Subsection 52(1) - Cost of certain property the value of which included in income

Administrative Policy

6 August 2013 T.I. 2012-0469481E5 F - Benefit under trust

An estate sold personal-use real estate to one of its beneficiaries for a price less than the property's fair market value, so that s. 69(1)(b)(i) applied. The capital gain to the estate was payable to a beneficiary other than the purchaser.

CRA rejected a submission - that the exception in s. 107(1)(a) applied to exclude a taxable benefit to the purchaser because later in the same year the purchaser sold the property at a capital gain which was increased by the amount of the purchaser's reduced cost for the property. Accordingly, that difference represented a taxable benefit to the purchaser, but such amount was required to be added to the purchaser's adjusted cost base under s. 52(1) – with a resulting reduction in the capital gain on the subsequent sale.

3 January 2003 T.I. 2002-014396 -

When an amount was included in the income of an initial subscriber for a share of a corporation on the basis that the nominal subscription price was less than the fair market value of the share, the amount of the resulting benefit under s. 15(1) or 246(1) generally would be added to the ACB of the share to the purchaser pursuant to s. 52(1).

Income Tax Technical News, No. 11, September 30, 1997, "U.S. Spin-Offs (Divestitures) - Dividends in Kind"

The cost of shares received as a dividend-in-kind will be equal to the amount of dividend included in the shareholder's income.

18 March 1993 Memorandum (Tax Window, No. 32, p. 7, ¶2599)

Where bond coupons are sold for an amount that is different from the discounted amount calculated pursuant to Regulations 7000(2)(b), a capital gain or capital loss will result.

October 1992 Central Region Rulings Directorate Tax Seminar, Q. N (May 1993 Access Letter, p. 233)

The amount included in income under s. 12(9) in respect of a prescribed debt obligation is added in computing the cost to the investor of that instrument under s. 52(1).

13 June 1991 T.I. (Tax Window, No. 4, p. 14, ¶1306)

Amounts included in income each year in respect of a prescribed debt obligation will be added in computing the adjusted cost base of the prescribed debt obligation.

Subsection 52(2) - Cost of property received as dividend in kind

Administrative Policy

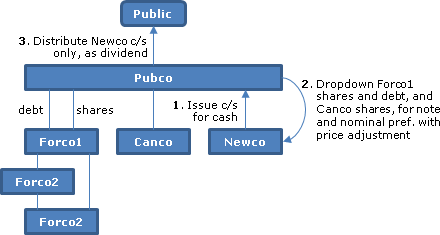

2013 Ruling 2013-0488291R3 - Reorganization of Corporations - Rollover

Background

Pubco (a Canadian public company) wishes to spin-off Canco and Forco1 (a foreign affiliate) to its shareholders without incurring the expense of a plan of arrangement or holding a shareholders' meeting.

Proposed transactions.

- Pubco will incorporate Newco (a taxable Canadian corporation) and subscribe for common shares.

- Pubco will transfer its shares of Canco and Forco1, and a loan owing by Forco1, to Newco mostly in consideration for interest-bearing notes of Newco - as well as the issuance of preferred shares with a nominal redemption amount and subject to a price adjustment clause. The agreed amount in s. 85(1) elections will be the fair market value of the transferred properties.

- Pubco will declare and pay a dividend-in-kind to its shareholders consisting of the Newco common shares.

- Pubco will lend cash to Newco for an interest-bearing note.

- "To facilitate the payment of the Part XIII tax associated with the dividend in kind, PUBCO will cause Newco to repurchase shares of its capital stock from the affected shareholder with a value equal to the amount of the withholding tax owing, which will then be remitted to the CRA."

Rulings

- Subject to s. 69(11), s. 85(1) will apply to the transfer in 2.

- Per s. 52(2), Pubco will dispose of the Newco shares for their fmv and its shareholders will be deemed to acquire them at the same amount, which will also be the amount of the taxable dividend.

- S. 84(3) deemed dividends will arise in 5 based on any excess of the repurchased shares' fmv over their PUC.

Articles

Patrick W. Marley, Kim Brown, "Foreign Mergers and 'Demergers' Under Recent Canadian Proposals", Tax Management International Journal, 10 February 2012, Vol 41, No. 2, p. 86

Ademerger, which under the foreign corporate law, might be viewed as one stream splitting into two, might not qualify under draft s. 90(2) as a pro rata distribution on a class of shares of the foreign affiliate, with the result that s. 15(1) could apply. However, even if the demerger were considered to be a dividend, the demerged affiliate might be considered to have disposed of shares of the new foreign affiliates at fmv pursuant to s. 52(2), potentially resulting in the creation of hybrid surplus or additional fapi.

Subsection 52(4) - Cost of property acquired as prize

Cases

The Queen v. Rumack, 92 DTC 6142 (FCA)

It was found that no inference could be drawn from s. 52(4) that a monthly annuity won by the taxpayer in a lottery was exempt from income tax.

Administrative Policy

84 C.R. - Q. 21

A prize of $1,000 per month has a cost equal to fair market value at the time of obtaining the right to the prize. Thereafter, ss.56(1)(d), 60(a) or 56(1)(d.1) will be applicable.

Subsection 52(6)

Administrative Policy

4 February 1992 T.I. (Tax Window, No. 16, p. 5, ¶1728)

Where at the time a taxpayer acquires a unit in a unit trust the value of the unit includes income payable by the trust at year-end and realized capital gains, on a subsequent redemption of the units s. 52(6) will attribute a cost to the right to receive the income and capital gains equal to the amount received in satisfaction of that right, and no gain or loss will arise.