Subsection 94.1(1) - Offshore investment fund property

See Also

Barejo Holdings ULC v. The Queen, 2015 TCC 274

An offshore fund ("SLT"), in which the taxpayer had an interest, invested in instruments (styled as "Notes") of non-resident subsidiaries of Canadian banks. The Notes did not bear interest and provided for a payment on maturity that reflected the performance of a matching actively-managed portfolio of assets held by affiliates of the obligors. If the Notes constituted "debt obligations" under s. 95(1) or "debt" under s. 94.1, the taxpayer (a unitholder of SLT) would be required to recognize its share of resulting foreign accrual property income of SLT.

Boyle J found that the Notes were debt for ITA purposes notwithstanding that the offshore fund could not ascertain what it would receive on maturity until that day arrived, as it was sufficient that there be a "liquidated amount" only on such maturity. The Notes satisfied his basic criteria for what is debt: an amount is advanced or "credited" to acquire the investment; a liquidated amount is payable when it matures (which could be a nil amount); and there is interest (albeit of nil). See summary under s. 12(11) – investment contract.

Administrative Policy

23 May 2013 IFA Round Table, Q. 1

Will s. 94.1 apply where a taxpayer invests in and earns income from a widely held offshore mutual fund in a country that does not levy an income, profit or withholding tax in respect of income earned by the fund - where it wishes to take advantage of the fund managers' experitise?

Response

: After stating that "it is our view that tax reduction or deferral does not have to be the only reason, or even the main reason for the investment; it merely has to be one of the main reasons," and noting (citing Walton v. The Queen, 98 DTC 1780) that regard should be had to "objective manifestations of purpose," CRA stated:

We generally would expect that a Canadian taxpayer investing in a mutual fund resident in a tax haven country would be subject to section 94.

10 January 2011 Memorandum 2009-0342861I7 - Meaning of "portfolio investment" in 94.1(1)(b)

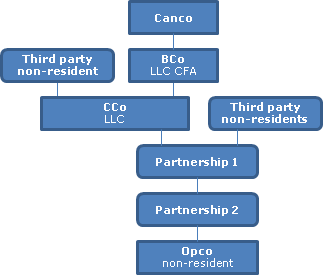

Canco owns XX% of the voting membership interests in BCO, which is a CFA and an LLC. BCo owns XX% of the voting membership interests in CCo, also an LLC, with an arm's length non-resident investor owning XX% of the voting Class A membership interests of CCo. CCo owns xx% of Partnership1 (a non-resident partnership) with the balance held by unrelated non-resident investors, and Partnership1 holds xx% of Partnership2 (also non-resident). Partnership2 holds XX% of the beneficial ownership interest in Opco, which carries on an active business.

After noting that s. 94.1 will apply in computing the FAPI of BCo if its shares of CCo may reasonably be considered to derive their value, directly or indirectly primarily from portfolio investments of CCo or any other non-resident entity, CRA stated:

The test is not whether the shares of CCo are "portfolio investments" to BCo, but whether the shares of CCo (i.e. the "non-resident entity" that we are testing) derive their value primarily from portfolio investments of "that entity" (i.e. CCo), or "any other non-resident entity".

After implying that Opco likely would not be considered to be a non-portfolio investment ("in its 1984 federal Budget, the government stated that the rules in section 94.1 will not apply to investments in non-resident entities whose principal business is a bona fide active business"), CRA commented on the application of the tax avoidance test in s. 94.1(1)(d):

If Canco held the Opco shares directly, and Opco were a foreign affiliate of Canco earning active business income, dividends paid to Canco by Opco would be deductible by Canco under paragraph 113(1)(a). On the sale of the Opco shares, Canco could make a subsection 93(1) election....Accordingly, even if it can be said that the shares of CCo derive their value from portfolio investments, it appears that the provisions of section 94.1 would not apply to BCo, since the earnings of Opco could be paid to Canco without tax.

After noting that BCo's equity percentage in Opco is greater that 10%, CRA stated:

If Canco's economic investment in Opco were substantially less than 10%, then we suggest that the CRA might consider the application of subsection 95(6) or the General Anti-Avoidance Rule to say that the Class B shares were issued only to take advantage of the foreign affiliate status.

90 C.R. - Q46

"Portfolio investments" are not confined to interests in non-resident entities which derive their value from passive investments or from those investments defined as portfolio investments in the CICA Handbook.

25 April 1990 Memorandum (September 1990 Access Letter, ¶1424)

RC has not yet determined whether a beneficiary under discretionary trust, who receives income or capital completely at the discretion of the trustee, has an "interest" in the specific assets of the trust.

86 C.R. - Q.19

"Portfolio investment" generally has its meaning in commercial practice (e.g., investors, investment managers and investment promoters).

Articles

Morrie Hotter, "Foreign Investment Entity Update", Corporate Finance, Vol. XI No. 4, 2004, p. 1118.

Subsection 94.1(2) - Definitions

non-resident entity

Administrative Policy

9 June 1991 Memorandum (Tax Window, No. 4, p. 21, ¶1286)

A non-resident trust may be a "non-resident entity" if the tests in ss.94(1)(a) and (b) are met, even if neither ss.94(1)(c) or (d) causes anyone to pay Canadian tax on the FAPI of the trust.