Subsection 74.4(2) - Transfers and loans to corporations

Administrative Policy

2 June 2015 T.I. 2015-0570071E5 F - Attribution Rules Trust

underline;">: Result of 1st freeze. Trust A (an inter vivos personal trust) holds all the common shares of Opco (a CCPC but not a small business corporation) and Mr. X (who is the sole trustee of Trust A) holds all of its preferred shares as the result of a previous estate freeze transaction. The beneficiaries of Trust A are Mr. X's adult children, their minor children and the adult siblings of Mr. X.

2nd freeze

In a fresh estate freeze transaction, Trust A will exchange its common shares of Opco for preferred shares under s. 51, and common shares will be issued for their fair market value to a new trust (Trust B), whose beneficiaries are the same as for Trust A, plus Mr. X, his ex-spouse and any corporation controlled by one or other of the beneficiaries (other than any corporation in which Trust B has a direct or indirect interest).

Q&A

Who are the individual and the designated persons for purposes of ss. 74.4(2) and 74.5(5)? After referring to the ss. 104(1) and (2) definitions, CRA stated (TaxInterpretations translation):

[T]he individual, for purposes of subsection 74.4(2), would be Trust A.

Respecting who are the objects of the test provided in subsection 74.4(2), which refers to where it may reasonably be considered that where one of the main reasons for a transfer or a loan of property to a corporation may be to reduce the income of the transferor and to benefit a designated person in respect of the individual, we are of the view that a designated person in respect of Trust A would include, in this situation, a person under 18 years who would be beneficially interested in Trust A if subsection 248(25) applied without taking into account clauses (b)(iii)(A)(II) to (IV), or a person under 18 years who did not deal at arm's length with a person who would be beneficially interested in Trust A if subsection 248(25) applied without taking into account clauses (b)(iii)(A)(II) to (IV). This follows from the definition of designated person in subsection 74.5(5), and from paragraph 251(1)(b) which indicates that a taxpayer and a personal trust are deemed not to deal at arm's length.

Consequently…the grandchildren of Mr. X are "designated persons" respecting Trust A.

10 October 2014 APFF Roundtable Q. 19, 2014-0538041C6 F

Mr. X holds all 100 of Opco's Class A shares with a fair market value of $1,000,000 and nominal ACB and PUC. Opco pays a stock dividend comprising Class B shares which have a retraction right for $900,000; the 100 Class shares are exchanged for estate freeze Class C preferred shares; and the family trust subscribes for Class shares for $10. (Consistently with 2003-0004125 F) would s. 74.4(2) not apply to the Class B shares issued on the stock dividend? (d) What would be the safe income attributable to the Class B shares issued as the stock dividend? (e) If the shares of the corporation instead were held equally by three shareholders and the steps otherwise were the same except that the new common shares would be issued to three family trusts, would s. 15(1.1) would apply to the stock dividend. CRA responded (Tax Interpretations translation):

In general, a stock dividend paid by a corporation does not constitute in itself a transfer directly or indirectly (by means of a trust or otherwise) to a corporation by an individual. Thus, the provisions of ITA subsection 74.4(2) would not apply so as to calculate deemed income on the value of the Class B shares received in satisfaction of the stock dividend.

In contrast, the exchange of the 100 Class A shares of Opco for preferred Class C freeze shares would constitute a transfer made directly or indirectly (by means of a trust or otherwise) to a corporation by an individual for purposes of ITA subsection 74.4(2).

27 March 2013 Folio S4-F3-C1

CRA will consider a price adjustment clause to represent pricing at fair market value if:

- the agreement reflects a bona fide intention of the parties to transfer property at FMV;

- the purported FMV is determined by method that is fair and reasonable in the circumstances (which does not necessarily entail using CRA's preferred method, nor engaging a valuation expert);

- the parties agree that a CRA or Court valuation, if any, will supersede the price otherwise determined; and

- the excess or shortfall is actually refunded or paid, or legal liability therefor is adjusted (para. 1.5).

Price adjustment clauses involving shares may use a number of adjustment mechanisms. CRA non-exhaustively mentions changes in redemption value, the issuance of a note or change in the principle amount of a note, or a change in the number of shares issued - although CRA recommends against using the latter because of inherent legal and technical difficulties (para. 1.6).

