Subsection 80(2) (old)

Administrative Policy

93 C.P.T.J. - Q.38

Where one corporation (Y) lends $100,000 U.S. to an affiliate (X) at a time that the equivalent Canadian dollar amount is $115,000, and the two corporations amalgamate when the Canadian dollar equivalent is $125,000, s. 80(2) will deem the debt obligation to have been settled or extinguished by a payment of an amount equivalent to Y's adjusted cost base of $115,000. Consequently, s. 80(1) will not apply to X.

3 June 1992 T.I. 913040 (May 1993 Access Letter, p. 198, ¶C76-067)

Where on the amalgamation of a debtor corporation and creditor corporation, the creditor corporation was owed a trade debt on which it previously had claimed a deduction under s. 20(1)(p), the cost amount of that debt will be its adjusted cost base as reduced under s. 53(2)(m) for the amount claimed under s. 20(1)(p), with the result that s. 80(1) will apply to the debtor corporation as a result of the amalgamation.

Subsection 80(1) - Definitions

See Also

Mitchell v. The Queen, 96 DTC o (TCC)

The taxpayer, who was the general manager of a corporation ("HSS"), acquired debt of another corporation ("LTM") for consideration that was found by the Court to be nominal. Following the acquisition of LTM by HSS and the subsequent amalgamation of HSS and LTM, the debt owing by the amalgamated corporation ("Amalco") that the taxpayer had so acquired was set-off by book entry against debt owing by the taxpayer to Amalco.

Beaubier TCJ. found that because one of the purposes of the carefully-planned transactions was for HSS to cause LTM to become profitable, and because the taxpayer reasonably foresaw (and intended) that he would realize a profit on the loans, the gain realized by the taxpayer on the subsequent set-off of the loans was on income account.

Hanson v. The Queen, 95 DTC 311 (TCC)

A promissory note that the taxpayer had given as consideration for a limited partnership interest acquired by him was found to be a legally enforceable claim of the banks to which it had been assigned. Accordingly, the release of the taxpayer's obligations under the promissory note in consideration for the payment of a lower cash amount gave rise to the application of s. 80(1).

Les aliments Kouri Inc. v. MNR, 93 DTC 35 (TCC)

The taxpayer paid a relatively nominal amount to acquire all the shares of a corporation ("Grandiose") having substantial non-capital losses and liabilities substantially in excess of the book value of its assets. After the acquisition, Grandiose sold all its assets to the taxpayer "subject to the [taxpayer] assuming and discharging all of the liabilities of [Grandiose]", and on the basis that the purchase price (which was stated to be the book value of the assets) was to be payable on demand, and that the taxpayer was to discharge all the liabilities of Grandiose.

On the basis of these terms, Couture C.J. found that s. 80(1) did not apply.

National Trust Co. v. Mead, [1990] 5 WWR 455, [1990] 2 S.C.R. 410

The assumption of a mortgage was found not to entail its novation in light inter alia of a clause in the original mortgage which provided that no "dealing by the Mortgagee with the owner of the equity of redemption of the Mortgage Premises shall in any way affect or prejudice the rights of the Mortgagee against the Mortgagor ... for the payment of the money secured by this Mortgage." Wilson J. also discussed the following three-part test for determining whether a novation has occurred (p. 472):

- The new debtor must assume the complete liability;

- The creditor must accept the new debtor as principal debtor and not merely as an agent or guarantor; and

- The creditor must accept the new contract in full satisfaction and substitution for the old contract.

MNR v. Mid-West Abrasive Co. of Canada Ltd., 73 DTC 5429, [1973] CTC 548 (FCTD)

Sweet, D.J. indicated that under an arrangement where a Canadian subsidiary agreed to pay interest "when requested" on advances totalling $210,000 made to it by its U.S. parent, liability for interest was created on the execution of the promissory notes and that the U.S. "lender's omission to make the request would merely be a waiver of its rights and a forgiveness of the respondent's liability for interest which existed from the beginning."

Administrative Policy

2007 Ruling 2007-024528

In connection with the winding-up of an income fund (the "Fund") after the acquisition of all its units, the Fund disposes of its assets (principally, limited partnership units) to the acquiring corporation ("Bidco") in consideration for a note of Bidco, and then distributes the note to Bidco in satisfaction of a capital distribution and capital gains distribution declared by the Fund so that the note is extinguished as a matter of law.

Ruling that there will be no forgiven amount upon such extinguishment of the note.

5 December 2003 T.I. 2002-0165195

"If a portion of the debt has been used to earn FAPI, and the remainder to earn active business income, we are of the view that the whole debt would be a 'commercial debt obligation', not just the portion that related to the earning of FAPI ... if any amount in respect of interest on the CFA1 debt would have been deductible in computing CFA1's FAPI had interest been paid or payable thereon, the income inclusion attributable to the forgiveness of the whole debt would be brought into the computation of FAPI. However ... the forgiveness of the CFA1 debt does not affect the computation of FAPI because all of the debt was used to earn dividends from subsidiaries and interest income that was deemed active business income pursuant to subparagraph 95(2)(a)(ii) ... ."

9 September 2002 T.I. 2002-014100

Canco, which is indebted to an NRO in an amount greater than the value of its assets, receives a contribution of capital from its non-resident parent in an amount sufficient to pay off that debt. "Section 80 would not appear to apply, since the total debt will be repaid in cash."

2 August 1994 T.I. 941805 (C.T.O. "Economic Defeasance")

S.80 would not apply to a defeasance arrangement under which the debtor is not relieved of its legal obligations under the debt instrument but discharges the debt in economic terms by settling upon a trust some income-producing assets that will be sufficient to meet scheduled payments of interest and principal.

5 April 1994 T.I. (C.T.O. "Debtor's Gain on Settlement of Debt")

Non-capital losses arising before an acquisition of control can be utilized under s. 80(1)(a) even though the prospects for such losses otherwise being deducted from taxable income for future taxation years are less than 100%.

93 C.R. - Q. 46

Pursuant to s. 80(1)(a), non-capital losses for preceding taxation years will not be reduced where they are not deductible in computing the taxpayer's taxable income for the year or a subsequent year. Accordingly, pre-acquisition losses that are not available for carry forward will not be reduced by a post-acquisition forgiveness.

