Cases

CIBC v. The Queen, 2013 DTC 5098 [at 6020], 2013 FCA 122

The taxpayer paid approximately $3 billion in settlements relating to claims that it or its subsidiaries were jointly and severally liable with Enron and other defendants for working with Enron while aware that Enron was publishing misleading financial reports. The Minister denied the deduction of the settlement payments on the basis inter alia that they were not expenses incurred to produce income; and pleaded that the taxpayer's conduct was "so egregious and repulsive" that the settlement payment could not be justified as being incurred for such purpose.

The Court granted the taxpayer's motion to strike the statement from the pleadings. Paragraph 18(1)(a) does not invite the Court to weigh the morality of the taxpayer's conduct. After referring to Iacobucci J's obiter dictum in 65302 regarding "egregious or repulsive" conduct, Sharlow JA stated (at paras. 65-66):

I do not accept that Justice Iacobucci, having rejected the notion that the Courts may superimpose on paragraph 18(1)(a) a non-legislated public policy test, would accept in the very same case the proposition that the Courts nevertheless may superimpose on paragraph 18(1)(a) a non-legislated requirement that the taxpayer's conduct not be "egregious or repulsive."

...Essentially, he was recognizing that certain conduct may, because of its egregious or repulsive nature, be so disconnected factually from the taxpayer's actual business (or any business) that an expense the taxpayer incurs because of that conduct cannot meet the income earning purpose test.

Lyncorp International Ltd. v. The Queen, 2012 DTC 5032 [at 6684], 2011 FCA 352, aff'g 2010 DTC 1351 [at 4335], 2010 TCC 532

The taxpayer, owned and operated by Mr. Mullen, invested in shares and made non-interest bearing loans to a number of corporate ventures to which Mr. Mullen provided management services free of charge by him or the taxpayer. The significant expenses of a private jet which were incurred primarily in connection with Mr. Mullen making visits to the offices of these ventures were deducted in computing the taxpayer's income. The Minister denied these deductions.

Miller J. allowed only the expenses related to a business carried on directly by the taxpayer. In respect of its investments described above, he concluded that the related flight expenses were not incurred for the purpose of earning income from either a business or property. He noted (at para. 75):

The [taxpayer] was, in effect, giving its business ventures several hundred thousand dollars, neither by way of debt or equity but simply by providing free services towards the operation of the business ventures' businesses... . This generosity was neither a loan nor an equity investment by the [taxpayer]. It might best be described as an agreement to pay someone else's expenses. Equity investments yield dividend income. Debt investments yield interest income. Free services, with no obligation to repay, yield only hope. This is not a deductible expense.

Miller J. also noted that, because the debts were interest-free, they could not have an income-producing purpose even though they were issued in anticipation of subsequent dividend income from the business ventures. "The dividend income does not arise from the debt. Put in tax terms, the debt is not the source of dividend income" (para. 67).

The Court of Appeal affirmed the reasoning given at the Tax Court (and in particular adopted para. 75) and rejected the further submission that, under the ultimate purpose test in Byram, the taxpayer could deduct an expense under s. 18(1)(a) provided that it were incurred to increase the profitability of the corporations for the purpose of receiving dividend income. Evans J.A. stated (at para. 14):

Byram is relevant in that it recognizes that the connection between an expense incurred by a taxpayer and anticipated dividend income cannot be tenuous or remote.

Teck Corp. v. The Queen, 2005 DTC 5338, 2004 BCCA 514

Mining taxes paid by the taxpayer to the provinces of Ontario, Quebec and Newfoundland and Labrador were income taxes the deduction of which was prohibited by s. 18(1)(a) rather than taxes in the nature of royalties the deduction of which was prohibited by s. 18(1)(m) of the Act. (The latter characterization would have resulted in the deductibility of such taxes by virtue of s. 8(1) of the Income Tax Act (BC)).

McNeill v. The Queen, 2000 DTC 6211 (FCA)

Some years after the taxpayer sold his chartered accountancy practice to another firm, he was ordered to pay damages and costs of $465,908 in respect of the breach of his covenants in the sale agreement to provide consultancy services and not to compete with the purchaser as well as for breach of an independent fiduciary duty to the purchaser.

After noting that the Tax Court had found that the taxpayer's objective in breaching these covenants was to keep his clients and his business, Rothstein J.A. found that the analysis in 65302 British Columbia Ltd. respecting the deductibility of fines and penalties also applied to a court award of damages. As the Court was not satisfied that the taxpayer's conduct was so egregious or repulsive that the damages subsequently awarded were not justified as being incurred for the purpose of producing income, the damages were deductible.

65302 British Columbia Ltd. v. The Queen, 99 DTC 5799, [1999] 3 S.C.R. 804

The taxpayer, which was a registered egg producer, deliberately produced over quota in order to maintain its major customer, (who was expanding), until it could purchase additional quotas. The over-production was discovered by the British Columbia Egg Marketing Board and the taxpayer deducted a resulting over-quota levy paid by it to the Board together with related interest and legal expenses.

In finding that all such amounts were fully deductible, Iacobucci J. indicated that he declined to follow Imperial Oil, 3 DTC 1090 (whose requirement that expenses need be incidental, in the sense that they were unavoidable, was based on the more restrictive statutory ancestor of s. 18(1)(a)), that making the deductibility of fines depend upon considerations of public policy would "place a high burden on the taxpayer who is to engage in this analysis in filling out his or her income tax return and would appear to undermine the objective of self-assessment underlying our tax system" (p. 5811), and that, in any event, that denying deductibility might undercut one of the underlying premises of our tax system which "is that the state taxes only net, rather than gross, income because it is net income that measures a taxpayer's ability to pay". He concluded that fines and penalties that are incurred for the purpose of producing income (as was the case here) should be deductible.

He added (at p. 5813):

It is conceivable that a breach could be so egregious or repulsive that the fine subsequently imposed could not be justified as being incurred for the purpose of producing income.

Taylor v. The Queen, 97 DTC 5120 (FCA)

In a situation where the taxpayer had misappropriated funds from 1986 to 1989, then effected restitution in 1990, Linden J.A. stated that "the carryback and carryforward provisions are still open to the appellant if the proper forms are filed".

Amway of Canada. Ltd. v. The Queen, 96 DTC 6135 (FCA)

Strayer J.A. found that all amounts paid by the taxpayer to Revenue Canada in settlement of an enforcement action brought against it pursuant to s. 192(1) of the Customs Act represented a penalty notwithstanding that a portion of the amounts paid by it were equal to the customs duties and excise tax that would have been payable by the goods in question had it properly reported their dutiable value. "Strayer J.A. went on to find (at p. 6141) that such penalties were non-deductible because it could not have been concluded that the taxpayer's "deliberate and fraudulent scheme to avoid payment of higher duties and taxes to the revenue of Canada was an unavoidable incident in the operation of Amway's business of importing goods and selling them in Canada".

Tonn v. The Queen, 96 DTC 6001 (FCA)

Before going on to find that rental losses incurred by the taxpayers were fully deductible by them, Linden J.A. stated (at p. 6005) that s. 18(1)(a) required that an:

expense must have been incurred within a business framework, bearing some relation to the income earning process ... . [S]uch intention, strictly speaking, is subjective; no requirement of objective reasonability is expressly imposed by the section.

Poetker v. MNR, 95 DTC 5614 (FCA)

Before affirming the finding of the Tax Court judge that the taxpayer was not able to deduct persistent losses from two condominium units that the taxpayer had acquired with a view to earning rental income but which the Tax Court judge had found had not been acquired with a reasonable expectation of profit, Stone J.A. noted that the decision in Landry (94 DTC 6624) could not be distinguished from the present case, and noted that "we do not read the majority decision as founded upon the presence of some personal benefit element in the taxpayer's business activity".

Symes v. The Queen, 94 DTC 6001, [1993] 4 S.C.R. 695

Before indicating that it was unnecessary to determine whether there should be a change in the traditional position that child care expenses (in this case, the expenses of a nanny paid by a mother who practised law full-time as a partner in a Toronto firm) were non-deductible, Iacobucci J. noted that the character of child care expenses was unique. Favouring their deductibility was the significant percentage of a taxpayer's income they represented, their general linkage to the taxpayer's ability to gain or produce income, and policy considerations (the expenditures are incurred as part of the development of another human life). On the other hand, such expenditures are also made in order to make a taxpayer available to the business.

