Subsection 90(1) - Dividend from non-resident corporation

See Also

Ahmad v. The Queen, 2013 DTC 1112 [at 601], 2013 TCC 127

The taxpayer held 1000 shares in a Bermudan corporation ("Tyco"). In a corporate reorganization, Tyco distributed 250 shares to the taxpayer of its two wholly owned subsidiaries, and consolidated the taxpayer's 1000 shares into 250. The taxpayer was assessed for receiving a dividend in kind.

Rip CJ upheld that the shares distributions were a dividend in kind, as Tyco had failed to file a s. 86.1 election. He stated (at para. 13):

I agree with Mr. Ahmad and his representative that Mr. Ahmad incurred no economic benefit as a result of the Tyco reorganization. However, according to the Act, he did receive dividends in kind from Tyco and the dividends had a value.

Revenue and Customs Commissioners v. First Nationwide, [2012] BTC 99, [2012] EWCA Civ 278

The taxpayer, in cooperation with two banks, a Cayman Islands corporation and its parent, implemented the following series of transactions:

The subscription proceeds for preference shares of a Caymans company ("Blueborder") were substantially in excess of the nominal or par value of the shares, with the excess being credited to its share premium account (transaction 6). The deductibility of a manufactured dividend paid by the UK taxpayer (transaction 8) turned on whether a dividend paid to the taxpayer out of Blueborder's share premium account (transaction 7) was an income or capital payment. Before finding that it was an income payment because it was a dividend under Caymans law (i.e., a distribution of profits from the issuance of shares for more than their par value - see para. 15), Moses L.J. stated (at para. 10):

The jurisprudence is well-established. Payments made by a company in respect of shares are either income payments, or, if the company is not in liquidation, by way of an authorised reduction of capital. The courts have recognised no more than that dichotomy. The distinction has depended upon the mechanics of distribution. If the payments are made by deploying the mechanisms appropriate for reduction of capital, then they are payments of capital. Such mechanisms can be readily identified as designed to protect the capital of a company. If the payments are not made by such mechanisms but are made by way of dividend, they are income payments.

The fact that the payment of the dividend out of the share premium account reduced the capital that would have been distributable on a winding-up of Blueborder was not relevant as "it is the form by which the payments are made which determines their character" (para. 25).

Marshall v. The Queen, 2011 DTC 1353 [at 1976], 2011 TCC 497

The taxpayer was a shareholder of a Bermudian corporation ("Tyco"), and received shares as part of the same spin-off described in Capancini, where it was concluded Tyco had never owned the shares received by the taxpayer and therefore that they were not dividends in the hands of the taxpayer under s. 12(1)(k) and s. 90(1). However, Capancini had been heard under informal procedure. In the present case the Minister introduced evidence establishing that the two spin-off corporations were incorporated in Bermuda in 2000 as wholly-owned subsidiaries of Tyco. Therefore, the conclusions in Capancini could not be relied on and V.A. Miller found that the shares of the two spin-off corporations were dividends in kind.

Capancini v. The Queen, 2010 DTC 1394 [at 4569], 2010 TCC 581

Under a reorganization, the Canadian-resident taxpayer received, in exchange for shares he previously held of Tyco International Ltd. (a non-resident corporation), one share of each of two new corporations and one new share of Tyco International Ltd. The Minister assessed on the basis that the receipt of the shares of the two new corporations represented a dividend to the taxpayer. In finding that the taxpayer had not received a dividend, Bowie, J. noted that the shares of the two new corporations were never owned by Tyco International Ltd. and, instead, were created in the course of a reorganization, and that the distribution of the new shares did not represent a "dividend" in the ordinary meaning of the word, namely, a distribution of a pro rata portion of a company's earnings or profits.

Morasse v. The Queen, 2004 DTC 2435, 2004 TCC 239

The taxpayer, who held American Depositary Receipts for a Mexican public company (Telmex) became the owner of an equal number of shares of another Mexican company (America Movil) pursuant to a spin-off transaction implemented by Telmex. The spin-off was implemented using a Mexican corporate law procedure called "escisión" or "split-up" under which an existing company is divided, creating a new company to which specified assets and liabilities are allocated.

In finding that the distribution received by the taxpayer was not taxable to her as a dividend or otherwise as income, Miller J. indicated (at p. 2440) that: "what occurred is more akin to a stock split than a stock dividend" and stated (at p. 2439):

"As part of the reorganization, Telmex arranged that its shareholders receive the America Movil shares, not as part of any distribution of profits, but as recognition of a shift of capital from Telmex to America Movil."

Cangro Resources Ltd. v. MNR, 67 DTC 582 (TAB)

A payment received by the taxpayer that was stated to be made out of "paid-in capital and paid-in surplus" pursuant to the provisions of the Wisconsin Business Corporations Act was found to be a dividend for purposes of the Act. Mr. Davis stated (at p. 585) that:

As the funds distributed by Marine Capital Corporation admittedly represented nothing more than premiums paid into the treasury on the purchase of shares at prices in excess of their par value of $1 per share, the share capital was neither disturbed nor impaired by the distribution of these funds.

And (at p. 586) that:

There is no question but that the appellant received its proportionate share of the fund, it having been distributed on the basis of the number of shares of Marine Capital Corporation held by each shareholder. ...[T]herefore...the payment...was a dividend received by the appellant... . The accepted ordinary meaning is to be given to the word as it is used in the Income Tax Act. The Shorter Oxford Dictionary states that the word 'dividend' is derived from the Latin word dividendum and defines it as 'a sum of money to be divided among a number of persons; a portion or share of anything divided, especially the share that falls to each distributee'."

Robwaral Ltd. v. MNR, 60 DTC 1025, [1960] CTC 16 (Ex Ct), briefly aff'd 64 DTC 5266 (SCC)

A private Ontario company declared a dividend on December 21, 1953 payable to common shareholders of record on December 31, 1953, and then drew the cheque for the dividend on January 22, 1954. The dividend was not "received" until 1954. "When the section says 'received', I do not believe that it means 'receivable'. I would say that a right to a dividend in an amount of money is not income until received."

Administrative Policy

25 August 2014 T.I. 2014-0528361E5 - premium on redemption of foreign affiliate shares

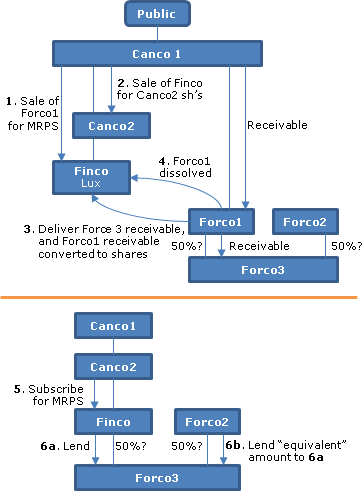

After noting that in 2012-0439741I7 "we indicate that upon redemption of MRPS [mandatory redeemable preference shares], the redemption premium would be characterized as a dividend," CRA stated:

This statement does not reflect the views of the CRA. In the absence of an election under subsection 93(1) of the Act, redemption proceeds are treated as proceeds of disposition. Accordingly, Rulings document 2012-0439741I7 will be removed from our database.

30 April 2013 Memorandum 2012-0439741I7 -

withdrawn by CRA on 25 August 2014

Mandatory Redeemable Preferred Shares ("MRPS"): are voting; have a mandatory redemption date approximately 10 years from the allotment date, with the redemption proceeds (equal to the issue price, plus the Premium accrued to the redemption payment date) to be paid in cash on the mandatory redemption date; and have a Premium equal to the per share equivalent of (a) a fixed premium of 7.1% per annum of the issue price, compounded quarterly, plus (b) a variable premium of 5.5% of the aggregate net profit after tax less, minus any amount paid by way of dividend. The TSO position was that the MRPS were debt, consistent with their accounting treatment and their treatment for tax purposes "in other jurisdictions."

In indicating that the MRPS would be considered equity, CRA stated that "generally speaking, we will respect the form of the investment regardless of how it is accounted for or how it is treated for tax purposes in other jurisdictions," and that "payments of interest or dividends will derive their income tax consequences from the legal nature of the payment." Respecting the redemption Premium, "as it is paid on a share investment, we consider it to be a dividend."

12 July 2011 T.I. 2010-0391621E5

Capital gains distributions made to Canadian-resident shareholders by U.S. non-diversified closed-ended management investment companies, comprised of "long-term capital gains" and "short-term capital gains," were dividends rather than capital gains for Canadian purposes.

21 October 2004 Memorandum 2004-006013

The distribution of amounts out of a share premium account of a foreign corporation that could have been declared and paid as a dividend under the foreign corporate law, but was not, should be characterized as a distribution of paid-in capital and not as a dividend.

31 August 1999 APFF Roundtable Q. 3, 5-992092

Publico, a Canadian public corporation, invested $1 million in its wholly-owned US affiliate which is an LLC under the American corporate law. What is the fiscal treatment of a repatriation of the initial subscription? The Department stated (TaxInterpretations translation):

In a given situation, whether an amount is paid as a reimbursement of an initial subscription in a LLC is a question of fact. However, in a case where an amount paid to Publico by the LLC could be considered a reimbursement of its initial subscription under its relevant constituting documents, the amount paid would be considered a reduction in the paid-up capital rather than a dividend for purposes of the Act.

28 October 1997 T.I. 971196 [distribution treatment turns on US corporate law]

Whether a capital distribution made to a Canadian shareholder of a U.S. corporation would be a dividend or a return of capital for Canadian tax purposes would be a question of U.S. corporate law.

