Subsection 80.01(3) - Deemed settlement on amalgamation

Administrative Policy

2 December 2014 Folio S4-F7-C1

1.92 …The provision applies where an indebtedness (including a distress preferred share), as referred to in subsection 80.01(3), owed by one corporation to another corporation is cancelled or extinguished on an amalgamation of those corporations. The application of subsection 80.01(3) is not limited to a qualifying amalgamation described in [s. 87(1)] but may apply to any amalgamation. …

1.94 It is the CRA's view that any accrued foreign exchange gain or loss on a foreign currency denominated debt which is extinguished on an amalgamation of the debtor and the creditor and is deemed to be settled by virtue of subsection 80.01(3) will not be realized as a consequence of the amalgamation. This is because the payment deemed to have been made by the debtor to the creditor under subsection 80.01(3) is the creditor's cost amount which is determined by the exchange rate at the time the indebtedness arose and not at the time the indebtedness is deemed to be settled or extinguished on the amalgamation under subsection 80.01(3).

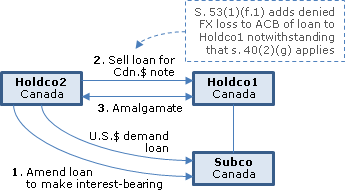

2014 Ruling 2013-0479701R3 - Transfer of US dollar loan

Current structure

Holdco2, which is wholly-owned by Mr. X (a Canadian resident), made seven non-interest-bearing demand U.S-dollar loans (collectively, the "US Loan") to another Canadian corporation ("Subco") which was wholly-owned by a Canadian corporation ("Holdco1"). Holdco1 is controlled by Mr. X through non-participating voting shares and its non-voting common shares are held by family trusts. There is an accrued FX loss to Holdco2 on US Loan.

Proposed transactions

- US Loan will be amended (without being novated) to bear a commercial rate of interest.

- Holdco2 will transfer the US Loan to Holdco1 in consideration for a demand Canadian-dollar interest-bearing promissory note.

- Holdco1 and Subco will amalgamate so that the US Loan will be extinguished.

Rulings

The US Loan amendment will not result in its disposition nor a gain or loss under s. 39(2). The denied capital loss for Holdco2's disposition of the US Loan will be added to Holdco1's ACB for the US Loan under s. 53(1)(f.1). S. 80.01(3) will apply on the amalgamation (no forgiven amount).

Subsection 80.01(4) - Deemed settlement on winding-up

Administrative Policy

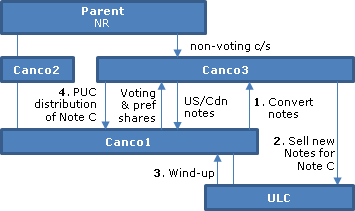

2014 Ruling 2013-0514191R3 - Debt restructuring, forgiveness and winding-up

Currrent structure

Canco1 holds all the outstanding voting shares of Canco3, and also is obligated to Canco3 under non-interest-bearing U.S.-dollar debt evidenced by demand notes ("Notes A") as well as further non-interest-bearing Canadian-dollar debt to be subsequently evidenced by notes (the "Canco1 Note A"). The fair market value of all such debt is substantially lower than its adjusted cost base to Canco3 (equal to its principal). In addition, there is an accrued FX gain to Canco1 on Notes A. The non-voting common shares of Canco3 are held by a non-resident public company (Parent), which also is the indirect parent of Canco1.

Proposed transactions

- The terms of the Notes A will be amended (but with no novation) to change the governing law and to add a right allowing the holder to exchange them for new Canadian-dollar interest-bearing demand notes ("Notes B"); and a similar exchange right into Canco1 Note B will be added to Canco1 Note A – with both exchange rights then being exercised by Canco3.

- Approximately XX months after 1 above, Canco3 will sell to a newly-incorporated subsidiary of Canco1 ("New ULC") the Notes B and the Canco1 Note B in consideration for a demand non-interest bearing Canadian-dollar note of New ULC (the "Note C").

- New ULC will be wound-up into Canco1 under s. 88(1), with Canco1 filing an s. 80.01(4) election.

- Canco3 will reduce the stated capital of its outstanding voting preferred shares by distributing Note C, so that Note C is settled by operation of law.

