Subsection 108(1) - Definitions

Beneficiary

Administrative Policy

19 August 1994 T.I. 941574 (C.T.O. "Definition of Beneficiary")

A properly executed release or surrender of all of an individual's interest in a trust, including any right within the meaning of s. 245(25) as well as any right to any other benefit or advantage under the trust, would result in that individual ceasing to be a beneficiary.

Capital Interest

Articles

Hayhurst, "Transactions in Income and Capital Interests in Trusts", 1988 Conference Report, c. 38

Discussion of background to introduction of personal trust rule.

Cost Amount

Administrative Policy

10 October 2014 APFF Roundtable Q. , 2014-0538261C6 F

In order to settle the capital interest in a discretionary family trust of a beneficiary who is related to the trustees, that beneficiary agrees to renounce his interest in consideration for $200,000 paid by the trust as to $50,000 in cash and as to $150,000 by the issuance of a promissory note due by the trust in 5 years' time and bearing interest at 5%. Do ss. 107(1) and (2) apply so that there is no capital gain or loss to him? Is the cost amount to the beneficiary of his interest equal to $200,000? CRA responded (TaxInterpretations translation):

In ... Chan ... the Tax Court of Canada defined the term "distribution" as being an act effected by a trustee in accordance with his obligations under the terms of the deed of trust. …

[T]he issuance of a note by a trust does not result in the beneficiary having the ownership of property which belonged to the trust and to which he had a right as beneficiary immediately before its distribution. Therefore subsection 107(2) cannot apply respecting the note for $150,000. …

[T]he issuance of a note does not constitute the distribution of property of a trust to a beneficiary for purposes of paragraph (a) of the definition of cost amount in subsection 108(1).

Income Interest

Cases

The Queen v. Propep Inc., 2010 DTC 5088 [at 6882], 2009 FCA 274

As an individual was an income beneficiary of the trust, he was to be regarded for purposes of the Act as a beneficiary of the trust.

Administrative Policy

IT-385R2 "Disposition of an Income Interest in a Trust"

Preferred Beneficiary

Administrative Policy

17 May 1994 T.I. 941128 (C.T.O. "Step-grandchild as a Preferred Beneficiary")

The word grandchild includes a step-grandchild.

Settlor

Administrative Policy

IT-374 "Meaning of 'Settlor'"

Testamentary Trust

Administrative Policy

16 December 2014 T.I. 2014-0539841E5 F - Testamentary Trust

Would a trust created by will in favour of the child of the deceased (the "Child Trust") cease to qualify as a testamentary trust in the year of operation of a clause in the will directing that a trust created by the will for the exclusive benefit of the deceased's spouse to pay over the residue to the Child Trust on the spouse's death? After referring to s. 248(8)(a), CRA stated (TaxInterpreations translation):

[A] contribution of property to a trust by a deceased contributor which takes effect at a date subsequent to death, such as a contribution of property to a trust following the death of a surviving spouse, generally would not disqualify the trust as a testamentary trust.

The summary stated that "the property is contributed to the second [child] trust by the deceased person, through specific directions given in that person's will."

11 October 2013 APFF Roundtable Q. , 2013-0493671C6 F

When asked to confirm that 2011-0417391E5 F signified that "all the testamentary trusts which are created in the future for one of the beneficiaries of an inter vivos trust…will lose their status of testamentary trust or not obtain it in the first place" (TaxInterpretations translation), CRA stated that the position in 2011-0417391E5 F was maintained.

12 June 2012 STEP CRA Roundtable Q. , 2012-0442931C6

In the situation where the estate trustees are instructed under the Will to set up a number of trusts from the residue of the estate, CRA "generally has viewed the trusts created out of the residue as arising on death."

26 June 2012 T.I. 2011-0417391E5 F -

Where the trustees of a Quebec inter vivos trust have the power to appoint beneficiaries including a testamentary trust, does the testamentary trust, if not so designated, lose its status as a testamentary trust? CRA referred to Art. 1282 of the Civil Code, which provided:

In the case of a personal or private trust, the power to appoint may be exercised by the trustee or the third person only if the class of persons from which he may appoint the beneficiary is clearly determined in the constituting act.

CRA stated (TaxInterpretations translation):

[A] trust created by will that is part of the category of persons from which the trustee can designate beneficiaries of an inter vivos trust has a beneficial interest by virtue of subsection 248(25).

