See Also

Commissioner of Taxation v. Resource Capital Fund III LP, [2014] FCAFC 37 (Fed. Ct. of Austr.)

The appellant ("RCF") was a non-Australian partnership which was assessed on the basis that its gain from the sale of a "member ship interest" in an Australian company ("SBM") with two underground gold mines in Western Australia was from "taxable Australian real property". The SBM membership interest qualified as TARP "if the sum of the market value of [SBM]'s assets that [were] taxable Australian real property exceed[ed] the sum of the market values of its assets that [were] not taxable Australian real property." The primary judge below had found that the SBM membership interests were not TARP, in part, on the basis that the mining information of SBM (a non-TARP asset) had a substantial value in light of the substantial exploration cost that would be required to reproduce this information, as well as the substantial present value of the mining production that would be foregone during the three to five year exploration and evaluation process and that the valuation of the mining rights (a TARP asset) should be discounted by the same factors.

In rejecting this approach on appeal, the Court stated that the market values of the various assets should be made:

on the hypothesis of a simultaneous sale to the one purchaser with the capacity to use those assets in combination in a gold mining operation as their highest and best use. …[A]ll the experts…agreed that in the case of a simultaneous sale to the one purchaser, the hypothetical purchaser could expect to acquire the mining information and plant and equipment for less than their re-creation costs with little or no delay.

Accordingly, it appeared that the Commissioner was successful, although the parties could make submissions on the final calculations.

Lipson v. the Queen, 2012 DTC 1064 [at 2796], 2012 TCC 20

The taxpayers received a number of capital distributions from the liquidator of their mother's "succession" (a Quebec estate), but only filed a notice under s. 116(3) respecting the final distribution. The Minister assessed penalties against the taxpayers on the basis that the taxpayer was deemed under para. (d) of the definition in s. 248(1) of disposition to have disposed of taxable Canadian property (an interest in a trust) without filing the required notices under s. 116(3) respecting the previous distributions.

Jorré J. allowed the taxpayer's appeal. As Quebec succession is not a trust, the distributions did not represent dispositions of interests in a trust. Although s. 104(1) provided that a reference to "trust" or "estate" included an executor or a liquidator of a succession, this merely facilitated a drafting technique to permit the word "trust" or "estate" to refer both to a trust or estate, and the persons charged with responsibility for carrying out the obligations of the trust or estate, as the case may be - and did not have the effect of deeming a Quebec succession to be a trust.

Administrative Policy

19 June 2015 STEP Roundtable, Q. 10

A testator dies leaving an estate comprised mostly of real property situated in Canada (a principal residence). Upon completion of the estate administration, a ½ share of the residue (now all cash) is paid (as required under the will) to a resident trust (the "Son's Trust") for the benefit of the testator's non-resident son. One year later, the trustee of the Son's Trust makes a capital distribution to the son. Would son's interest in Son's Trust be taxable Canadian property, so that s. 116 would apply to that distribution to him?

CRA indicated that the most likely situation is that the transfer of cash from the estate to Son's Trust would satisfy para. (f) of the definition of "disposition" in s. 248(1) (no change in beneficial ownership), so that s. 248(25.1) would deem Son's Trust to be a continuation of the estate. On this basis, and in light of the 60-month look-back rule in para. (b) of the definition of tcp, Son's interest in Son's Trust would be considered to be derived directly or indirectly from Canadian real property, so that the cash distribution by Son's Trust would be considered to have been made on taxable Canadian property.

Alternatively, if the transfer of Son's share of the estate cash to Son's Trust did not meet all the conditions of para. (f), s. 248(25.1) would not apply. However, Son's interest in Son's Trust (being an indirect interest in the estate) would be taxable Canadian property here as well, so that again, as the distribution occurs within 60 months, it would be a distribution on taxable Canadian property.