Purpose

to eliminate the Canco1 debt without a merger of Canco1 and Canco3 by way of amalgamation or wind-up, which is not a viable alternative.

Rulings

include:

- The addition of the exchange rights and change in governing law in 1 will not result in a disposition.

- S. 51.1 will apply, and ss. 80 and 39(2) will not apply, to the exchange of the U.S.-dollar debt in 1.

- Ss. 40(2)(e.1) and 53(1)(f.1) will apply to the note transfers in 2 so that the ACB to New ULC of the notes will be increased by an amount equal to the denied capital loss.

- Provided the s. 80.01(4) election is timely filed, ss. 80 and 39(2) will not apply to the note settlements in 3.

- S. 80 will not apply to the elimination of Note C in 4.

4 April 2014 T.I. 2014-0522501E5 - Cancellation of ATR-66

ATR-66, which contained out-of-date statutory references, was cancelled effective September 30, 2012. This "cancellation…does not represent a change in the CRA's view as to whether the general anti-avoidance rule would apply to the transaction described therein."

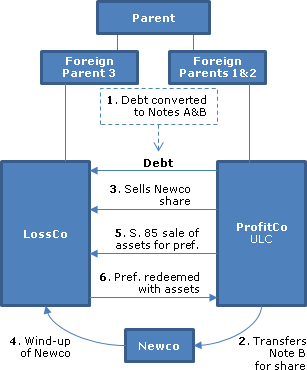

2012 Ruling 2012-0451431R3 - Loss Consolidation

LossCo, which is insolvent, and ProfitCo, are both indirect subsidiaries of a foreign parent. LossCo is indebted to ProfitCo under the LossCo Indebtedness. (Steps 5-6 of the above diagram are discussed under s. 111(1)(a)).

Proposed transactions include:

- the terms of the LossCo Indebtedness will be amended to make them convertible into two new interest bearing debt obligations: the LossCo Note A Indebtedness, bearing interest at LIBOR and ranking pari passu with the general creditors; and the LossCo Note B Indebtedness bearing interest at LIBOR plus X% and ranking junior to the general creditors

- ProfitCo will then exercise this conversion right

- ProfitCo will transfer the LossCo Note B Indebtedness to a newly-incorporated Canadian subsidiary in exchange for one share of Newco

- ProfitCo will sell Newco to LossCo for $X, subject to a price adjustment clause "whereby LossCo will issue a demand promissory note to ProfitCo in an amount equal to the amount of any price adjustment"

- Newco will be wound up into LossCo to make an election under s. 80.01(4) in respect of the settlement of the LossCo Note B Indebtedness; as a result of such settlement, LossCo will become solvent

Rulings:

- the addition of the conversion feature will not result in a disposition of the LossCo Indebtedness provided that there was no novation or rescission of the debt

- s. 51.1 will apply to the conversion, and no forgiven amount will arise

- the loss denied under s. 40(2)(e.1) on the transfer of the LossCo Note B Indebtedness to Newco will be added to the adjusted cost base of that debt to Newco under s. 53(1)(f.1)

- no forgiven amount will arise on the settlement of the LossCo Note B Indebtedness

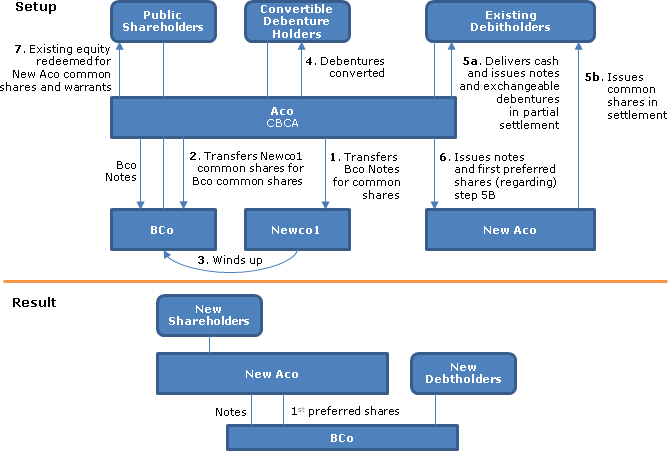

2012 Ruling 2012-0452821R3 - Forgiveness of debt

Aco is a Canadian public company holding interest-bearing promissory notes (Bco Notes) and shares of a Canadian subsidiary (Bco). Preliminarily to a Plan of Arrangement (referred to in Steps 4 to 7 of the above diagram and summarized under s. 80(1) - forgiven amount):