After discussing the testamentary trust definition , CRA stated:

[T]here is no requirement to restrict the expression "property contributed" to the assets of the inter vivos trust. …[T]he interest of a trust created by will in an inter vivos trust is property which is contributed to it gratuitously otherwise than by a particular deceased on or after his death and as a consequence thereof. Consequently, whether such capital or income interest in the inter vivos trust is a future or conditional interest, a trust established by will would lose its status as a testamentary trust within the terms of subsection 108(1) – or not acquire that status in the first place - if it received an interest in an inter vivos trust. The trust established by will receives such an interest from the moment it obtains a beneficial interest as described in subsection 248(25).

30 November 1998 T.I. 5-982646 -

A trust created out of an individual's estate by a court order for the sole benefit of the mentally handicapped son of the deceased during the son's lifetime with the remainder to be distributed to a charity on his death would qualify as a testamentary trust.

23 February 1994 T.I. 5-933673 -

The comments in IT-381R2, paragraph 21 (respecting paragraph (b)) also apply to paragraph (c) of the definition.

5 March 1991 T.I. (Tax Window, No. 1, p. 22, ¶1137)

A payment of cash to an estate to enable it to pay its liabilities is a contribution of property, which could result in the trust losing its status as a testamentary trust and as a personal trust.

30 April 1990 Memorandum: 26 April 1990 T.I. (September 1990 Access Letter, ¶1427)

An income beneficiary may agree to pay a trust's tax liability arising from a designation under ss.104(13.1) or (13.2) without there being considered to be a contribution for purposes of s. 108(1)(i)(ii) or a gift for purposes of s. 122(2)(d).

19 April 1990 T.I. (July 1990 Access Letter, ¶1324)

After reconsidering its technical interpretation of 7 December 1989, RCT was of the view that where an income beneficiary has agreed to bear the burden of a trust's tax liability arising out of a designation under s. 104(13.1) or (13.2), the payment of the taxes by the beneficiary would not by itself result in a contribution to the trust for the purposes of s. 108(1)(i) or a gift to the trust for purposes of s. 122(2)(d).

7 December 1989 T.I. (May 1990 Access Letter, ¶1225)

Where a beneficiary makes a payment to the trustee to enable the trustee to pay the tax liability of the trust caused by a designation under s. 104(13.1), the payment will represent a contribution to the trust for purposes of s. 108(1)(i)(ii), with the result that the trust will no longer qualify as a testamentary trust.

26 September 89 T.I. (February 1990 Access Letter, ¶1113)

The payment of tax on behalf of a testamentary trust potentially can convert it into an inter vivos trust.

IT-381R2 "Trusts - Deduction of Amounts Paid or Payable to Beneficiaries and Flow-Through of Taxable Capital Gains to Beneficiaries" under "Double Taxation Relief"

An income beneficiary may agree to pay a trust's tax liability arising from a designation under ss.104(13.1) or (13.2).

Articles

H. Carr, "Definition of a Testamentary Trust", Goodman on Estate Planning, Vol. VII, No. 1, 1998, p. 490.

trust

Cases

Labow v. The Queen, 2012 DTC 5001 [at 6501], 2011 FCA 305

The taxpayer, who employed both his wife and two part-time employees in his medical practice, deducted $150,000 and $247,691 for contributions he made in 1996 and 1997, respectively, to a health plan trust which he established only for her. The Minister reassessed to deny these deductions and to include the income subsequently generated from the plan assets in the income of the taxpayer under s. 75(2). The trial judge found that these contributions were not made for the purpose of earning income from the taxpayer's medical practice. In affirming the trial judge's finding that the plan was not a trust described in para. (a.1) of the definition of trust in s. 108(1), so that the exclusion from the application of s. 75(2) to the plan income in s. 75(3)(b) did not apply, Dawson J.A. stated (at para. 36):

Counsel argued that the Judge failed to consider the phrase "because of, an office or employment." Counsel argued that the Judge failed to consider whether the benefits were provided "in respect of" Dr. Labow's wife's office or employment. However, given the Judge's finding of fact that the benefits were provided because of Dr. Labow's wife's marital status, it cannot be said the benefits were provided wither "because of" or "in respect of" her office or employment.