1 April 2003 T.I. 2003-0004125 F -

In Situation 1, Mr. A holds all the shares of Opco, being 100 common shares having a FMV of $800,000. Opco declares and pays to Mr. A a stock dividend comprising 800 preferred shares with a redemption amount and FMV of $1000 per share, so that the FMV of the common shares is reduced to $100. Immediately thereafter, a trust for his children subscribes for 1000 common shares of Opco for $1000. Does s. 74.4(2) apply? CRA responded (TaxInterpretations translation):

[I]n general, a stock dividend paid by a corporation does not constitute in itself a transfer directly or indirectly (by means of a trust or otherwise) to a corporation by an individual.

5 March 2001 T.I. 2001-006772 -

Subject to s. 74.4(4), the provisions of s. 74.4(2) will apply to a typical estate freeze whether it utilizes s. 85(1) or s. 86.

20 March 1997 T.I. 963505

"In a situation where subsections 74.1(1) and 74.2(1) of the Act apply to attribute to an individual the income or loss from transferred property and the taxable capital gain or allowable capital loss arising from the property, it would appear to us that one cannot generally say that one of the main purposes of the transfer of the property by the individual to his or her spouse is to reduce the income of the individual and to benefit the spouse. Therefore, provided that subsections 74.1(1) and 74.2(1) of the Act apply, and subsection 74.5(11) of the Act does not apply, then subsection 74.4(2) of the Act would not normally apply to deem the individual to have received an amount as interest."

20 March 1995 T.I. 942992 ("C.T.O. 74.2(2) and Amalgamation")

Where a holding company amalgamates with its operating subsidiary, there will be considered to be a "transfer of property" to the amalgamated corporation for purposes of s. 74.4 if, as a result of the amalgamation, shares of the holding company are cancelled by it and new shares are issued.

12 October 1994 T.I. 5-941148 -

"Technically the application of subsection 74.4(2) of the Act could change from time to time if a corporation moved from being a small business corporation to a non-small business corporation and back to a small business corporation."

11 May 1994 T.I. 913071 (C.T.O. "Transfer of Property re 74.4(2) Amalgamation")

Where a corporation ("A") owned by an individual amalgamates with a second corporation ("B") owned by a trust for the benefit of the individual's infant children, s. 84(9) of the Act would result in a disposition of shares of A to Amalco if, as a result of the amalgamation, shares of A were cancelled by A and new shares were issued. In such event, there would be considered to be a "transfer of property" to Amalco for purposes of s. 74.4. The individual would not be regarded as having transferred property of A indirectly to Amalco.

17 February 1994 T.I. 940111 (C.T.O. "Attribution Control Co Invest in Preference Share of 2nd Co")

S.74.4(2) would not apply where a corporation (as opposed to an individual) transfers or loans property to another corporation unless an individual may be said to have indirectly transferred or loaned property to the other corporation, or s. 74.5(6) is applicable.

26 January 1994 T.I. 5-932995 -

Where one's spouse guarantees a bank loan made to an investment company owned equally by both spouses, s. 74.5(7) will not permit the interest payments made to the bank by the investment company to be deducted when making the calculation under s. 74.4(2)(e), because the guarantor will not be deemed to have received such interest payments. However, the purpose test in s. 74.4(2) will not be satisfied only by the fact that an individual guarantees an arm's length loan made by a bank at a commercial rate to a corporation of which his spouse owns not less than 10% of the issued shares of one class.

30 March 1993 T.I. (Tax Window, No. 29, p. 23, ¶2454)

There is no provision for a reduction in the amount of attributed income where the income actually earned by the corporation is less than the prescribed rate.

92 C.R. - Q.34

The transferee corporation in s. 74.4(2)(c) is required not only to be a small business corporation at the time of the transfer, but also throughout the period for which the exemption from imputed interest is sought.

21 August 1992 T.I. (Tax Window, No. 23, p. 24, ¶2154)

Any rights or dividend entitlements attached to preferred shares held by an individual would not by themselves be indicators that a particular transaction does not benefit a designated person.

27 June 1991 Memorandum (Tax Window, No. 4, p. 13, ¶1320)

Discussion of the application of the main purpose test where an individual transfers shares of an operating company to a holding company and those shares are subsequently redeemed by the operating company.