- Aco will transfer the Bco Notes (having an adjusted cost base equal to their principal) to a newly-incorporated CBCA corporation (Newco1) in consideration for the issuance of Newco1 common shares

- Aco will transfer its Newco1 common shares to Bco in consideration for the issuance of a nominal number of Bco common shares

- the paid-up capital of the Newco1 common shares will be reduced

- Newco1 will be wound-up into Bco, with Bco making a s. 80.01(4) election

Rulings:

- ss. 40(2)(e.1) and 53(1)(f.1) will apply to the dispositions of the Bco Notes to Newco1, so that their ACB is preserved

- the extinguishment of the Bco Notes on the winding-up of Newco1 will not give rise to a forgiven amount (per s. 80.01(4))

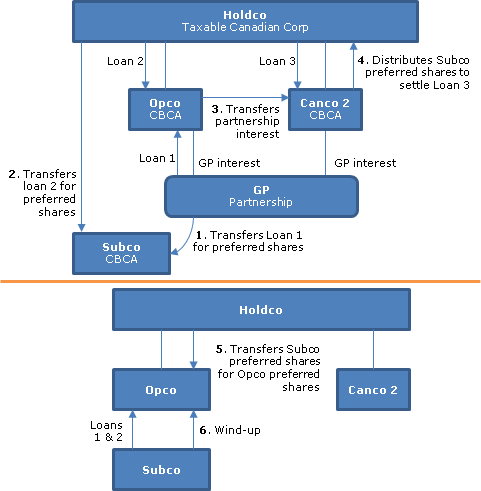

2012 Ruling 2011-0426051R3 - Debt Restructuring

Opco is a Canadian resource company whose liabilities far exceed the value of its assets. It is the indirect subsidiary of a foreign parent and is obligated under an interest-bearing loan (Loan 2) to its immediate Canadian parent (Holdco), which also holds the shares and an interest-bearing loan (Loan 3) of Canco 2. Opco and Canco 2 are the partners of a general partnership (GP) which holds an interest-bearing loan (Loan 1) of Opco.

The proposed transactions will be implemented before a potential acquisition of control of the foreign parent (which would "grind" the adjusted cost base of Loans under s. 111(4)):

- GP and Holdco will transfer Loan 1 and 2 to a newly-incorporated subsidiary (Subco) of Opco in consideration for Subco Preferred Shares

- Opco will transfer its partnership interest in GP to Canco 2, so that GP will cease to exist and Canco 2 will receive Subco Preferred Shares

- Canco 2 (which does not have significant tax attributes) will distribute such Subco Preferred Shares to Holdco in settlement of Loan 3 (thereby giving rise to a forgiven amount to it)

- Holdco will transfer its Subco Preferred Shares to Opco in consideration for Opco Preferred Shares

- Subco will be wound up into Opco under s. 88(1) (following a reduction of the stated capital of the Subco Preferred Shares)so that Loans 1 and 2 (previously owing to Subco by Opco) will be extinguished

Rulings (following ATR-66):

- Ss. 40(2)(e.1) and 53(1)(f.11) will apply to the dispositions of Loans 1 and 2 to Subco

- The settlement of Loans 1 and 2 on the Subco winding-up will not give rise to a forgiven amount per s. 80.01(4)

- Neither s. 40(2)(e.1) nor s. 40(3.4) will apply to deny the capital loss to Holdco on the settlement of Loan 3

- S. 61.3(3) will not apply to deny the application of s. 61.3(1) to Canco 2 (re inter alia the forgiven amount arising to it on the settlement of Loan 3)

- S. 245(2) will not be applicable

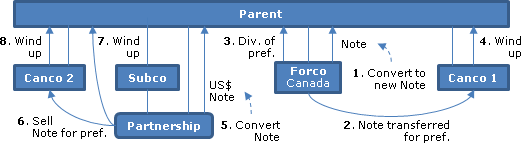

2009 Ruling 2008-0300161R3

Background

Parent, which is in CCAA proceedings, owns all but one share of Forco, which was incorporated outside Canada but whose central management and control is in Canada. Forco holds a non-interest-bearing note (the Forco Note) of Parent as its only substantial asset. The Partnership of which Parent is the majority partner and a CBCA subsidiary of Parent (Subco) is the other partner holds, as its only asset, a U.S. dollar non-interest-bearing note (the GP Note) owing by Parent with a latent FX capital loss to the Partnership.