(g)

See Also

The Queen v. Boger Estate, 93 DTC 5276 (FCA)

Heald JA summarized followings of the trial judge (as follows at pa. 5279), which he later adopted (at p. 5281):

- that an interest is vested if (a) the person entitled to it is ascertainable and, (b) that person can take possession forthwith and can only be prevented from doing so by the existence of some prior interest. A vested interest is distinct from a contingent interest, which gives no right of enjoyment unless or until a future event occurs (a condition precedent); and

- that vested interest is defeasible if it is subject to a condition subsequent or determinable limitation which condition or limitation must e contained in the grant.

Administrative Policy

18 December 2013 T.I. 2011-0414841E5 F - All interests vested indefeasibly

The trust indenture of a discretionary trust will be modified for it to become a non-discretionary trust, in order to avoid the application of the 21-year realization rule under s. 104(4)(b). Before indicating that it could not comment on whether such amendments would accomplish this end, and on their consequences, without examining the amendments and other facts in the context of a ruling application, and after summarizing the termination rule in (g)(v), CRA stated (TaxInterpretations translation):

[T]here could be an indefeasible vesting of the interest in a trust if each beneficiary holds rights in the trust unconditionally and no subsequent event could annul those rights.

30 June 1994 T.I. 9408895 ["vested indefeasibly"]

Respecting a question as to whether that all interests in a Trust had vested indefeasibly for purposes of the predecessor of para. (g), CRA referred to The Queen v. Boger Estate, 93 DTC 5276 (FCA), and stated:

In order to apply this interpretation it is necessary to ascertain whether the beneficiaries' respective interests in the Trust had vested without either a condition subsequent or determinable limitation attached thereto.

This condition appeared to be satisfied, at the latest, following the death of XX, as following that time it appeared that the Trust was not revocable.

Subsection 108(2) - When trust is a unit trust

Paragraph 108(2)(a)

Administrative Policy

16 November 2015 T.I. 2015-0595041E5 - Mutual Fund Trusts & 108(2)(a)(i)

Where a provincial securities commission has a policy on what it considers to be redeemable on demand, will CRA for provincial securities purposes that the Canada Revenue Agency will generally accept such policy in determining whether the redeemable-on-demand requirement in s. 108(2)(a)(i) is satisfied? CRA responded:

[W]here a provincial securities commission has a policy concerning what it considers to be redeemable on demand for provincial securities purposes [CRA]…will generally accept such policy in determining whether a particular trust would satisfy the redeemable on demand requirement in subparagraph 108(2)(a)(i). … . In addition, where the relevant securities legislation accepted as redeemable at the demand of the holder a redemption schedule that provided for no less than two redemptions annually, such a fund could generally qualify as a unit trust under subparagraph 108(2)(a)(i).

2004 Ruling 2004 - 007431

The Class A units of a trust (the "Trust") are redeemable for the lesser of o % of their market price [over an unspecified period] and o % of the closing market price on the redemption date, with the Trust having the right to pay the redemption price (no later than the last day of the month following the month in which the units are tendered for redemption) by distributing notes of a wholly-owned subsidiary trust. Class B units of the Trust, the distributions on which are subordinated to distributions on the Class A units until EBITDA of the Trust has achieved a stipulated level (the "Stated Target"), are redeemable on similar terms to the Class A units except that during the period that distributions are subordinated, the redemption price is reduced to reflect any shortfall in EBITDA from the Stated Target and, given that the level of EBITDA will not be known at the time of redemption, the Class B units will be redeemed for an interest-bearing note (a "Class B Redemption Note") whose principal amount is not determined until the EBITDA for that fiscal period is determined, with the Class B Redemption Note thereupon becoming redeemable for cash or notes of the subsidiary trust.

Ruling that the Trust will qualify as a unit trust.

16 August 2000 Ruling 2000-000751

Ruling that provision for suspension of the right of unitholders to redeem in the event that units ceased to trade by order of a competent authority under applicable securities law or for any reason there was likely to be no closing bid price for the units quoted on the exchange for a trading day would not, by itself, cause the units not to qualify under s. 108(2)(a).

2000 Ruling 2000-004168

Ruling that a trust would satisfy the redeemable-on-demand requirements of s. 108(2)(a) where its net asset value was calculated on a monthly basis, with a right for the unit holder to give a written notice of redemption and to receive the net asset value per unit on the next monthly valuation date, with the payment to be received no more than 30 days following that valuation date.