9 May 1994 Memorandum 940934 (C.T.O. "Shares Issued for Debt")

Where shares are issued in exchange for indebtedness, and the shares have a lower fair market value, s. 80 will apply to the difference notwithstanding that the full amount of the indebtedness cancelled was added to the stated capital of the shares issued.

92 C.R. - Q.18

Where s. 87(7) applies to a winding-up by virtue of s. 88(1)(e.2), s. 88(1) will not apply to an obligation of the subsidiary that is assumed on the winding-up.

92 C.M.TC - Q.14

Where a debt owing by a cash-basis farmer including accrued but unpaid interest is settled by a cash payment of less than the full amount owing, and the mortgage provides that all payments will be applied against outstanding interest first, RC will consider the payment to have been applied first against accrued but unpaid interest.

91 CPTJ - Q.2

The acquisition of control of a parent holding an intercompany debt (resulting in the application of s. 111(4)(d)) does not result in the application of s. 80.

November 1991 Memorandum (Tax Window, No. 13, p. 17, ¶1581)

S.80 can be applied only at the partnership level and cannot be applied to the partners.

23 October 1991 Memorandum (Tax Window, No. 12, p. 23, ¶1549)

Accounts receivable arising in the normal course of the business of a taxpayer are not capital property of the taxpayer for purposes of s. 80.

11 October 1991 Memorandum (Tax Window, No. 11, p. 22, ¶1518)

Where there has been a forgiveness of debt of the taxpayer before the end of the year that the taxpayer has disposed of all its depreciable property of a class, the undepreciated capital cost of the class at the end of the year must be determined after making the adjustments required by s. 80. S.80 will be applied where capital property of a taxpayer has been transferred to a creditor prior to the forgiveness or settlement as part of the same series of transactions.

10 July 1991 Decision Summary (Tax Window, No. 5, p. 12, ¶1346)

S.80 will not apply to debt restructurings involving an extension of the time to repay or a change in the method of calculating interest at a commercial rate, provided there is no novation. However, s. 80 should apply on the conversion of an interest-bearing debt to a non-interest bearing debt because such a conversion does not indicate a genuine restructuring.

26 June 1991 T.I. (Tax Window, No. 4, p. 8, ¶1317)

Where $100,000 is lent to A and B on a joint and severable basis and the debt later is settled for $60,000 paid by A and B in proportion to their use of the money, s. 80 will apply to A and B only to the extent of their respective shares of the forgiven $40,000.

Where A instead pays B $25,000 to assume A's joint and severable obligations on the $100,000 debt, s. 80 will not apply at the time of the assumption if C does not release A from its obligation.

3 December 1990 T.I. (Tax Window, Prelim. No. 2, p. 11, ¶1062)

Where receivables are transferred to the debtor corporation in consideration for treasury shares, s. 80 applies if the fair market value of the shares is less than the principal amount of the debt.

8 November 1990 T.I. (Tax Window, Prelim. No. 2, p. 10, ¶1046)

Ss.69(1)(a) and 80(1) both will be applied where a creditor accepts low fair market value shares in satisfaction of the debt previously owing to it.

90 C.P.T.J. - Q.5

Where the creditors of a corporation in financial difficulty agree to exchange their debt for common shares of the corporation on the basis of the market price of a share on the date of the agreement, section 80 will apply if the market price of the shares declines by the time for closing the exchange.

11 June 1990 T.I. (November 1990 Access Letter, ¶1524)

Where a parent corporation sells depreciable property to a wholly-owned subsidiary under a sales agreement, the depreciable property is transferred back to the parent on default by the subsidiary at a time that the property has a UCC of $100,000 and a fair market value of $50,000, and the debt owing by the subsidiary of $80,000 to the parent is extinguished by a quit claim deed, s. 80 will apply to the amount of $80,000 owing by the subsidiary to the parent.

7 June 1990 T.I. (November 1990 Access Letter, ¶1522)

Where a corporate taxpayer makes a gain on the purchase of its obligation where s. 39(3) does not apply, s. 80 will apply to the gain.

10 April 1990 Memorandum (September 1990 Access Letter, ¶1421)

The loss of the right to sue by prescription does not result in the settlement or extinguishment of the debt.

30 October 89 T.I. (March 1990 Access Letter, ¶1146)

Because the disposition of money in Canadian currency would not result in a capital gain or a capital loss, money is not a capital property for purposes of s. 80(1).

89 C.M.TC - Q.21

a partnership is a taxpayer for purposes of ss.79 and 80.

88 C.R. - Q.14

Where the debts of a partnership have been settled or extinguished, s. 80(1)(a) will not reduce the losses of the partners.

87 C.R. - Q.58

On the conversion of an interest-bearing debt into a non-interest bearing debt, the interest-bearing debt will be settled or extinguished on the conversion for an amount equal to the fair market value of the non-interest bearing debt at the time of the conversion.

86 C.R. - Q.60

Generally, S.80 has no effect where the taxpayer has no loss carryforwards or capital property.

80 C.R. - Q.38

Re application of s. 80 to the cancellation of debt on the winding-up of a subsidiary.

80 C.R. Q.46

S.6(1)(a) generally will prevail over s. 80 when an employee stock-acquisition loan is forgiven.

79 C.R. Q.27

Where a shareholder contributes funds to the corporation which in turn are paid to satisfy the debt owing to him, s. 80 may apply. RC is prepared to rule that s. 80 is not applicable where the shareholder limits the adjustment to his ACB to the increase in the fair market value of his shares.

S.80 applies where an outstanding debt is converted under its terms into shares of the corporation which have a value lower than the principal amount of the debt.

IT-293R "Debtor's Gain on Settlement of Debt"

IT-382 "Debts Bequeathed or Forgiven on Death"

IT-239R2 "Deductibility of Capital Losses from Guaranteeing Loans for Inadequate Consideration and from Loaning Funds at less than a Reasonable Rate of Interest in Non-arm's Length Circumstances" under "Application of Section 80"

Articles

Schafer, "Tax Implications of Restructuring and Refinancing", 1992 Corporate Management Tax Conference Report, c. 4.

Wertschek, "Application of a Corporation's Indebtedness to the Issue Price of its Shares Constitutes the Full Payment of the Debt", Corporate Structures and Groups, Vol. 1, No. 2, 1992, p. 16

Frankovic, "Taxing Times: Foreclosures, Default Sales, Debt Forgiveness, Doubtful and Bad Debts", 1991 Canadian Tax Journal, p. 889.