The Queen v. Shefner Estate, 93 DTC 5482 (FCTD)

The expropriation committee of the City of Anjou threatened to pursue criminal and civil action against the taxpayer and a corporation owned by him ("Alderton") in connection with the excessive amount of expropriation proceeds received by a corporation 1/3 of whose shares were owned by the taxpayer and Alderton. A payment made by the taxpayer in settlement of this claim was fully deductible from his income based on a finding that his potential liability was incurred as part of his real estate business and given that settling with the City avoided possible damage to his business reputation.

Parkland Operations Ltd. v. The Queen, 90 DTC 6676 (FCTD)

A loss of $563,396 which the taxpayer suffered from defalcations made by minority shareholders was found to have resulted from wrongful draw-downs from the taxpayer's operating lines of credit in the course of the taxpayer's trading operations, and therefore was realized by it on income account. The minority shareholders "misappropriated the money while dealing with it in the course of the company's activities, and not by exercising some overrriding control over the funds which existed outside of those activities" (p. 6680).

Graves v. The Queen, 90 DTC 6300 (FCTD)

The taxpayers were entitled to deduct a portion of their house expenses based on the square footage of 1/2 of their basement relative to their house square footage, on the ground that they used that portion of the basement: (a) as a reception area for Amway distributors to wait and collect Amway products each week following delivery to the taxpayers (who were direct distributors), (b) for the storage of Amway products and (c) for filing cabinets. However, the taxpayers' claim that they were entitled to deductions in respect of 1/2 of the space of their two-car garage, on the basis that one of the two cars was primarily used in the Amway business, was found to be without merit in light of the fact that the taxpayers had owned two cars and built the two-car garage prior to becoming involved in their Amway business.

In addition, the taxpayers, in appealing a finding of the Tax Court judge that only 75% of the expenses attributable to one of the automobiles were deductible as a business expense, were found to have failed to have established that 90% of the total mileage was for business use. MacKay J. stated (with reference to the travel log which the taxpayers had prepared, which contained only estimates of the miles that have been travelled on business use) stated that "a taxpayer cannot simply estimate businesses travelled in the hope that this will suffice as an adequate accounting of mileage actually completed in the course of business for which expenses are claimed as a business expense."

Conventions of Amway distributors that the taxpayers attended in the United States for the purpose of developing their leadership abilities and for the purposes of developing motivation, enthusiasm and vision were found to have been incurred for an income-producing purpose.

Friedland v. The Queen, 89 DTC 5341 (FCTD)

The taxpayer was able to deduct the payment by it of expenses incurred by its individual shareholder in connection with driving his BMW and Rolls downtown and to York University.

La Compagnie Idéal Body Inc. v. The Queen, 89 DTC 5344 (FCTD)

A private corporation which prior to the death of its principal shareholder had regularly declared and paid bonuses to him of under $100,000 was permitted to deduct only $100,000 of a $210,000 bonus which it declared to his widow in light of the fact that she relied heavily on other company personnel and worked for the corporation about five hours per week. The cancellation of the bonus as the 1982 recession deepened did not affect its (partial) deductibility for 1981.

Moloney v. The Queen, 89 DTC 5062 (FCTD), aff'd 92 DTC 6570 (FCA)

The taxpayer and other individuals each paid $20,000 to an off-shore corporation ("Applied Research") purportedly as a pre-paid royalty for a licence to market (through a designated agent) a speed-reading course in a designated area of the U.S.A., and $100 for the licence itself. Generally, the expenditure was paid through a "performance bond" (i.e., a cheque payable to the taxpayer and Applied Research) received from a corporation not dealing at arm's length with Applied Research, and a promissory note which was payable by the taxpayer only if he received his tax refund. The $20,000 "payment" was not deductible in light of the financial inability of the corporations to market the speed-reading course and the lack of a reasonable expectation of profit.

In the Court of Appeal, Hugessen J.A. stated (p. 6570):

... For an activity to qualify as a 'business' the expenses of which are deductible under paragraph 18(1)(a), it must not only be one engaged in by the taxpayer with a reasonable expectation of profit, but that profit must be anticipated to flow from the activity itself rather than exclusively from the provisions of the taxing statute.

Mattabi Mines Ltd. v. Ministry of Revenue (Ontario), [1988] 2 CTC 294, [1988] 2 S.C.R. 175

In response to a submission that mining machinery and equipment had not been purchased "for the purpose of earning income" because the profits initially generated by the mine would be eligible for a federal and provincial tax holiday, Wilson J. stated:

If [as established in case law cited by her] there is no need to demonstrate a causal connection between a particular expenditure and a particular income, and no need for the income to be generated in the same year in which the expenditure was made, then it would not seem to matter whether Mattabi suffered tax losses in 1971 or that it would have been exempt from tax had it made a profit. The only thing that matters is that the expenditures were a legitimate expense made in the ordinary course of business with the intention that the company could generate a taxable income some time in the future.

Mott v. The Queen, 88 DTC 6359, [1988] 2 CTC 127 (FCTD)

Since travelling expenses incurred for the purpose of commuting between one's place of residence and place of business are not deductible, aircraft expenses incurred for the purpose of travelling between the taxpayer's home and his orchard business were non-deductible. In addition, since the expenses of travelling between one's residence and business en route to another business, and back, are also not deductible, aircraft expenses incurred by the taxpayer for purposes of travelling between his law practice and his orchard were also not deductible because they involved commuting between two different businesses and his residence.

The Queen v. Royal Trust Corp. of Canada, 83 DTC 5172, [1983] CTC 159 (FCA)

It was noted that the question to be answered under s. 18(1)(a) (unlike S.6(1)(a) of the Income War Tax Act, 1948) is whether the outlay or expense "was incurred for the purpose of gaining or earning income - not 'the income' (which implies a specific source of income) and not 'wholly, exclusively and necessarily ...' therefrom, but simply 'for the purpose of ...'". Expenditures incurred in the raising of capital to be used in a company's operations accordingly were within the broad words of the exception to s. 18(1)(a) (a provision which, in effect, is incorporated by reference into s. 14(5)(b)(i), which latter provision was the section before the Court).

The Queen v. Dorchester Drummond Corp. Ltd., 79 DTC 5163, [1979] CTC 219 (FCTD)

The defendant company bought land with the intention of building a highrise office building thereon, but instead operated a parking lot on the property until a City bylaw prohibited the operation of parking lots in the area. Property taxes were deductible expenses even after the company ceased to derive revenues from the property. The company never entirely abandoned its desire to develop the land as a revenue producing property, and it derived interest from loans (the making of loans being part of its business).

Deputy Min. of Rev. of Quebec v. Lipson, [1979] CTC 247, [1979] 1 S.C.R. 833

The shareholders of a company which was incorporated in 1961 to own and operate an apartment building, in 1962 leased the building from the company for a three-year renewable term and suffered substantial losses. It was held that when they renewed the lease in 1965, they did not expect to make a profit and that the sole reason for renewal was to create a deductible loss. No profits were realized in respect of the apartment building until 1971, and even highly optimistic profit projections hardly succeeded in showing they could break even. Deduction of the entire loss for 1966 was denied by virtue of s. 15 of the Provincial Income Tax Act (R.S.Q. 1964).

Pigeon, J., stated that "in order for an expense to be admissible as a deduction from a taxpayer's income, it must have been incurred in order to make a profit. It is not enough that the expense was incurred in order to obtain gross income."

Frappier v. The Queen, 76 DTC 6066 (FCTD)

The taxpayer, who was a licensed investment dealer, made advances to her clients to cover their losses when the brokerage company for which she worked went into bankruptcy. The advances became deductible losses in the subsequent year (when they were established to be irrecoverable) given that her purpose was to maintain the clients as a source of revenue and continued referrals.

Sunshine Mining Co. v. The Queen, 75 DTC 5126 (FCTD)

Damages paid by the taxpayer as a consequence of its failure to perform exploration work under an agreement to earn one-half interests in mining properties satisfied the test in s. 18(1)(a).

The Queen v. Clark, 74 DTC 6242, [1974] CTC 305 (FCTD)

A cash-basis farmer purchased cattle from a cattle company at the end of his taxation year on the understanding that the cattle company would repurchase the cattle for the same amount (minus its commission) at the beginning of the following taxation year. Since the taxpayer made the outlay for the sole purpose of reducing his taxes in the year, it was not deductible.