27 June 2013 T.I. 2012-0459481E5 - Taxation of a Non-Resident

In response to a query as to whether precious metal coins stored in Canada on behalf of a non-resident individual would be taxable Canadian property, CRA stated that the question as to whether the non-resident was carrying on business in Canada was one of fact on which it could not comment, and further indicated that if he were carrying on business in Canada, there was a potential exemption under Art. VII of the Canada-U.S. Convention.

2013 Ruling 2012-0444431R3 - Taxable Canadian Property

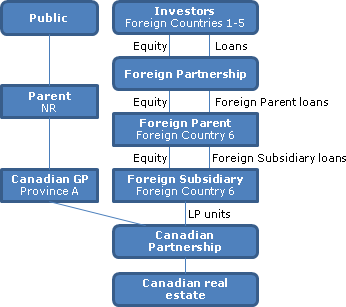

A partnership (Foreign Partnership), whose non-resident members (Investors) are resident in Foreign Countries 1 through 5, uses a portion of its cash from unit and loan subscriptions to subscribe for equity of a Newco resident in Foreign Country 6 (Foreign Parent), and applies the balance of its subscription cash to subscribe for a mixture of profit-participating loans and non-interest-bearing loans of Foreign Parent (the Foreign Parent Loans). Foreign Parent, in turn, uses such cash proceeds to subscribe for shares of another Newco (Foreign Subsidiary), also resident in Foreign Country 6 and to subscribe for interest-bearing loans of Foreign Subsidiary (the Foreign Subsidiary Loans). Foreign Subsidiary, in turn, uses such cash proceeds to acquire partnership interests in a partnership (Canadian Partnership) holding Canadian real property.

Ruling that each Investor's interest in the Foreign Partnership will be taxable Canadian property.

19 March 2013 Memorandum 2010-0385931I7 - Taxable Canadian property and Partnerships

A partnership is disposing of its 25% shareholding of a listed public corporation ("Pubco"). Those shares derived more than 50% of their fair market value from Canadian real property and are not treaty-protected property for any of the partners, all of whom are non-resident and deal with each other at arm's length.

In finding that the non-resident partners are not taxable on the disposition under s. 2(3)(c) and that "section 116 has no application," CRA stated:

…subsection 96(1) does not apply for the purposes of paragraph 2(3)(c). Thus, for the purpose of determining whether the non-resident partner is taxable under subsection 2(3)…the partners of the partnership are considered to have disposed of their respective interest in the property of the partnership and paragraph 96(1)(c) does not apply….In other words, the "non-resident person" referred to in subsection 2(3) is the non-resident partner and not the partnership.

…although the partnership realizes a gain from the disposition of a TCP and a portion of the gain is allocated to the non-resident partner and included in computing his taxable income earned in Canada under paragraph 115(1)(a) and paragraph 115(1)(b), the shares are not TCP for the purposes of paragraph 2(3)(c), in respect of each non-resident partner….[U]nder common law... it may not be said that the non-resident partner owned a specific percentage of the underlying property of the partnership. Therefore, ... none of the non-resident partners is taxable in Canada on their portion of the gain realized by the partnership on the disposition of the shares of Pubco.

We believe this result to be unintended and have advised officials at the Department of Finance.

29 November 2011 November CTF Roundtable Q. , 2011-0425931C6

CRA confirmed that:

when determining whether a share listed on a designated stock exchange is TCP at "any particular time" during a 60 month period both of the tests at subparagraphs (e)(i) and (ii) of the definition must be satisfied at the same time.

28 November 2011 CTF Roundtable Q. , 2011-0425901C6

In response to a question as to how the 50%-derived-from-real-property test should be applied where the non-resident disposes of shares of Parent which holds Subsidiary, CRA stated:

a determination will need to be made of the proportion of the total gross assets of the Subsidiary that comprises of real or immovable property situated in Canada (and certain other property....). Under the current wording of the "taxable Canadian property" definition, an amount equal to that same proportion of the FMV of the shares of the Subsidiary will be considered real or immovable property situated in Canada of the Parent in the determination of whether the shares of the Parent derive their value principally from real or immovable property situated in Canada.

