Subsection 75(2) - Trusts

Cases

Sommerer v. The Queen, 2012 DTC 5126 [at 7219], 2012 FCA 207

The taxpayer (a Canadian-resident individual) sold shares of a Canadian company to an Austrian private foundation (privatstiftung) which had been contemporaneously formed and funded in Austria by his father. The taxpayer, as an "ultimate beneficiary" under the foundation deed, was entitled to the property in the event that his father revoked the foundation. CRA assessed the taxpayer on the basis that s. 75(2) applied to attribute a taxable capital gain to the taxpayer when the foundation sold most of its shares to a third party at a gain.

After noting (at para. 48) that s. 75(2) "is generally intended to ensure that a taxpayer cannot avoid the income tax consequences of the use or disposition of property by transferring it to another person in trust while retaining a right of reversion or a right of disposition with respect to the property or property for which it may be substituted" (para. 48), Sharlow J.A. rejected the Crown's submission that s. 75(2) can apply (as in this case) to "property that has been purchased by a trustee from a beneficiary at fair market value and held subject to the terms of the trust," noting that this would produce absurd outcomes (para. 49). In particular, this could result in the same gain being attributed to a vendor to the trust of property, and the settlor who had contributed the property used by the trust to make that purchase.

Fraser v. The Queen, 91 DTC 5123 (FCTD), aff'd 95 DTC 5684 (FCA)

Subsection 75(2) did not apply to income earned by unit holders in a trust which used the subscription proceeds for the units to acquire mortgages because "subsection 75(2) relates to property income only, not income from a business" (p. 5129) and because "subsection 75(2) only applies when the beneficiary has a reversionary right and ... no such right exists in this case" (p. 5129).

The Queen v. Quinn, 73 DTC 5215, [1973] CTC 258 (FCTD)

Under a contract with the Canadian Scholarship Trust Fund it was agreed that interest on funds deposited by the taxpayer would be transferred to the Trustee on the maturity of the plan, to be applied to the education costs of the taxpayer's son if certain conditions were met, or otherwise for the benefit of other beneficiaries. Since the taxpayer would not receive the interest regardless of the circumstances under which the plan matured or was terminated, in a year prior to maturity or termination there was no "income" received to which s. 75(2) could apply.

See Also

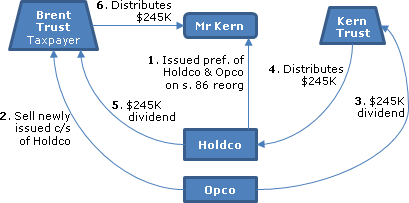

Brent Kern Family Trust v. The Queen, 2013 DTC 1249 [at 1396], 2013 TCC 327, aff'd 2014 FCA 230

The facts (see para. 29 of the Reasons, which states the opposite of para. 6 of the poorly-drafted Statement of Agreed Facts) appear to be that:

- an Alberta company ("Opco") sold all the common shares of another Alberta company ("Holdco"), having a modest value due to a recently completed transaction involving the conversion of most of its share capital to preferred shares, to a family trust (the "Brent Trust," namely, the taxpayer) of which it was one of the beneficiaries;

- Opco paid a dividend of $245,000 to another family trust (the "Kern Trust"), with the Kern Trust then distributing that amount to Holdco as one of its beneficiaries;

- Holdco paid a $245,000 dividend to the Brent Trust;

- the Brent Trust distributed this dividend amount to an individual beneficiary, who lent that amount to Opco.

The taxpayer contended that s. 75(2) applied to deem the dividend in 3. to have been received by Opco, so that Opco was eligible for the inter-corporate dividend deduction in s. 112.

Bocock J found, applying Sommerer, that as the shares of Holdco had been sold by Opco to the Brent Trust, s. 75(2) did not apply to attribute the $245,000 dividend income of the Brent Trust to Opco. Accordingly, any application of GAAR (s. 245) to the transactions was moot.