First Pioneer Petroleums Ltd. v. MNR, 74 DTC 6109, [1974] CTC 108 (FCTD)

Income taxes are not deductible expenses because, "by their very nature the income taxes were incurred because income was gained or produced and not for the purpose of gaining or producing it." In addition "profit" is that which is charged with income tax, rather than the residual amount.

E.R. Squibb & Sons Ltd. v. MNR, 73 DTC 5139, [1973] CTC 120 (FCTD)

In 1952, the taxpayer purchased 52 acres of land outside Montreal in order to construct its own facilities for use in research, manufacturing and marketing. The Minister disallowed the deduction of 84% of the municipal taxes on the ground that they related to unoccupied land. Since the vacant land was retained in the reasonable expectation of future expansion for which the land would be utilized, the municipal tax expenditures were deductible.

Henry v. MNR, 72 DTC 6005, [1972] CTC 33, [1974] S.C.R. 155

The taxpayer was an anaesthetist who supplied his services to a hospital, maintained an office at another location (Douglas Street) in common with a group of other anaesthetists at which they kept their records and billed and received accounts for their services, and used a den in his home (one and a half miles from the hospital) where he made out his accounts. The Minister allowed the taxpayer his expenses in going to and from his Douglas Street office and for emergency calls, as well as for trips between his home and the hospital in the evenings, but disallowed his claims for expenses in going to and from the hospital each working day of the week. In finding that the latter expenses were non-deductible, Hall J. stated:

I am unable to discern any difference between the appellant and the self-employed owner of any business who maintains a home from which he leaves in the morning and returns in the late afternoon as a matter of course.

In the Exchequer Court (69 DTC 5395) Sheppard D.J. had made a finding of fact (at p. 5397) that "both objectively and subjectively the house was a home and not a base of professional operations".

Olympia Floor & Wall Tile (Quebec) Ltd. v. MNR, 70 DTC 6085 (FCTD)

Gifts which the taxpayer made to Jewish organizations in the Montreal area in amounts over $100 were accepted to have been made for the purpose of increasing its sales and, therefore were deductible in computing its income. Jackett P stated (at p. 6089) that he could find "no inherent incompatibility between an ‘outlay…for the purpose of…producing income' and a gift to a charitable organization." Conversely, "even though they took the form of contributions to charitable organizations [they] were not ‘gifts' within the meaning of…section 27(1)(a) [the predecessor of s. 110.1(1)(a)]" (p. 6090).

British Columbia Power Corp. Ltd. v. MNR, 67 DTC 5258, [1967] CTC 406, [1968] S.C.R. 17

The taxpayer incurred various expenses in connection with communicating with its shareholders respecting B.C. legislation under which its shares of a public utility company (which represented its principal asset) were expropriated and respecting the progress of its successful action to have such legislation declared ultra vires. In finding such expenses to be deductible, Martland J. noted that they did not represent capital expenditures because they were not laid out to preserve a capital asset, and stated (at p. 5264):

The reasonable furnishing of information from time to time to shareholders by a company respecting its affairs is properly a part of the carrying on of the company's business of earning income and a corporate taxpayer should be entitled to deduct the reasonable expenses involved as an expense of doing business.

Associated Investors of Canada Ltd. v. MNR, 67 DTC 5096 (Ex. Ct.)

Before going on to find that the taxpayer was entitled to write off the irrecoverable amount of advances made by it to an employee, Collier J. stated (at p. 5099):

It was not argued that a loss could not be taken into account in computing profit unless it arose from an operation or transaction calculated or intended to produce a profit. It is clear that such a contention could not succeed. A profit arising from an operation or transaction that is an integral part of the current profit-making activities must be included in the profits from the business ... . If such a profit must be included in computing profits from a business then a loss arising from any such source ... must also be taken into account ... .

Southam Business Publications Ltd. v. MNR, 66 DTC 5215, [1966] CTC 265 (Ex. Ct.), briefly aff'd 67 DTC 5150 (SCC)

Noël J. held that there is no question that an expenditure made by the taxpayer to acquire the Financial Times was made for the purpose of gaining or producing income within the meaning of s. 12(1)(a) of the pre-1972 Act.

Premium Iron Ores Ltd. v. MNR, 66 DTC 5280, [1966] CTC 391, [1966] S.C.R. 685

Before concurring with Martland and Spence JJ. that legal expenses incurred by the taxpayer in connection with challenging potential assessments against its income by the U.S. revenue authorities were deductible, Hall J. stated (at pp. 5286, 5292):

A company such as the appellant exists to make a profit. All its operations are directed to that end. The operations must be viewed as one whole and not segregated into revenue producing as distinct from revenue retaining functions, otherwise a condition of chaos would obtain ... To limit the expenditure, if it is to qualify as a deductible, to the income of the particular year in which it was made requires writing into s. 12(1)(a) of the Income Tax Act words which Parliament did not put there. ... No limitation as to time can be found in the section in question.

Quemont Mining Corp. Ltd. v. MNR, 66 DTC 5376, [1966] CTC 570 (Ex. Ct.), aff'd 70 DTC 6046 (SCC)

"Duties" payable on a graduated scale under the Quebec Mining Act on the difference between the gross value of mining output and specified deductions were a non-deductible tax on profits, rather than expenditures (as in Harrods) which were not dependent upon whether profits were made or not, and which were paid in order to earn profits.

Seaboard Advertising Co. Ltd. v. MNR, 65 DTC 5188, [1965] CTC 310 (Ex. Ct.)

Unexpired advertising contracts which the taxpayer acquired as part of the purchase of substantially all the business of a competitor were acquired for the purpose of gaining or producing income from its business.

MNR v. Eldridge, 64 DTC 5338, [1965] 1 Ex. C.R. 758

The taxpayer, the operator of an unlawful call girl business, was entitled to deduct the expenses incurred in earning the profits of that business where they were substantiated with documentary evidence. The permissible deductions included the expenses incurred in obtaining bail bonds for her employees, legal expenses paid to defend her employees from criminal charges, the cost of hiring individuals to provide physical protection for her employees, and rent paid for the premises used by her employees.

MNR v. E.H. Pooler & Co. Ltd., 62 DTC 1321 (Ex. Ct.)

The taxpayer, which carried on business as a stock broker, was required to pay a fine to the T.S.E. as a result of one of its vice-presidents inducing other member firms to open up margin accounts in the names of clients of the taxpayer who subsequently were prosecuted in respect of their trading activities in the stock of a mining company.

After finding that the fines clearly were not "made" for an income-producing produce, Thurlow J. went on to find that they also were not "incurred" for an income-producing purpose given that the activity of the vice-president in introducing the clients to competitors of the taxpayer was not established to have promoted the taxpayer's business or otherwise to have occurred as part of the taxpayer's business.

Meteor Homes Ltd. v. MNR, 61 DTC 1001, [1960] CTC 419 (Ex. Ct.)

A payment which one group of shareholders (the "Schoelas") caused the taxpayer to make to another group of shareholders (the "Manasters") was found to have been motivated by the desire of the Schoelas "to break a deadlock of their own creation and to obtain absolute control not only of the appellant company but also of [another company with similar share ownership]" (p. 1004). There was no satisfactory evidence that the payment was made in lieu of salary which otherwise would have been earned by the Manasters. Accordingly, it was non-deductible.

Bannerman v. MNR, 59 DTC 1126, [1959] CTC 214, [1959] S.C.R. 562

In discussing the replacement of s. 6(a) in the Income War Tax Act by s. 12(1)(a) of the Income Tax Act, Kerwin C.J. stated (p. 1127):

"In view of the disappearance of what was s. 6 ... many of the decisions under that Act are inapplicable. However, this Court held ... that a certain degree of latitude must be allowed in determining the question whether the disbursements or expenses were laid out or expended for the purpose of earning the income, i.e., with the object and intent that they should earn the particular gross income reported for the taxation period. Under s. 12(1)(a) of the present Act, it is sufficient that an outlay be made or expense incurred with the object or intention that it should earn income, but since in one sense it might be said that almost every outlay or expense was made or incurred for that purpose, a line must be drawn in the individual case depending upon the circumstances and bearing in mind the provisions of s. 12(1)(b)."