Durand, "Debt Restructuring for Companies in Financial Difficulty", Tax Aspects of Corporate Financing, CCH Seminars, September 13, 1990

Discussion of authorities supporting the proposition that s. 80 does not apply where a taxpayer in financial difficulty issues shares or debt in replacement of its existing indebtedness.

Brussa, "Strategies for Troubled Times", 1990 Conference Report, c. 17.

Flynn, "Restructuring Financially Troubled Corporations", 1989 Conference Report, c. 19.

Couzin, "Debt Restructuring", 1986 Corporate Management Tax Conference Report, p. 140.

Commercial Debt Obligation

See Also

Genex Communications v. The Queen, 2010 DTC 1064 [at 2840], 2009 TCC 583, rev'd 2011 DTC 5061 [at 5707], 2010 FCA 353)

Favreau J. found that non-interest bearing shareholder advances to a corporation satisfied paragraph (b) of the definition of "commercial debt obligation" given that the advances had been made to the corporation to fund its operations. While the French version is vague on this point, the English version clearly contemplates in paragraph (b) that not all commercial debt obligations entail an obligation to pay interest. Furthermore, it was not relevant that it was contemplated at the time of the advances that they would be subsequently converted into preferred shares.

Administrative Policy

9 April 2014 Memorandum 2014-0519231I7 - Debt forgiveness and guarantees

Forco, a wholly-owned subsidiary of Canco, borrowed under a secured "Borrowing" from a lending syndicate, with Canco providing a guarantee" secured by, inter alia, its shares of Forco and with no fee being charged by it. Canco also guaranteed various contractual obligations of Forco. Forco became insolvent, both guarantees (the "Guarantees") were called and Canco commenced CCAA proceedings. There was an insufficiency after a sale of Forco, and Canco defaulted on its Guarantees.

In finding that s. 80 did not apply in respect of the forgiveness of amounts owing by Canco under the Guarantees, the Directorate noted (respecting s. 20(1)(c)(i)) that "Canco should not be considered to have borrowed money under the Borrowing" and (respecting s. 20(1)(c)(ii)) "the amounts owing by Canco were not amounts payable for property acquired for the purpose of gaining or producing income from property." Accordingly, the Guarantee obligations were not commercial debt obligations.

20 May 2014 T.I. 2013-0516121E5 F - Debt forgiveness

A compromise by Aco under Division I of Part III of the Bankruptcy and Insolvency Act resulted in reassessments owing by Aco for unremitted GST and QST including interest and penalties being compromised for the payment of a stipulated sum under a stipulated schedule. After finding that the forgiveness "gain" was not income under s. 9, CRA stated (TaxInterpretations translation) that:

[T]he portion of the amount of the gain arising from the settlement of the unremitted GST and QST (including interest and penalties) would not be subject to …section 80 given that such [amounts]…would not be considered as a "debt issued" by the debtor under the terms of subsection 248(26), as is required by the definition of "commercial debt obligation" in subsection 80(1).

Excluded Obligation

See Also

Denthor Developments Ltd. v. The Queen, 97 DTC 667 (TCC)

The gain of the taxpayer, which was a land developer, on being discharged pursuant to a settlement agreement of bank indebtedness of $2.2 million through the payment of $1 million to the bank, did not give rise to income to it under s. 9. Accordingly, the only tax consequences to the taxpayer arose under the forgiveness rules in former s. 80.

Administrative Policy

10 October 2014 APFF Roundtable Q. 15, 2014-0538151C6 F

A newly formed corporation ("Newco") purchases the shares of a target corporation ("Target") for consideration that includes an earn-out clause (resulting in a debt which is subsequently forgiven). Newco and Target amalgamate, so that the shares of Target are cancelled. (a) Would a reduction in the cost of the shares of Target (through the application of subsection 143.4(2) of the ITA) prior to the subsequent amalgamation of Target with Newco cause the debt to qualify as an "excluded obligation" (as defined in subsection 80(1) of the ITA), so that the settlement of the debt following the amalgamation should not result in a "forgiven amount" (as defined in subsection 80(1) of the ITA)? (b) When the transaction (and related debt) occurred in a taxation year ending before March 16, 2011 (so that s. 143.4 does not apply due to the transitional rule), or there was no "right to reduce", would the the fact that the shares no longer exist after the amalgamation and that their cost is therefore not reduced, result in a "forgiven amount" because the debt that is settled would not qualify as an "excluded obligation" as per s. 80(1)? CRA responded (TaxInterpretations translation):

[Y]ou have assumed the Newco would, at the moment of the acquisition, have a real legal obligation to pay the maximum purchase price, so that ITA subsection 143.4(2) would be applicable at the moment of the acquisition of the shares for an unpaid purchase price, and that the purchase price would be extinguished after the amalgamation. It is not possible to provide definitive responses without knowing all the facts of a specific case. However we can offer the following general comments which nonetheless, in some circumstances, would not apply in a particular situation. …

…(a)…[A] reduction in the cost of the shares of the Target by the application of ITA subsection 143.4(2) prior to the amalgamation would in general permit the debt to qualify as an "excluded obligation" as per the definition provided in ITA subsection 80(1) by reason of the application of paragraph (a) of that definition.

Paragraph (d) of the definition of "excluded obligation in general could not apply because the debt was of a capital nature.

…(b)…In such situations…the extinguishing of the debt could ["pourrait"] generally give rise to a "forgiven amount" given that the debt would not qualify as an "excluded obligation"… .

In the situation presented (i.e., ITA subsection 143.4(2) cannot apply), the fact that the shares no longer existed following the amalgamation and that consequently their cost would not be reduced, does not appear relevant to the question of there being a "forgiven amount"… .

29 January 1997 T.I. 963597

"A reduction of the eligible capital expenditure of a taxpayer pursuant to paragraph 14(3)(b) of the Act is a result contemplated by subparagraph (a)(iii) of the definition of 'excluded obligation' in subsection 80(1) of the Act."

15 July 2009 T.I. 2008-028973 -

In response to a question whether s. 80 would apply where a creditor waived the right to receive accrued and payable interest on a debt, the Directorate indicated that where the forgiven interest amount is determined to be on account of capital, s. 80 is applicable irrespective of whether or not the amount was forgiven in the same or subsequent taxation year.

