Subsection 74.5(1) - Transfers for fair market consideration

Administrative Policy

29 April 1994 T.I. 933662 (C.T.O. "Attribution Rules")

Where an individual (the transferee) has acquired an income-producing property from his spouse and given to the transferor a demand promissory note bearing interest at the prescribed rate in effect at the time of the transfer, a subsequent lowering of the interest rate to the prescribed rate in effect at the subsequent time would result in the condition in s. 74.5(1)(b)(i) no longer being satisfied. Accordingly, the attribution rules would apply in respect of the property from the time of the resetting of the interest rate.

If, instead, the promissory note was forgiven, the requirement in s. 74.5(1)(b)(i) would no longer be satisfied.

15 June 1992 T.I. 921368 (December 1992 Access Letter, p. 18, ¶C56-208)

No payment will be considered to occur pursuant to an agreement between the parties to the effect that interest on a promissory note will be deemed to be paid and then loaned back to the borrower.

Articles

Summerville, "Income Splitting may be Implemented by Transferring Residential Property to Spouse", Taxation of Executive Compensation and Retirement, December 1989/January 1990

In a 24 August 89 Technical Interpretation, RC passed favourably on a transaction whereby a high income spouse transfers to his low income spouse an investment portfolio in exchange for a 25% interest in their residence which had been paid for (through contributions to the mortgage) by the low income spouse.

Subsection 74.5(2) - Loans for value

Administrative Policy

10 June 2013 STEP Canada Roundtable Q. , 2013-0480271C6

Can the interest rate on a loan to a spouse or other family member remain fixed at the current prescribed rate of 1% (so that there is no income attribution) where the loan is a demand loan with no term, or it has a term of say 20 years? CRA stated:

Income and gains will not be attributed to the transferor (pursuant to subsections 74.1(1) and (2), and section 74.2) if the loan is set at the prescribed rate "at the time the indebtedness was incurred" as stated in subsections 74.5(1) and 74.5(2).

29 April 1994 T.I. 933662 (C.T.O. "Attribution Rules")

Where an individual (the transferee) has acquired an income-producing property from his spouse (the transferor) in consideration for a demand promissory note bearing interest at the prescribed rate in effect at the time of the transfer, a subsequent agreement of the transferor to make a loan to the transferee at the lower prescribed rate prevailing at the time of the loan, with the loan proceeds being used to repay the demand promissory note, would not result in the exception in s. 74.5(2) being applicable because the proceeds of the loan would be used to repay the note rather than to generate any income or produce gain.

21 October 1991 T.I. (Tax Window, No. 12, p. 20, ¶1544)

Where a loan is made on September 30, 1991 with interest payable annually, the exemption will apply only if the interest due on September 30, 1992 is paid within 30 days after the end of the 1992 calendar year.

19 July 1989 T.I. (Dec. 89 Access Letter, ¶1047)

No attribution of income will be made in the situation where father loans a newly-established trust with his minor children as beneficiaries the sum of $100 at a commercial rate of interest, followed by the trust buying common shares of a small business corporation for $100 which then pays a dividend on its common shares which enables the trust to repay the loan plus the accrued interest thereon.

79 C.R. - Q.5

Re criteria for a "genuine" loan.

Subsection 74.5(3) - Spouses or common-law partners living apart

Administrative Policy

88 C.R. - Q.54

RC is aware that the provision may not be workable, because spouses typically are unable to settle the terms of their separation agreement in the year of separation, and until then they will not know whether they wish to elect.

Subsection 74.5(7) - Guarantees

Administrative Policy

86 C.R. - Q.44

RC will apply s. 74.5(7) where a third-party lender requires a spouse to guarantee a loan, except where s. 74.5(11) applies.

Subsection 74.5(11) - Artificial transactions

Cases

Swirsky v. The Queen, 2013 TCC 73, 2013 DTC 1078 [at 431], aff'd 2014 FCA 36

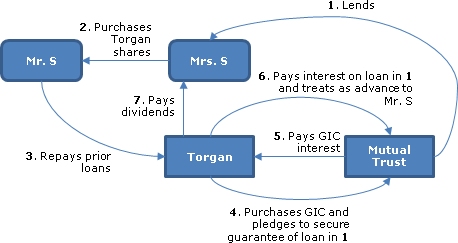

For creditor-proofing reasons, the taxpayer sold shares in a family real estate development company ("Torgan") to his wife, and used the sales proceeds to satisfy shareholder loans owing by him to Torgan. Torgan, in turn, used the proceeds to purchase a GIC, which it pledged (as security for a guarantee) to a trust company which had lent the shares' purchase price to the taxpayer's wife. He sought to have his wife's related losses (mostly due to interest on the loan) attributed to him pursuant to s. 74.1(1).

After finding that the loan interest was not deductible, Paris J. went on to address the Minister's argument that if, in fact, losses had arisen on the wife's share investment, the attribution of such losses should be denied pursuant to s. 74.5(11) as the shares had been transferred in order to reduce the taxes payable on income derived from the Torgan shares. In dismissing this alternative argument, Paris J. (after referring, at para. 52, to the reference in para. 28 of Canada Trustco to an "objective assessment of the relative importance of the driving forces of the transaction") accepted the taxpayer's evidence that the transactions were carried out in order to pay off the shareholder loans to him and for creditor proofing, and that tax reduction was not one of the main reasons for the transactions.

Administrative Policy

24 March 2014 T.I. 2014-0519661E5 - Subsection 74.5(11) Attribution

A professional who formerly operated an unincorporated professional practice formed a corporation with him and his spouse each subscribing for shares, and her then gifting her shares to him so that he then was able to comply with a requirement that professional corporations be solely owned by professionals. Did s. 74.5(11) prevent attribution of dividend income to her on the shares which she had gifted to him?

After noting the submission that "the sole reason for the transfer of the shares from the spouse to taxpayer was to comply with the requirements of the corporation to qualify as a professional corporation," CRA stated that:

[I]t is possible that subsection 74.5(11) may apply… if one of the main reasons was to reduce the amount of tax that would…be payable under Part I on the income… derived from the property… .