B.C. Electric Railway Co. Ltd. v. MNR, 58 DTC 1022, [1958] CTC 21, [1958] S.C.R. 133

Before finding that payments made to municipalities in order to secure their acquiescence to the taxpayer's application for permission to terminate passenger railway service in the area, were payments whose deduction was not prohibited by s. 12(1)(a) of the pre-1972 Act (before considering the prohibition against the deduction of capital expenditures in s. 12(1)(b)), Abbott J. stated (pp. 1027-1028):

"Since the main purpose of every business undertaking is presumably to make a profit, any expenditure made 'for the purpose of gaining or producing income' comes within the terms of s. 12(1)(a) whether it be classified as an income expense or as a capital outlay."

Royal Trust Co. v. MNR, 57 DTC 1055, [1957] CTC 32 (Ex. Ct.)

It was found that the taxpayer's purpose in paying the admission fees and annual dues of social clubs of which its officers were members "was to increase its business through personal contacts of its officers with persons whom it would not otherwise readily reach". Accordingly, such expenditures were made by it for the purpose of earning income from its business.

Montship Lines Ltd. v. MNR, 54 DTC 1151 (Ex. Ct.), briefly aff'd 55 DTC 1060 (SCC)

Repair expenditures which the taxpayer incurred in accordance with the terms of agreements for the sale by it of two vessels were incurred in order to carry out the sale of capital assets rather than for the purpose of gaining or producing income from its business, and therefore were non-deductible.

Imperial Oil Ltd. v. MNR, 3 DTC 1090, [1947] CTC 353 (Ex. Ct.)

Due to the negligence of its employees a vessel of the taxpayer caused another company's vessel to sink. A substantial sum which the taxpayer paid in settlement of the other company's claim was fully deductible given that "negligence on the part of the appellant's servants in the operation of its vessels, with its consequential liability to pay damages for collision resulting therefrom, was a normal and ordinary risk of the marine operations part of the appellant's business and really incidental to it" (p. 1096).

See Also

Emballages Starflex Inc. v. ARC, 500-80-019409-110 (Court of Quebec)

At the trial's opening, the taxpayer requested an amendment to its pleadings to argue in the alternative that donations made by it to U.S. charities, which it had claimed as charitable deductions under the Taxation Act, were deductible as business (promotional) expenses. Before denying the charitable deduction claims, and in finding that the additional claim should not be entertained, Pokomandy JCQ stated (at paras. 66-67, 71):

The amendment implicitly changes the nature of the disbursement… .

This new position is difficult to reconcile with the original claims which Starflex appears to have not renounced. One cannot claim to have donated a sum and alternatively to have expended it in earning income from a business.

…[T]he Notice of Objection…contains no mention of the possible qualification of these expenditures as business expenses.

Bessette v. ARC (Quebec Revenue Agency), 2014 QCCQ 4329

The dental practice of the taxpayer paid fees of approximately 70% of its revenues to a services company (which was wholly-owned by the dentist through a holding company) pursuant to annual contracts which (in an apparently back-dated Appendix) provided for the provision of management and health services to the practice by the services company. Gouin JCQ stated (at para. 34, TaxInterpretations translation) that "the evidence…demonstrates clearly that [the services company] had no employees and did not purchase any supplies for eventual use in management or health services."

Before confirming ARC's denial of the deduction of the fees in toto under TA, ss. 128 and 140 (similar to ITA, ss. 18(1)(a) and 67), Gouin JCQ stated (at para. 30) that "it is necessary to prove that the management expenses constitute genuine expenses and not a sham in the sense that the concluded agreements represented genuine transactions between the parties," and then quoted with approval the statement in Fillion v. The Queen, 2004 FCA 135, at para. 72 [clumsy official translation below] that:

In order to claim an expense, it is not enough to make an accounting entry backed by a vague invoice [and]… it must be established that the evidence was real, fully supported and justified and, moreover, that the expenditure was incurred in order to produce business income… .

Michaud v. The Queen, 2014 DTC 1089 [at 3152], 2014 TCC 83

Hogan J found that the fact that the taxpayer often took his children along on his prospecting trips did not change that the prospecting activities constituted a business. The prospecting activities were carried out in a commercial manner, and ultimately lead to the discovery of gold deposits.

Garber v. The Queen, 2014 DTC 1045 [at 2812], 2014 TCC 1

Each taxpayer bought units in a limited partnership, which was to acquire a large yacht to be used for catered vacation charters. However, the capital raised was grossly insufficient for accomplishing the marketed objectives, and Rossiter ACJ characterized the arrangements as a "Ponzi-like scheme [which] was set to collapse eventually" (para. 344).

After finding that "the Limited Partnerships did not carry on a genuine business which constituted a source" (para. 389), Rossiter ACJ went on to find that most of the claimed expenses giving rise to partnership losses were fictitious, and that "expenses that were not fictitious or phony were incurred as window dressing for the purpose of perpetuating a fraudulent scheme" (para. 392), so that they did not satisfy s. 18(1)(a) even if they had been incurred in the course of a business.

Harvey v. The Queen, 2013 TCC 298

The taxpayer's teenaged daughter and her friends (all without a driving licence) took the taxpayer's Jeep without his permission and got into an accident, as a result of which the taxpayer incurred over $15,000 in repair expenses. After stating (at para. 72) that "what I must do is to determine what use was being made of the vehicle when it was stolen, not when it was actually in the accident," Graham J found that as the taxpayer had not authorized this use, the taxpayer could deduct a portion of the repair expenses based on the percentage of business use of the vehicle prior to the day of the accident.

Emond v. The Queen, 2013 DTC 1012 [at 68], 2012 TCC 380

The taxpayer bought a 10-room inn and lived in it. He started a company ("La Zénon) to operate the inn, which had a restaurant and bar.

Paris J found that inn was not a source of income to the taxpayer, and hence not a source of business losses. The taxpayer charged La Zénon $2000 per month for rent, which was not enough to cover insurance, taxes and maintenance. The taxpayer therefore had no reasonable expectation of profit.

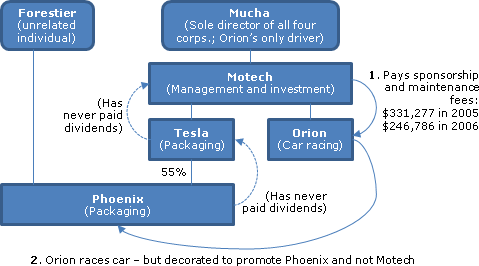

Motech Molding Inc. v. The Queen, 2012 DTC 1293 [at 3913], 2012 TCC 351

The taxpayer held two corporations ("Tesla" and "Orion"), and Tesla Packaging held 55% of the shares of another corporation ("Phoenix"). Tesla and Phoenix were both in the business of manufacturing and marketing stretch wrap packaging equipment, while Orion was in the business of car racing. The taxpayer and all of the corporations were directed and administered by the same individual ("Mucha"), who was also the taxpayer's only shareholder and Orion's only driver. Phoenix had never paid dividends to Tesla, which in turn had never paid dividends to the taxpayer.

D'Auray J. found that, in accordance with Lyncorp, sponsorship and maintenance fees ($331,277 and $246,786 in 2005 and 2006) that the taxpayer paid to Orion to promote Phoenix were not deductible as business or property expenses. She stated (at paras. 80-81):

Simply stated, the potential receipt of dividends was too remote.

It is also difficult to understand how the payments made by Motech to Orion Racing for the race car maintenance and repairs expenses were for the purpose of gaining dividends from Tesla. There is clearly no nexus between the operating expenses of Orion Racing and the alleged dividends income from Phoenix Innotech via Tesla.

D'Auray J. also suggested that the deductions might be disallowed under s. 18(1)(h) or s. 67, but the point was moot.

Chow v. The Queen, 2011 DTC 1196 [at 1088], 2011 TCC 263

V.A. Miller J. found (at para. 27) that the seizure of approximately $110,000 of proceeds of drug trafficking at the taxpayer's apartment did not give rise to a deductible business expense, as the deduction was prohibited under s. 67.6. She also found (at para. 27) that the amount would not have been deductible in any case, reiterating her position in Anjara that forfeitures are not normally incurred to gain or produce income.

Big Bad Voodoo Daddy v. The Queen, 2011 DTC 1173 [at 955], 2011 TCC 226

The taxpayer was a U.S. limited liability corporation (LLC) which performed jazz concerts in Canada. A CRA appeals officer stated in his testimony (para. 957) "that a U.S. LLC cannot deduct for Canadian tax purposes, the salaries paid to members of the LLC because a U.S. LLC is a partnership for U.S. federal income tax purposes...."