Income Tax Technical News, No. 11, September 30, 1997, "U.S. Spin-Offs (Divestitures) - Dividends in Kind"

8 January 1996 T.I. 942802 [all distributions from Delaware corps are dividends]

It is the Department's view that a dividend can include any distribution of property by a corporation to its shareholders that is not a return of the paid-up capital of a corporation." Because under the Delaware corporate law, "it is not possible for a corporation to make any asset distribution by reducing its capital" and "cash distributions must be made from the surplus account and constitute dividends" under such law, such a distribution from a Delaware corporation's surplus account will be a dividend for purposes of s. 90(1) of the Act.

7 June 1994 T.I. 9415515 [capital distribution by Delaware corp]

FA1, a Delaware corporation, wishes to make a cash distribution to Canco by reducing its capital. However, as under Delaware corporate law a cash distribution can only be made from a "surplus" account, FA1 must first transfer the amount from its capital account to its surplus account. CRA stated:

[T]hese payments are not distributions of corporate profits. This does not appear to have any bearing on the matter as such distributions are still regarded as dividends in Delaware. … [A] distribution as described above would be regarded as a dividend and not as a return of capital, regardless of whether the initial contribution was made to capital or to surplus, and… this tax result is attributable to the fact that Delaware corporate law does not permit any return of capital except from a surplus account.

24 March 1994 T.I. 940285

Dividends received from a non-resident corporation, including a mutual fund, are generally included in income as dividend income for the Canadian resident (subject to the provisions of s. 95(1) for dividends received from a foreign affiliate) irrespective of the source of such distribution (as business income, property income or capital gains).

Subsection 90(2) - Dividend from foreign affiliate

Administrative Policy

2015 Ruling 2014-0527961R3 - Deemed dividend under subsection 90(2)

underline;">: €/US$ share structure. The constating documents of FA (which is a wholly-owned subsidiary of Canco that was incorporated and is resident in Country X, and whose functional currency is the U.S. dollar) state that "the capital of the Company is €XX and US$XX divided into XX shares of €XX each and XX shares of US$XX each," and that "[all] dividends shall be declared and paid according to the amounts paid or credited as paid on the shares in respect whereof the dividend is paid" and "[all] dividends shall be apportioned and paid proportionately to the amounts paid or credited as paid on the shares. FA issued US$ denominated shares and maintains the corresponding US$ capital account in order to match the currency of its investments and its functional currency.

Proposed Transactions

FA will declare and pay an amount that constitutes a dividend as a matter of FA's governing corporate law on all of its issued and outstanding shares (the "FA dividend"), based on the amount paid or credited as paid on the respective shares. Given the current relative currency values, the paid in capital of the € shares on a per share basis is greater than the paid in capital of the US$ shares and, as a result, the € shares will be entitled on a per share basis to a larger proportion of the dividend. Country X corporate law counsel opined that it considers that the two groups of shares of FA form two separate classes of shares under Country X's corporate law.

Rulings

The share capital of FA will be considered to consist of two classes of shares. The distribution on FA shares will be considered to be in respect of two classes of shares of FA and will be deemed to be a dividend paid by FA and received by Canco pursuant to ss. 90(2) and (5) for the purposes of ss. 15(1), 90 and 113.

17 June 2014 T.I. 2013-0506731E5 - Immigration

An individual shareholder immigrates to Canada, thereby becoming a Canadian resident, and then receives $1,000 from a wholly-owned non-resident corporation ("NRCo") in satisfaction of a $1,000 dividend declared before her immigration. Scenario 2 is the same except NRCo issues a $1,000 promissory note to her in satisfaction of the dividend declared before the immigration (with the note being paid after the immigration).

In Scenario 1, the dividend received by her after immigration would be a dividend to her at common law and under s. 90(2) only at that time. Since in Scenario 2, the dividend would be considered received at the time when the shareholder was still a non-resident of Canada on the presumption (applying Banner Pharmacaps) that the note was issued and delivered to the shareholder in satisfaction of the obligation to pay the dividend, ss. 114 and s 90(1) would not apply to include such dividend in her income after immigration.

CRA would be prepared to consider the application of GAAR respecting any avoidance under Scenario 2 in the context of a ruling request.

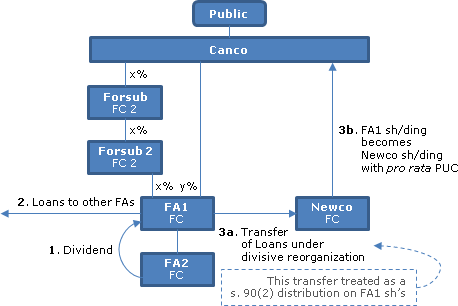

2013 Ruling 2012-0463611R3 - Foreign Divisive Reorganization

Structure

Canco, a Canadian public company, directly owns a portion of the shares of FA1. FA1 is a controlled foreign affiliate of Canco resident in "Foreign Country" and holding X% of the shares of FA2, which also is a CFA of Canco and resident in Foreign Country. The balance of the shares of FA1 are owned by Forsub2 (resident in Foreign Country2), which is a subsidiary of Forsub (also resident in Foreign Country2) which, in turn, has X% of its voting shares owned by Canco.

Proposed transactions

In order to establish Newco as a "Finco" for the group:

1) FA2 will pay a dividend of FC$X to FA1, with FA1 lending such amount under the "FA Loans" to other foreign affiliates of Canco (with interest income thereon to be included in FA1's exempt surplus).

2) FA1 will undergo a divisive reorganization (the "Division") for the division of FA1 into two legal entities (FA1 and Newco) under which:

a) Newco will be formed as limited liability corporation under the laws of Foreign Country;

b) Under the deed of formation of Newco, the shares of FA2 (and other property) and liabilities of FA1 will be retained by FA1, while the FA Loans will be assigned by FA1; the legal paid-up capital of the FA1 shares will be reduced, and that of the Newco shares will be increased, on a proportionate basis; and

c) By operation of the corporate laws of the Foreign Country, Canco and Forsub2's approval of the Division will result in Canco and Forsub2 becoming the shareholders of Newco and FA1, respectively (and with liability limited to their respective capital contributions);.

Opinions

In addition to rulings on current law (including the reduction under s. 53(2)(b)(ii) of the ACB of the shares of FA1 held by Canco and Forsub2), the following opinions were provided:

- the assignment of the FA Loans by FA1 will be a pro rata distribution in respect of the shares of FA1 and the amount of the FMV of the FA Loans will be deemed to be a dividend pursuant to proposed s. 90(2);

- the Division will not result in a reduction to the ACB of the shares of FA1, held by each of Canco and Forsub2, under proposed s. 53(2)(b); and

- the Division will not result in a shareholder benefit under proposed s. 15(1.4)(e) by virtue of the exception in that provision for dividends.

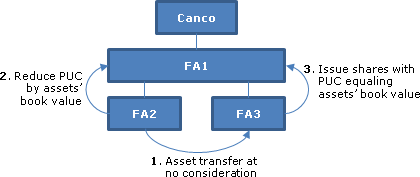

23 May 2013 IFA Round Table, Q. 2

Canco owns 100% of the shares of FA1 and FA1 owns 100% of the shares of FA2. FA3 is either formed with nominal assets by FA1 or comes into existence as part of the legal division of FA2 into two legal entities pursuant to the corporate laws of the foreign country where FA2 and FA3 are resident. As a result of the reorganization, FA2 transfers some of its assets for no consideration to FA3 and FA3 issues shares to the shareholders of FA2 pro rata based on the number of shares they hold in FA2. As FA1 is FA2's sole shareholder, FA1 becomes the sole shareholder of FA3. The legal paid up capital of the shares of FA2 is reduced by the book value of the transferred assets, and the legal paid up capital of the shares of FA3 is equal to such book value.

CRA agreed that there is a pro rata distribution for purposes of draft s. 90(2) in this situation so that the exception under s. 15(1)(b) for dividends would apply. CRA further indicated that it would come to the same conclusion if a Canadian corporation were the holding company rather than a non-resident company (FA1).

Articles

Michael Gemmiti, "FA Dividends Must be Pro Rata", Vol. 3, No. 3, August 2013, p. 7

The new pro rata rule can present problems. For example, a US LLC (which qualifies as an FA of a taxpayer) may have only one class of units but maintain a separate "capital account" for unitholders. Distributions from the US LLC to its unitholders may be made in relation to that particular unitholder's capital account and not in relation to its units. Accordingly, distributions to unitholders on the units in this manner cannot be made on a pro rata basis, will not be considered to be dividends for Canadian tax purposes, and will not receive the section 113 deduction.

Patrick W. Marley, Kim Brown, "Foreign Mergers and 'Demergers' Under Recent Canadian Proposals", Tax Management International Journal, 10 February 2012, Vol 41, No. 2, p. 86

A demerger, which under the foreign corporate law, might be viewed as one stream splitting into two, might not qualify under draft s. 90(2) as a pro rata distribution on a class of shares of the foreign affiliate, with the result that s. 15(1) could apply.

Geoffrey S. Turner, "Upending the Surplus Ordering Rules: Implications of the New Regulation 5901(2)(b) Election", CCH Tax Topics, No. 2079, p. 1, 12 January 2012

Elaine Buzzell, "Distributions of Share Premium by Foreign Affiliates", Corporate Finance, Vol. XVII, No. 2, 2011, p. 1962

Includes discussion of the treatment under the previous version of s. 90 of payments out of a share premium account as a dividend or shareholder benefit.

Subsection 90(3) - Qualifying return of capital

Administrative Policy

20 March 2015 T.I. 2014-0535971E5 - Meaning of "paid-up capital" in subsection 90(3)

How is the paid-up capital of a US LLC computed for purposes of s. 90(3)? Would the paid-up capital be computed differently if the US LLC were previously not a foreign affiliate?