In the Federal Court of Appeal, Near JA stated (at para. 5), in response to a submission that Sommerer was "manifestly wrong," that "counsel...has not pointed to any fundamental matter that was overlooked sufficient to justify intervention."

Sommerer v. The Queen, 2011 DTC 1162 [at 845], 2011 TCC 212, aff'd 2012 FCA 207

The taxpayer (a Canadian-resident individual) transferred shares of a Canadian company to an Austrian private foundation (privatstiftung) which had been contemporaneously formed and funded in Austria by his father. The taxpayer, as an "ultimate beneficiary" under the foundation deed, was entitled to the property in the event that his father revoked the foundation. After noting (at para. 109) that "no technical meaning need to be ascribed to 'revert' in the context of property distributed to a beneficiary that was previously owned by the beneficiary," C. Miller J found that the shares acquired by the foundation thus could revert to the taxpayer.

CRA assessed the taxpayer on the basis that s. 75(2) applied to attribute a taxable capital gain to the taxpayer when the foundation sold most of its shares to a third party at a gain.

After finding that the foundation was the trustee of a trust, Miller J. found that because s. 75(2) only referred to property that was held by a trust on its creation (or property substituted for such property), the "person" referred to in that subsection is either a settlor or someone who contributes property to a trust as if the person were a settlor. The taxpayer was neither of these - rather, he was a beneficiary selling property to the trust at fair market value. Accordingly, the taxpayer was not subject to attribution under s. 75(2).

Garron v. The Queen, 2009 DTC 1568, 2009 TCC 450, aff'd sub nom St. Michael Trust Corp. v. The Queen, 2010 DTC 5189 [at 7361], 2010 FCA 309, aff'd sub nom Fundy Settlement v. Canada, 2012 SCC 14

In the course of the reorganization of the share structure of a Canadian holding company ("PMPL") for a Canadian automotive business, two newly established Barbados trusts for the two principals ("Dunin" and "Garron") of PMPL and/or family members subscribed for shares of newly-incorporated Canadian corporations ("325" and "333") which, in turn, subscribed for common shares of PMPL for nominal consideration. Two years later, the trusts sold shares of 325 and 333 for substantial cash proceeds.

Although the 1998 transactions entailed a transfer of property from the holders of common shares of PMPL to the new common shareholders (the trusts), these transactions did not entail any acquisition of property by the trusts from the former common shareholders. Accordingly, s. 94 did not apply even if the trusts were not resident in Canada.

Howson v. The Queen, 2007 DTC 141, 2006 TCC 644

Monies advanced by the taxpayer to a family trust were found to be a loan rather than a contribution of capital, notwithstanding that a loan agreement was not signed until three years later, given that the funds were contributed as part of a complex plan which contemplated that they would be advanced as a loan and the financial statements for the trust showed a loan.

Administrative Policy

10 October 2014 APFF Roundtable Q. , 2014-0538241C6 F

5(a)

When a rental property has been transferred to a trust, is rental income attributed to the transferor under s. 75(2) transformed into trust property income under s. 108(5), so that the "earned income" of the transferor will not be increased for "RRSP deduction limit" purposes?

5(b)

X, who is the sole beneficiary of a protective trust, holds voting shares of a corporation giving him control thereof, with the trust holding retractable shares (previously gifted to it by X) having a nominal paid-up capital and an adjusted cost base equal to their redemption amount. On its retraction of its shares, a deemed dividend is attributed to X under s. 75(2) and its capital loss is deemed to be nil under s. 40(3.6)(a). Is the capital loss as computed before the application of s. 40(3.6) attributed to X or to the protective trust, and is it added to the ACB of the trust's or X's shares – and would the answers change if all the shares were held by the trust?