Favreau J. stated (at para. 26) that "the long-standing position of the CRA is that a U.S. LLC is treated as a corporation for all purposes of the Act regardless of whether the LLC is treated as a corporation or a partnership for U.S. tax purposes." Therefore, salaries paid to band members were deductible from income. However, the taxpayer failed to meet its business record-keeping obligations under s. 230 so its deductions were denied on that basis.

4145356 Canada Limited v. The Queen, 2011 DTC 1171 [at 937], 2011 TCC 220

After finding that the taxpayer was entitled under s. 126(2) to a foreign tax credit in respect of its share of US corporate income tax paid by a Delaware limited partnership of which it was a limited partner, Webb J. went on to find that such taxes were not deductible for purposes of the Act in computing the income of the partnership. He stated (at para. 61):

It seems to me that income taxes paid to the U.S. government as a result of earning income would not be made or incurred for the purpose of gaining or producing income but would be incurred as a result of gaining or producing income.

Bilous v. the Queen, 2011 DTC 1126 [at 710], 2011 TCC 154

The individual taxpayer was the principal shareholder of the corporate taxpayer, a canola farm supplier with annual sales in the tens of millions. Sheridan J. found that the taxpayers' expenses in establishing and operating a snowmobile museum were deductible as business expenses and capital cost allowances, because the costs were incurred to promote the canola business. In reaching that conclusion, she noted that the individual taxpayer often used the topic of snowmobiles as a "conversational in" to build a rapport with potential customers (who, being canola farmers, were often snowmobilers themselves), and that the costs in operating the museum were small compared to the taxpayers' revenue. Moreover, given that the costs had a clear connection to earning business income, the Court could not second-guess the taxpayers' business judgment.

Bougret v. The Queen, 2011 DTC 1032 [at 143], 2010 TCC 642

The taxpayer could not deduct a payment made to the Receiver General in satisfaction of his director's liability for source deductions under s. 227.1. Sheridan J. stated at para. 5: "By the time the Appellant made the payment to the Receiver General in respect of [his corporation's] source deductions, the company had long since ceased operations; from this it follows that there was no possibility of the Appellant having acquired his debt for the purposes [of producing income from business]."

Doiron v. The Queen, 2010 DTC 1348 [at 4325], 2010 TCC 519, aff'd 2012 DTC 5105 [at 7092], 2012 FCA 126

The taxpayer, a lawyer, received a four-year sentence and was suspended from practising law as a result of his conviction for obstruction of justice in respect of his defence of a client. (A related conviction of the taxpayer for money laundering was reversed on appeal.) McArthur J. noted (at para. 190) that, "while it is difficult to determine the Appellant's primary motivation," his legal expenses "arose directly from his law practice." McArthur J., applying Iacobucci J.'s obiter dicta in Symes, found at para. 21 that the taxpayer's related legal expenses would not "have been incurred if the taxpayer was not engaged in the pursuit of business income [his income from the practice of law]." Accordingly, the fees were deductible in computing the taxpayer's professional income.

Labow v. The Queen, 2010 TCC 408, 2010 DTC 1282 [at 3956], aff'd 2012 DTC 5001 [at 6501], 2011 FCA 305

The taxpayers disguised a tax deferral scheme as a health plan for their employee wives. Bowie J. found that the plans had not been entered into with considered judgment as to their commercial benefit to the taxpayers' firm. Therefore, the contributions to the plans had not been made for the purpose of earning income.

Les Entreprises Réjean Goyette Inc. v. The Queen, 2009 DTC 1880, 2009 TCC 351

Management fees paid by the taxpayer to an affiliated company which had non-capital losses were non-deductible by it given that the only evidence of services provided in consideration for the management fees was of services provided by the indirect sole shareholder of the two corporations, who had already been fully paid for his services by the taxpayer. Furthermore, the fees were paid by the taxpayer without it being legally bound to do so.

Jolly Farmer Products Inc. v. The Queen, 2008 DTC 4396, 2008 TCC 409

In finding that the taxpayer was entitled to deduct capital cost allowance in respect of houses situated close to the taxpayer's greenhouse operation and occupied by employee-shareholders of the corporation (all of whom had similar religious beliefs), Bowman, C.J. stated (at para. 23-24):

Once I conclude that it is a business decision to house the employees in company-owned houses and to provide other facilities in the Commons it is not up to me or the Minister to question that decision, even if I were to disagree with it, which I do not... . This case is an excellent example of the CRA seeking to substitute its business judgment for that of the taxpayer.

Mensah v. The Queen, 2008 DTC 4358, 2008 TCC 378

Bowman C.J. noted (at para. 35) that amounts that an employee may have stolen from the till of a delicatessen business would have given rise to deductible expense.

Anjara v. R., 2008 DTC 2306, 2007 TCC 746

V.A. Miller J. stated (at para. 6):

First of all, the forfeiture of the proceeds of crime was not an expense or outlay incurred by the Appellant. The proceeds of crime were the profits or net income earned by the Appellant. The forfeiture was not incurred to gain or produce income from business and did not assist the Appellant in producing income from his business of selling drugs. Justice Angers recently decided the appeal of Brizzi v. R., [2007] 4 C.T.C. 2334 ([2007 TCC 226] [Informal Procedure]), an appeal where the facts were very similar to those in the present appeal. I agree with his decision and especially in paragraph 7 when he stated the following:

... The loss incurred through the forfeiture is in my opinion a consequence of carrying on an illegal business activity and therefore certainly not an expense that assisted or resulted in producing income.

ZR v. The Queen, 2007 DTC 1577, 2007 TCC 598

The taxpayer was permitted to deduct as a business loss amounts paid by her in settlement of claims brought by a franchisor against her bankrupt husband, who had personally guaranteed franchise obligations of companies in which they had invested. McArthur J. noted (at para. 18) that in determining the potential deductibility of damages "it is appropriate to focus on the origin of the claim" and found that the origin of the claim was a franchise agreement which was entered into by the two companies for the purpose of earning income from a hotel business. He went on to find that if the purpose of making the settlement was instead relevant, that purpose was to allow the taxpayer and her husband "to continue carrying business in the motel industry" (para. 23) and that although the settlement also preserved the assets to the corporations, this was a secondary purpose.

Falkener v. The Queen, 2007 DTC 1470, 2007 TCC 514

The taxpayer was able to deduct costs of maintaining a dog (who helped protect llamas at his farm from danger) and cats (who were useful for rodent control). Bowie J. also stated (at para. 27):

Nor do I accept the respondent's argument that the veterinary fees associated with the terminal diagnosis of cancer and the resulting euthanasia and cremation of Ryder should be disallowed on the basis that those services could not contribute to producing income. If the animal's primary purpose is connected to producing income, as I have found, then the humane treatment at the end of its life is surely an incident of that.

Ellis v. The Queen, 2007 DTC 996, 2007 TCC 289, aff'd 2008 DTC 6230, 2008 FCA 92

A fee paid by the taxpayer to Ernst & Young LLP for advice in connection with strategizing as to how to monetize his shares through a forward exchange contract were not incurred to assist him in gaining or producing income from the shares and, therefore, were not deductible.

Renaud v. The Queen, 2006 DTC 3104, 2006 TCC 354

The taxpayer, who had made a proposal to creditors, was permitted to deduct trustee's fees incurred by him in making the proposal as the proposal was made for business purposes.

Wedge v. The Queen, 2005 DTC 1213, 2005 TCC 480

A compensation payment made by the taxpayer to the taxpayer's shareholder, his wife and children, who were employees of the taxpayer, in respect of their termination of employment by an affiliated corporation was deductible.

Welton v. The Queen, 2005 DTC 869, 2005 TCC 359

A "management fee" paid by the taxpayer, a self-employed real estate agent, to her husband was non-deductible. There was no documentary evidence to support the deduction other than invoices generated on a "totally retrospective" basis following a Revenue Canada audit. Sarchuk J. indicated (at p. 871) that:

There is substantial merit to the Respondent's position that what existed between the Appellant and her husband was nothing more than a domestic arrangement which was not and could not be considered to have created a legally binding agreement between them.

O'Flynn v. The Queen, 2005 DTC 556, 2005 TCC 230

The taxpayers were able to establish that a dental plan was available to all employees of the corporate taxpayer notwithstanding that only members of two families that owned the corporation availed themselves of the dental benefits. Accordingly, the dental premiums were deductible under s. 18(1)(a), and there was no inclusion in the individual taxpayers income by virtue of s. 6(1)(a)(i).