After stating that the paid-up capital of the US LLC in respect of its shares (as determined under s. 93.2(2)) is to be computed pursuant to the definition of "paid-up capital" in subsection 89(1), and noting that IT-463R2, para. 2 states "that paid-up capital is ‘based on the relevant corporate law rather than tax law. The amount calculated under corporate law is usually referred to as the ‘stated capital'...," CRA stated:

[T]he relevant jurisdiction's laws under which the US LLC was created and the US LLC's constating documents would be the starting point for determining the paid-up capital of the US LLC… .

To the extent [such] laws and constating documents do not provide for stated capital akin to that which is provided for under Canadian domestic corporate law but, rather, provide for an attribute that is akin to a partner's capital account, the US LLC would not…have stated capital for the purposes of subsection 89(1). As such, it would not have paid-up capital for the purposes of subsection 90(3) or paragraph 53(2)(b).

As the paid-up capital of the US LLC is computed pursuant to s. 89(1), regardless of whether it is a foreign affiliate of the unit holder, it does not matter for PUC purposes when it became a foreign affiliate.

6 December 2011 TEI Roundtable Q. 5, 2011-0427001C6

Under what circumstances will CRA apply subsection 15(1) to distributions of share premium? CRA stated:

[T]he proper approach for determining the character of a distribution from a foreign corporation to a shareholder for Canadian tax purposes is the same two-step approach that is used for the classification of foreign entities for Canadian tax purposes as set out in ITTN #38. That is, the first step is to determine the characteristics of the distribution under foreign corporate law (not tax law), and then compare these characteristics with those of recognized categories of distributions under Canadian common law and corporate law in order to classify the distribution under one of those categories. … [A]s a practical matter…[w]here the distribution is a dividend or a return of legal capital under the foreign corporate law, that characterization will generally not be challenged by the CRA.

2004 Ruling 2004-0065921R3

Conversions of corporations incorporated under the laws of Delaware and California into limited liability corporations would not result in dispositions at the shareholder or the entity level, given that the conversions would be similar to corporate continuances in Canada. Although no rulings were given on the paid-up capital of the LLCs, the description of the "Shares" of the Delaware LLC ("LLC2") to be contained in the LLC Agreement - and similarly for California - stated:

"Capital" of Shares is the aggregate of all amounts paid to LLC 2 and the monetary value at the time of contribution of property contributed to LLC 2 (in each case including amounts paid or contributed prior to USco 2's conversion to LLC 2) in consideration for the issuance of Shares together with any amounts added thereto by the Board of Managers or the Stockholders in accordance with the provisions of the LLC 2 Agreement, less the aggregate of all amounts by which such capital has been reduced by the Stockholders or the Board of Managers in accordance with the LLC 2 Agreement.

1998 Ruling 2002-0135307 F

USco1, a subsidiary of Canco (held directly and through a Canadian subsidiary), will declare and make a distribution which will qualify as a dividend under the local (likely Delaware - see 2002-0135307 F) corporate law. The dividend will be paid out of USco1's "surplus" account as defined under such corporate law. Ruling that the distribution is a dividend and s. 15(1) will not apply.

Summary states that the corporate law "provides for the issuance of par value shares. It is our understanding that paid-in capital can only be returned as a dividend payment from the corporate surplus account."

8 January 1996 T.I. 942802 [all distributions from Delaware corps are dividends]

It is the Department's view that a dividend can include any distribution of property by a corporation to its shareholders that is not a return of the paid-up capital of a corporation." Because under the Delaware corporate law, "it is not possible for a corporation to make any asset distribution by reducing its capital" and "cash distributions must be made from the surplus account and constitute dividends" under such law, such a distribution from a Delaware corporation's surplus account will be a dividend for purposes of s. 90(1) of the Act.

7 June 1994 T.I. 9415515 [capital distribution by Delaware corp]

FA1, a Delaware corporation, wishes to make a cash distribution to Canco by reducing its capital. However, as under Delaware corporate law a cash distribution can only be made from a "surplus" account, FA1 must first transfer the amount from its capital account to its surplus account. CRA stated:

[T]hese payments are not distributions of corporate profits. This does not appear to have any bearing on the matter as such distributions are still regarded as dividends in Delaware. … [A] distribution as described above would be regarded as a dividend and not as a return of capital, regardless of whether the initial contribution was made to capital or to surplus, and… this tax result is attributable to the fact that Delaware corporate law does not permit any return of capital except from a surplus account.

Subsection 90(4) - Connected person or partnership

Articles

David Bunn, Sandra Slaats, "A Critique of Proposed Subsections 90(4) to (10)", International Tax Planning, Vol XVII, no. 1, 2011

Technical deficiencies discussed include that there is a double income inclusion where a a foreign subsidiary of a partnership makes a loan the the Canco limited partner of the partnership; multiple income inclusions can arise where a loan from a foreign affiliate to a specified debtor is assigned to another specified debtor or transferred to another foreign affiliate (because the indebtedness has not been repaid) - or if the loan is assigned to a Canadian corporation there can be a double inclusion under ss. 90(4) and 15(2); the rule continues to apply even if the creditor cease to be a foreign affiliate of the taxpayer; and the money-lending business exception in s. 90(5) does not apply where the foreign affiliate acquires existing receivables, e.g., in a factoring operation.

Drew Morier, "Canadian Proposals Mark a Decade of Changes to the Foreign Affiliate Rules", Journal of International Taxation, January 2012, p.26

Discusses application of rule where cash is not redeployed within a Canadian controlled group.

Jason D. Durkin, "Upstream Loan Rules - Why Now?", CCH Tax Topics, No. 2073, 1 December 2011, p. 1

Includes references to technical deficiencies.

Sandra Slats, David Burns, "Canada Considers New Rules on Repatriation", Tax Notes International, Vol 63, No. 9, 29 August 2011, p. 641

General discussion.

Subsection 90(6) - Loan from foreign affiliate

Administrative Policy

30 October 2014 T.I. 2013-0488881E5 - Upstream Loan

As a result of a wind-up of a 2nd tier FA following a s. 90(6) loan to Canco, there technically would be a double income inclusion to Canco under ss. 90(6) and (12). By virtue of s. 248(28)(a), only one of the two amounts would be included in Canco's income.

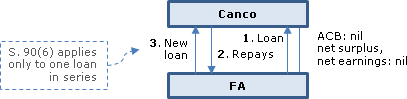

Where FA lent to Canco, the loan was repaid (with no s. 90(14) deduction available because this occurred as part of a series) and the money was readvanced to Canco (technically giving rise to a 2nd s. 90(6) inclusion), CRA's policy is that s. 90(6) will not be applied to the 2nd loan. See detailed summaries of Scenarios 6 and 7 under s. 90(9).

14 November 2013 T.I. 2013-0499121E5 - upstream loan

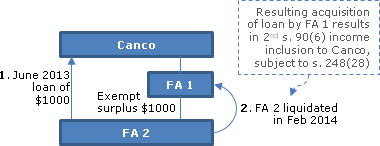

Canco wholly owns FA 1 which wholly-owns FA 2. Each has a calendar taxation year. On December 31, 2012, FA 2 has US$1,000 of exempt and net surplus, and FA 1 has nil net surplus. After lending the "FA2 Loan" (of US$1,000) to Canco on June 15, 2013, FA 2 liquidates into FA 1 in February 2014, so that the FA 1 now holds the FA2 Loan (renamed the "FA1 Loan") and its exempt surplus increases to US$1,000.

For its 2013 year, the Loan amount of US$1,000 is included in Canco's income under s. 90(6) and it deducts US$1,000 under s. 90(9) respecting FA 1's exempt surplus.

CRA stated:

[A]s a result of the liquidation of FA2 into FA1, Canco "becomes indebted to" FA1… . Therefore, subsection 90(6) will apply to include a "specified amount" in Canco's income in its taxation year ending on December 31, 2014 in respect of the FA1 Loan… .

…[B]y virtue of the restrictions in paragraph 90(9)(b)…[the] US$1000 exempt surplus balance can be used by Canco to claim a deduction under subsection 90(9) only in respect of either the FA1 Loan or the FA2 Loan.

...[S]ubsection 90(6) provides for duplicate inclusions in Canco's income in respect of what is essentially the same loan. … Therefore…paragraph 248(28)(a)… applies to remedy the situation and avoid double taxation of the same amount. The amount to be included in Canco's income in its taxation year ending on December 31, 2014, would be either the amount under subsection 90(6) in respect of the FA1 Loan or the amount under 90(12) of the Act in respect of the FA2 Loan, but by virtue of paragraph 248(28)(a) of the Act not both. In either case, a full deduction would be available under subsection 90(9)… .

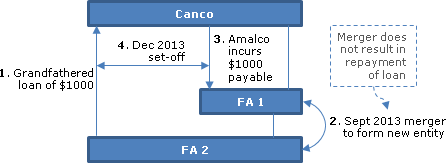

Under a second scenario in the same Canco/FA 1/FA 2 structure described above, FA 1 lent the FA1 Loan to Canco before August 19, 2011 and then merged with FA 2 on September 1, 2013 to form Amalco, which was not a continuation of either FA 1 or FA 2. On October 3, 2013, Amalco incurred a US$1,000 payable owing to Canco (the "Canco Payable"), and this was set-off against what now was labelled as the "Amalco Loan" on December 31, 2013.