CRA then sumarized the 27 August 2010 amendment that would prevent an indirect "look through" approach where shares of Subsidiary were not themselves taxable Canadian property.

13 September 2012 CICA Compliance Roundtable Q. , 2012-0453021C6

Respecting a question as to whether shares of an unlisted corporation would be taxable Canadian property if during the preceding 60 months "most of the value of the corporation's shares was derived directly from assets consisting of non-defaulted arm's length mortgages secured by real property situated in Canada," CRA stated:

...CRA is of the view that the fact that at some time during the 60-month period that ended at the determination time, most of the value of the shares of a corporation that is not listed on a designated stock exchange was derived directly from assets consisting of non-defaulted arm's length mortgages secured by real property situated in Canada, would not result in a share of that corporation being TCP. However, if the rights of a particular mortgagee were different from those described in subsection 248(4) of the Act, we would need to examine all of the facts and circumstances relating to that particular mortgage before taking a final position....

17 May 2012 IFA Conference Roundtable Q. , 2012-0444091C6

In determining (when a non-resident disposes of shares of Parent) what portion of the shares of the Subsidiary of Parent represent real or immovable property of Parent, CRA will apply to the fair market of the shares of Subsidiary the proportion which the real or immovable property of Subsidiary represents of its total gross assets – and the same approach is applied respecting a subsidiary partnership. There is an exception where shares of Subsidiary were not themselves taxable Canadian property.

The determination as to whether the value of the shares of Parent are derived directly or indirectly form Canadian real property will not be affected by whether (wholly-owned) Subsidiary is capitalized only with equity or with debt as well.

2012 IFA Roundtable, Q.5 [preliminary -final above]

In determining whether the shares of of a Canadian corporation (Canco 1) are taxable Canadian property, CRA will apply a proportionate value approach to any subsidiary (Canco 2) of Canco 1 whose shares are themselves taxable Canadian property, so that if Canco 2 has a NAV of $401 resulting from holding Canadian real property with a value of $1,000, mortgage debt of $999 and cash of $400, Canco 1 will be considered to hold Canadian real estate with a value of ($1,000/$1,400)*$401, or $286, for the purposes of determining whether the shares of a Canco 1 derive more than 50% of their fair market value from Canadian real estate, resource or timber properties. CRA is considering whether intercompany debt should be disregarded for purposes of applying this proportionate value approach. Investments in subsidiary partnerships will be handled the same way.

7 July 2011 T.I. 2011-040327

Gold bullion situated in Canada owned by a non-resident is not taxable Canadian property provided that it is not part of the inventory of a business carried on in Canada.

18 December 2002 T.I. 2002-015179 -

In light of the repeal of s. 115(3), a taxpayer who owns directly 20% of the shares of a listed corporation and has an option to acquire an additional 5% of those shares will not be considered to hold taxable Canadian property. However, where the taxpayer or persons with whom the taxpayer does not deal at arm's length owns 25% or more of any class of the shares of a corporation, both the shares and any options to acquire additional shares will be taxable Canadian property.

92 C.M.TC - Q.6

It is essentially a question of fact whether a ship used in international shipping constitutes taxable Canadian property.

91 C.R. - Q.49

RC treats options to acquire property as described in s. 115(1)(b)(iv) held by non-resident persons, or persons with whom they did not deal at arm's length, as having been exercised for purposes of evaluating the 25% ownership test.

1 May 1990 Memorandum AC70442

"With respect to the application of the provisions of section 116 of the Act to the disposition of partnership property, (i) the assumptions in subsection 96(1) of the Act are not applicable, (ii) on the disposition of partnership property, each member of the partnership is considered to have disposed of his share of that property, and (iii) each non-resident partner is a non-resident person referred to in section 116 ... . The Department also considers that section 116 applies to a non-resident partner who disposes of his partnership interest which is taxable Canadian property by virtue of subparagraph 115(1)(b)(v) to the partnership in return for certain partnership property. Each remaining partner is considered to be the person referred in subsection 116(1)(a)."