Shaver v. The Queen, 2003 DTC 2112, 2004 TCC 10

Expenses incurred by the taxpayer in taking seven people including him, his wife, and some Amway distributors (only two of whom were sponsored by him) to Las Vegas were not deductible given the silence in the evidence as to the role the guests played in enabling the taxpayer to earn income from his business, and given the substantial element of social entertainment in the trip.

Bains v. The Queen, 2003 DTC 376, 2003 TCC 211

The taxpayer had deliberately permitted a business colleague to mislead an investor ("Bhandar") into thinking that the taxpayer and his colleague had already invested significant sums in a business venture in which they were asking Bhandar to invest. After finding that damages for deceit that the taxpayer was required to pay to Bhandar were, in any event, not deductible because there was no evidence that the taxpayer's efforts to obtain Bhandar's money by deception were connected with a business or a venture in the nature of trade of the taxpayer, Rip T.C.J. went on to indicate (at p. 381):

However, even if I erred in so concluding, the actions of Mr. Bains in usurping money out of Mr. Bhandar is the egregious or repulsive breach that Iacobucci, J. states [in the 65302 case] could not be justified as being incurred for the purpose of producing income.

Costigane v. The Queen, 2003 DTC 254, 2003 TCC 67

The taxpayer, who was a dentist, entered into an arrangement with an off-shore company under which that company would pay him 95% of all invoices rendered by him in the month and retained the excess of the amount collected over 95% for itself. On the basis of a finding that this arrangement was entered into by him in order to protect himself against collections falling below 95%, the amounts received by the off-shore company were deductible on the basis that (p. 257):

Insurance expenses incurred to replace income, for whatever reason, are deductible.

Foresbec Inc. v. The Queen, 2002 DTC 1786, Docket: 98-2034-IT-G (TCC), aff'd 2003 DTC 5455, 2002 FCA 186

At the time of the sale of a control block of the taxpayer, it and the purchasing shareholder "granted" to the vendor a consulting contract for the services of a former executive of the taxpayer associated with the vendor. The payments made under the contract were not deductible given that it was never contemplated that the contract would be implemented and all that it provided for was the obligation to make payments irrespective of the level of services provided.

International Colin Energy Corp. v. The Queen, 2002 DTC 2185 (TCC)

The taxpayer paid a fee to a financial advisor, calculated as 0.7% of the market value of its equity and of the amount of its long-term debt net of working capital, in consideration for advice provided in connection with considering alternatives to maximize shareholders' value, with an emphasis on merger possibilities. The transaction ultimately implemented entailed the taxpayer's shareholders selling their shares, pursuant to a plan of arrangement, to another publicly-traded oil and gas company in consideration for treasury shares of that purchaser.

In finding that the fee had been incurred by the taxpayer for an income-producing purpose, Bowman A.C.J. noted that the taxpayer was in a downward spiral (its assets were being sold in order to pay down a loan which, in turn, reduced its income-producing capacity and risked breach of its covenants to long-term creditors) and that retaining the advisor "was intended to improve the ability of the appellant to earn income by combining its resources with that of another entity".

Chamberlain v. The Queen, 2002 DTC 2050, 2003 TCC 307

The taxpayer's estranged wife obtained a court order to have the taxpayer jailed and, without authorization, took control of the taxpayer's business and arranged for all collections of accounts receivable to go into the account of her lawyer. Because she was continuing to operate the business after taking control (for example, she made payroll and source deduction payments) the money which she collected (and the taxpayer never received) reduced the taxpayer's profit from that business.

Fredette v. The Queen, 2001 DTC 621, Docket: 98-1340-IT-G (TCC)

A partnership that was owned by the taxpayer and trusts for his children owned (through a second partnership that was owned by the first partnership and the taxpayer's wife) a triplex, one unit of which was rented (by the second partnership) to her. Archambault T.C.J. found that the expenses of that partnership incurred in connection with the unit rented to the taxpayer's wife (and a pro rata portion of interest on money borrowed to fund his partnership interest) were not incurred for an income-producing purpose.

Matt Harris & Son Ltd. v. The Queen, 2001 DTC 28, Docket: 1999-3427-IT-I (TCC)

The taxpayer, the operator of a wood contracting and construction business, was able to deduct the amount of racing expenses incurred by it (less prize money claimed) in respect of a stock car owned by it but driven by its sole shareholder and president, on the basis that such expenses were a form of advertising, and should not be disallowed simply because of the owner's satisfaction and interest in the activity.

Quantetics Corporation v. The Queen, 2000 DTC 2177 (TCC)

A $1.4 million bonus declared by the company and never paid by it was found to have been made pursuant to a legal obligation, with the result that it was found not to be deductible.

Coté v. The Queen, 99 DTC 5215 (FCTD)

A research program supervised by the taxpayer, who was associated with a Montreal hospital, was found to be a business in itself that was intended to produce exploitable intellectual property. Conversely, the taxpayer was not an employee of the hospital or an associated institute, notwithstanding that research grants were received by him from the institute. Accordingly, legal fees incurred by him when the institute terminated research grants were deductible.

Gagnon v. The Queen, 99 DTC 845, Docket: 97-3058-IT-G (TCC)

Bowman T.C.J. stated (at p. 848):

It was argued at some length that the income earned and expected to be earned by the appellants was income from property and that the range of expenses deductible in computing income from property is more restricted than in the case of income from a business. I know of no authority that would justify a more restrictive treatment of expenses relating to the earning of property income.

Splend'or Industries Ltd. v. The Queen, 99 DTC 560, Docket: 97-2376-IT-G (TCC)

The taxpayer was unable to deduct the cost of replacing the roof of premises that were rented to it because such repair was the responsibility of the landlord (its shareholder).

SPG International Ltée v. The Queen, 98 DTC 1093 (TCC)

The taxpayer, which was a Canadian manufacturer of tool boxes and metal lockers, established an American marketing subsidiary and decided that, during the start-up period, it would pay various expenses (such as trade convention reservation fees, and travelling expenses) directly rather than charge them to the subsidiary. In finding that such expenses were deductible by the taxpayer, Dussault T.C.J. noted that each American sale made by the subsidiary also represented a sale for the taxpayer (because the taxpayer was an exclusive supplier of the subsidiary), that the taxpayer made more profits on such sales than the subsidiary and that the taxpayer's decision to absorb such expenses was a perfectly legitimate business decision analogous with the sharing of expenses for advertising, marketing or promotion by a taxpayer with its distributors.

Robitaille v. The Queen, 97 DTC 346 (TCC)

Lamarre T.C.J. accepted the evidence of the taxpayer (a criminal lawyer) that he used his automobile 80% for business purposes (namely, visiting courthouses and police stations in order to find clients, and transporting a child to a babysitter).

C.I.R. (Hong Kong) v. Cosmotron Manufacturing Co. Ltd., [1997] B.T.C. 465 (P.C.)

After the taxpayer closed its only factory and ceased its business, it made redundancy payments to laid-off employees pursuant to a statutory formula.

In affirming a finding that s. 17(1)(b) of the Hong Kong Inland Revenue Ordinance, which prohibited the deduction of "any disbursements or expenses not being money expended for the purpose of producing such profits", did not prohibit the deduction of the redundancy payments, Lord Nolan stated (at p. 470):

The obligation to make them [the redundancy payments] was contingent, like many of the employer's other contractual or statutory obligations, but was nonetheless incurred as a necessary condition of retaining the services of the employees concerned.

In refusing to follow the decision in Godden v. A. Wilson's Stores (Holdings) Ltd. (1962), 40 T.C. 161 (CA), he noted that the taxpayer's argument -- that the severance payments were deductible because its obligation to make them arose from the terms upon which their employees had been engaged and had remained in employment -- had not been put to the Court of Appeal in that case.

Vodafone Cellular Ltd. v. Shaw, [1997] BTC 247 (C.A.)

The taxpayer, which provided management services to its two subsidiaries which, in turn, ran a cellular phone system and sold cellular telephones, agreed with an American cellular telephone company ("Millicom") to pay an annual fee equal to 10% of its consolidated pre-tax profits for 15 years in consideration for the supply to the taxpayer from time to time at its request with future know-how.