CRA stated:

[A]ll pre-August 19, 2011 loans and indebtedness are entitled to a five year repayment window, such that they are not subject to the provisions of subsection 90(6), if they are repaid before August 20, 2016. However, all post August 19, 2011 loans and indebtedness must be repaid within two years of the day the loan was made or the indebtedness incurred… .

[T]he legal set-off will constitute repayment of the Amalco Loan for purposes of paragraph 90(8)(a) of the Act.

There is no provision in the Act that provides…the FA1 Loan was repaid or settled. …[However], it is reasonable to consider that…both the FA1 Loan and the Amalco Loan are repaid on December 31, 2013. Since the FA1 Loan is repaid before the August 19, 2014 deadline set out in the coming into force provisions of the Explanatory Notes, it is not deemed to be a separate loan received by Canco on August 20, 2014. Accordingly, subsection 90(6) of the Act does not apply to require Canco to include an amount in respect of the FA1 Loan in its income… . in any taxation year. Similarly… the Amalco Loan is fully repaid within two years… .

22 May 2014 May IFA Roundtable Q. , 2014-0526731C6

When is the interest on a loan made by a creditor affiliate to a specified debtor treated as indebtedness for purposes of s. 90(6), for example, a loan where the interest is payable together with principal on maturity of the loan after three years? CRA stated:

[W]e would consider subsection 90(6) to apply to the full amount of the principal portion of the loan, as well as to any interest that accrued in year one. Provided the loan and accrued interest are paid in full immediately upon the maturity of the loan, the interest that accrues in years two and three would be excepted from subsection 90(6) by paragraph 90(8)(a). In any event, a deduction under subsection 90(14) would be available when the loan, including accrued interest, is finally repaid.

22 May 2014 IFA Roundtable Q. , 2014-0526751C6

- On September 1, 2011 a foreign affiliate (FA) of a corporation resident in Canada (Canco) made a loan to a "specified debtor" in respect of Canco. If Canco sells the shares of the FA such that FA ceases to be a foreign affiliate of Canco, before September 1, 2013, and the loan is outstanding on September 1, 2013, will Canco be deemed to have an income inclusion pursuant to proposed s. 90(6) on September 1, 2011?

- Alternatively, if prior to August 19, 2011 FA) made a loan to a "specified debtor" in respect of Canco, and Canco sells the shares of the FA before August 19, 2014, will Canco have an income inclusion per s. 90(6) on August 20, 2014, if the loan remains outstanding on August 20, 2016?

- Alternatively, if Canco sells the shares of FA after August 20, 2014 but the loan remains outstanding on August 20, 2016, will s. 90(6) apply?

Response

: Respecting the first case, proposed s. 90(6) provides that the relationships between Canco, FA and the debtor are to be tested at the time the loan is received or the debt incurred (in this case, September 1, 2011) - so that, if the loan is not repaid by September 1, 2013 (even if FA is then no longer a FA of Canco), the exception in proposed s. 90(8)(a) will not be available so that Canco will have an income inclusion on September 1, 2011. In the other case, proposed ss. 90(6) to (15) are to be applied as if the loan was received or indebtedness was incurred on August 20, 2014. If FA is not a FA of Canco at that time (e.g., the FA shares were sold before then), proposed s. 90(6) will not apply to Canco. However, if the sale of the shares of FA takes place on or after August 20, 2014 and the loan remains outstanding on August 20, 2016, since proposed s. 90(6) provides that the relationships between Canco, FA and the debtor are to be tested at the time the loan is received or the debt incurred (in this case, August 20, 2014), it will apply, so that Canco will have an income inclusion on August 20, 2014, notwithstanding that those relationships are no longer in place on August 20, 2016. Note that Canco will get a deduction pursuant to proposed s. 90(14) when the indebtedness is repaid.

22 May 2014 IFA Roundtable Q. , 2014-0526751C6

Will CRA apply IT-119R4 to give administrative relief from interest and penalties relating to the requirement to withhold tax on deemed dividends to non-residents arising from s. 90(6)?

Response

: CRA generally looks to its practices on s. 15(2) to deal with practical issues involving the application of proposed ss. 90(6) to 90(15). However, as proposed s. 90(6) only applies to include a "specified amount" in the income of a taxpayer resident in Canada, consistently with its practice respecting the application of subsection 15(2) to Canadian resident debtors, CRA will not provide administrative relief from interest and penalties in the context of the application of proposed s. 90(6). Instead, it will exercise its right of enforcement.

Articles

"https://www.ctf.ca/ctfweb/EN/Newsletters/Canadian_Tax_Focus/2015/3/150307.aspx", Canadian Tax Focus, Vol. 5, No. 3, August 2015, p.5.

Potential double inclusion for unpaid fee owing by Canco to FA (p.5)

Assume that Canco owns a foreign affiliate (FA). Both Canco and FA have calendar taxation years. On January 1, 2015, FA provides services to Canco in consideration for a fee. Canco accrues an expense in respect of the fee and deducts the amount from its taxable income in 2015. If the expense remains unpaid for years, both subsection 78(1) and subsection 90(6} could potentially apply, subjecting the fee to Canadian tax twice.

Inclusion under s. 90(6) and s. 78(1) (p. 6)

On January 2, 2017, if Canco has not settled its account payable, the upstream loan rules could apply to include the amount of the accrued fee in Canco's 2015 income (unless the indebtedness is considered to have arisen in the ordinary course of the lender's business). In 2018, if no paragraph 78(1)(b) agreement is filed and the payable is still outstanding, Canco may also be required to ad t se back into income under subsection 78(1)….The fee could then be subject to tax under both subsections 90(6) and 78(1), albeit at different times.

Applying presumption against double taxation (p. 6)

It may be possible to prevent such a double inclusion of the fee - for example, pursuant to subsection 248(28). Relief under that provision is permitted "unless a contrary intention is evident." The fact that subsections 78(1) and 90(6) have different objectives (namely, preventing the deductibility of accrued expenses that are not paid within a reasonable time, and preventing tax-free distributions in excess of tax attributes) might be evidence of such a contrary intention… . However… Holder … (2004 FCA 188) seems to stand for the opposite conclusion: the starting point, prima facie, is no double taxation… .

Effect on s. 90(6) of s. 78(1)(b) agreement (p.6)

Another way to avoid the double inclusion is to file a paragraph 78(1)(b) agreement. However, it is not clear whether and how subsection 90(6) will apply to the loan that is then deemed to be made to the taxpayer (Canco) by the creditor (FA) on the first day of the taxpayer's third taxation year.

Paul Barnicke, Melanie Huynh, "Upstream Loans: CRA Update", Canadian Tax Highlights, Vol. 21, No. 12, December 2013, p. 3

Their discussion includes a summary of an as-yet unpublished CRA technical interpretation [2013-0499121E5, now summarized above], which dealt with two scenarios:

FA-to-FA liquidation (p. 3)

Canco wholly owns FA 1 which wholly-owns FA 2. Each has a calendar taxation year. On December 31, 2012, FA 2 has US$1,000 of exempt and net surplus, and FA 1 has nil net surplus. After lending the Loan (of US$1,000) to Canco on June 15, 2013, FA 2 liquidates into FA 1 in February 2014, so that the FA 1 now holds the Loan and its exempt surplus increases to US$1,000.

For its 2013 year, the Loan amount of US$1,000 is included in Canco's income under s. 90(6) and it deducts US$1,000 under s. 90(9) respecting FA 1's exempt surplus. For its 2014 year, the 2013 deduction under s. 90(9) is included in its income under s. 90(12) and it has a further inclusion of US$1,000 respecting the Loan now owing by it to FA 1.

CRA indicated that Canco cannot claim a deduction under s. 90(14) on the liquidation of FA 2 as such liquidation did not result in a repayment of the Loan. Furthermore the US$1,000 of exempt surplus can only be used by Canco once in 2014 to claim a deduction under s. 90(9) notwithstanding that there was a double-inclusion in respect of the of the Loan. However, CRA will apply s. 248(28)(a) to avoid such double inclusion.

Merger following grandfathered loan (pp. 3-4)

Under the same Canco/FA 1/FA 2 structure described above, FA 1 lent US$1,000 to Canco before August 19, 2011 (the Loan) and then merged with FA 2 on September 1, 2013 to form Aamalco, which was not a continuation of either FA 1 or FA 2. On October 3, 2013, Amalco incurred a US$1,000 payable owing to Canco (the Canco payable), and this was set-off against the Loan on December 31, 2013.

CRA indicated that the Loan was not repaid or settled as a result of the merger. As the Loan was repaid on December 31, 2013 by set-off against the Canco payable (so that it was not outstanding on August 19, 2014), s. 90(6) did not apply.

Variations on scenarios (p. 4)

Barnicke and Huynh state:

If the first situation described above does not involve a liquidation, but instead FA 1 and FA 2 merge, and if in the second situation the FA 1 loan is made after August 18, 2011, we expect the CRA to take positions that preclude multiple income inclusions. One hopes that the CRA will broaden its policy to cover a variety of other situations in which an upstream loan or debt either is assigned between creditor FAs or is assumed between Canco debtors when the original Canco debtor is amalgamated or liquidated.

Ken J. Buttenham, "Are you Ready for the Upstream Loan Rules?", Canadian Tax Journal, (2013) 61:3, 747-68

Relationships tested when upstream loan arose (pp. 761-2)

The application of subsection 90(6) and other upstream loan rules is based on the relationships and tax attributes that exist at the time an upstream loan arises, with no reference to, or relief provided for, any subsequent changes in relationships. This becomes an issue if, for example, foreign affiliates of a Canadian taxpayer are disposed of to a foreign parent company during the first two years after an upstream loan arises (and before its repayment), or if a specified debtor ceases to be a specified debtor (in situations where the specified debtor is not the Canadian taxpayer or a non-arms' length Canadian entity) prior to a repayment. [fn 48: The latter situation may be less likely to arise, because upstream loans are likely to be repaid prior to a third-party sale of the specified debtor or the upstream loan may be purchased by the acquirer. The sale of an upstream loan to a third party does not seem to meet the repayment requirement under the upstream loan rules.]