CRA responded (TaxInterpretations translation):

…5(a)…Subsection 108(5) does not have the effect of modifying the application of subsection 75(2)… . [T]he net rental income…preserves its nature and the person who had transferred the property must include this income…in his return of income … . For purposes of the calculation of the "RRSP deduction limit" of the person subject to subsection 75(2) …the income from the rental property…is included in his "earned income"… .

…5(b)…A loss which is deemed to be nil by virtue of paragraph 40(3.6)(a) is not attributable to anyone. … On the assumption that after the retraction of the shares…held by the protective trust, it continuously holds at least one share…, the amount of the loss must be added in the calculation of the adjusted cost base of a share…held by the protective trust immediately after the disposition… . In effect, the taxpayer subject to subsection 40(3.6) is the protective trust.

3 October 2014 T.I. 2013-0476871E5 - Subsection 75(2)

Property settled on a trust includes an LP interest. On termination of the trust, the trust property will revert to the settlor. Will s. 75(2) not apply to business income of the LP allocable to the trust? CRA stated:

Where the partnership earns property income such as interest or dividend income and in accordance with the partnership agreement the trust is allocated such property income, that income will flow through to the trust and will be attributable to the [settlor]… . The business income that flows through to the trust from the limited partnership will not be attributed to the settlor.

16 June 2014 STEP Roundtable Q. , 2014-0523061C6

2010-036630117 concerned the sole trustee and capital beneficiary of a trust (the taxpayer) who, had

transferred property to the trust by accepting undervalued freeze shares as consideration when growth shares were issued to the trust. It was our view that because the growth shares could revert back to the taxpayer, subparagraph 75(2)(a)(i) applied, and furthermore, because he was the sole trustee, both 75(2)(a)(ii) and 75(2)(b) were also applicable.

16 June 2014 STEP Roundtable Q. , 2014-0523001C6

An "evil trust" is structured to deliberately cause the application of subsection 75(2), so as to cause the attribution of dividend income to a connected corporation, where the income will not be taxable, while at the same time distributing proceeds in the form of cash by way of either a capital distribution or a loan to the intended recipient. Brent Kern Family Trust was recently decided by the Tax Court on the basis that the principle in Sommerer applied, and subsection 75(2) did not apply. Can CRA comment? CRA stated:

Given that the Brent Kern Family Trust decision [2013 TCC 327] is currently under appeal, it would be inappropriate to comment at this time as to the specifics of that case. … [The] trust structures designed to purposely invoke attribution pursuant to subsection 75(2), with a view to avoiding the payment of tax on extracted corporate dividends …typically involves two Canadian corporations and a trust that acquires shares in one of the corporations ("Corp A"). In some cases, the acquisition is by subscription for the Corp A shares using cash contributed to the trust by the other corporation ("Corp B"), or the arrangement may involve having Corp B contribute shares of Corp A that it holds directly to the trust. In either case, when Corp A subsequently declares a dividend on the shares held by the trust, the scheme is intended to attribute the dividend income to Corp B, which then claims an offsetting deduction under section 112.

In some of these arrangements, the facts have led to a conclusion that the trust acquired the shares for fair market value consideration (perhaps by transferring cash to Corp B on the acquisition of the Corp A shares from it). ... CRA agrees with the general proposition that where property is transferred to a trust by a beneficiary for fair market value consideration, subsection 75(2) will not apply to attribute income in respect of that property to the beneficiary.

In the alternative, if the facts are such that it may be concluded that the trust did not acquire the shares for fair market value consideration, CRA will typically challenge the arrangement on other grounds. Depending on the particular facts, assessments may be pursued to include the dividend income pursuant to paragraph 12(1)(j) or subsection 104(13), in calculating the income of the trust and/or its beneficiaries. Furthermore, CRA would typically hold the view that a strong GAAR argument would exist in support of an assessing position in such cases.

12 February 2014 Memorandum 2013-0508841I7 F - Application of subsection 75(2)

Corp transferred its limited partner interest in a partnership ("SEC") to Trust. It then applied s. 75(2) to attribute to itself the business losses of SEC, which were allocated to Trust under the SEC partnership agreement.