Forgiven Amount

See Also

Richer v. The Queen, 2009 DTC 1413, 2009 TCC 394

A forgiven amount arose in respect of the indebtedness of the taxpayer for unpaid contribution amounts to a partnership at the time that he entered into an agreement settling the claim of the general partner against him for those amounts, rather than at the time he paid the amount owing by him pursuant to the Settlement Agreement. The amount of the forgiven amount was not simply the difference between the amount owing by him for unpaid contributions and the amount paid by him, but rather was reduced further by the value of the rights in the form of potential claims he had against the general partner that he gave up by entering into the Settlement Agreement.

Administrative Policy

2013 Ruling 2013-0498551R3 - Loss Consolidation

Lossco, an indirect subsidiary of Parent, will make interest-bearing loans to (profitable) Parent, and Parent will subscribe for redeemable retractable preferred shares of Lossco ("prefs"). On the unwinding following utilization of Lossco's losses, Lossco will redeem the prefs by delivering the loans which it made to Parent. Ruling inter alia that such delivery of the loans on the pref redemption will not give rise to a forgiven amount.

12 September 2012 Annual CTF Roundtable Q. , 2012-0453381C6

An insolvent (but not bankrupt) company negotiates a settlement with CRA of unpaid source deductions and unremitted GST for less than the balance owing. Would this give rise to a forgiven amount or other income? CRA stated:

[I]nterest and penalties assessed under the ITA are not deductible (see section 67.6 and paragraph 18(1)(t)…). As such, the debt owed by the company…would not satisfy the definition of a commercial debt obligation and therefore, the debt forgiveness rules would not apply.

However, the amount as it related to source deductions would be included in income under s. 9, and under s. 12(1)(x) as it related to GST.

28 November 2010 CTF Roundtable Q. , 2010-0387451C6

IT-293R continues to reflect CRA's view that para. (i) of the definition of "forgiven amount" does not apply in circumstances in which a bankruptcy is annulled as the result of a proposal under Part III of the Bankruptcy and Insolvency Act.

2012 Ruling 2012-0452821R3 - Forgiveness of debt

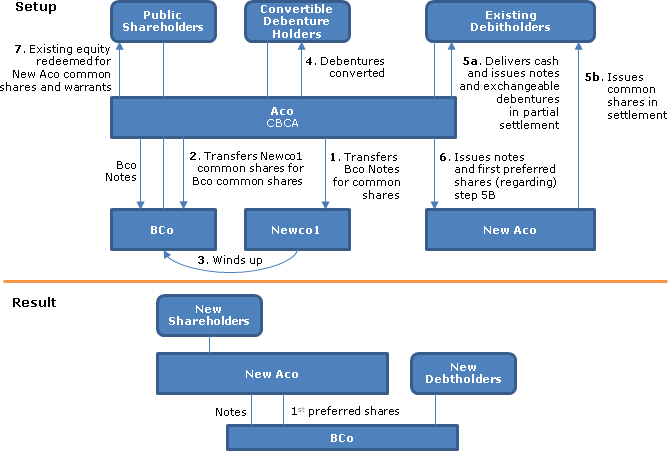

Aco is a Canadian public company holding interest-bearing promissory notes (Bco Notes) and shares of a Canadian subsidiary (Bco). Preliminarily to a Plan of Arrangement:

- Aco will transfer the Bco Notes (having an adjusted cost base equal to their principal) to a newly-incorporated CBCA corporation (Newco1) in consideration for the issuance of Newco1 common shares

- Aco will transfer its Newco1 common shares to Bco in consideration for the issuance of a nominal number of Bco common shares

- the paid-up capital of the Newco1 common shares will be reduced

- Newco1 will be wound-up into Bco, with Bco making a s. 80.01(4) election

- a CBCA corporation (New Aco) will be incorporated

Under the Plan of Arrangement:

- convertible debentures owing by Aco will be converted into Aco common shares

- Aco (and New Aco on its behalf) will deliver or issue cash, Aco senior notes, Aco debentures exchangeable into New Aco common shares and New Aco common shares in exchange for the debt (which is then cancelled) of existing debt holders of Aco – with Aco thereafter issuing first preferred shares and notes to New Aco in consideration for the issuance of the New Aco common shares to such debt holders

- the pre-Arrangement common and preferred shares of Aco will be purchased by Aco in consideration for the delivery of New Aco common shares and cashless warrants to acquire New Aco common shares

Rulings:

- ss. 40(2)(e.1) and 53(1)(f.1) will apply to the dispositions of the Bco Notes to Newco1, so that their ACB is preserved

- the extinguishment of the Bco Notes on the winding-up of Bco will not give rise to a forgiven amount (per s. 80.01(4))

- interest on the debt issued by Aco to the former debt holders will be deductible provided the interest on the former debt was deductible

- capital losses arising to Aco under s. 111(4)(d) on the acquisition of its control by New Aco [i.e., because its first preferred shares are voting?] will form part of its capital losses for its taxation year ending immediately before such acquisition of control for purposes of s. 80(12)

- the settlement of the debt of Aco will result in a forgiven amount

- s. 245(2) will not apply

20 April 2009 Memorandum 2008-0302511I7

On an open market purchase of liquid yield option notes ("Lyons"), s. 80 will not apply on the repurchase if s. 39(3) so applies (i.e., there is a gain on capital account). CRA stated:

[S]ubsection 39(3)...allow[s] for a capital gain or capital loss where a taxpayer purchases in the open market any obligation earlier issued by the taxpayer and these provisions would apply in these current circumstances. The provisions do not...affect transactions which are income transactions under the general rules for distinguishing income from a capital gain. ...Subsection 248(27) of the Act clarifies that the open market purchase of any portion of an obligation under subsection 39(3) of the Act is treated on the same basis as the purchase of the entire obligation. Further, the definition in subsection 80(1) of the Act of "forgiven amount", at paragraph (d) of the formula calculating B, clarifies that any portion of a debt extinguished under circumstances to which subsection 39(3) of the Act applies is not subject to the application of subsection 80(1) of the Act. Subsection 39(3) of the Act overrides any of the more general provisions. Accordingly, in our view, section 80 would not apply in the situation described.

30 April 2004 T.I. 2004-005753 -

Respecting the situation where a wholly-owned corporation with an accounting deficit was wound-up pursuant to s. 238(1)(e) of the Business Corporations Act (Ontario), the Agency noted that paragraph (i) of the definition of forgiven amount did not apply to a person who was an insolvent person but did not have the legal status of a "bankrupt". S.61.3(1) of the Act in effect provided that an insolvent corporation was required to recognize income as a consequence of s. 80(13) only to the extent of twice the amount of its net assets.