Subsection 90(7) - Back-to-back loans

Paragraph 90(7)(a)

Administrative Policy

John Lorito and Trevor O'Brien, "International Finance – Cash Pooling Arrangements," draft version of paper for CTF 2014 Conference Report.

In the case of notional pooling, loans to and from the third party bank may be subject to the upstream loan rules through the application of the back-to-back loan rule in subsection 90(7)….

Subsection 90(8) - Exceptions to subsection (6)

Paragraph 90(8)(a)

Administrative Policy

24 November 2013 CTF Roundtable Q. , 2013-0508151C6

A loan or indebtedness will be considered to have been repaid by a debtor by way of set-off against a receivable of the debtor "if the set-off represents a legal discharge of the loan or indebtedness." This generally will be accepted to have occurred "if the intention to do so is evidenced in the relevant books and records including any contracts or agreements between the parties and the accounting records of the parties."

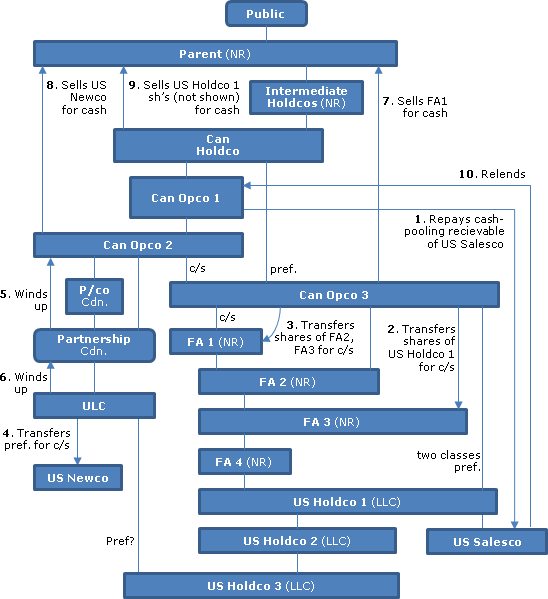

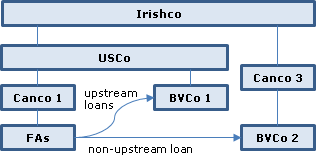

2013 Ruling 2013-0491061R3 - Upstream Loans

Non-resident subsidiaries (perhaps resident in the US) of a non-resident public company ("Parent") hold stacked non-resident companies (FA 1 to 4 in a mystery jurisdiction, which in turn hold stacked US companies, namely, US Holdco 1 to 3) through a structure of stacked Canadian companies (Can Holdco and Can Opco 1 to 3). A US marketing subsidiary of US Holdco 1 ("US Salesco") is owed amounts by Can Opco 3 under a cash-pooling arrangement. Under a largely-unwound "tower" structure, a ULC, held by Can Opco 2 through a resident partnership ("Partnership" - which is a corporation for Code purposes), holds preference shares of US Holdco 3.

In connection with unwinding this "sandwich" structure:

- Can Opco 1 repays the payable owing by it to US Salesco;

- Can Opco 3 transfers its shares of US Holdco 1 under s. 85.1(3) to FA 3 for common shares of FA 3

- Can Opco 3 transfers its shares of FA 2 and FA 3 to FA1 under s. 85.1(3) for common shares of FA 1;

- ULC transfers its pref shares of US Holdco 3 to a new US subsidiary for shares of US Newco (under s. 85.1(3));

- The general partner of Partnership is wound-up so that Partnership, in turn, is wound-up;

- ULC is wound-up into Can Opco 2;

- Can Opco 3, Can Opco 2 and Can Holdco sell their shares of FA 1, US Newco and US Holdco 1 to Parent for cash;

- US Salesco (which now is a "sister" rather than indirect sub of Can Opco 1) relends the amount received by it in 1 to Can Opco 1.

Rulings:

- the exemption in s. 212.3(18)(b)(ii) applies to steps 2 and 3

- respecting the acquisition of the general partner's partnership interest in step 4, the exemption in s. 212.3(18)(c)(i) applies to deemed indirect acquisition by Can Opco 2 of US Newco resulting from the application of s. 212.3(25)(c) to such acquisition by Can Opco 2 of the general partner's interest

- upon the dissolution of Partnership in step 5, such indirect acquisition by Can Opco 2 of the shares of US Newco will be exempted

- the exemption in s. 212.3(18)(a)(i) applies to step 6

- by virtue of its coming into force provisions and s. 90(8)(a), s. 90(6) will not include any amount in respect of the loan by US Salesco in the income of Can Opco 3 (and similarly re "Treasuryco Debts" not described above)

Subsection 90(9) - Corporations: deduction for amounts included under subsection (6) or (12)

Administrative Policy

28 May 2015 IFA Roundtable Q. 4, 2015-0581501C6

underline;">: Part A: LIFO ordering assumption for s. 90(9)(b) purposes, and no impact on s. 113(1)(a) deduction for actual dividends. In 2013 FA, which had exempt surplus ("ES") and net surplus ("NS") of US$100, made a US$100 loan (Loan 1) to Canco (its wholly-owning parent). In 2014 FA paid a dividend (Dividend) of US$50 at a time when it had ES and NS of US$150 (no Reg. 5901(2)(b) election is made). Loan 1 is not repaid within two years and Canco has nil adjusted cost base ("ACB") in the FA shares.

In 2014 Canco will have an income inclusion of C$63, the equivalent of the US$50 dividend. Is Canco able to claim a deduction in each of 2013 and 2014 under s. 90(9)(a)(i)(A) for the Canadian dollar equivalent (C$125) at the "lending time" of Loan 1? Will Canco be entitled to a deduction in computing its 2014 taxable income of C$63 under s. 113(1)(a)?

CRA responded:

…[I]f one were to assume that exempt surplus were reduced on a first-in, first-out basis, it may be possible to argue that the dividend paid in 2014 would "spend" some of the exempt surplus that is relied upon for purposes of the 90(9) deduction such that, in 2014, paragraph 90(9)(b) would be breached.

However…we would consider a last-in, first-out ordering approach to give an appropriate result… .

…Canco would…be entitled to a subsection 90(9) deduction in both 2013 and 2014 in respect of Loan 1. As for the second question, we would note that there is nothing in section 90 that impacts in any way the availability of a deduction under subsection 113(1) in respect of dividends from a foreign affiliate. As such, Canco would be entitled to a deduction of C$63 under that subsection for the dividend received in 2014.

Part B: Subsequent exempt loss not affecting ongoing s. 90(9) deduction, and subsequent Reg

5901(2)(b) election. The same facts as in Part A except that FA's exempt surplus balance went down to US$60 as a result of a loss in 2013 and at the time of the Dividend in 2014 Canco's ACB in the FA shares was equal to C$63 as a result of a share subscription, in 2014 but before the dividend, by Canco for FA shares. Canco elects Reg. 5901(2)(b) so that the 2014 C$63 dividend is deemed to be paid out of pre-acquisition surplus. May Canco claim a deduction in 2013 and 2014 under s. 90(9)(a)(i)(A) of C$125? Can it claim a deduction in computing its 2014 taxable income of C$63 under s. 113(1)(d)? CRA responded:

…[A]bsent tax avoidance activity, a subsection 90(9) deduction of C$125 would be available in both 2013 and 2014, given that the reduction of surplus resulting from a loss is not an event contemplated in either paragraph 90(9)(b) or (c) and that the relevant time at which to measure surplus is the dividend time and not any time in a subsequent year in which a subsection 90(9) deduction is claimed to offset a subsection 90(12) inclusion.

…[T]he conditions for making a paragraph 5901(2)(b) election would be met…given that, again, the provisions of section 90 in no way affect the surplus balances of a foreign affiliate. In other words, the condition in the pre-amble of paragraph 5901(2)(b) that requires that "in the absence of [that] paragraph" subsection 5901(1) would deem an amount to be paid out of exempt, hybrid or taxable surplus would be met. …[A] subsection 113(1) deduction would be available by virtue of paragraph 113(1)(d).

Part C: Subsequent upstream loan utilizing Reg. 5901(2)(b) election

: The same facts as in Part A except that at the lending time in 2013 Canco's ACB in the FA shares was C$63, no new ES is generated after Loan 1 is made and, instead of FA paying the US$50 dividend in 2014, FA made a second loan (Loan 2) to Canco of US$50 (which loan is not repaid within two years) in 2014. May Canco claim a deduction in 2013 and 2014 under s. 90(9)(a)(i)(A) of C$125? Can it claim an additional deduction in 2014 of C$63 under s. 90(9)(a)(i)(D) on the basis that it could have made a Reg. 5901(2)(b) election respecting Loan 2? CRA responded:

[In] 2013-048379…we took the position that a taxpayer would be entitled to rely on clause 90(9)(a)(i)(D) if the taxpayer would have been in a position to make a paragraph 5901(2)(b) election if the notional dividend had been a real dividend.

…Thus, if the taxpayer would have been in a position to make a paragraph 5901(2)(b) election had the notional dividend relating to Loan 2 been a real dividend, it is our view that Canco would, in this example, be entitled to a deduction of C$63 under subsection 90(9) by virtue of clause 90(9)(a)(i)(D). Furthermore, the taxpayer may continue to rely on clause 90(9)(a)(i)(A) in respect of Loan 1.