Robinson

, 98 DTC 6065 established that "if SEC carried on a business through its general partner, its limited partner (Trust) is also considered to be carrying on that business, even if it does not take an active part in the activities of SEC." As it was CRA's policy, based on Robin, 63 DTC 1012 and Fraser, 91 DTC 5123, that s. 75(2) did not apply to attribute income or loss from a business, s. 75(2) did not apply to the losses of SEC.

23 January 2014 T.I. 2013-0500711E5 F - Paragraph 75(2)

The will of X provided for the bequeathing of some of his property to family inter vivos discretionary trusts. The liquidator (i.e., executor) of X's succession (i.e., estate) also is a beneficiary of the inter vivos trusts. Is X (rather than the liquidator) the "person" referenced in s. 75(2)(a)(i), so that s. 75(2) did not apply to X.

In responding affirmatively, CRA noted (TaxInterpretations translation) that "the property held by the trust (the succession) had been contributed by X" and that, conversely, respecting the liquidator "assuming that… in the course of his mandate, additional powers were not granted to him respecting the disposition of properties or their distribution…subsection 75(2) could not apply to the latter if he were also a beneficiary of the inter vivos trusts."

11 October 2013 APFF Roundtable Q. , 2013-0495721C6 F

Mr. X, who holds all the common shares of Corporation, exchanges his common shares under s. 51 for preferred shares having an equivalent fair market value and subscribes for common shares having a nominal value (the "Property"). He then sells the Property for its fair market value to a trust of which he is the beneficiary but not the settlor. (Other similar scenarios are described.) CRA stated (TaxInterpretations translation):

Taking into account…Sommerer, the sale of the Property by Mr. X to Trust, at a stipulated price and for consideration equal to its FMV, does not result in the income from the Property being attributed to Mr. X by virtue of ITA subsection 75(2). However, the Property acquired by Trust must not be a property substituted for a property otherwise contributed by Mr. X.

11 June 2013 STEP Roundtable Q. 9, 2013-0480351C6

Respecting whether CRA accepted Sommerer decision, it stated that the decision stood:

for the general proposition that where property is transferred to a trust by a beneficiary of the trust in return for consideration that constitutes a fair market value, subsection 75(2) will not apply to attribute income in respect of that property to that beneficiary.

Respecting the statement of Sharlow JA that the Crown's interpretation of s. 75(1) was "wrong because it is based on the incorrect premise that 75(2) can apply to a beneficiary of a trust who transfers property to the trust by means of a genuine sale," CRA stated:

As was noted in H. W. Liebig & Co. v Leading Investments Ltd., [1986] 1 S.C.R. 70, "the primary meaning of sale is the transfer of property to another for a price." …[T]he FCA…had a more definitive concept in mind when it referred to a bona fide or genuine sale.

23 May 2013 Memorandum 2013-0481651I7 F - Attribution rules- business loss

S. 75(2), which otherwise would apply to attribute income and loss of a trust to the settlor, did not so apply to any losses on income account realized by the trust on trading in marketable securities (citing inter alia Robins v. The Queen, 63 DTC 1012).

27 March 2013 Folio S4-F3-C1

CRA will consider a price adjustment clause to represent pricing at fair market value if:

- the agreement reflects a bona fide intention of the parties to transfer property at FMV;

- the purported FMV is determined by method that is fair and reasonable in the circumstances (which does not necessarily entail using CRA's preferred method, nor engaging a valuation expert);

- the parties agree that a CRA or Court valuation, if any, will supersede the price otherwise determined; and

- the excess or shortfall is actually refunded or paid, or legal liability therefor is adjusted (para. 1.5).

