour of a Canadian estate as a capital dividend is used for the payment of estate taxes, the question of determining if a subsequent distribution in favour of non-resident beneficiaries can reasonably be considered to be a distribution of an amount received by the estate, or derived from such an amount, as a dividend is a question of fact. … Where applicable, the distribution would be subject to a withholding tax pursuant to subsection 212(11) and paragraph 212(1)(c)… .

17 July 2003 T.I. 2003-0020695

A trust receives a capital dividend in Year 1 (so that no part of the dividend is included in its income) and in Year 2 it makes a distribution in the same amount to its sole (non-resident) beneficiary. Would the distribution be subject to withholding under s. 212(1)(c)? CRA responded:

Withholding tax will apply…if either subparagraph 212(1)(c)(i) or (ii) applies. …(ii)…applies where it can reasonably be considered that the distribution is derived from an amount received by the trust as a capital dividend on a share of a corporation resident in Canada. Thus…withholding tax would be required.

20 October 1997 T.I. 971526

"In our view, subsection 212(11) of the Act merely characterizes any amount paid or credited by a trust or estate as income of the trust or estate for the purposes of paragraph 212(1)(c) of the Act. The wording in paragraph 212(1)(c) then makes it clear that such an amount is only subject to Part XIII tax to the extent it is an amount described in subparagraphs 212(1)(c)(i) or (ii) ... ."

12 April 1995 T.I. 5-941713 -

Taxable capital gains of a mutual fund trust designated to a non-resident unitholder under s. 104(21) would not be taxable in Canada.

Alberta Chartered Accountants Round Table, 2 May 1994, Q. 8, 940956 (C.T.O. "Capital Amount Paid by Trust to Non-Resident (8192)")

S.212(11) does not make all capital distributions by a trust subject to Part XIII tax. Instead, it merely characterizes any amount paid or credited as income for the purposes of s. 212(1)(c). The wording of s. 212(1)(c) then makes it clear that such an amount is only subject to Part XIII tax to the extent it is described in s. 212(1)(c)(i) or (ii).

22 February 1994 T.I. 5-932954

S.212(11) does not tax the non-taxable portion of capital gains distributed by an ordinary trust to a non-resident, or any portion of a capital gain distributed to a non-resident beneficiary of a mutual fund trust (given the exemption in s. 212(1)(c)(i)).

IT-465R "Non-Resident Beneficiaries of Trusts" 19 September 1985

- Subject to the exemptions in subsections 212(9), (10), (11.1) and (11.2)… subsection 212(11) provides that any amount paid or credited by a trust to a beneficiary (otherwise than on a distribution or payment of capital) shall be deemed for the purpose of paragraph 212(1)(c) to have been paid as income of the trust regardless of the source from which the trust derived it. Even if the amount so paid or credited was received by the trust in a form which, if it had been paid directly to the non-resident beneficiary, would have been exempt from Part XIII tax, subsection 212(11) applies to render that amount subject to tax under paragraph 212(1)(c) when it is paid or credited to the non-resident by the trust.

Subsection 212(13) - Rent and other payments

Paragraph 212(13)(a)

Administrative Policy

14 November 1997 Memorandum 971822

Annual payments made by a non-resident person carrying on business in Canada to a non-resident software supplier for updates, maintenance and servicing of computer software would not qualify as payments of "rent" and, accordingly, would not come within s. 212(13)(a). A review of judicial decisions indicated "that rent is generally a fixed payment (usually periodic) for the use of property for a given period of time, after which the right to use the property would extinguish (i.e., the right would be reverted back to the owner ... [O]nly in rare and unique situations would the word 'rent' be considered to mean 'royalty'".

Subsection 212(13.1) - Application of Part XIII tax where payer or payee is a partnership

Paragraph 212(13.1)(a)

See Also

The Queen v. Williams, 90 DTC 6399 (FCA), rev'd 92 DTC 6320 (SCC)

Stone J.A. found that unemployment insurance benefits earned by an Indian were not "property ... situated on a reserve" because the debtor (Her Majesty as represented by the Canada Employment and Immigration Commission) was not resident on the Reserve.

Twock v. Estate Duty Commissioners, [1988] 1 WLR 1035 (PC)

A simple contract debt (including a debt payable in futuro) is situate where the debtor resides. In the case of corporate debtors which carry on business in many jurisdictions, debts owing by them will be situate at the place where the company could be served with process at its registered office or place of business. Where there is more than one such place:

"The locality of the chose in action falls to be determined by reference to the place - assuming it to be also a place where the company is resident - where, under the contract creating the chose in action, the primary obligation is expressed to be performed." (p. 1041-1042)

Administrative Policy

25 February 1991 T.I. (Tax Window, Prelim. No. 3, p. 16, ¶1127)

If a partnership between a Canadian corporation and a non-resident corporation carrying on business in Canada is not entitled to deduct royalties in computing its income from a source in Canada, tax need not be withheld on the royalty payments.