84 C.R. - Q.36

S.116 has no application to dispositions of Canadian real estate that constitutes inventory to the non-resident investor.

Articles

Sheryl Troup, "Purchasing Private Corporation Shares: Hazards if the Vendor is Non-Resident", Canadian Tax Focus, Volume 3, No. 4, November 2013, p. 5.

Gross v. net asset method (p.5)

At a CRA and Revenue Québec round table published in the Canadian Tax Foundation's 2011 Conference Report, the CRA stated that the gross asset value method should be used in respect of all property dispositions (both for tax treaty purposes and for the purposes of the definition of "taxable Canadian property" in the Act) for all dispositions after 2012. Thus, the determination of whether a share of a company derives its value principally from real or immovable property situated in Canada should be made by reference to the value of the properties of the company without taking into account its debts or other liabilities.

Example (p. 5)

For a highly leveraged company, the answer to the question whether the shares are TCP can differ significantly if a valuation method other than the gross asset value method is used. Assume, for example, that a company has land with an FMV of $500,000, other assets of $10 million, and liabilities of $9.8 million. If the gross asset value method is used, the land constitutes 5 percent of the total value of the shares. If a net asset value method is used, the land value exceeds 50 percent of the FMV of the shares, and the shares are TCP.

Edward A. Heakes, "Another Wave of Foreign Affiliate Proposals", International Tax Planning, Volume XVIII, No. 4, 2013, p. 1275

De minimis partnership interests are included in test (p. 1276

[I]f a taxpayer holds 5% of the shares of a listed company and is a partner in a partnership that holds 20% of such shares, the 25% test would be met.

Under the current draft, the size of the taxpayer's interest in the partnership is not taken into account in determining whether the listed shares are taxable Canadian property and this has the potential to create various anomalous results….

Jack Bernstein, Francesco Gucciardo, "TCP Proposal Overshoots Objective?", Canadian Tax Highlights, Vol. 21, No. 8, p. 4

The authors provided the following example showing that a small direct holding of shares of a Canco could become taxable Canadian property under the draft amendments by virtue of the non-resident investor also having small investments in investment or trading limited partnerships:

Assume that Mr. X, a non-resident, owns 2 percent of the shares of a Canadian public company (Canco). At all relevant times, Canco's assets consist primarily of Canadian real property or Canadian resource property: this holding satisfies the subparagraph (e)(ii) condition in the TCP definition that at the relevant time more than 50 percent of Canco's asset value is attributable to property with the required Canadian nexus. Mr. X has small investments in several funds, each of which has thousands of other investors; Mr. X holds a 0.025 percent interest in each of the two funds that are structured as partnerships (fund 1 and fund 2). Mr. X is at arm's length with each of those two funds and with every other fund investor; fund 1 and fund 2 are not related. In aggregate, fund 1 and fund 2 own 23 percent of Canco shares, which make up 1 percent of each of their portfolios.

Mr. X. sells his 2 percent shareholding in Cando. Are those shares TCP?....

Under the amended 25 percent ownership test, the direct ownership of the 2 percent is unchanged, but it is augmented by all Canco shares that are owned by or that belonged to partnerships in which Mr. X, or any person not at arm's length with him, holds a membership interest (either directly or indirectly through one or more partnerships). Fund 1 and fund 2 are partnerships in which Mr. X holds a membership interest. Because fund 1 and fund 2 own in the aggregate 23 percent of Canco's shares, all of those shares are attributed to Mr. X under the proposed definition to determine whether the Canco shares that he owns directly are TCP. On the facts of this example, the shares held directly and sold by Mr. X are TCP because at least 25 percent of the issued Canco shares of any class are owned by or belong to any combination of the persons described.

Steve Suarez, Maire-Eve Gosselin, "Canada's Section 116 System for Nonresident Vendors of Taxable Canadian Property", Tax Notes International,9 April 2012, p. 175

Includes discussion of change in CRA policy (net to gross asset value) re determination of whether shares derive their value primarily from real estate.