Price adjustment clauses involving shares may use a number of adjustment mechanisms. CRA non-exhaustively mentions changes in redemption value, the issuance of a note or change in the principal amount of a note, or a change in the number of shares issued - although CRA recommends against using the latter because of inherent legal and technical difficulties (para. 1.6).

5 July 2012 Memorandum 2010-0388551I7 F - Fiducie - retour de sommes

In the course of a 10-page consideration of complex transactions involving a Quebec estate freeze, CRA stated (TaxInterpretations translation):

As a corporation is not the owner of its own shares before their issuance, it follows that such issuance by the corporation to a trust for consideration equal to their FMV does not generally constitute a transfer of property to which subsection 75(2) can apply. Following the case of The Queen v. Kieboom, 92 DTC 6382 (FCA), subsection 75(2) nonetheless could apply when the subscription for the shares is not for consideration equal to their FMV.

4 March 2013 T.I. 2011-0428661E5 - trust payments to minor

The trustees of a Quebec trust exercise their discretionary power in order to allocate an amount of income or taxable capital gain to a minor child beneficiary. The amount is paid by issuing a non-interest bearing promissory note while the funds representing the income or taxable capital gain are left in the trust and reinvested. CRA was asked:

If the funds are left in the trust but are reinvested and notionally belong to the child, does...CRA..consider that subsection 75(2) of the Act applies to such funds because the minor child may be considered to be a contributor?

CRA indicated that if the funds in fact had been made payable to the benficiary by means of the proisssory note, it was not appropriate to treat such funds as only "notionally" belonging to the child.

5 October 2012 APFF Roundtable Q. , 2012-0453591C6 F

The question described a situation where most of the income generated by a discretionary family trust was generated from a loan made to the trust by Mr. X at the prescribed rate of interest and pursuant to a written loan agreement, and then asked whether s. 75(2) would apply if Mr. X was a beneficiary or the sole trustee of the trust. CRA responded (TaxInterpretations translation):

Provided that the loan made by Mr. X to the trust is, in accordance with the true legal relationship between the parties, legally a loan rather than a contribution of capital to the trust, the fact that Mr. X was a beneficiary or a trustee of the trust, as the case may be, would not be itself result in the application of subsection 75(2).

5 October 2012 APFF Roundtable Q. , 2012-0453891C6 F

The summary (which is more specific than the actual question) describes an estate freeze in which a taxpayer exchanges his common shares of of a corporation for preferred shares of the same corporation, with the purchase price and the value of the preferred shares being subject to a price adjustment clause. (New) common shares of the corporation then are issued to a discretionary family trust.

CRA was asked whether the price adjustment clause will prevail if CRA seeks to apply s. 75(2), and whether this depends on whether the preferred shares are still held by the taxpayer at the time of such assessment. CRA stated (TaxInterpretations translation):

In the context of an estate freeze, if the price adjustment clause is valid and the taxpayer makes the necessary adjustments to the price for the common shares and to the redemption value of the freeze preferred shares received as consideration, and to the amount that is due for the preferred shares on their redemption (so that the corporation receives a reimbursement or makes a payment for the difference, as the case may be), the CRA considers that the tax consequences of the estate freeze take such clause into account. ... It thus is not necessary that the price adjustment clause specify that it applies as well for purposes of subsection 75(2). ...

If the CRA recognizes a price adjustment clause as being valid in a given situation in accordance with the wording of the clause, it can engage a retroactive adjustment to the redemption amount of the freeze preferred shares. In the situation you described, the freeze preferred shares have not been redeemed. Consequently, where the estate freeze occurred in a particular year, the price adjustment clause causes an adjustment to the redemption amount of the freeze preferred shares which has an effect respecting subsequent years in which these shares are redeemed.

28 November 2010 CTF Roundtable Q. , 2010-0386351C6

The correspondent asked how to report income attributed to a non-beneficiary settlor under s. 75(2). CRA stated:

Where income is allocated pursuant to subsection 75(2), a T3 information slip must be prepared in respect of the income attributed and issued to the person or persons to which the income is attributed.