Proposed transactions

:

- The terms of the Forco Note will be amended to change their governing law, and to make it convertible into a new interest-bearing note (the "New Forco Note"), with neither amendment resulting in a novation; and the Forco Note will be converted into the New Forco Note.

- XX months later, Forco will transfer the New Forco Note to a Canadian subsidiary of Parent (Canco1) in consideration for redeemable retractable non-voting preferred shares of Canco1.

- Forco will reduce the nominal value of its shares to create distributable reserves, and pay a dividend-in-kind to Parent of such preferred shares.

- Canco1 will be wound-up under s. 88(1) and Parent will file a s. 80.01(4) election in respect of the resulting settlement of the New Forco Note.

- The GP Note will be converted into the New GP Note similarly to 1.

- XX months later, the Partnership will transfer the New GP Note to a Canadian subsidiary of Parent (Canco2) in consideration for redeemable retractable non-voting preferred shares of Canco2.

- The Partnership will be wound up so that Parent and Subco receive undivided interests in the Canco2 preferred shares.

- Subco will pay a dividend-in-kind to Parent of such preferred shares.

- Canco2 will be wound-up under s. 88(1) and Parent will file a s. 80.01(4) election in respect of the resulting settlement of the New GP Note.

Rulings

:

- The amendments/governing law changes in 1 and 5 will not result in a disposition of the Notes.

- S. 51.1 will apply to the conversions in 1 and 5 such that Forco and the Partnership will be considered to dispose of the Notes for their ACB and to have reacquired them for the same amount.

- Such conversions will not give rise to a forgiven amount to Parent nor (in the case of the GP Note) a s. 39(2) gain to it.

- Ss. 40(2)(e.1) and 53(1)(f.11) will apply to the Note transfers in 2 and 6, so that a denied capital loss will be added to the ACB of the Note to Canco1 or Canco2.

- The extinction of the Notes on the windings-up in 4 and 9 will not give rise to a forgiven amount to Parent nor (in the case of 9) a s. 39(2) gain to it.

2009 Ruling 2009-031392

Ruling that when a Canadian debtor is wound-up into its Canadian parent and an election under s. 80.01(4)(c) is made, then, in light of s. 80(2)(k), no gain or loss will be realized under s. 39(2).

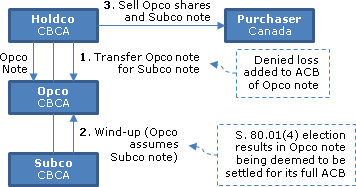

ATR-66 (Cancelled) 20 April 1995.

Proposed transactions

- Holdco, a CBCA corporation, will transfer its note (the Opco note) of Opco (its wholly-owned CBCA subsidiary) to a newly incorporated CBCA subsidiary of Opco (Subco) for the Opco note's fair market value (which is less than its principal amount) in consideration for the issuance by Subco of the Subco note.

- Subco will be wound-up into Opco under s. 88(1) (with the Subco note being assumed by Opco) and Opco will elect under s. 80(3)(b) [now, s. 80.01(4)].

- Holdco then will sell its shares and note of Opco (i.e., the former Subco note) to an arm's length purchaser, who will wind-up or amalgamate with Opco with a view to utilizing its non-capital losses.

Rulings

- The denied capital loss [under former s. 85(4)(a) – see now s. 40(2)(e.1)] on the drop-down of the Opco note will be added to the adjusted cost base of the Opco note under s. 53(1)(f.1).

- The provisions of s. 80(1) [now 80(3) et seq.] will not be applied to the extinguishment of the Opco note on the winding-up.

- S. 245(2) will not be applied.