30 October 2014 T.I. 2013-0488881E5 - Upstream Loan

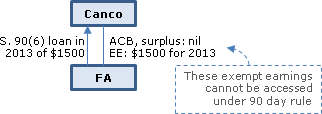

Scenario

1 [90-day rule unavailable]. On December 31, 2012, FA has a nil "net surplus" balance and no relevant deficits. In its 2013 (calendar)taxation year it earns $1500 of "exempt earnings" and on June 30, 2013, it makes a loan of $1500 to Canco (which wholly-owns it). This "Loan" will not be repaid by June 30, 2015. In determining the amount deductible by Canco pursuant to s. 90(9), does the "90-day" rule in Reg. 5901(2)(a) apply to the s. 90(9)(a) notional dividend so that Canco can deduct $1,500 for 2013? In responding negatively, CRA stated:

Although Canco would have been in a position to have paragraph 5901(2)(a)… apply to deem an actual dividend to be paid out of FA's current year exempt surplus… it would be contrary to the words "exempt surplus at the lending time in respect of the corporation" in clause 90(9)(a)(i)(A) to consider the application of paragraph 5901(2)(a)… in determining the amount deductible under subsection 90(9).

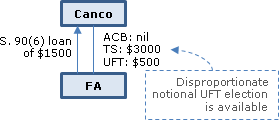

Scenario 2

[notional UFT disproportionate election]. The facts are similar except that on 31 December 31 2012, FA has taxable surplus ("TS") and underlying foreign tax ("UFT") balances of $3000 and $500, respectively. In determining the amount deductible by Canco under s. 90(9), can Canco be considered to have filed a disproportionate election under s. (b) of the UFT definition in Reg. 5907(1) so that Canco can deduct $1500 for 2013? In responding affirmatively, CRA noted that absent a disproportionate election, the notional s. 90(9)(a) dividend would have been characterized as having been paid from FA's TS, thereby allowing Canco a $750 deduction under s. 113(1)(b), and stated:

However…Canco could be considered, hypothetically, to have taken all the necessary steps to make the Disproportionate Election, such that…a $1500 deduction would be available to Canco under subsection 90(9) by virtue of clause 90(9)(a)(i)(C).

Scenario 3

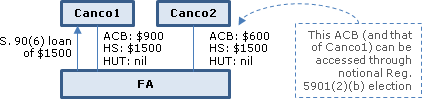

[notional Reg. 5901(2)(b) election]. Canco1 and Canco2, which are related, own 60% and 40% of the shares of FA1 having ACBs of $900 and $600, respectively. FA has hybrid surplus ("HS") and net surplus balances of $1,500 and nil hybrid underlying tax ("HUT") respecting both Cancos. On 30 June 2013 FA lent $1,500 to Canco1, and this loan was not repaid by 30 June 2015. Accordingly, $900 and $600 is included in their respective incomes for their years ending 31 December 2013, based on their respective surplus entitlement percentages. Can Canco1 and Canco2 be treated as having made the election under Reg. 5901(2)(b) so that the notional dividend under s. 90(9)(a) would deemed to be paid from FA's pre-acquisition surplus? CRA stated:

Since…Canco1 and Canco2 have an ACB of $900 and $600, respectively, in the shares of FA, and Canco1 and Canco2 would each have been in a position to jointly make an election under paragraph 5901(2)(b)… to deem an actual dividend paid by FA to be out of FA's pre-acquisition surplus, …[therefore] for the purposes of subsection 90(9) Canco 1 and Canco 2 would be in position to demonstrate that $900 and $600 may "reasonably be considered to have been deductible" by them… .

Scenario

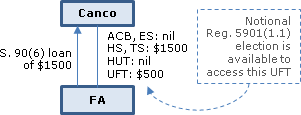

4 [notional Reg. 5901(1.1) election]. Similar facts to Scenario 1, except that FA has HS and HUT balances of $1500 and nil, and TS and UFT balances of $1500 and $500. Can Canco be treated as if it had made the Reg. 5901(1.1) election to have the s. 90(9)(a) notional dividend deemed to be paid from FA's TS? CRA responded:

Since Canco would have been in a position to make an election under subsection 5901(1.1)… to deem the full amount of an actual $1500 dividend paid by FA to be paid out of FA's TS …[therefore] an amount may "reasonably be considered to have been deductible" in respect of the dividend under paragraph 113(1)(b)…[so that] Canco would be in a position to deduct $1500 from its income pursuant to clause 90(9)(a)(i)(C).

Scenario

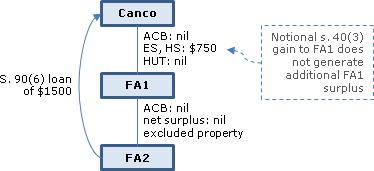

5 [notional s. 40(3) gain does not generate surplus]. Canco owns nil ACB shares of FA1, which had HS and ES balances of $750 each, and nil HUT and ES. FA1 held all the shares of FA2 which had nil ACB and were excluded property. FA2 had nil net surplus. On 30 June 2013 FA1 lent $1,500 to Canco, and this loan was not repaid by 30 June 2015. An actual $1500 dividend paid by FA2 to FA1 would have given rise to a s. 40(3) capital gain to FA1. Would a notional $1,500 s. 90(9) dividend from FA2 to FA1 increase the HS of FA1 for purposes of computing the s. 90(9) deduction to Canco? CRA responded:

[O]nly the actual ES, HS, HUT, TS, UFT and ACB amounts at the lending time..[are] relevant in the determination of the deduction …under [s. 90(9)]. Therefore…. the deemed gain to FA1 that would arise…if, as contemplated by paragraph 90(9)(a), FA2 were to pay a $1500 dividend to FA1 (and FA1 were to pay a $1500 dividend to Canco) would not be included when computing the HS balance of FA1 and the deduction available to Canco under subsection 90(9) in the above scenario.

Scenario

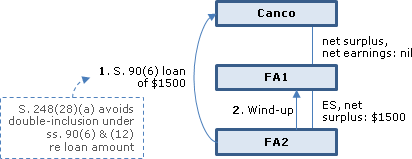

6 [no double inclusion following FA creditor wind-up]. Canco owns all the shares of FA1, which had nil net surplus and net earnings. FA1 held FA2, which had ES and net surplus of $1,500, and nil net earnings. On 20 June 2013 FA2 made the $1,500 "FA2 Loan" to Canco for 10 years – but FA2 was wound-up into FA1 on 20 February 2014. As a result of the liquidation, Canco becomes indebted to FA1 ("FA1 Loan"), resulting in a s. 90(6) income inclusion for 2014. Furthermore, as Canco deducted $1,500 under s. 90(9) in computing its 2013 income to offset the 90(6) income inclusion in respect of the FA2 Loan, that amount will fall into its 2014 income pursuant to s. 90(12). Is any relief available respecting this double income inclusion? CRA responded:

[B]y virtue of paragraph 248(28)(a), either the amount determined under subsection 90(6) in respect of the FA1 Loan or the amount determined under subsection 90(12) in respect of the FA2 Loan, not both, is required to be included in the income of Canco for its taxation year ending on December 31, 2014.

Scenario 7

[no s. 90(6) inclusion for 2nd loan in series]. Canco owns nil ACB shares of FA, which had no relevant surplus or net earnings amounts. On 20 June 2013 FA made a loan of $1,500 to Canco with a term of one year, and this loan was repaid and readvanced on 6 February 2014. $1,500 would be included in Canco's income for 2013 under s. 90(6), with no deduction under s. 90(9), and with no s. 90(14) deduction on repayment because the repayment would be considered to be part of a series of loans or other transactions and repayments. Would the amount of the new loan also be included in its income under s. 90(6)? CRA responded:

[W]here subsection 90(6) has applied to a loan or indebtedness that is a part of a series of loans or other transactions and repayments, it will not apply again to the same amount of another loan or indebtedness in that series. Therefore…subsection 90(6) would not apply to include the amount of the New Loan in Canco's income.

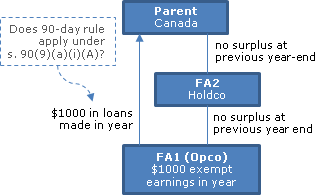

22 May 2014 May IFA Roundtable Q. 3, 2014-0526721C6

An indirectly-owned foreign affiliate ("FA1") generates substantial exempt surplus during a taxation year and uses the resulting cash flow to make upstream loans to (Canadian) "Parent." Neither FA1 nor any other intervening FA has a surplus account balance at its last taxation year end. Does the 90-day rule in Reg. 5901(2)(a) apply in calculating exempt surplus for purposes of s. 90(9)(a)(i)(A)? CRA stated:

The exempt earnings of a foreign affiliate of a corporation are computed on an annual basis and are added to the affiliate's exempt surplus in respect of the corporation only at the conclusion of each of the affiliate's respective taxation years. As a result, we would not consider exempt earnings of a foreign affiliate in respect of a corporation arising in the taxation year of the affiliate in which a particular loan is made to…the corporation, to form part of the exempt surplus, at the lending time, of the foreign affiliate… .

[W]ere paragraph 5901(2)(a) applicable to a real series of dividends paid up the chain of affiliates at that time such that a deduction would be available to Parent under paragraph 113(1)(a) in respect of the real dividend received by it, we would not consider that deduction to be in respect of the exempt surplus of any foreign affiliate of Parent at the lending time.