All T3 income amounts are entered on the appropriate rows and columns of part A of schedule 9 of the T3 return. A statement showing the amount of income attributed to the person or persons must be submitted with schedule 9. The total of all allocations and designations, including those made to beneficiaries, on line 928 is transferred to part A of line 47 of the T3 Trust Income Tax and Information Return. All allocations and designations are therefore deducted from the trust's income by way of line 47 of the return.

CRA also stated that allocated taxable capital gains are not included in the trust's adjustable taxable income for the purpose of calculating Alternative Minimum Tax.

2006 STEP Roundtable Q. 4, 2006-0185571C6

Although CRA does not apply s. 75(2) to a genuine loan of cash to the trust, this position does not extend to a loan of income-producing property to the trust or to the situation where a capital beneficiary of a trust transfers property to that trust, regardless of whether or not the capital beneficiary receives fair market value consideration.

2004 Ruling 2004-006020 -

Ruling re attribution of income to a First Nation (which was exempt under s. 149(1)(c)) from investments transferred by it and exclusion of such attributed income from income of the trust with the remainder of the income of the trust (particularly income on reinvested income) being deductible under s. 104(6)(b).

7 February 2003 T.I. 2002-012676 -

A trust of which the settlor and family members are beneficiaries uses the settlement proceeds to buy a net profits interest in a particular oil and gas property. The trust does not have involvement in the operations or management of the property and the property's acquisition is not incidental to and does not pertain to an active business carried on by it.

Income generated by the net profits interest would be subject to the application of s. 75(2).

25 September 2000 T.I. 2000-002585

A Nova Scotia company limited by guarantee would not constitute a trust for purposes of s. 75(2). Corporations incorporated under the Nova Scotia Companies Act are corporations for purposes of the Act.

13 October 1999 T.I. 983238

Where the settlor of a trust changes his common shares of a corporation into preferred shares and the trust then subscribes for common shares, s. 75(2) generally would apply if the subscription price was less than the shares' fair market value.

6 July 1998 T.I. 981111

Discussion of when a loan of money by a parent to a trust will qualify as a "genuine loan" so that s. 75(2) does not apply.

May 1998 Advance Life Underwriting Round Table, No. 9807000

Where property held by an RCA trust may revert to the employer corporation that settled the trust, e.g., where employees do not satisfy vesting requirements, and new beneficiaries may be added to the plan from time to time after the trust was created, s. 75(2) will apply to attribute investment income and taxable capital gains of the RCA trust to the employer corporation.

3 December 1997 T.I. 962276

RC noted that, notwithstanding a previous memorandum, it was now its position that "in circumstances where the conditions for the application of both subsection 94(1) and subsection 75(2) of the Act are fulfilled ... the provisions of subsection 75(2) of the Act will apply first".

10 January 1996 T.I. 5-940686 -

Unlike s. 94(1), there is no mechanism for the utilization of foreign tax credits by a person to whom income is attributed under s. 75(2).

21 August 1995 T.I. 951427 (C.T.O. "75(2) - Estate Freeze - Subscription of Shares by a Trust")

S.75(2) would apply where under the trust agreement, decisions are made by majority vote and the affirmative vote of the settlor must be included in the vote.

22 June 1995 T.I. 950818 (C.T.O. "Attribution of Income to a Trust")

Where contributions made by members of a union to a benefit plan (that was established by the union in accordance with a collective agreement), are paid into a trust created to receive the contributions, the income earned by the trust on the contributions received will not be attributed to the union under s. 75(2)(a)(i) where (based on a reading of the trust indenture) the contributions represent property received from the members of the union and not from the union itself.

14 June 1994 T.I. 940584 (C.T.O. "Trust Property Acquired by Mortgage")

S.75(2) would not apply where a trust acquires a property from an arm's length vendor (who is not a trustee or beneficiary of the trust) in consideration for a vendor take-back mortgage which restricts the ability of the trust to sell the property during the one-year term of the mortgage without the consent of the vendor.

