Subsection 50(1) - Debts established to be bad debts and shares of bankrupt corporation

Cases

Sunatori v. The Queen, 2011 DTC 5153 [at 6175], 2011 FCA 254

The taxpayer was the sole shareholder and employee of a corporation. The corporation paid him his entire salary on December 31 each year, which he immediately lent back to the corporation and claimed as a bad debt. Noël stated (at para. 7):

The appellant cannot maintain at once that he made bona fide loans to his company and that the loans gave rise to bad debts on the very day on which they were advanced. A monetary loan, by definition, is an amount advanced in the expectation that it be repaid... .

Simmonds v. MNR, 2006 DTC 6083, 2006 FC 130

In reviewing an adverse response of the Minister to a request of the taxpayer that the Minister grant under s. 152(4.2) the taxpayer's request for recognition of an allowable business investment loss in a statute-barred year, Dawson J. found that the Minister had erred in finding that it was not reasonable to expect that a corporation ("PGL") owned by the taxpayer would be dissolved and wound up in light of the fact that the corporation was a party to litigation.

"A review of the considerations that led to the decision shows that the Director failed to consider the likelihood that when the lawsuit was resolved PGL would be dissolved and would not commence carrying on business. This would involve consideration of things such as the nature of the claims advanced in the lawsuit, the role of PGL in the lawsuit and what would be the reasonable expectation of PGL's future if the lawsuit succeeded."

Turner v. The Queen, 2000 DTC 6442, Docket: A-538-98 (FCA)

The trial judge erred in finding that the taxpayer should have elected under s. 50(1)(b) in respect of his share investment in a company for 1984 (the year its license to operate was revoked) rather than 1994 (the year in which it was wound-up) given that the licence was restored in 1985 and the law suit brought by the taxpayer and the company against the federal authorities relating to alleged wrongful revocation of the licence was not settled until 1994.

See Also

Kokai-Kuun Estate v. The Queen, 2015 TCC 217

In denying the recognition by the taxpayer of a capital loss under s. 50(1)(a), Lyons J stated (at paras. 55, 58, 62, 67):

In Harris v The Queen, 2005 TCC 501, 2005 DTC 1179, Sheridan J….stated "To be eligible to claim either of the amounts as a deduction, Mrs. Harris must have complied with subsection 50(1)… ."

Given the appellant failed to make an election in 2006, or any other year, as required under paragraph 50(1)(a), the appellant cannot succeed as it is imperative to claim that a capital loss is available… .

Since the appellant failed to elect in the return to claim the capital loss, its remedy is to file an application to the Minister under section 220… .

Despite this, no application was made by the appellant to the Minister under the fairness relief provisions. This Court has no jurisdiction with respect to those provisions.

Gaumond v. The Queen, 2014 DTC 1024 [at 98], 2014 TCC 339

The Canadian-controlled private corporation ("GMG") of which the taxpayer was the principal shareholder made a proposal in May 2011 under the Bankruptcy and Insolvency Act which, when accepted by its creditors, resulted in the interest–bearing unsecured debt owing by GMG to him being extinguished on 30 August 2011. In finding that the resulting capital loss to the taxpayer did not also qualify as a business investment loss ("BIL"), Lamarre J found that a BIL could not be recognized under the s. 50 branch of the definition as the debt was not owing to him at the end of 2011.

See summary under s. 39(1)(c).

St-Hilaire v. The Queen, 2014 TCC 336

The taxpayer made non-interest bearing advances to a wholly-owned incorporated radio station. On 8 August 2008, the corporation made a proposal under the Bankruptcy and Insolvency Act, which was accepted by the creditors, and then approved by the Quebec Superior Court on 9 October 2008. The taxpayer subsequently sold his shares at a gain to a purchaser which was interested in the CRTC radio licences.

The taxpayer's complete loss under the proposal on his advances (although conceded to be a capital loss) was not a business investment loss because his disposition of the advances was not a disposition to which s. 50(1) applied, which required that the advances be owing to him at the end of his taxation year (31 December 2008). After noting that most authorities suggested that under a proposal, the debtor was released of its obligations when the proposal had been accepted by the creditors and approved by the Court, Paris noted that here the taxpayer had renounced his entitlement to receive a distribution with the unsecured creditors (in order to secure approval) and that the corporation had written off the debt in its financial statements for its 31 October 2008 fiscal year:

As the taxpayer's loan no longer existed at 31 December 2008, the provisions of section 50 of the Act could not apply and the appellant had no right to an ABIL (para. 41)

Coveley v. The Queen, 2014 DTC 1041 [at 2771], 2013 TCC 417, aff'd 2014 FCA 281

The taxpayers were a married couple employed by a technology research corporation ("cStar"), and one taxpayer was also a shareholder. They lent a significant portion of their salaries back to cStar over several years. In 2005, citing an inability of cStar to meet its financial obligations, they wrote off the loans and claimed business investment losses.