22 May 2013 IFA Roundtable Q. , 2013-0483791C6

Assume that Canco owns all the shares of FA. FA has $100 of taxable surplus ("TS"), no exempt surplus and no underlying foreign tax (UFT) balances. The TS is attributable to foreign accrual property income ("FAPI") of FA and has been fully included in the income of Canco and the ACB of FA's shares. Assume that FA makes a $100 loan to Canco and the "specified amount" in respect of the loan is included in Canco's income pursuant to proposed s. 90(6). Will a reserve be available to Canco pursuant to the provisions of proposed s. 90(9)?

Response

: In this scenario, no amount is included in the reserve under proposed s. 90(9)(a)(ii) in respect of previously taxed FAPI, because the specified debtor is Canco (which is not a person described in proposed s. 90(9)(a)(i)(D)(I) or (II)). Furthermore, no deduction could be made under s. 90(9)(a)(i)(C) because FA has no UFT, and no deduction could be made under s. 90(9)(a)(i)(D) because no portion of the notional dividend was out of FA's pre-acquisition surplus. However, the ACB of Canco's shares of FA is increased as a result of the inclusion in respect of the FAPI of FA; and the suppression election in proposed Reg. 5901(2)(b) allows a taxpayer to have the whole dividend deemed to be paid out of pre-acquisition surplus. Since Canco would have been in a position to make the suppression election to deem the dividend to be paid out of pre-acquisition surplus, it is CRA's view that:

for the purposes of proposed subsection 90(9) an amount may "reasonably be considered to have been deductible" in respect of the dividend under paragraph 113(1)(d). Therefore an amount would be included in the subsection 90(9) reserve under proposed clause 90(9)(a)(i)(D).

Articles

Ian Bradley, Marianne Thompson, Ken J. Buttenham, "Recommended Amendments to the Upstream Loan Rules", Canadian Tax Journal, (2015) 63:1, 245-67.

Narrowness of s. 90(11) (p. 261)

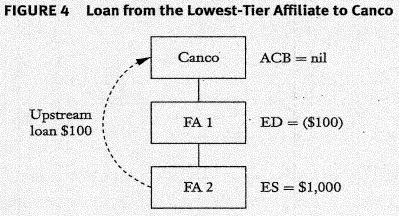

Subsection 90(11) incorporates only the surplus of the downstream foreign affiliates that are directly or indirectly owned by the creditor affiliate. Where the lowest-tier foreign affiliate makes an upstream loan, subsection 90(11) does not apply, and the taxpayer must apply the notional distribution analysis in subsection 90(9) based on the surplus balances of each relevant foreign affiliate in the chain to determine whether, and to what extent., there is a Canadian tax benefit associated with the upstream loan….

Blocking deficit in top-tier FA (pp. 261-3)

[i]n figure 4. A Canadian-resident corporation (Canco) owns all of the shares of a non-resident corporation (FA 1). Canco's ACB in respect of the FA 1 shares is nil. FA 1 has an exempt deficit of $100 in respect of Canco and owns all of the shares of a non-resident corporation (FA 2), which has $1,000 of exempt surplus in respect of Canco. FA 2 makes a $100 loan to Canco, which is not repaid within two years.

If, rather than making an upstream loan, FA 2 paid a dividend of $100, FA 1's exempt deficit would be reduced to nil (computed as the initial exempt deficit of $100 less the $100 exempt surplus dividend from FA 2). If FA 1 then paid a dividendof $100 to Canco, Canco would have an income inclusion equal to $100 pursuant to subsection 90(1) and could claim an offsetting deduction of $100 pursuant to paragraph 113(l)(d) for the portion of the dividend deemed paid out of FA 1's pre-acquisition surplus. There would also be a $100 reduction in the ACB of the FA 1 shares held by Canco. In this case, the ACB of the shares would become negative, and Canco would be deemed to have realized a $100 capital gain from a disposition of the FA 1 shares pursuant to subsection 40(3). However, Canco could then file an election pursuant to subsection 93(1) in the amount of $100 to reduce the subsection 49(3) gain to nil….

[A]t the time that FA 2 makes its upstream loan of $100, FA 1 has a deficit oF$100 and the FA 1 shares have no ACB to Canco. After the notional distribution of FA 2's surplus to FA 1, FA 1's net surplus is still less than the amount of the upstream loan; therefore, the taxpayer must rely on clause 90(9)(a)(i)(D) to claim a full subsection 90(9) deduction. [fn 37: This clause refers to the deduction that would be available under paragraph 113(l)(d) for the portion of the notional distribution paid from preacquisition surplus. Subsection 90(11) does not apply since FA 2 made the loan, rather tiian FA 1. If, instead, FA 2 paid a dividend to FA 1 and FA 1 then made the loan to Canco, subsection 90(11) would apply, resulting in an available reserve of $100.] However, in contrast to the case of an actual dividend payment, the amount of the notional paragraph 113(l)(d) deduction under clause 90(9)(a)(i)(D) is limited to the amount of the ACB of the FA 1 shares to Canco at the time. In thi.q case, there is no ACB and therefore no ability to claim a subsection 90(9) deduction in respect of the upstream loan from FA 2.

This example illustrates that, no matter the quantum of surplus pools in a foreign affiliate group, a "blocking deficit" in a top-tier foreign affiliate may result in an income inclusion under the upstream loan rules, even in situations where a series of dividends could have h&ea-pa&d-iree of Canadian tax….

Multiple application of same blocking deficit (p. 263)

…FA 2 makes three $100 loans to Canco, one on each of day 1, day 2, and day 3, and none of these I loans is repaid within two years. This example (illustrated in figure 5) demonstrates What the problem with blocking deficits described above can be multiplied when applying the reserve mechanism….

[W]hen calculating the amount of any reserve available pursuant to subsection 90(9), each upstream loan must be analyzed as a separate notional distribution at the time that FA 2 advanced the loan. It does not appear to be possible, when applying paragraph 90(9)(a) to a new upstream loan amount, to consider the movement of surplus on prior notional distributions. In the situation depicted in figure 5, this means that FA 1 will continue to have a $100 deficit for the purposes of each notional distribution made by FA2. As a result, Canco will not be able to claim any subsection 90(9) deduction….

Ken J. Buttenham, "Are you Ready for the Upstream Loan Rules?", Canadian Tax Journal, (2013) 61:3, 747-68

Uncertainties under s. 90(9) (p. 763)

The operation of subsection 90(9) raises a host of unanswered questions and is probably what will create the most uncertainty as taxpayers apply the rules. This uncertainty stems from a lack of clarity concerning the relationship between the rules applicable to a notional dividend and the basic distribution rules that apply to actual dividends.

The two sets of rules will often give different results. For example, subsection 90(11) considers the net surplus of the creditor affiliate for the purposes of the notional dividend to include the net surplus of all lower-tier affiliates. That is not the case for actual dividends. On the other hand, a deduction is available under paragraph 113(1)(a.1) in respect of the hybrid surplus component of an actual dividend whether there is any associated hybrid UFT or not. With respect to the notional dividend, a deduction is permitted only if there is sufficient hybrid UFT to result in the hybrid surplus dividend being fully sheltered. [fn 51: See clause 90(9)(a)(i)(B).] Yet another difference relates to the deduction under subsection 91(5) for previously taxed FAPI. This is available in respect of a notional dividend only if the specified debtor is a non-resident. [fn 52: See subparagraph 90(9)(a)(ii). At the 2013 IFA seminar, the CRA was asked to comment on whether a reserve would be available under subsection 90(9) in respect of previously taxed FAPI if Canco were the specified debtor; the CRA said that it may be prepared to develop an administrative position that an election can be made to change the ordering so that the notional dividend is considered to be a distribution coming out of preacquisition surplus.]

There are many other situations that the upstream loan rules do not address. The question for taxpayers in these cases is whether the normal distribution provisions can be relied on or not. The following paragraphs touch briefly on four of the more pressing questions.

Is 90-day rule available under s. 90(9)? (p. 764)

Assume that a foreign affiliate (FA) makes an upstream loan of $1,000 when it has no net surplus. Further assume that the loan was advanced more than 90 days from the beginning of FA's taxation year and that FA earns net exempt earnings of $1,000 in that taxation year. The 90-day rule in regulation 5901(2) will apply to characterize an actual dividend as being paid from FA's exempt surplus, making a full deduction available under paragraph 113(1)(a). However, it is not clear that a similar result arises under subsection 90(9). Clause 90(9)(a)(i)(A) refers to the exempt surplus of the affiliate in respect of the taxpayer at the lending time. [fn 53: Comparable language in respect of hybrid, taxable, and preacquisition surpluses is contained in clauses 90(9)(a)(i)(B), (C) and (D), respectively.] At the lending time, there is no exempt surplus balance, unless the provision is read expansively to incorporate the operation of the 90-day rule.

Are notional dividend elections available under s. 90(9)? (p. 764)

The Act includes a number of elections that provide taxpayers with considerable flexibility in managing the consequences of actual dividends, including the following:

- the election in regulation 5900(2) that deems a dividend to be paid from taxable surplus ahead of exempt surplus;

- the election in regulation 5901(1.1) that deems a dividend to be paid from taxable surplus ahead of hybrid surplus;

- the preacquisition surplus election in regulation 5901(2)(b) that deems a dividend to be paid from preacquisition surplus; and

- the disproportionate election in respect of UFT under paragraph (b) of the definition of "underlying foreign tax applicable" in regulation 5907(1).

The question for taxpayers is whether these elections are available to them as notional elections when assessing the deductions available under subsection 90(9) in respect of notional dividends. Subsection 90(9) does not address this question. However, the October 2012 explanatory notes make it clear that the Department of Finance intended that the disproportionate election be taken into consideration when determining the hypothetical deduction under paragraph 113(1)(b).