The Court reversed a finding of the Commissioners (which had been affirmed in the Court below) that a lump-sum payment made by the taxpayer for the cancellation of this agreement was not deductible because it was not wholly and exclusively expended for the purposes of its trade. Millett L.J. noted that if Millicom had not agreed to cancel the fee agreement, there would have been no basis on which the taxpayer could properly have required the subsidiaries to reimburse it for making available to then know-how which they had not asked for and did not need. Because the liability in question was a liability of the taxpayer alone, the cancellation of that liability was made exclusively to serve the purposes of its trade.

Port Colbourne Poultry Ltd. v. The Queen, 97 DTC 237 (TCC)

Rowe D.J. found that a fine that the taxpayer agreed to pay as a result in respect of a decision by one of its unsupervised employees to flush sludge that had been spilled on the ground into a nearby ditch, did not represent an amount incurred for the purpose of earning income after stating (at p. 241) that "there should have been a policy in place to allow for proper handling of such an incident which is not so rare as to not be reasonably foreseeable when dealing with 3,000 gallons of sludge per day and ultimate transport of that substance in the course of supply to consumers". He went on to find that, in any event, the fine would have been non-deductible on grounds of public policy, and noted that the Crown had allowed the deduction of associated legal fees.

Sunys Petroleum Inc. v. The Queen, 96 DTC 1759 (TCC)

Penalties payable by the taxpayer (which operated gasoline stations) as a result of its failure to remit federal sales and excise taxes on some of its sales were found to be deductible given that the principals of the business were surprised by the failure of the controller (an experienced chartered accountant) to pay such taxes. Bell T.C.J. stated (at pp. 1764-1765):

The acts of a servant of the company cannot constantly be monitored nor should they be in situations like those of the Appellant where a man with expertise was engaged to attend, among other things, to the very matters giving rise to the imposition of the penalty.

Ogden Funeral Homes Ltd. v. The Queen, 94 DTC 1405 (TCC)

An indirect shareholder of the taxpayer requested his son, the general manager of the taxpayer, to return from Australia to Canada five days prior to his scheduled return in order to handle certain difficulties which had arisen in the negotiations of the purchase of the Millcroft Inn located near Toronto. O'Connor T.C.J. accepted evidence that the return was required for valid business reasons, with the result that the cost of the ticket was deductible. (The terms of the ticket for the scheduled return did not permit a refund.)

Grunbaum v. The Queen, 94 DTC 1384 (TCC)

Expenses incurred by the corporate taxpayer as a result of inviting business guests to a wedding reception held in honour of the daughter of a shareholder were found by Garon T.C.J. to have been incurred by it for the purpose of gaining or producing income from its business. The decision in Fingold v. MNR, 92 DTC 2011 was distinguished on the basis that in this case, the invitations to the business guests were sent through the corporate taxpayer and those guests were well aware that they were guests of the taxpayer company.

Barclays Mercantile Industrial Finance Ltd. v. Melluish, [1990] BTC 209 (Ch. D.)

In rejecting a finding of special commissioners that agreements for the licensing or other distribution of a film had not been entered into by a corporation in the course of its trading activities because the agreements, themselves, were not expected to produce profits, Vinelott J. stated (at p. 246):

That in my judgment is not sufficient by itself to found the conclusion that the distribution agreements were not entered into in the ordinary course of its business. It is not difficult to conceive of cases in which a trader may be very pleased to enter into a long-term contract which covers or nearly covers its overhead costs leaving him to make a profit if he can sell the same product to others at a price above the marginal cost of production.

RTZ Oil and Gas Ltd. v. Elliss, [1987] BTC 359 (Ch. D.)

A consortium of oil companies including the taxpayer installed a manifold, loading lines and buoy over an off-shore oil field under a license that required their removal when exploitation of the field was completed. On this basis, Vinelott J. accepted the Crown's concession (p. 392):

that given that the obligation to remove the [equipment] was imposed by the license and that acceptance of it was in substance part of the consideration given by the consortium for the right to win oil from the North Sea, the expenditure when incurred will be expenditure wholly and exclusively incurred for the purpose of the company's trade even if on the abandonment of the Argyll Field the company's trade comes to an end.

Harrowston Corporation v. The Queen, 93 DTC 995 (TCC), aff'd 96 DTC 6544 (FCA)

A debt to the taxpayer from a non-resident corporation, which arose because of the taxpayer's inadvertent failure to withhold from interest payments made to the non-resident and which the taxpayer was unable to collect, was not deductible and did not relate to a deductible expenditure.

Ginn v. MNR, 92 DTC 2233 (TCC)

The taxpayer was unsuccessful in his submission that the sum of $159,347 which he was ordered by the Supreme Court of British Columbia to pay as damages for fraudulently inducing clients to purchase condominiums from him and his relatives at a substantial profit, were amounts that arose "as a result of matters that were incidental to the practice of the taxpayer's profession". Accordingly, such amount was not deductible on income account.

United Color and Chemicals Ltd. v. MNR, 92 DTC 1259 (TCC)

Kickback payments made by the taxpayer to purchasing agents employed by its customers were made for the purpose of generating sales and therefore were deductible.

ELB Productions Ltd. v. MNR, 91 DTC 1466 (TCC)

Before finding that an expenditure by the taxpayer was non-deductible on other grounds, Bowman J. stated (p. 1468):

Risky enterprises sometimes succeed and become taxable. Where they fail it would be unconscionable for the entrepreneur to be penalized because the Minister, basing his decision on the wisdom of hindsight, concludes that the project was not commercially viable.

Cassidy's Ltd. v. MNR, 89 DTC 686 (TCC)

Losses suffered by a corporation, resulting from a senior vice-president fraudulently having cheques issued to him and charged to cost of goods, were deductible. "[I]t is a risk in operating a business that dishonest people may be employed."

Heather v. P-E Consulting Group Ltd. (1972), 48 T.C. 293 (CA)

A management consulting company provided money on an annual basis to a trust fund which purchased the company's own shares and shares of a holding company to be held for the benefit of the professional staff. These payments were deductible because the company's objective was to obtain the goodwill of its staff and to ensure that control of the company would remain in their hands (their independence being important to the welfare of the company's trade).

Horton Steel Works Ltd. v. MNR, 72 DTC 1123, [1972] CTC 2147 (T.R.B.)

The taxpayer was reassessed for unpaid federal sales taxes plus a penalty of 8% per annum. In finding that the penalty was non-deductible, Frost FCA stated:

As the business of the appellant could have been carried on without any infraction of the law, the penalty is not an outlay made for the purpose of producing income ...

Harrods (Buenos Aires) Ltd. v. Taylor-Gooby (1964), 41 T.C. 450 (CA)

The taxpayer was resident in the United Kingdom but carried on the business of a large retail store in Buenos Aires. The taxpayer was liable in Argentina to a tax known as the "substitute tax", which was exigible on 1% of the capital of companies which carried on business in Argentina through a permanent establishment. In finding that the payment of this tax met the requirement for deduction under the Income Tax Act, 1952 (U.K.) that it be "money wholly and exclusively laid out or expanded for the purposes of [its] trade", Lord Justice Diplock stated:

Liability to the tax does not depend upon whether profits are made or not. It is a payment which the company is compelled to make if it has a business establishment in Argentina at all, and it must have a business establishment if it is to carry on its trade. I can see no relevant difference between this tax and rates upon its business premises.

The 1% capital tax accordingly was deductible in computing the taxpayer's income for English income tax purposes.

Morgan v. Tate & Lyle Ltd., [1955] A.C. 21 (H.L.)

Before finding that the taxpayer was permitted to deduct expenses which it incurred in opposing a nationalization of its business that would have entailed a successor entity acquiring its assets in continuing to carry on its trade, Lord Reid stated (p. 57):

It is not difficult to suppose a case where a trader is shortly to be succeeded in his trade by another person and where he spends money the benefit of which will accrue in whole or in part to his successor. It could not be said that for that reason the money was not wholly and exclusively laid out for the purposes of the trade.

Canadian Fruit Distributors Ltd. v. MNR, 54 DTC 1145, [1954] CTC 284 (Ex. Ct.)

The taxpayer, which was the subsidiary of a non-profit fruit growers' non-share corporation, and whose business involved the marketing of fruit products of its parent and, to a lesser extent, of third parties, agreed that for each fiscal year it would pay to its parent the excess of the total receipts of its business over its total operating expenses. Thorson P. found that this arrangement was effective to reduce the taxpayer's income to nil.