23 January 1996 T.I. 5-952790 -

"Section 79 has priority over section 80 except if paragraph 80.01(8) has applied in a previous year." [Translation]

19 January 1996 T.I. 952810 (C.T.O. "Forgiven Amount - Second Partnership Tier")

Where a corporation that is active in the operations of a particular partnership is not a member of the particular partnership but, instead, is a member of a partnership which, in turn, is a member of the particular partnership, the exemption in paragraph (k) of the definition of "forgiven amount" will not be available.

Relevant loss balance

Administrative Policy

6 October 2011 APFF Roundtable Q. , 2010-0371941C6 F

Where following an acquisition of control of a subsidiary so that non-capital losses and net capital losses of the subsidiary for taxation years ending before the acquisition of control would are precluded from being carried forward under the rules in s. 111(5) and (4), such losses would not be includible in the relevant loss balance of the parent following a winding-up of the subsidiary under s. 88(1) given the application of the rules in s. 88(1.1)(b) and 88(1.2)(b). However, such losses generally would be included in the amalgamated corporation's relevant loss balance by virtue of s. 87(2.1) if the subsidiary instead was amalgamated with the parent corporation under s. 87(1), provided that the restrictions in para. (d) and (e) of the relevant loss balance definition did not apply.

Debtor

Cases

Metro-Can Construction Ltd. v. The Queen, 2000 DTC 6495, 2001 FCA 227

McDonald J.A. accepted the position of the Crown that former s. 80(1) applied, in computing income at the partnership level, to a partnership whose debts had been forgiven notwithstanding that the portion of the provision dealing with the extinguishing of non-capital losses could have no application to a partnership.

See Also

Metro-Can Construction Ltd. v. The Queen, 99 DTC 29, Docket: 95-3210-IT-G (TCC)

Because s. 80 in its pre-1995 form applied at the partnership level rather than the level of the member partners, the forgiveness of debts owing by a partnership of which two subsidiaries of the taxpayer were members reduced the undepreciated capital cost of depreciable property of the partnership, rather than reducing losses of the subsidiaries.

Subsection 80(2) - Application of debt forgiveness rules

Paragraph 80(2)(a)

Cases

Dieni v. The Queen, 2001 DTC 290, Docket: 1999-832-IT-G (TCC)

The transfer of Quebec real estate by the taxpayer to a lender pursuant to a Deed of Giving In Payment which was executed following an action by the lender that McArthur T.C.J. described (at p. 291) as "equivalent to that of mortgage foreclosure in most other provinces" was governed by s. 79 rather than s. 80. McArthur T.C.J. noted (at p. 294) that the lender and the taxpayer did not fix or vary their existing rights and obligations with respect to the property, and the lender took the property in accordance with the strict terms of its Deed of Loan.

The Queen v. Diversified Holdings Ltd., 97 DTC 5203, Docket: A-309-94 (FCA)

The predecessor of the taxpayer ("Diversified Holdings") purchased, in an arm's length transaction, all the shares of another BC company ("860"). Prior to the amalgamation of Diversified Holdings and 860 to continue as the taxpayer, a corporation wholly owned by the taxpayer's individual shareholder ("173235") purchased mortgage indebtedness of 860 owing to Central Trust Company as part of transactions that resulted in the encumbered land being transferred by 860 to Central Trust Company and the mortgage being discharged.

Although agreeing (at p. 5205) "that for all practical purposes the debt no longer exists", Strayer J.A. indicated (at p. 5206) "that for a debt to be settled or extinguished within the meaning of subsection 80(1) there must be a legally binding termination in form and that does not exist in the present case".

See Also

Central City Financial Services Ltd. v. The Queen, 98 DTC 1021 (TCC), aff'd 98 DTC 6645 (FCA)

A hand-written settlement agreement (whose terms were not clearly described in the reasons for judgment) between the guarantor of debt of the taxpayer and the bank was characterized as giving rise at that time to a settlement of the debt notwithstanding that various matters (that were characterized by Margeson TCJ. as of an "administrative" nature) remained to be carried out.

Carma Developers Ltd. v. The Queen, 96 DTC 1798 (TCC), briefly aff'd 96 DTC 6569 (FCA)

Under a plan that was approved by the requisite majority of creditors in accordance with the companies' Creditors Arrangement Act, various classes of unsecured or undersecured creditors of the taxpayer ("CDL") transferred indebtedness of the taxpayer in exchange for shares of the taxpayer's parent corporation ("CL").

Bowman TCJ. found that the debts were not extinguished by novation notwithstanding that the creditors acknowledged to CDL that no further consideration was owed to them in respect of the assigned indebtedness, and stated (at p. 1802):

"A novation involves the creation of a new contractual relationship, generally where a debtor is released from its obligation to an obligee with the consent of the obligee and the assumption of the obligation by a third party so that a new obligation arises between the obligee and the third party. Here there is no new contract. The same debt of CDL continues to exist."

He also found that the debts had not been settled, and stated (at p. 1802):

"'Settle' connotes a final and legal resolution of a taxpayer's obligation whereby that obligation is reduced or brought to an end."

Administrative Policy

21 November 2014 T.I. 2014-0535361E5 - Debt forgiveness rules

In the course of a general discussion, CRA stated:

Carma Developers Ltd. v. The Queen

, [1996] 3 C.T.C. 2029 (T.C.C.), affirmed at [1997] 2 C.T.C. 150 (F.C.A.), stated:

In the context of section 80, however, "settle" connotes a final and legal resolution of a taxpayer's obligation whereby that obligation is reduced or brought to an end. Moreover, it must be a final and legally binding termination or reduction of the debtor's obligations.

… The Queen v. Diversified Holdings Ltd., [1997] 2 C.T.C. 263 (F.C.A.)… dealt similarly with this issue.

8 August 2014 T.I. 2014-0524951E5 - Debt forgiveness; liability on dissolution

Before going on to note that the debt parking rules in ss. 80.01(6) and (8) would in any event deem the debt to be forgiven, CRA noted that in the circumstances there might also be a settlement of the debt for nil consideration on more general principles, and quoted a statement in Carma Developers Ltd. v. The Queen, [1996] 3 C.T.C. 2029 (T.C.C.), affirmed at [1997] 2 C.T.C. 150 (F.C.A.), that "'settle' connotes a final and legal resolution of a taxpayer's obligation whereby that obligation is reduced or brought to an end… ."