Subsection 80.01(6) - Specified obligation in relation to debt parking

Administrative Policy

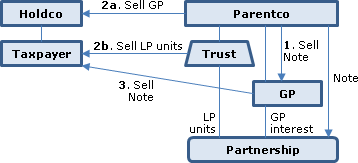

28 October 2014 Memorandum 2014-0529981I7 - Allocation of partnership loss to a former partner

The Taxpayer entered into the "Purchase Agreement" for the purchase of a limited partnership (the "Partnership") with substantial current losses. The partners were the limited partners, namely, the "Trust" (the holder of essentially all the LP units other than a special unit held by "Parentco" with no income entitlement) and the "General Partner," a subsidiary of Parentco.

- As directed in the Purchase Agreement, Parentco' special unit was repurchased, and Parentco transferred the "Particular Note," owing to it by the Partnership, to the General Partner for $XX and one common share of the General Partner.

- The parent of the Taxpayer (Holdco) then purchased the shares of the General Partner and the Taxpayer purchased the LP units and debt owing by the Partnership to the vendor group.

- The General Partner sold the Particular Note to the Taxpayer for $XX.

In finding that the debt parking rules did not apply, the Directorate noted:

[T]he Particular Note was[not] a specified obligation at any time. In this regard, at no time did the various owners of the Particular Note deal at arm's length with the debtor (i.e., the Partnership). Further, with respect to subparagraph 80.01(6)(a)(ii), at both times that the Particular Note was acquired by another person…[in steps 1 and 3] that other person was related to the holder of the Particular Note.

After noting a current GAAR review by Aggressive Tax Planning, the Directorate stated that LeCavalier "supports the application of GAAR… where the debt parking rules…were considered to have been misused or abused."

18 July 1995 Memorandum 951761 (C.T.O. "Debt Parking")

S.80.01(8) would, but for the 80% role, have applied in the situation where OBCO, which is owned on a 50/50 basis by an individual (X) and an unrelated corporation (ACO), and a corporation (BCO) wholly-owned by (X) acquires both shareholding in OBCO of ACO and the debt owing by OBCO to ACO.

Subsection 80.01(8) - Deemed settlement after debt parking

Administrative Policy

8 August 2014 T.I. 2014-0524951E5 - Debt forgiveness; liability on dissolution

If the Canadian-resident "Individual" makes a s. 50(1) election respecting a loan owing to him by an insolvent CCPC of which he is the sole shareholder, will the debt parking rules apply?

[A]n obligation is a "specified obligation" if the obligation is deemed by subsection 50(1)… to have been reacquired at a particular time. If a valid subsection 50(1) election is made, the debt parking rules will deem the Loan to be settled because…the Loan has become a parked obligation and the specified cost at the particular time to the holder of the obligation (which would be nil as a result of the subsection 50(1) election) will be less than 80% of the principal amount of the obligation.

…Generally, unless the Individual has assigned the Loan to a third party, the Individual will not be able to dispose of the Loan without a corresponding settlement of the Loan for purposes of the debt forgiveness rules.

14 October 1998 Memorandum 972672

Where a Canadian parent made a non-interest bearing advance to its wholly-owned subsidiary, if the parent elects under s. 50(1), s. 40(2)(g)(ii) may deem the loss to be nil even though s. 80.01(a) will deem the debt to have been settled for a nil amount with the attendant consequences under s. 80(2)(e). This would be avoided if a loss properly could be claimed under s. 20(1)(l) rather than s. 50(1).

23 January 1996 T.I. 5-952790 -

"Section 79 has priority over section 80 except if paragraph 80.01(8) has applied in a previous year." [Translation]

Subsection 80.01(9) - Statute-barred debt

Administrative Policy

5 October 2012 APFF Roundtable Q. , 2012-0454081C6 F

An adult son was lent $100,000 by his father under a demand promissory note. The prescription period under the Quebec Civil Code was three years, so that after that point, the note ceased to be enforceable in a legal action.

CRA confirmed that s. 80.01(9) did not apply as the debtor and creditor were related. Respecting whether the debt forgiveness rules nonetheless could apply on general principles as a result of the prescription, CRA stated (TaxInterpretations translation):

a debt is settled or extinguished if there is an extinguishent or settlement of the debt at law. The question as to whether the Note could otherwise be extinguished in the situation described above depends on the relevant facts and the applicable civil law.