D'Auray J agreed with the Minister that the losses should be denied. The bulk of the evidence showed that, despite various setbacks (e.g. the 2001 the dot-com bubble bust), cStar's financial health was in no worse condition than usual, it continued to attract investors in 2006, many of the setbacks had occurred well before 2005, and the taxpayers continued to lend their salaries.

Kyriazakos v. The Queen, 2007 DTC 373, 2007 TCC 66

The taxpayer advanced funds to a start-up company, sold the shares to a friend and, after the sale, made no attempt to collect the advances from the company as she knew the friend was in financial difficulty and, as a friend, she did not want to add to his problems.

In accepting that the taxpayer has sustained an allowable business investment loss, Miller J. stated (at pp. 376-37):

"I conclude that where a creditor could access financial information to assist in assessing the collectibility of a debt but chooses not to, the Court should take into account not only all the factors the creditor in fact considered, but the Court should also consider such financial information in assessing the reasonableness of the creditor's decision."

Netolitzky v. The Queen, 2006 DTC 2953, 2006 TCC 172

In finding that the taxpayer was entitled to claim business investment losses in respect of portions of amounts advanced to him by a company run by his wife and also to his an independent company, Sheridan J. stated (at p. 2956) that "the case law is clear that under paragraph 50(1)(a), either all or a portion of the debt may be considered bad" and rejected (at p. 2955) as "an unwarranted expansion of the duty imposed on the taxpayer" a submission of the Crown that the taxpayer ought to have obtained an independent assessment of the amount of the loss and of the company's potential resale value.

Hopmeyer v. The Queen, 2006 DTC 2919, 2006 TCC 185

At the time in question the corporation was serving customers as usual, employees were working as usual, orders were being taken and filled, accounts receivable being collected, the corporation was developing, manufacturing and selling specialized equipment and was engaged in scientific research in experimental development. Lamarre Proulx J. accepted the taxpayer's submission that in order for a person to be carrying on a business, the person must be engaged in the pursuit of profit, but rejected a submission that because the corporation had as an important goal the repayment of its debts, this meant that it no longer was pursuing profit as a purpose.

Litowitz v. The Queen, 2005 DTC 1469, 2005 TCC 557

In finding that the taxpayer had realized an allowable business investment loss with respect to an advance owing to him, Bowman C.J. noted (at p. 1472) that although the assessor, in concluding that the debt had not become bad, had approached the question carefully and conscientiously, the assessor obviously was substituting his judgment for that of the taxpayer, and the judgment of the taxpayer in the matter was one that a reasonable person would make in the circumstances. Furthermore, the fact that five years later the taxpayer ultimately collected on the debt did not establish that it was not a bad debt in the taxation year in question. "One should, in general, not apply the wisdom of hindsight in determining whether a debt is bad at a particular point in time." (p. 1472).

Keating v. The Queen, 2005 DTC 743, 2005 TCC 296

A loan owing to the taxpayer by a corporation owned by her but which had been depleted of its assets by her estranged husband had become a bad debt at the end of 1998 given that at time the corporation had no assets or customers, was not carrying on business and was not earning income. As there was no evidence to show that collection of the debt was reasonably possibly, the taxpayer was under no obligation to take steps to collect. The Minister unsuccessfully argued that the business investment loss of the taxpayer was reduced by $180,000 in damages for oppression received by her from her husband and his companies.

Jacques St-Onge Inc. v. The Queen, 2003 DTC 153 (TCC)

The taxpayer was able to claim an allowable business investment loss with respect to its investment in a subsidiary that had been incorporated to engage in a speculative business activity that was unsuccessful, notwithstanding that the subsidiary was not wound-up and was amalgamated with the taxpayer more than three years after the year-end at which the allowable business investment loss was claimed. The company was not wound-up or dissolved because of the threat of legal proceedings against the subsidiary, and the double-tax benefit to be derived from a winding-up (i.e., both an allowable business investment loss, and access to the non-capital losses of the subsidiary) made it reasonable to expect that a winding-up would occur notwithstanding that, the proprietor of the taxpayer indicated that, in fact, he never had any intention to have the subsidiary wound-up.

Campbell v. The Queen, 2000 DTC 2528, Docket: 1999-1745-IT-G (TCC)

Before going on to find that the taxpayer had realized an ABIL in his 1994 taxation year, as claimed by him, Hamlyn T.C.J. stated (at p. 2530):

"A debt is usually considered to have become a bad debt when the taxpayer has exhausted all legal means of collection. The question of when a debt is to be considered uncollectible is a matter of the taxpayer's own judgment as a prudent, pragmatic, businessman. However, the Court must be satisfied that the taxpayer acted in a pragmatic, business like manner in making the determination of uncollectibility. (See Berreti v. MNR, 86 DTC 1719 at p. 1723.)"