2 August 1994 T.I. 941805

Generally, it is the view of RC that s. 80 does not apply to an economic defeasance arrangement.

4 April 1997 T.I. 970436

"Section 80 would apply where a son repays a commercial debt obligation owing to his father from a gift received immediately before and for the sole purpose of repayment of the commercial debt obligation."

Paragraph 80(2)(b)

Administrative Policy

13 June 2011 T.I. 2011-0393561E5 -

In the course of a general discussion, CRA stated:

Paragraph 80(2)(b) of the Act is a deeming clause, and, in essence, it provides that for the purposes of subsections 80(1) and (3), an amount of interest in respect of a debt shall be deemed to be a debt issued by a taxpayer that has a principal amount. Therefore, subsections 80(1) and paragraph 80(2)(b) of the Act, read together, apply both to the principal amount of a debt in its ordinary sense and the amount of the debt that is made up exclusively of interest deducted or deductible by the debtor.

15 July 2009 T.I. 2008-0289731E5

In response to a question as to whether s. 80 would apply where interest is waived and forgiven in the same taxation year in which it was accrued, or whether such interest should be included in the debtor's income for that year by virtue of s. 9, CRA noted that where the gain on the settled debt is of an income nature, the debt is an excluded obligation (so that s. 80 does not apply), and stated that where the debt

is a trade debt or on account of income, it may be included in the taxpayer's computation of profit under section 9 of the Act. If the debt is considered on account of capital, section 80 of the Act may apply.

CRA concluded:

Therefore, where the interest amount is determined to be on account of income, and the interest on the debt is forgiven in the same taxation year in which the interest expense is deducted or deductible, the interest amount is included in income in that same taxation year. Generally, where such amount is forgiven in a subsequent year, in our view, section 80 of the Act will apply.

Paragraph 80(2)(g)

See Also

Cornerbrook Pulp and Paper Ltd. v. The Queen, 2006 DTC 2329, 2006 TCC 70

In determining the fair market value of shares issues by a subsidiary ("Deerlake Power"), a power company, to its parent in satisfaction of debt owing by Deerlake Power to its parent, it was appropriate to ignore a long term supply contract for the supply of electricity by Deerlake Power to its parent at prices substantially below current electricity prices, given that if the parent had ever wished to sell the shares of Deerlake Power, it first would have arranged for the cancellation of that contract. Accordingly, the debt forgiveness rules did not apply to the settlement of the debt as the shares issued had a fair market value substantially in excess of the debt.

King Rentals Ltd. v. The Queen, 96 DTC 1132 (TCC)

The pre-1994 version of s. 80 did not apply to the satisfaction of indebtedness of the taxpayer (a New Brunswick corporation) through the issuance of preferred shares having an equivalent par value but a much lower fair market value. Lamarre TCJ. stated (at p. 1138):

"Here, by issuing the shares in full satisfaction of its liabilities ... the Appellant gave up its rights to claim from the subscriber the price that it would have been entitled to receive on this share subscription, which is the par value of the new shares. The Appellant therefore acted in conformity with the statute as the shares were paid in property (forgiveness of the debt) that was the fair equivalent of the money that the Appellant would have received if the shares had been issued for money."

Administrative Policy

10 March 1999 T.I. 5-982912

Although a price adjustment clause may be used for satisfying the requirements of s. 80(2)(g), "an acceptable price adjustment clause should not involve the cancelling of issued shares or the issuing of additional shares".

Paragraph 80(2)(h)

Administrative Policy

28 February 1996 TI 960179

Where a debt denominated in U.S. dollars was replaced by a new debt obligation denominated in Canadian dollars whose amount was equivalent to the U.S.-dollar debt at the current exchange rate, there would be a foreign exchange gain recognized and no forgiven amount recognized.

1995 Alberta CICA Roundtable Q. 4, 7-951210

There is no forgiven amount where one commercial debt obligation is exchanged for another commercial debt obligation having the same principal amount.

Paragraph 80(2)(k)

Administrative Policy

2009 Ruling 2009-031392

Ruling that when a Canadian debtor is wound-up into its Canadian parent and an election under s. 80.01(4)(c) is made, then, in light of s. 80(2)(k), no gain or loss will be realized under s. 39(2).

28 February 1996 TI 960179

Where a debt denominated in U.S. dollars was replaced by a new debt obligation denominated in Canadian dollars whose amount was equivalent to the U.S.-dollar debt at the current exchange rate, there would be a foreign exchange gain recognized and no forgiven amount recognized.

Articles

Thomas A. Bauer, "Restructuring Debt Obligations", 2008 Conference Report

Discussion of issues where US dollar debt is settled in Canadian dollars (an issue raised in 1996 Conference Report article by Firoz Ahmed and Jack Silversen entitled "The New Debt Forgiveness Rules: Planning Opportunities and Traps for the Unwary").

Paragraph 80(2)(o)

Administrative Policy

2 October 1997 T.I. 972542

"Paragraph 80(2)(o) of the Act results in section 80 only applying to the particular person for his proportionate share ... . Section 80 of the Act will not apply with respect to the settled amount to any of the other debtors other than the particular person."

Subsection 80(3) - Reductions of non-capital losses

Administrative Policy

17 June 2003 T.I. 2002-017825

The non-capital losses of a subsidiary which amalgamates with its parent would be available to be applied against a forgiven amount arising on the forgiveness of a commercial debt obligation incurred by the subsidiary before the amalgamation. In particular, s. 87(2.1)(a) would apply to the application of s. 80(3): even though s. 80(3) is in Division B, not Division D, and s. 87(2.1)(a) applies for Division D and not Division B purposes, s. 80(3) applies for the purpose of computing Amalco's taxable income in Division D including a determination of Amalco's non-capital losses.

Subsection 80(4) - Reductions of capital losses

Administrative Policy

92 C.M.TC - Q.15

S.80(4) would not apply to accrued but unpaid interest for a cash basis farmer, because such interest is not deductible until paid.

92 C.M.TC - Q.14

Where a debt owing by a cash-basis farmer including accrued but unpaid interest is settled by a cash payment of less than the full amount owing, and the mortgage provides that all payments will be applied against outstanding interest first, RC will consider the payment to have been applied first against accrued but unpaid interest.