24 December 1999 Ruling 991430

Favourable ruling where the units were redeemable for the lessor of 95% of the closing unit price on the date the units were surrendered for redemption and 95% of the closing price for the ten preceding trading days, with provision for an in specie distribution of a share of underlying assets (without a discount) in the event that redemptions exceeded a specified dollar amount in a month, or over a six-month period. "The Trust has received a report from an investment dealer that states that it is reasonable to expect that unitholders will choose to exercise the redemption right in certain circumstances."

1 January 1999 Ruling 991832

A trust would be considered to be open-ended notwithstanding that units might be redeemed for 25-year interest-bearing promissory notes rather than cash.

1999 Ruling 991832

The only assets of an inter vivos trust (the "MFT") are (as to a cost of 85%) interest-bearing promissory notes ("First Notes") with a term of 25 years owing by another inter vivos trust ("CT") carrying on a business that was purchased from a public corporation and units of CT which may be redeemed on demand for interest-bearing notes (the "Second Notes") of CT payable after one year. The MFT units are redeemable on demand for cash up to a specified aggregate amount applicable in each calendar month (at the redemption price equal to the lesser of 90% of the weighted average trading price of a unit for the ten preceding trading days and the closing price on the redemption date), with redemptions for amounts in excess of that maximum being by way of an in-specie redemption through the distribution of CT units and First Notes (at the redemption price equal to the fair market value of the units as determined by the Trustee), provided that where MFT unitholders are RRSPs or the like, Second Notes rather than CT units are distributed in the event of an in-specie redemption.

The MFT will be considered to be an open-ended trust for purposes of s. 108(2)(a), its only undertaking will be considered to be the investing of its funds in CT units and the First Notes, the MFT units will not be considered to be foreign property (provided that the MFT continues to hold less than 20% of its property in the CT units), and GAAR will not apply.

29 September 1994 Memorandum 940941 (C.T.O. "Mutual Fund and Unit Trust")

A trust (for example, a trust whose units are traded on a stock exchange and that gives the unitholders the option of demanding redemption of the units at a price equal to a percentage of the stock market price) can meet the definition of a unit trust even though it does not meet the definition of a mutual fund in National Policy No. 39 (which requires a right to redeem at the net asset value).

28 February 1994 T.I. 940328 (C.T.O. "Real Estate Investment Trust")

Where the trustees of a REIT have the right to suspend the redemption of its units for valid reasons and such a suspension is imposed, the fund will cease to qualify as a unit trust where the suspension lasts for more than 12 months. If a REIT has a permanent cap on the amount of units that it will redeem on its valuation dates, it will not qualify as a unit trust. However, it is permissible for the REIT to offer to redeem its units only at a reasonably discounted redemption price (i.e., as a percentage of the current stock market price of the unit) where the fund can demonstrate that it is reasonable to expect that under certain conditions investors would redeem their units as opposed to selling them on the stock market.

11 February 1993 Memorandum (Tax Window, No. 29, p. 9, ¶2428)

The requirements of s. 108(2)(a)(i) will be considered to be met even though the administrator of the unit trust may suspend redemption of units when normal trading is suspended in securities held by the fund that represent more than 50% of its total net assets, or during any period not exceeding 120 days during which the fund administrator determines that disposal of this portfolio of securities is not reasonably practicable, or that it is not reasonably practicable to determine fairly the net asset value of the fund.

91 C.R. - Q.6

RC will not in general view a unit that is issued in accordance with the rules of securities commissions as failing to meet the requirements of s. 108(2).

22 November 89 Review Committee Memorandum (April 90 Access Letter, ¶1177)

On one occasion, the Committee had been unable to conclude that a fundamental requirement of redemption at the demand of the holder was met where the fund had units that were redeemable quarterly.

Articles

Allgood, "Athabasca Oil Sands Trust: Tax Implications of Royalty Trust", Corporate Finance, Vol. V, No. 1, p. 348

Includes discussion of whether a royalty interest is a "security".

Botz, "Mutual Fund Trusts and Unit Trusts: Selected Tax and Legal Issues", 1994 Canadian Tax Journal, Vol. 42, No. 4, p. 1037.

Paragraph 108(2)(b)

See Also

Shaughnessy v. The Queen, 2002 DTC 1272, Docket: 2000-178-IT-G (TCC)

In the context of a case dealing with whether the taxpayer had acquired an interest in a condominium unit with a reasonable expectation of profit, Bowman A.C.J. stated (at p. 1274):

... the word "investment" is a completely neutral term. It can refer to a long-term investment in land and buildings or in corporate or government bonds - plainly a capital purpose - or it can refer to an investment in a commercial enterprise or in property that is intended to sell at a profit (an adventure in the nature of trade).