Burns v. The Queen, 94 DTC 1370 (TCC)

The taxpayers were entitled to write-off 1/2 of the debts owing to them at the end of 1986 by a company ("WFC") given that on October 25, 1986 minutes of a WFC shareholders' and directors' meeting of WFC referred to the intention of the company to cease operations effective December 31, 1986 and that the debt owing to the taxpayers and other family members would not be paid in full and that they had been advised that the most they could expect to receive from WFC would be 50% of the amount outstanding. The balance of the debt was deducted in the following year when it became clear that no money would be forthcoming from WFC.

Administrative Policy

17 October 2014 Memorandum 2014-0535121I7 F - Hypothèque et créance irrécouvrable

In order to facilitate a sale, a real estate agent (the "Broker") provided financing to the purchaser by way of a second-ranking hypothec (which was capital property). When the Broker did not receive repayment in full, no action was taken to seize the property, and the property was not sold.

In finding that no write-down could be taken under s. 50(1) as (per the summary) "the debt is not bad yet since the taxpayer has not exhausted all legal means of collection," the Directorate stated (TaxInterpretations translation):

[S]ince the Broker did not exercise all the rights and remedies under the Civil Code of Quebec, the hypothecary claim did not become irrecoverable.

11 October 2013 APFF Roundtable Q. , 2013-0495671C6 F

When asked how CRA's position - that a debt must be unrecoverable in its entirety before it could qualify as a bad debt under s. 50(1) - could be reconciled with CRA's position that a partly bad debt could be deducted under s. 20(1)(p), CRA stated (TaxInterpretations translation):

[T]he concept of debts in subparagraph 20(1)(p)(i) can refer to each account receivable of the taxpayer. Thus…certain of the amounts due by a client can become irrecoverable and these represent the portion of the debt which has become irrecoverable.

On the other hand:

A debt can be eligible for the election under subsection 50(1) if it is irrecoverable in its entirety at the end of a taxation year.

3 January 2014 T.I. 2013-0482081E5 - Nil value partnership units

A limited partnership "has ceased all activity but has not legally ceased to exist;" and "all partnership funds have been lost in a failed investment." CRA stated:

As limited partnership units are not the type of property described in subsection 50(1), that provision cannot apply to the situation at hand. Further, there is no provision in the Act that provides similar treatment for nil value limited partnership units. [However]…where a partnership is dissolved and the taxpayer is not entitled to and does not receive any share of the partnership's net assets (if any), the dissolution would generally result in a disposition of the partnership interest and an amount of zero may be used as proceeds of disposition... .

9 November 2012 CTF Atlantic Roundtable Q. , 2012-0465981C6

When a tax return is filed electronically, how can the taxpayer satisfy a requirement to "elect in the return" (see s. 50(1)) or "by letter attached to the return ... elect..." (see Reg. 1101(5b.1))? CRA responded:

[E]lections, designations, agreements, waivers, and special elective returns must be submitted in paper format by the appropriate due dates... .

A taxpayer can indicate in the software that they are making an election and the software will build an Election indicator field. ... Completion of this field code does not constitute an election; it is designed only to inform us that an election form or a letter/note containing the required information is being submitted in paper format

...

The Minister has discretion as to how to accept elections. With respect to the election under subsection 1101(5b.1) of the Regulations, the CRA will not deny the election on the basis that it was mailed separately and not attached to the electronic return.

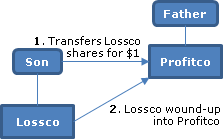

5 October 2012 APFF Roundtable Q. , 2012-0454061C6 F - Transfer of a Lossco to a related corporation

underline;">: Example 1.

Son claims an ABIL under s. 50(1) with respect to his share investment in a wholly-owned corporation (Lossco), which had ceased active business operations in the year, and then transfers his shares of Lossco at the beginning of the following year to a corporation wholly-owned by his Father (Profitco) for consideration of $1, with Lossco then being liquidated into Profitco under s. 88(1).

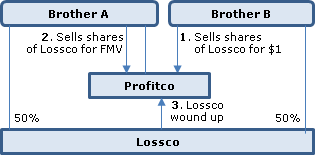

Example 2

Brothers A and B each hold 50% of the common shares of Lossco, which had ceased active business operations in the year, with Brother B claiming an ABIL under s. 50(1). Brother B then transfers his shares of Lossco at the beginning of the following year to a corporation wholly-owned by Brother A (Profitco), Brother A sells his shares of Lossco to Profitco for their fair market value, and Lossco is liquidated into Profitco under s. 88(1).