11 June 1991 T.I. (Tax Window, No. 4, p. 8, ¶1297)

S.80 does not apply to forgiven interest which was not deductible because of the thin capitalization rules.

Subsection 80(5) - Reductions with respect to depreciable property

See Also

Richer v. The Queen, 2009 DTC 1413, 2009 TCC 394

After finding that various other provisions subsequent to ss.80(3) and (4) applied only if the taxpayer chose to utilize them, Jorré, J. found that the remaining balance of the forgiven amount after being applied under ss.80(3) and (4) was to be included (as to 1/2 thereof) in the taxpayer's income, as the taxpayer had not made such a designation. Accordingly, there was an inclusion in a statute-barred taxation year of the taxpayer, and the undepreciated capital costs of depreciable property of the taxpayer was not reduced.

MNR v. Mid-West Abrasive Co. of Canada Ltd., 73 DTC 5429, [1973] CTC 548 (FCTD)

Sweet, D.J. indicated that under an arrangement where a Canadian subsidiary agreed to pay interest "when requested" on advances totalling $210,000 made to it by its U.S. parent, liability for interest was created on the execution of the promissory notes and that the U.S. "lender's omission to make the request would merely be a waiver of its rights and a forgiveness of the respondent's liability for interest which existed from the beginning."

Administrative Policy

2007 Ruling 2007-024528

In connection with the winding-up of an income fund (the "Fund") after the acquisition of all its units, the Fund disposes of its assets (principally, limited partnership units) to the acquiring corporation ("Bidco") in consideration for a note of Bidco, and then distributes the note to Bidco in satisfaction of a capital distribution and capital gains distribution declared by the Fund so that the note is extinguished as a matter of law.

Ruling that there will be no forgiven amount upon such extinguishment of the note.

5 December 2003 T.I. 2002-0165195

"If a portion of the debt has been used to earn FAPI, and the remainder to earn active business income, we are of the view that the whole debt would be a 'commercial debt obligation', not just the portion that related to the earning of FAPI ... if any amount in respect of interest on the CFA1 debt would have been deductible in computing CFA1's FAPI had interest been paid or payable thereon, the income inclusion attributable to the forgiveness of the whole debt would be brought into the computation of FAPI. However ... the forgiveness of the CFA1 debt does not affect the computation of FAPI because all of the debt was used to earn dividends from subsidiaries and interest income that was deemed active business income pursuant to subparagraph 95(2)(a)(ii) ... ."

9 September 2002 T.I. 2002-014100

Canco, which is indebted to an NRO in an amount greater than the value of its assets, receives a contribution of capital from its non-resident parent in an amount sufficient to pay off that debt. "Section 80 would not appear to apply, since the total debt will be repaid in cash."

2 August 1994 T.I. 941805 (C.T.O. "Economic Defeasance")

S.80 would not apply to a defeasance arrangement under which the debtor is not relieved of its legal obligations under the debt instrument but discharges the debt in economic terms by settling upon a trust some income-producing assets that will be sufficient to meet scheduled payments of interest and principal.

5 April 1994 T.I. (C.T.O. "Debtor's Gain on Settlement of Debt")

Non-capital losses arising before an acquisition of control can be utilized under s. 80(1)(a) even though the prospects for such losses otherwise being deducted from taxable income for future taxation years are less than 100%.

93 C.R. - Q. 46

Pursuant to s. 80(1)(a), non-capital losses for preceding taxation years will not be reduced where they are not deductible in computing the taxpayer's taxable income for the year or a subsequent year. Accordingly, pre-acquisition losses that are not available for carry forward will not be reduced by a post-acquisition forgiveness.

9 May 1994 Memorandum 940934 (C.T.O. "Shares Issued for Debt")

Where shares are issued in exchange for indebtedness, and the shares have a lower fair market value, s. 80 will apply to the difference notwithstanding that the full amount of the indebtedness cancelled was added to the stated capital of the shares issued.

92 C.R. - Q.18

Where s. 87(7) applies to a winding-up by virtue of s. 88(1)(e.2), s. 88(1) will not apply to an obligation of the subsidiary that is assumed on the winding-up.

92 C.M.TC - Q.14

Where a debt owing by a cash-basis farmer including accrued but unpaid interest is settled by a cash payment of less than the full amount owing, and the mortgage provides that all payments will be applied against outstanding interest first, RC will consider the payment to have been applied first against accrued but unpaid interest.

91 CPTJ - Q.2

The acquisition of control of a parent holding an intercompany debt (resulting in the application of s. 111(4)(d)) does not result in the application of s. 80.

November 1991 Memorandum (Tax Window, No. 13, p. 17, ¶1581)

S.80 can be applied only at the partnership level and cannot be applied to the partners.

23 October 1991 Memorandum (Tax Window, No. 12, p. 23, ¶1549)

Accounts receivable arising in the normal course of the business of a taxpayer are not capital property of the taxpayer for purposes of s. 80.

11 October 1991 Memorandum (Tax Window, No. 11, p. 22, ¶1518)

Where there has been a forgiveness of debt of the taxpayer before the end of the year that the taxpayer has disposed of all its depreciable property of a class, the undepreciated capital cost of the class at the end of the year must be determined after making the adjustments required by s. 80. S.80 will be applied where capital property of a taxpayer has been transferred to a creditor prior to the forgiveness or settlement as part of the same series of transactions.

10 July 1991 Decision Summary (Tax Window, No. 5, p. 12, ¶1346)

S.80 will not apply to debt restructurings involving an extension of the time to repay or a change in the method of calculating interest at a commercial rate, provided there is no novation. However, s. 80 should apply on the conversion of an interest-bearing debt to a non-interest bearing debt because such a conversion does not indicate a genuine restructuring.

26 June 1991 T.I. (Tax Window, No. 4, p. 8, ¶1317)

Where $100,000 is lent to A and B on a joint and severable basis and the debt later is settled for $60,000 paid by A and B in proportion to their use of the money, s. 80 will apply to A and B only to the extent of their respective shares of the forgiven $40,000.

Where A instead pays B $25,000 to assume A's joint and severable obligations on the $100,000 debt, s. 80 will not apply at the time of the assumption if C does not release A from its obligation.

3 December 1990 T.I. (Tax Window, Prelim. No. 2, p. 11, ¶1062)

Where receivables are transferred to the debtor corporation in consideration for treasury shares, s. 80 applies if the fair market value of the shares is less than the principal amount of the debt.