6 February 1990 T.I. (July 1990 Access Letter, ¶1336)

For purposes of determining whether income is earned on a reserve, income from sources other than those enumerated in IT-62 generally will be considered to have their source at the payor's principal place of business, e.g., the head office of a payor bank.

Articles

Gregory Wylie, "Canada Revenue Agency Comments on Cross-Border Transactions", Tax Notes International, 7 June 2004, p. 991

Comment on CRA position that due to the joint and several liability of Canadian partners of a U.S. partnership, interest on a loan made to a U.S. partner having Canadian partners might be viewed as interest payable by the Canadian partners.

Paragraph 212(13.1)(b)

Cases

The Queen v. Gillette Canada Inc., 2003 DTC 5078, 2003 FCA 22

Some of the shares held by the taxpayer in its French subsidiary were purchased for cancellation by the subsidiary in consideration for the assignment to the taxpayer of a note (denominated in French-francs) owing to the subsidiary by a French partnership whose principal partner was the U.S. parent of the taxpayer. A month later, the note was converted into indebtedness denominated in Canadian dollars.

The conversion of the note to Canadian dollars did not give rise to a payment, credit or loan given that the Canadian dollar note was issued and accepted as replacement for the original note in circumstances where the terms were remained the same except the currency of payment.

Administrative Policy

27 March 2013 T.I. 2012-0450491E5 - Election under s. 216

Where a Canadian-resident tenant pays rent

to a partnership that has one or more partners who are not resident in Canada…the [Part XIII] withholding applies to the full amount of the payment even though some members of the partnership are residents of Canada.

30 October 1997 T.I. 971673

Where s. 212(13.1)(b) applies to payments to a partnership of which there is a non-resident limited partner, Part XIII tax will be applicable to the entire amount of such payment rather than the portion of such payments allocated to the non-resident partner.

IT-81R "Partnerships - Income of Non-Resident Partners"

Subsection 212(13.2) - Application of Part XIII tax — non-resident operates in Canada

See Also

Eastern Successco Ltd. v. The Queen, 2004 DTC 3521, 2004 TCC 689

The taxpayer, which was a non-resident trust, financed its construction of a condominium project in Canada through a loan from a non-resident lender. The interest was paid following the completion of construction.

Mogan J. found that as the interest accruing on the loan to the completion of construction was capitalized as part of the cost of the project under s. 18(3.1), that interest when paid should not be considered to be deductible in computing the taxpayer's taxable income earned in Canada for purposes of s. 212(13.2). Mogan J. noted that when an amount of interest is capitalized, "it loses its character as 'interest' and becomes merged in the overall cost of the building like the cost of the concrete foundation, brick siding, windows, roof and heating plant". Furthermore, it had been established in Oryx (74 DTC 6352) and Shofar (79 DTC 5347) that "when computing the income of a trader, any outlay or expense which becomes part of the cost of inventory is taken into account when computing 'gross profit' but is not deductible in computing income". Accordingly, Part XIII tax was not applicable to the payment of interest that had been capitalized as part of the real estate inventory of the taxpayer.

Administrative Policy

24 February 2000 Memorandum 1999-001425

Interest capitalized as inventory pursuant to s. 18(3.1) would be considered to be deductible for purposes of s. 212(13.2). The debtor will be required to withhold Part XIII tax on such interest in the taxation year in which the interest is paid or credited.

1996 Corporate Management Tax Conference Round Table, Q. 8

Where s. 250(5) deems a U.S.-incorporated subsidiary whose central management and control is in Canada, to be resident in the U.S., the subsidiary will be considered a "non-resident person" for purposes of applying s. 212(13.2). Therefore, if its operations are carried on solely in Canada, interest payments made by it to a non-resident of Canada will be subject to Part XIII tax (unless an exemption, such as under s. 212(1)(b)(vii)) is available.

Subsection 212(13.3) - Application of Part XIII to authorized foreign bank

Administrative Policy

13 July 2001 Comfort Letter No. 20010713

"The broad direction of our thinking" is that "it should be possible to provide that the payor's reasonable belief, or a presumption based on the payee's address, will suffice to relieve the payor from possible liability" where it makes a payment to a foreign bank that is believed to be in respect of that bank's Canadian banking business.