Before addressing the loss transfer issue raised in the question (and further noting that the transfer by Brother B of his Lossco shares to Profitco gave rise to a capital loss (i.e., not a business investment loss) subject to the loss being limited by s. 69(1)(b)), CRA indicated that it was "not evident" that the conditions in s. 50(1)(b)(iii) for realizing a capital loss under s. 50(1) were satisfied in either example, stating (TaxInterpretations translation):

...it is necessary to attribute to the word "insolvent" its ordinary meaning as this term is not defined in the ITA. A dictionary definition defines the term 'insolvent" as follows: "That which is no longer able to pay its debts." Consequently, a corporation which has neither assets nor liabilities at the end of a taxation year (or, in any event, it has no liabilities at that moment) cannot generally be considered insolvent for purposes of ITA subparagraph 50(1)(b)(iii).

The condition provided in ITA clause 50(1)(b)(iii)(C) is that the fair market value of the shares which are subject to the election under ITA subsection 50(1) must be nil. In this regard, it appears to us that the valuation of the shares in the situations described above would normally take into account the accumulated tax losses which can eventually be deducted in the calculation of a corporation's income.

16 December 2003 Memorandum 2003-04616 -

With respect to the situation where a parent corporation ("Parentco") would elect to have s. 50(1) apply in respect of the shares of one of its wholly-owned subsidiaries ("Lossco") and then, in a subsequent taxation year, Parentco disposes of its Lossco shares in favour of another wholly-owned subsidiary ("Profitco") for a nominal cash consideration, the Agency commented that it would be difficult for Parentco to satisfy the requirements of ss.50(1)(b)(iii)(A) and (C) stating that "the benefits that can be derived from the utilization of non-capital losses should generally be taken into consideration in assigning a value to the shares of a corporation".

8 January 2002 T.I. 2001-009600 -

A debt would not qualify as being bad, i.e., completely uncollectible, by virtue only of a decision having been made that the debtor corporation will only use its remaining net assets to pay trade receivables rather than such debt.

15 June 1998 Memorandum 980234

A corporation that had made a general conveyance of all its assets to its shareholder in the course of voluntary dissolution proceeding, with the shareholder assuming all its liabilities, was not insolvent, i.e., unable to pay its debts.

1994 A.P.F.F. Round Table, Q. 6

"Nothing in the wording of subsection 50(1) of the Act leads us to believe that a portion of a debt may be deemed a bad debt. This interpretation rests on the fact that the deemed acquisition of the debt at a cost equal to nil seems to be possible in a situation where, at the end of a particular taxation year, the original debt has no known value."

6 April 1993 T.I. (Tax Window, No. 30, p. 5, ¶2493)

Anderson v. MNR, 92 DTC 2296 (TCC) (in which a letter of the taxpayer's accountant requesting the application of an allowable business investment loss to prior years was found to constitute an election) is not a precedent in this regard because it was based on its particular facts and because the Court felt the taxpayer was entitled to an allowable business investment loss on the deemed disposition of the debt owing to him by his corporation.

Central Region Rulings Directorate Seminar, Q. A (May 1993 Access Letter, p. 228)

The deemed disposition likely does not occur on a debt owing by a corporation all of whose other loans have been called by the bank so long as interest continues to be paid on the debt.

17 February 1993 Memorandum 930202 (Tax Window, No. 30, p. 21, ¶2496)

The onus is on the taxpayer to establish that there was a debt owing to him, i.e., "a sum payable in respect of a liquidated money demand, recoverable by action".

1992 A.P.F.F. Annual Conference, Q. 4 (January - February 1993 Access Letter, p. 51)

Given that the dictionary meaning of "insolvent" refers to incapability of paying debts, a corporation that has neither assets nor debt cannot generally be considered to be insolvent.

23 October 1991 Memorandum (Tax Window, No. 12, p. 23, ¶1548)

An investor who suffers a loss due to fraud may be entitled to claim a capital loss if the criteria in IT-159R3, para. 10 are met.

29 July 1991 T.I. (Tax Window, No. 7, p. 19, ¶1377)

A corporation will not have ceased to carry on a business until the liquidation of all assets capable of being used in an income-earning process is substantially complete.

12 December 1989 T.I. (May 1990 Access Letter, ¶1215)

The cessation of business and the insolvency referred to in s. 50(1)(b)(iii) need not occur in the same year as long as the corporation satisfies both conditions in the particular taxation year.

25 October 89 T.I. (March 1990 Access Letter, ¶1145)

Where a creditor agrees with an insolvent corporation to take less than the full amount owing in exchange for a full and final release of all further liability, the unpaid portion of the debt will be considered to be a debt owing to the taxpayer at the end of the year for purposes of s. 50(1)(a), and therefore will be eligible for the deduction.