Clevite Development Ltd. v. MNR, 61 DTC 1093 (Ex. Ct.)

Thurlow J. referred with approval to the distinction drawn in IRC v. Desoutter Brothers Ltd., [1946] 1 All E.R. 58 (C.A.) and Tootal Co. Ltd. v. IRC, [1949] 1 All E.R. 261 (HL) between income from a business and income from investments before going on to find that the taxpayer received patent royalty income as income from a business rather than from "a mere property holding".

International Brotherhood of Teamsters v. Daniel, 439 U.S. 551 (1979)

A non-contributory compulsory pension plan did not constitute an "investment contract" for purposes of the Securities Exchange Act of 1934 under the Howey test given that there was no investment of money into the plan by the employee (he sold his labour primarily to obtain a livelihood rather than in return for the employer's contribution to the plan), and because the pension plan could not be regarded as a common venture based on a reasonable expectation of profits to be derived from the entrepreneurial or managerial efforts of others (the return to the employee rested primarily upon employer contributions and on the employee's ability to meet the substantial pre-conditions to vesting, rather than on the investment performance of the plan).

Re Ontario Securities Commission and British Canadian Commodity Options Ltd. (1979), 22 OR (2d) 278 (HCJ.)

The respondent sold across Canada options to purchase at a future time commodities which were traded on the London commodities market. The option premiums paid to the respondent went into its general account, and the respondent then purchased options on the London market through a broker in order to be able to meet its obligations to the purchasers, the profit to the respondent coming from the difference between the premiums and commissions paid to the broker, and the premiums charged to the customers. Grange J. affirmed the finding of the commission that these were "investment contracts" for purposes of the Securities Act (Ontario). He noted (p. 281) that the Howey test, as modified in Pacific Coast Coin Exchange, was as follows:

Does the scheme involve an investment of money in an enterprise in which the fortunes of the investor are interwoven with and dependent upon the efforts and success of those seeking the investment or of third parties, with profits to be derived in significant part from the efforts of those others?

Pacific Coast Coin Exchange of Canada v. Ontario Securities Commission (1977), 80 DLR (3d) 529, [1978] 2 S.C.R. 112

The appellant offered bags of silver coin for sale on margin (with 85% of all margin account purchasers closing out their account without taking delivery) and hedged its obligations through transactions in the futures markets. The "commodity account agreements" which the appellant entered into with purchasers were found to be "investment contracts" for purposes of the Securities Act (Ontario), with the result that the appellant was in breach of the requirement to file a prospectus. De Grandpré J. applied the test developed in the U.S. jurisprudence that there is an investment contract where individuals are led to invest money in a common enterprise with the expectation that they will earn a profit primarily through the efforts of the promoter or of someone other than themselves.

Prather v. King Resources Co., [1973] 1 WWR 700 (Alta. C.A.)

An employee was found to have breached the condition in an employee stock option plan that "the purchase of stock thereunder shall be for investment purposes, and not with a view to resale or distribution" when he exercised his options without any intention to hold the stock for any extended period after it was issued to him. After reviewing various definitions of "investment", Allen J.A. stated (p. 712):

With the exception of the definition given in the case of Archibald v. Hartley, supra, none of these definitions seem to require that to constitute an investment any property on which money is laid out must be held for any length of time, but I am of the view that the context in which the word is used must have some influence on how it is interpreted, and when it is used in contradistinction to the words 'for resale or distribution' I think it is clearly contemplated that some element of time would intervene between the purchase and sale of the stock as against an immediate disposition thereof after issuance.

Canadian & Foreign Securities Co. Ltd. v. MNR, 72 DTC 6354, [1972] CTC 391 (FCTD)

Demand loans made to a company which were evidenced by unsecured promissory notes were found to be "securities" for purposes of the definition of "investment company" in s. 69(2) of the pre-1972 Act.

State of Hawaii v. Hawaii Market Center, Inc., 485 P. 2d 105 (1971 (Hawaii S.C.))