28 April 1994 T.I. 941111 (C.T.O. "Attribution")

"Where subsection 75(2) of the Act applies to attribute income to a person, that income is never income of the trust for tax purposes and consequently it cannot be taxable through the trust nor can it be paid or payable to any beneficiary of the trust pursuant to subsection 104(13) of the Act. The attributed income therefore becomes capital of the trust."

Where the terms of the sale of the property to the trust require the trust to pay to the vendor the amount of income tax payable on any income attributed to her pursuant to s. 75(2), there will be no income inclusion to the vendor pursuant to either s. 105(1) or 12(1)(x).

27 January 1994 T.I. 933257 (C.T.O. "Attribution of Income")

S.75(2) will apply where the terms of the trust provide that the transferor of property to the trust (including a transfer for fair market value consideration) may have the property revert to her under the terms of the trust where the last of the other beneficiaries under the trust dies. However, where the trust may revert only by operation of law, eg., a total failure of the trust for lack of beneficiaries, and not pursuant to any condition under the trust indenture, s. 75(2) will not apply.

1994 A.P.F.F. Round Table, Q. 24

"The Department considers that subsection 75(2) of the Act could apply if the deed of trust or any other contract between the trustees and a person who contributes a property to a trust specifies that that person has a right to acquire the property or a property substituted therefor, even if that person does not control the trust property and has no other right as a beneficiary of the trust."

1994 I.C.A.A. Round Table, Q.4

Where s. 75(2) applies to the settlor of a non-resident trust who becomes a resident of Canada, income or loss from property settled on the trust and any taxable capital gain or allowable capital loss from the disposition of the property will be deemed to be that of the settlor notwithstanding that the trust may be exempt from the application of s. 94(1) by virtue of s. 94(1)(b)(i)(A)(iii).

19 May 1993 T.I. (Tax Window, No. 31, p. 13, ¶2528)

Where a trust indenture allows the settlor to reacquire the contributed property, s. 75(2) will apply even where the relevant provision can apply only in remote circumstances.

13 January 1993 T.I. (Tax Window, No. 28, p. 20, ¶2380)

A loan to a trust which is a genuine loan as discussed in IT-258R2, paragraph 8 and IT-260R, paragraph 3 would not be considered to result in property being held in trust on any of the conditions listed in ss.75(2)(a) and (b).

11 August 1992, T.I. 921396 (May 1993 Access Letter, p. 197, ¶C56-226)

S.75(2) would apply if the transferor retains the power to veto distributions of property to beneficiaries or could select beneficiaries from a predetermined class. Ss.75(2)(a)(ii) and 75(2)(b) might not apply if the transferor could not determine the identity of the beneficiaries but could only determine the amount of the trust property to be distributed to the beneficiaries identified by the trust documents.

22 July 1992, T.I. 920736 (March 1993 Access Letter, p. 71, ¶C56-219)

Where unanimity was required in respect of any decision by the two trustees of a trust and the settlor was a trustee, s. 75(2)(b) would apply.

S.75(2)(b) also will apply where loan proceeds were used to acquire property from a parent, and the parents controlled the trust property as trustees or under the terms of the loan.

1992 A.P.F.F. Annual Conference, Q. 19 (January - February 1993 Access Letter, p. 57)

S.75(2) will apply to a taxpayer who establishes a usufruct for another person with respect to property of which the taxpayer is the naked owner.

19 June 1992 T.I. 9218450 (January - February 1993 Access Letter, p. 20, ¶C56-212)

S.75(2) can apply by virtue of a right of the contributor of property to reacquire that property at fair market value.

16 June 1992 T.I. 5-920008

S.75(2) will apply where the settlor is able to select additional beneficiaries or delete beneficiaries after the creation of the trust.