James Snook & Co., Ltd. v. Blasdale (1952), 33 T.C. 244 (CA)

The agreement for the sale of the shares in the capital of the taxpayer provided that the purchaser would cause the taxpayer to pay compensation for loss of office to directors of the taxpayer. The finding of the Commissioners that such compensation payments were not money "wholly and exclusively expended for the purposes of the trade" of the taxpayer, was not reversed.

Newsom v. Robertson (1952), 33 T.C. 452 (CA)

A barrister had chambers in London where he carried on his practice but resided at Whipsnade where he maintained a library and worked on professional matters during the evenings and weekends in term time, and throughout the weekdays as well during the long vacation. He unsuccessfully claimed expenses in respect of travelling between his residence and his chambers both in term time and during the vacation. Somervell L.J. noted (at p. 462):

that Whipsnade as a locality has nothing to do with Mr. Newsom's practice ... If he had found a house that suited him in Hertfordshire or Oxfordshire, everything would have gone on in precisely the same way.

Denning L.J. stated (at p. 464) that the taxpayer's "home was no more a base of operations than was the train by which he travelled to and fro." [C.R: 18(1)(h)]

Fairrie v. Hall (1947), 28 T.C. 200 (K.B.D.)

Damages which a sugar broker paid as a result of maliciously libelling a business rival were non-deductible notwithstanding that successully injuring the reputation of the rival might have increased his profits. Macnaghten J. stated (p. 206):

The loss fell upon the Appellant in this case in the character of a calumniator of a rival sugar broker. It was only remotely connected with his trade as a sugar broker.

Bassett Enterprises, Ltd. v. Petty (1938), 21 T.C. 730 (K.B.D.)

The purchaser of the shares of a corporation undertook as part of the arrangement that the acquired corporation would pay for the cancellation of service agreements with the manager and members of the family group that previously had controlled the corporation. Lawrence J. stated that it followed from this "that the Company's payment was not wholly and exclusively laid out for the purposes of the Company's business, because it was really laid out on account of the obligation which had been undertaken by [the purchaser]" (p. 738).

British Sugar Manufacturers, Ltd. v. Harris (1937), 21 TC 528 (C.A.)

The taxpayer agreed to pay 20% of its net profits to other corporations in consideration for their provision of managerial services and advice on technical matters. In finding the payments by the taxpayer to be deductible as "money wholly and exclusively laid out or expended for the purposes of the trade", Sir Greene, M.R. noted that although where a person purchases a share of profits, a payment of profits to that person will not be deductible, here "it is not cash that passes in exchange for these profits; it is services, and the badge of such a contract is remuneration for services ..." (p. 546).

Tata Hydro-Electric Agencies, Bombay v. Income Tax Commissioner, [1937] A.C. 685 (P.C.)

In acquiring the business of managing hydro-electric companies from a predecessor corporation, the taxpayer assumed the obligation to pay a commission equal to 25% of the management fees earned from the hydro-electric companies. The commission payments did not constitute "any expenditure (not being in the nature of capital expenditure) incurred solely for the purpose of earning such profits or gains" for purposes of s. 10(2) of the Indian Income-tax Act because "they did not arise out of any transactions in the conduct of their business" and:

The obligation to make these payments was undertaken by the appellants in consideration of their acquisition of the right and opportunity to earn profits, that is, of the right to conduct the business, and not for the purpose of producing profits in the conduct of the business.

The Herald and Weekly Times Ltd. v. Federal Commissioner of Taxation (1932), 2 A.T.D. 169 (H.C. of A.)

In finding that damages paid by an Australian newspaper for libel actions were deductible by it, the Court stated (p. 171):

None of the libels or supposed libels was published with any other object in view than the sale of the newspaper. The liability to damages was incurred, or the claim was encountered, because of the very act of publishing the newspaper. The thing which produced the assessable income was the thing which exposed the taxpayer to the liability or claim discharged by the expenditure.

B.W. Noble, Ltd. v. Mitchell (1927), 11 TC 372 (CA)

Although the taxpayer, which was an insurance and reinsurance broker, had cause to dismiss one of its directors, and to require him to transfer his valuable shares to the other directors for their nominal par value, the taxpayer did not dismiss him out of a concern that the matter might become public and adversely affect its reputation. A substantial sum (payable over five years) that was made in order to secure the retirement of the director was found to have been incurred "wholly and exclusively ... for the purposes of the trade" within the meaning of Rule 3(a) given that the taxpayer agreed to the sum in order to maintain its profitable trade.

British Insulated and Halsby Cables, Ltd. v. Atherton, [1926] A.C. 205 (HL)

Before going on to find that a substantial lump sum contribution by the taxpayer to an employee pension plan was a non-deductible expenditure, Viscount Cave found that its deduction was not prohibited by the prohibition against the deduction of expenses not "wholly and exclusively laid out or expended for the purposes of such trade" (p. 212):

A sum of money expended, not of necessity and with a view to a direct and immediate benefit to the trade, but voluntarily and on the grounds of commercial expediency, and in order indirectly to facilitate the carrying on of the business, may yet be expended wholly and exclusively for the purposes of the trade ... [T]he payment was made for the sound commercial purpose of enabling the company to retain the services of existing and future members of their staff and of increasing the efficiency of the staff... .

C.I.R. v. Alexander Von Glehn & Co. Ltd. (1920), 12 T.C. 233 (CA)

The taxpayer was unable to deduct penalties which it agreed to pay to the Attorney-General as a result of being unable to establish that goods which it exported from Britain during the First World War to neutral countries would not be used by the enemy, and also was unable to deduct related legal fees. Scrutton, L.J. stated (p. 244):

Were these fines made or paid for the purpose of earning the profits? The answer seems to me obvious, that they were not, they were unfortunate incidents which followed after the profits had been earned.

Administrative Policy

2015 Ruling 2013-0513411R3 F - Société de professionnels

Current structure. Mr. A, who carries on a professional practice and employs various individuals directly, holds Class E voting discretionary dividend shares, is wife and children hold Class F non-voting discretionary dividend shares and a family trust holds Class B non-voting common shares of the Corporation.

Proposed transactions.

The Corporation XX will enter into employment contracts with the employees (whereupon they will cease to be employees of Mr. A) and an Agreement will be entered into between the Corporation XX and the current employees which will contemplate the payment of Fees by Mr. A to the Corporation XX calculated based on the hours of work of each of the employees of the Corporation. Mr. A will deduct the Fees in computing his income in and the Corporation XX will add them in the computation of its income. The accumulated profits of Corporation XX will be periodically paid as dividends to the family trust.

Purpose.

The purpose of the proposed transactions is to reduce the profits of XX, which otherwise would be included in the income of Mr. A and be subject to the individual tax rate, in favour of Corporation XX. Such profits will instead be subject to corporate tax. Furthermore, the proposed transactions will permit a sharing of income derived from XX among the shareholders of Corporation XX.

Rulings.

- For the purposes of section 9, the deduction of the Fees will not be denied as current expenses in the computation of the income from XX of Mr. A, for the taxation years during which they are incurred, as a consequence of and by reason of the proposed transactions, subject to any application of sections 18, 20 and 67 of the Act.

- With the Fees being included in the income of the Corporation XX, the deduction of the salary of each XX established by virtue of the contract of employment will not be denied as a current expense in the computation of the income of Corporation XX for the taxation years during which it is incurred, as a consequence of and by reason of the proposed transactions subject to the application of section 67 and subsection 78(4) of the Act.

The summary states:

Since the proposed structure does not contravene the laws and regulations governing the practice of XX in Quebec, the deduction of fees will not be denied as a current expense in computing the XX business income.

24 July 2015 Folio S2-F1-C1

Employer contributions required

1.20 An employer is required to make contributions to a health and welfare trust to fund employee health and welfare benefits. Employer contributions cannot be made on a voluntary or gratuitous basis and must be enforceable by the trustee... .

Fund surplus

1.21 Employer contributions to a health and welfare trust must not exceed the amount required to provide health and welfare benefits to employees. ...

Deductibility of contributions

1.26 ...To the extent that they are reasonable and laid out to earn income from business or property, contributions paid or payable to a health and welfare trust are generally deductible in the tax year in which the legal obligation to make the contributions arose...[as] confirmed by...Labow...2011 FCA 305... .