Is upstream surplus available to lending affiliate under s. 90(9) and are s. 40(3) gains beneath the taxpayer relevant? (pp. 765-766)

Assume that Canco owns 100 percent of the shares of FA 1, and FA 1 owns 100 percent of the shares of FA 2. FA 2 makes a loan to Canco of $1,000 when FA 1 has a net exempt surplus balance of $750 and FA 2 has nil net surplus. Also assume that the ACB of FA 1 in the shares of FA 2 is nil.

If FA 2 were to pay an actual dividend of $1,000 up the chain to Canco, FA 1 would experience a gain of the same amount pursuant to subsection 40(3). This gain would have surplus consequences for FA 1 that would depend on whether the shares of FA 2 were excluded property or not. Those surplus consequences could also affect the character of future dividends received by Canco.

This example raises two questions:

- Is surplus upstream of the lending affiliate available for the purposes of subsection 90(9)?

- Are downstream subsection 49(3) gains ignored for the purposes of subsection 90(9)?

On the basis of the examples in the October 2012 explanatory notes, the answer to both questions appears to be yes.

…In example 1 in the explanatory notes, FA 2 does not have sufficient surplus to support a hypothetical dividend of $800. A portion of the dividend hypothetically paid to FA 1 in that example would be from preacquisition surplus. The example also states that there is no ACB in the shares of FA 2. Consequently, an application of the entire foreign affiliate regime when assessing the implications of this hypothetical dividend would result in subsection 40(3) gain to FA 1. The example does not address that possibility, but concerns itself only with the movement of surplus from affiliate to affiliate. On the basis of this example, ACB appears to be relevant only when the notional dividend is paid from a top-tier affiliate to a taxpayer, at which point a notional deduction under paragraph 113(1)(d) becomes a consideration.

Subsection 90(14) - Repayment of loan

Administrative Policy

22 May 2014 May IFA Roundtable Q. , 2014-0526741C6

CRA has not yet developed any specific positions on the application of the upstream loan rules to cash pooling arrangements and would welcome a detailed submission from industry.

2013 Ruling 2013-0477871R3 - 5900(1)(a) and dividends from foreign affiliate

A non-resident subsidiary (ForeignHoldco) of a taxable Canadian corporation (Parent) will eliminate a non-interest-bearing loan previously made by it to Parent by declaring a dividend, paying the dividend by issuing a demand promissory note and then receiving the note from Parent in payment of the loan. CRA was only asked to rule to the effect that dividends (including a liquidating dividend) previously received by ForeignHoldco from a Malaysian-resident subsidiary qualified as an addition to ForeignHoldco's exempt surplus in respect of that subsidiary.

See detailed summary under Reg. 5907(11.2).

Articles

Ian Bradley, Marianne Thompson, Ken J. Buttenham, "Recommended Amendments to the Upstream Loan Rules", Canadian Tax Journal, (2015) 63:1, 245-67.

Narrowness of repayment rule (p. 251)

There are situations in which an upstream loan may cease to represent a synthetic distribution from a foreign affiliate without the loan being repaid. However, because there is no repayment, the, appropriate relief is not available…

Non-exclusion where FA is sold to Canco's NR parent (p.252)

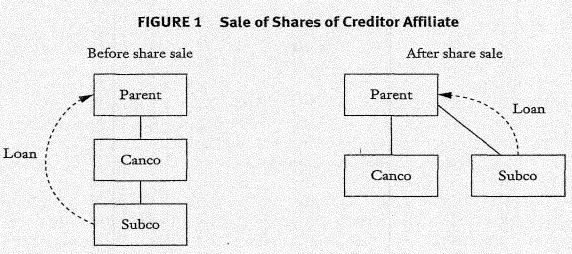

[I]n Figure 1…[a] non-resident corporation (Parent) owns all of the shares of a Canadian-resident corporation (Canco). Canco in turn owns all of the shares of another non-resident corporation (Subco). Subco makes a loan to Parent, which is not repaid within two years. At the time of the loan, Subco is a foreign affiliate of Canco, and Parent is a specified debtor in respect of Canco. Subsection 90(6) will therefore apply to Canco in respect of the loan.

Canco subsequently sells the shares of Subco to Parent for fair market value consideration. In this example, since Subco ceases to be a foreign affiliate of Canco, the loan should no longer represent a synthetic distribution of funds from a foreign affiliate….[T]he loan proceeds have been effectively repatriated to Canco, with full tax consequences for Canco….However, because the loan has not been repaid, no deduction is available under subsection 90(14).

Whether repayment and new loan following FA's sale to NR parent is a series (p. 255)

In some situations, it may not be possible to repay the upstream loan until after the creditor affiliate has ceased to be a foreign affiliate of the taxpayer….In a variation of the example in figure 1, if Parent repaid the existing loan after Subco ceased to be a foreign affiliate, and Subco made a new loan shortly thereafter, would the repayment of the existing loan be a part of a series?...Since loans by non-residents that are not foreign affiliates are outside the intended scope of the upstream loan rules, the new 1oan made by Subco should not be relevant when applying the series test in this context.

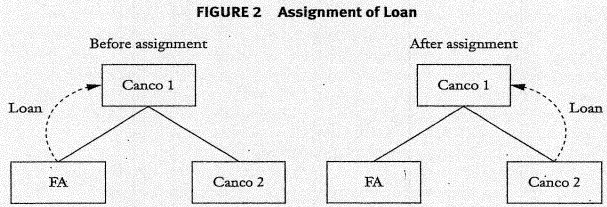

Non-exclusion following loan assignment by FA to Canco 2 (pp. 255-6)

Consider figure 2, in which a Canadian-resident company (Canco 1) has received a loan from a foreign affiliate (FA). This loan is subject to the upstream loan rules, although the subsection 90(6) income inclusion is partially offset by an annual subsection 90(9) deduction (by virtue of the surplus balances of FA). FA then assigns the loan to Canco 2, another Canadian-resident corporation, which is related to Canco 1, for fair market value consideration (without any novation of the loan). [fn 28: The CRA has stated that an assignment of a debt receivable to a new creditor without novation of the debt would not be considered a repayment of the debt for the purposes of subsection 15(2.6): see CRA document no. 2013-0482991E5, September 8, 2014.] The loan should now fall outside the intended scope of the upstream loan rules, since it is a loan between two Canadian corporations…However, since the loan is not repaid, it appears that from a technical perspective no deduction is available under subsection 90(14).

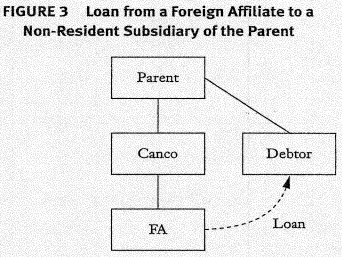

Non-exclusion where Canco acquires the NR affiliated debtor (pp. 256-7)

The next two scenarios involve a Canadian-resident corporation (Canco) that is a wholly owned subsidiary of a non-resident corporation (Parent). A foreign affiliate of Canco (FA) has made a loan to a non-resident subsidiary of Parent (Debtor) (see figure 3). Since Debtor does not deal at arm's length with Canco and is not a controlled foreign affiliate of Canco within the meaning of section 17, the upstream loan rules will apply to this loan.

In the first scenario, Canco acquires all of the shares of Debtor, so that Debtor becomes a controlled foreign affiliate of Canco. Since the loan is now between two controlled foreign affiliates of Canco, it should no longer represent a synthetic distribution from a foreign affiliate….

Non-exclusion where arm's length purchase of NR affiliated debtor (pp. 256-7)

In the second scenario, the shares of Debtor are sold to an unrelated third party, so that Debtor now deals at arm's length with Canco. In this scenario, it is less clear whether the loan continues to fall within the intended scope of the upstream loan rules….v

Ken J. Buttenham, "Are you Ready for the Upstream Loan Rules?", Canadian Tax Journal, (2013) 61:3, 747-68

Application to cash-pooling arrangements (p. 755)

…In practice, it may be challenging for taxpayers and the CRA to determine the correct application of the upstream loan rules when cash-positive foreign affiliates are members of a cash pool that also includes specified debtors. [fn 23: There may not be any ultimate income inclusion under these rules if one of the exceptions in subsection 90(8) applies or if a full deduction can be claimed under subsection 90(9); however, where an upstream loan exists, the potential application of these relieving provisions will have to be considered.] Owing to the nature of cash pool arrangements, not only is it difficult to determine whether an upstream loan exists, but it can also be difficult to track repayments (and maintain that they are not part of a series of loans or other transactions and repayments), as well as to determine when a "new" upstream loan is made.

Series of loans and repayments (pp. 759-760)

…[After discussing Meeuse v. The Queen, 94 DTC 1397 (TCC)] …On balance, the case law suggests that for transactions to constitute a series, they require a common purpose.

Thus, the CRA seems to agree that a repayment of a loan made for a specific identifiable purpose followed shortly by another loan made for a different specific identifiable purpose should not be considered to be part of a series. Conversely, the CRA seems to be of the view that repayments made in the course of a series of upstream loans for on-specific reasons and repayments that are clearly of a temporary nature should be treated as being part of a series. [fn 42: CRA document no. 9219115, October 5, 1992… .]

…In Attis v. MNR [fn 43: 92 DTC 1128 (TCC)] and Hill v. MNR, [fn 44: 93 DTC 148 (TCC)] the Tax Court of Canada dealt with the situation where shareholders received loans from their respective corporations during a year, which were later repaid in whole or in part by the declaration of dividends or bonuses….