27 February 1992 T.I. (Tax Window, No. 17, p. 8, ¶1766)

S.75(2) will apply where the settlor, in his capacity of sole trustee, has the discretion as to whom the trust property will be distributed on a distribution date out of a class of beneficiaries specified in the trust deed.

91 C.R. - Q.8

A genuine loan to a trust, or the unpaid purchase price for a property on an unconditional bona fide sale, will not by itself be considered to result in property being held by the trust on the conditions set out in s. 75(2)(a) and (b).

90 C.R. - Q23

Where a law firm receives funds from its clients to be held in trust pending the application of the funds for disbursements or against fees for services, the investment income if the relationship is one of trust/beneficiary will normally be included in the income of the client by virtue of s. 75(2) and no trust return will be required.

16 November 89 T.I. (April 90 Access Letter, ¶1175)

Father settles an irrevocable trust of which he is the sole trustee and whose terms are totally discretionary as to income and capital payments, and his beneficiaries are his adult children. The trust indenture provides that the trust will continue until the earlier of father's death or the day upon which father terminates the trust, at which date the trust capital is divided equally among the beneficiaries then alive. Because father can exercise control over the disposition of the trust property, s. 75(2)(b) could apply.

88 C.R. - Q.32

Because a bare trust is reversionary and revocable, all income, losses, capital gains and capital losses will be attributed to the transferor.

88 C.R. - Q.48

Capital gains attributed to the transferor by virtue of s. 75(2) are not eligible for the capital gains exemption.

86 C.R. - Q.46

A reversion requires a transfer of property, and the making or repayment of a loan does not constitute a transfer of property.

84 C.R. - Q.30

S.75(2)(b) may apply where the trustee may amend the dispositions of the trust deed with the approval of the settlor.

IT-369R "Attribution of Trust Income to Settlor"

1. ...A genuine loan to a trust would not...by itself result in the application of subsection 75(2)..., if the loan is outside and independent of the terms of the trust.

5. ...The subsection does not apply to attribute business income or losses even if the business operates with some or all of the property received from the particular taxpayer.

6. Any income or loss derived from the investment or other use of the earnings from property (or property substituted therefor) received from a person is not attributed to that person....

9. ...Although the lifetime of a corporation is indeterminate...this fact would not preclude the attribution of trust income to a corporation....

Articles

Carmen Thériault, "Alter Ego and Joint Partner Trust", 21 Estates, Trusts & Pensions Journal, p. 345.

Darling, "Bare Trusts", 1989 Corporate Management Tax Conference, c. 8.

Saunders, "Inter Vivos Discretionary Family Trust: A Potpourri of Issues and Traps", 1993 Conference Report, pp. 37:6-14.

Subsection 75(3) - Exceptions

Cases

Labow v. The Queen, 2012 DTC 5001 [at 6501], 2011 FCA 305

The taxpayer, who employed both his wife and two part-time employees in his medical practice, deducted $150,000 and $247,691 for contributions he made in 1996 and 1997, respectively, to a health plan trust which he established only for her. The Minister reassessed to deny these deductions and to include the income subsequently generated from the plan assets in the income of the taxpayer under s. 75(2). The trial judge found that these contributions were not made for the purpose of earning income from the taxpayer's medical practice. In affirming the trial judge's finding that the plan was not a trust described in para. (a.1) of the definition of trust in s. 108(1), so that the exclusion from the application of s. 75(2) to the plan income in s. 75(3)(b) did not apply, Dawson J.A. stated (at para. 36):

Counsel argued that the Judge failed to consider the phrase "because of, an office or employment." Counsel argued that the Judge failed to consider whether the benefits were provided "in respect of" Dr. Labow's wife's office or employment. However, given the Judge's finding of fact that the benefits were provided because of Dr. Labow's wife's marital status, it cannot be said the benefits were provided wither "because of" or "in respect of" her office or employment.