A member of the public, who became a "founder-member" of a retail store by purchasing either a sewing machine or a cookware set for an amount in excess of its fair market value, thereafter was able to earn money through commissions on sales to buyers to whom he had issued buyer's cards, and from fees in respect of other persons whom he induced to become founder-members. The "founder-member purchasing agreement" which the individuals signed with the corporation owning the retail store was an "investment contract" for purposes of the Uniform Securities Act (Hawaii) because the following tests were satisfied:

- An offeree furnishes initial value to an offeror [i.e., the excess paid over fair market value], and

- a portion of this initial value is subjected to the risks of the enterprise, and

- the furnishing of the initial value is induced by the offeror's promises or representations which give rise to a reasonable understanding that a valuable benefit of some kind [i.e., the commissions or fees], over and above the initial value, will accrue to the offeree as a result of the operation of the enterprise, and

- the offeree does not receive the right to exercise practical and actual control over the managerial decisions of the enterprise.

Re Peczenik's Settlement, [1964] 2 All E.R. 339 (Ch. D.)

A clause in a deed of settlement directing the trustees to hold the trust fund "for the purpose of investing such funds in any shares stocks property or property holding company as the trustees in their discretion shall considered to be in the best interest of Sheila" was found to authorize the trustees to invest in any shares, any stock, or any property. Buckley J. noted (p. 341) that "it must, of course, be property of a kind capable of being treated as an investment, not property which is acquired merely for use and enjoyment" and went on to note that the clause would not "authorize investments merely on personal security".

C.I.R. v. Reinhold (1953), 34 TC 389 (C.S. (1st. Div.))

Before going on to find that an admission of an intention to resell at the first opportunity did not necessarily mean that rental houses were acquired as adventures in the nature of trade rather than as investments, Lord Carmont quoted a statement by Lord Dunedin that "the fact that a man does not mean to hold an investment may be an item of admittance tending to show whether he is carrying on a trade or concern in the nature of trade in respect of his investments", and went on to state (p. 392):

I draw attention to Lord Dunedin's language being used with reference to 'an investment', meaning thereby, as I think, the purchase of something normally used to produce an annual return such as lands, houses, or stocks and shares. The language would, of course, cover the purchase of houses as in the present case, but would not cover a situation in which a purchaser bought a commodity which from its nature can give no annual return.

Tootal Broadhurst Lee Co. Ltd. v. I.R.C., [1949] 1 All E.R. 261 (HL)

In finding that royalties received by a manufacturer from patents which it had developed in its research department or acquired from others were not income from investments for purposes of the exclusion from excess profits tax on profits arising from a trade or business, Lord Simonds stated (p. 264):

['Investments'] is a word of which the meaning may vary according to its context. ... Here, the meaning is limited by the context, and the context is one in which a distinction has to be made between the income of investments and the other profits of a trade or business ... It appears to me that the problem may be solved in this way. I would take a schedule of the assets of the trading company concerned and, omitting assets such as stocks and shares to which ... the title of investments can in no circumstances be denied, would ask of each other asset: 'Is this an asset which the company has acquired or holds for the purpose of earning profits in, or otherwise for the promotion of, its particular trade or business?' ... Applying this test to the facts of the present appeal, I cannot believe that any business man (who may be regarded as the touchstone in such a case) would describe the patents rights here in question as investments of the taxpayer ...

Re Lilly's Will Trust, [1948] 2 All E.R. 906 (Ch. D.)

In finding that an exclusion in a bequest for "investments securities for money or leasehold property" did not include proceeds of life insurance policies, Harman J. first quoted a statement in Jarman on Wills that "'investment' is a vague term and no general rule can be laid down as to its meaning,'" and went on to state (p. 907):

Counsel rested his claim on the word 'investments' saying that anything was an investment which is a mode of laying out money with a view to obtaining a return, and that a man who put out his money to buy himself a policy to be returned a sum, whether at 65 or at his death, was investing money, and that the proceeds will properly be called an investment. I have no doubt that is so, but I think the problem is: What did this testator mean when he excepted 'investments' and 'securities for money?' I think he meant stock exchange investments - stocks in shares - and things which were not stocks or shares but were securities, such as debentures. I do not think he intended to include policy monies in that phrase.

In Re Power, [1947] 1 Ch. 572

A clause in a will stated that "all monies requiring to be invested under this my will may be invested by the trustee in any manner ... including the purchase of freehold property in England and Wales". This clause was found not to authorize the purchase of a home for occupancy by a beneficiary of the will. Although freehold property purchased for the sake of income is an investment, in this case the purchase might "not be, from the financial point of view, attractive or indeed at all beneficial, because part of the price might be attributable to the special benefit represented by the acquisition of a suitable place in which to live" (p. 575).