11 June 1991 T.I. (Tax Window, No. 4, p. 29, ¶1298)

The fact that the property transferred to the corporation does not produce income (e.g., it is vacant land) may be an indication that the reduction of the transferor's income was not one of the main reasons for the transfer.

2 November 1990 T.I. (Tax Window, Prelim. No. 2, p. 14, ¶1080)

The purpose test in s. 74.4(2) must be applied separately to each transfer of property, with the result that imputed income on a transfer which does not meet the purpose test effectively cannot be off-set by excess income received as the result of a transfer of property that does not violate the purpose test.

30 January 1990 Memorandum (June 1990 Access Letter, ¶1263)

The receipt by an individual (who some years earlier had effected an estate freeze) of a stock dividend on his preferred shares did not entail a direct or indirect transfer of property to a corporation.

ATR-36 (4 Nov. 88)

A favourable ruling is given with respect to an estate freeze involving a trust which will provide that "no amounts will be paid or payable to or for the benefit of, a particular beneficiary of the Trust until that beneficiary has attained the age of 18 years."

86 C.R. - Q.42

A s. 86(1) reorganization always involves a transfer of property (i.e., shares) to a corporation.

Articles

Emes, "Planning for Immigration to Canada from Countries other than the United States", 1993 Corporate Management Tax Conference Report, c. 13.

Discussion of immigrant trusts.

Subsection 74.4(4) - Benefit not granted to a designated person

Administrative Policy

7 November 2014 T.I. 2014-0549571E5 F - Attribution rule

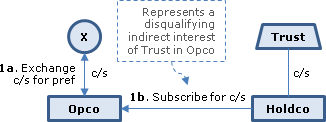

underline;">: Scenario 1.

X holds all the common shares of Opco. An inter vivos trust for the minor children of X ("Trust") holds all the common shares of Holdco. X transfers all his common shares of Opco to Opco in consideration for preferred shares of Opco and, at the same time, Holdco subscribes for common shares of Opco. Does s. 74.4(a) require that the trust hold the shares of the transferee corporation directly?

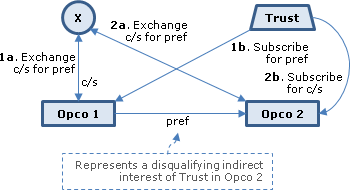

Scenario 2

X holds all the common shares of Opco 1 and 2, and Opco 1 holds the preferred shares of Opco 2. X transfers all his common shares of Opco 1 to Opco 1, and of Opco 2 to Opco 2, in consideration for preferred share of Opco 1 or Opco 2, as the case may be and, at the same time, an inter vivos trust for the minor children of X ("Trust") subscribes for common shares of Opco 1 and Opco 2. Is s. 74.4(a) satisfied respecting the transfer made by X to Opco 2 as the trust holds shares of Opco 2 both directly and indirectly through Opco 1? CRA responded (TaxInterpretations translation):

… Scenario 1…[T]he condition provided in paragraph 74.4(4)(a) would not be satisfied by reason of the shares in the issued share capital of Opco not being held by Trust but rather by Holdco. …[T]his situation could be corrected if Trust, rather than Holdco, subscribed for the new common shares in the capital of Opco.

… Scenario 2…[T]he designated person would have two interests in Opco 2… .

Thus, respecting the interest which the designated person would have in Opco 2 by means of Opco 1, the condition stipulated by paragraph 74.4(4)(a) would not be satisfied because the preferred shares in the capital of Opco 2 would be held by Opco 1, and not directly by Trust.

8 February 1993 T.I. (Tax Window, No. 29, p. 7, ¶2422)

Where the grandfather of the taxpayer settles a trust of which the taxpayer is a beneficiary, and the taxpayer's father contributes shares of a corporation to the trust, the conditions in 74.4(4) will be met if the taxpayer has no other interest in the corporation, he is only entitled to the income and capital of the trust after his father's death and he does not receive or otherwise obtain the use of any of the income and capital of the trust while he remains a designated person in respect of his father. If his father dies before he attains 18 years, s. 74.1(2) may apply to deem his revenue from the trust to be his grandfather's revenue.