8 November 1990 T.I. (Tax Window, Prelim. No. 2, p. 10, ¶1046)

Ss.69(1)(a) and 80(1) both will be applied where a creditor accepts low fair market value shares in satisfaction of the debt previously owing to it.

90 C.P.T.J. - Q.5

Where the creditors of a corporation in financial difficulty agree to exchange their debt for common shares of the corporation on the basis of the market price of a share on the date of the agreement, section 80 will apply if the market price of the shares declines by the time for closing the exchange.

11 June 1990 T.I. (November 1990 Access Letter, ¶1524)

Where a parent corporation sells depreciable property to a wholly-owned subsidiary under a sales agreement, the depreciable property is transferred back to the parent on default by the subsidiary at a time that the property has a UCC of $100,000 and a fair market value of $50,000, and the debt owing by the subsidiary of $80,000 to the parent is extinguished by a quit claim deed, s. 80 will apply to the amount of $80,000 owing by the subsidiary to the parent.

7 June 1990 T.I. (November 1990 Access Letter, ¶1522)

Where a corporate taxpayer makes a gain on the purchase of its obligation where s. 39(3) does not apply, s. 80 will apply to the gain.

10 April 1990 Memorandum (September 1990 Access Letter, ¶1421)

The loss of the right to sue by prescription does not result in the settlement or extinguishment of the debt.

30 October 89 T.I. (March 1990 Access Letter, ¶1146)

Because the disposition of money in Canadian currency would not result in a capital gain or a capital loss, money is not a capital property for purposes of s. 80(1).

89 C.M.TC - Q.21

a partnership is a taxpayer for purposes of ss.79 and 80.

88 C.R. - Q.14

Where the debts of a partnership have been settled or extinguished, s. 80(1)(a) will not reduce the losses of the partners.

87 C.R. - Q.58

On the conversion of an interest-bearing debt into a non-interest bearing debt, the interest-bearing debt will be settled or extinguished on the conversion for an amount equal to the fair market value of the non-interest bearing debt at the time of the conversion.

86 C.R. - Q.60

Generally, S.80 has no effect where the taxpayer has no loss carryforwards or capital property.

80 C.R. - Q.38

Re application of s. 80 to the cancellation of debt on the winding-up of a subsidiary.

80 C.R. Q.46

S.6(1)(a) generally will prevail over s. 80 when an employee stock-acquisition loan is forgiven.

79 C.R. Q.27

Where a shareholder contributes funds to the corporation which in turn are paid to satisfy the debt owing to him, s. 80 may apply. RC is prepared to rule that s. 80 is not applicable where the shareholder limits the adjustment to his ACB to the increase in the fair market value of his shares.

S.80 applies where an outstanding debt is converted under its terms into shares of the corporation which have a value lower than the principal amount of the debt.

IT-293R "Debtor's Gain on Settlement of Debt"

IT-382 "Debts Bequeathed or Forgiven on Death"

IT-239R2 "Deductibility of Capital Losses from Guaranteeing Loans for Inadequate Consideration and from Loaning Funds at less than a Reasonable Rate of Interest in Non-arm's Length Circumstances" under "Application of Section 80"

Articles

Schafer, "Tax Implications of Restructuring and Refinancing", 1992 Corporate Management Tax Conference Report, c. 4.

Wertschek, "Application of a Corporation's Indebtedness to the Issue Price of its Shares Constitutes the Full Payment of the Debt", Corporate Structures and Groups, Vol. 1, No. 2, 1992, p. 16

Frankovic, "Taxing Times: Foreclosures, Default Sales, Debt Forgiveness, Doubtful and Bad Debts", 1991 Canadian Tax Journal, p. 889.

Durand, "Debt Restructuring for Companies in Financial Difficulty", Tax Aspects of Corporate Financing, CCH Seminars, September 13, 1990

Discussion of authorities supporting the proposition that s. 80 does not apply where a taxpayer in financial difficulty issues shares or debt in replacement of its existing indebtedness.

Brussa, "Strategies for Troubled Times", 1990 Conference Report, c. 17.

Flynn, "Restructuring Financially Troubled Corporations", 1989 Conference Report, c. 19.

Couzin, "Debt Restructuring", 1986 Corporate Management Tax Conference Report, p. 140.

Subsection 80(9) - Reductions of adjusted cost bases of capital properties

Administrative Policy

10 January 2010 T.I. 2010-037102 -

Debts issued by a partnership will not be considered to be debts issued by a corporate member of that partnership, provided that there is a bona fide partnership and that the partners are jointly and severally liable for partnership debts. Consequently, a debtor is generally allowed under s. 80(9)(a) to reduce the adjusted cost base to the debtor of a capital property that is a debt issued by a partnership related to the debtor if all the conditions of subsection 80(9) are otherwise met.

Subsection 80(13) - Income inclusion

See Also

GKN Sinter Metals - St. Thomas Ltd. v. The Queen, 2006 DTC 3025, 2006 TCC 248

Before going on to consider the interpretation of regulations pursuant to the debt forgiveness rules that have since been repealed, Paris J. applied a statement of a commentator that:

"The tax policy rationale for triggering a tax gain when a debt forgiveness occurs is that the debt enabled the debtor to acquire property or make expenditures that gave rise to deductions in computing income. To the extent that debt is forgiven, the cost of the expenditures has not been borne by the debtor, and should therefore not be recognized for tax purposes."

Administrative Policy

2 June 2003 T.I. 2003-000248 -

A farmer transfers farm property to an adult child at fair market value taking back a promissory note as consideration, then makes a gift to his child of enough funds to allow for repayment of the note. Such a transaction would appear to be undertaken primarily to avoid the consequences of section 80, which would otherwise apply on a straightforward forgiveness of the debt, and, accordingly, such transaction may be subject to s. 245(2).

Articles

Bernstein, "Update on Debt Forgiveness - Part I", Tax Profile, Vol. 4, No. 25, July 1995, p. 269.

Ahmed, "Debt Forgiveness Rules and Share Purchase Transactions", Canadian Current Tax, March 1995, Vol. 5, No. 6, p. 58.

- The creditor must accept the new debtor as principal debtor and not merely as an agent or guarantor; and

- The creditor must accept the new contract in full satisfaction and substitution for the old contract." [check]