SEC v. Howey Co., 328 U.S. 293 (1946)

Units of a citrus grove development coupled with a contract for cultivation, marketing and remitting the net proceeds to the investor constituted "investment contracts" for purposes of the Securities Act of 1933. Murphy J. stated (pp. 298-299):

An investment contract for purposes of the Securities Act means a contract, transaction or scheme whereby a person invests his money in a common enterprise and is lead to expect profits solely from the efforts of the promoter or a third party, it being immaterial whether the shares in the enterprise are evidenced by formal certificates or nominal interests in the physical assets employed in the enterprise.

C.I.R. v. Desoutter Bros., Ltd. (1945), 29 TC 155 (C.A.)

Greene M.R. found that royalties derived by the taxpayer from the licensing of patents covering improvements in electrically operated hand tools were profits of its trade or business, rather than income from the holding of investments, in light of the relation of the patents to its business and the fact that it did not receive the royalties as a "mere passive owner". He also doubted the test of Macnaghten J. in C.I.R. v. Rolls-Royce, Ltd. (No. 2) (1944), 29 TC 137 (K.B.D.) that an investment involves the laying out of money, and cited the example of a son who is bequeathed a patent from which he thereafter passively derives investment income.

MacKinnon L.J., in concurring, stated (p. 165):

I think that the word 'investments' in the relevant Sections of the statute is not a word capable of legal definition. Like so many words in modern legislation, it is a word of current vernacular.

In Re Ferry, Allen v. Allen, [1945] N.Z.L.R. 448 (S.C.)

In finding that the phrase "my investments of all descriptions" in a will did not include money on current account at a bank, Kennedy J. stated (p. 451-452):

I do not think in popular parlance the word 'investment' covers money lodged in a post-office savings-bank. Such money is withdrawable at will just as money in a current account with the bank is. The only difference is until recent times the Post-Office Savings-Bank paid a low rate of interest - that is, a rate of interest lower in comparison with the rate obtainable elsewhere in what are sometimes termed gilt-edged investments. An investment is, I think, the antithesis of ready money, and ready money is usually used in a sense including money on current account or money withdrawable on demand.

In re Lewis' Will Trust, [1937] 1 Ch. 118

In finding that a bequest of "the following securities (or the investments representing the same at my death if they shall have been converted into other holdings)" included the proceeds of such securities which had been deposited in an interest-bearing bank account, Bennett J. stated (p. 120):

Money on deposit can be, in accordance with popular parlance, spoken of as invested.

Khoo Tek Keong v. Ch'ng Joo Tuan Neoh, [1934] A.C. 529 (PC)

A will which empowered the trustees "to invest all monies liable to be invested in such investments as they in their absolute discretion think fit" permitted the sole surviving trustee to make interest-bearing loans on the security of deposited jewellery without independent valuations, but was breached when he made other unsecured loans.

Pennsylvania Ry. Co. v. Interstate Commerce Commission, 66 F. (2d) 37 (3d C.A. (1933))

An acquisition by one railroad company of shares in another railroad company was found not to be contrary to the Clayton Act by virtue of an exemption which stated that "this section shall not apply to corporations purchasing such stock solely for investment". Davis C.J. stated (p. 39):

The word 'investment', as the Commission said, 'is one of broad application, including in its various uses purchases of practically every kind and description and for every purpose.' One of these purposes is the purchase of property for the sake of the direct return which can be realized from such property. This is the definition to which the Commission restricted the word in this case, but it is not primarily a technical word and has other meanings. It ordinarily signifies the use of money to purchase property, personal or real, for any purpose from which income or profit is expected, presently or in the future, speculatively or permanently.

C.I.R. v. Tyre Investment Trust, Ltd. (1924), 12 TC 646 (K.B.D.)

The taxpayer was incorporated by two individual shareholders of Dunlop Rubber Company, Limited (the "English Company") in order to acquire the shares of two foreign companies which held licences from the English Company and to sell those shares to the English Company at a profit. In addition to acquiring such shares, the taxpayer also acquired and disposed of a "Victory Loan" at a gain, and acquired preference shares of Amalgamated Cotton Mills Trust.

Rowlatt J. held that the taxpayer's principal business consisted of the making of investments, with the result that its gain from the disposition of the Victory Loan was a taxable profit subject to excess profits duty.

Wragg v. Palmer, [1919] 2 Ch. 58

A will which authorized the trustees "to invest any monies forming part of the trust estate in their names and at their discretion in or upon such stocks funds shares securities or other investments of whatsoever nature and wheresoever and whether involving liability or not or upon such personal credit without securities as his trustees should in their absolute and uncontrolled discretion think fit" was found to permit the purchase of real estate. Lawrence J. stated (pp. 64-65):

The verb 'to invest' when used in an investment clause may safely be said to include as one of its meanings 'to apply money in the purchase of some property from which interest or profit is expected and which property is purchased in order to be held for the sake of income which it will 'yield'; whilst the noun 'investment' when used in such a clause may safely be said to include as one of its meanings 'the property in the purchase of which the money has been so applied.' ... In ordinary parlance real estate is spoken of as an investment if bought in order to be held for the sake of the income or profit accruing from it. The expression 'investing in house property' is one which every lawyer must frequently have heard, and who can doubt that in such a case the house property purchased is property described as 'an investment'?

Price v. Newton, [1905] 2 Ch. 55

In finding that a bequest of "mortgages, debentures, and other securities for money, shares, stocks, and pecuniary investments" did not include a large sum on current account with the testator's bankers that was subject to ten days' notice of withdrawal, Farwell J. stated (pp. 58-59):

I think that no one in ordinary parlance speaking of money which he puts on deposit account at his bankers at a short call like this - ten days - taking the usual banker's interest, which is 1 per cent. below bank rate, would treat himself as making an investment ... The money which is deposited with such bankers awaits investment: the fact that it earns interest does not make it an investment ... [T]he fact that it earns interest cannot make it an investment, because it is quite within recent times ... that banks have allowed interest on current accounts if they exceed a certain amount.

Commissioner of Taxes v. Australian Mutual Provident Society (1902), 22 N.Z.L.R. 445 (C.A.)

When the holder of a life insurance policy fell into arrears on the payment of premiums, the taxpayer was entitled to charge the cash surrender value of the policy with the amount of the arrears plus accrued interest thereon, such amounts being a first charge on monies payable under the policy. In finding that the interest was "income from investments of any kind other than investments in or on land" for purposes of the Land and Income Assessment Act, 1900 (New Zealand) Edwards J. found that the amounts which were so charged should be characterized as sums advanced upon the security of the policy and bearing interest, and therefore should be regarded as investments, it being "quite immaterial that no money actually passes: the premium, if paid, would be available for investment" (p. 458). He earlier stated (pp. 456-457):

There is no statutory definition of the word 'investment'. The word must therefore be read in its popular meaning. That popular meaning embraces, I think, every mode of application of money which is intended to return interest, income, or profit. Money employed as capital in a business is, in popular language, money invested in the business; money used for the purchase of negotiable instruments is an investment; so also money lent upon a bond or other personal security; so money deposited with the bank or other financial institution at interest. Money advanced by the defendant society upon the security of its own policies is therefore, in my opinion, clearly an investment.

Worts v. Worts (1889), 18 OR 332 (Ch. D.)

A clause in a will which authorized the trustees "to invest in such securities as they shall think proper ... with power to retain any investments existing at his death as long as they shall see fit" was found not to authorize the trustees to hold a partnership interest in a firm of distillers, or to participate in turning the partnership into a joint stock company. Boyd C. stated (p. 340):

This latter clause does not mean the prosecution of the business he was engaged in, for at the longest that was to end in a year. Neither does it justify any change of form such as made here, whereby a partnership was superseded by a company of limited liability ... This was not ... retaining any investment existing at the time of his death, for investment is not a proper term as to monies in trade, and the testator has not used it in any popular sense, because he speaks of investing in connection with securities and does not regard his business as an investment.

Re Barwick, [1884] OR 710 (Ch. D.)

In finding that a deed of settlement which directed the trustee to "invest" the trust property "in such estate or securities, whether real or personal, and of what nature or kind whatsoever as to him or them shall seem best, and most advantageous to the interest of the trust hereby created" authorized the trustee to acquire a lot in the City of Toronto, Boyd C. stated (p. 714):

If this manner of investment was not so productive of regular annual income as might be in other kinds of investment, that (especially if the adults who received the income do not complain) would not invalidate the right of the trustee to make such a choice if he exercised his best discretion, as is here unquestioned.

Smith v. Smith (1876), 23 Ch. R. 114 (Ont CA)

A power in a will authorizing the trustees to "invest" certain proceeds was seen by the majority to authorize the purchase of some land adjoining a mill site owned by the estate on the ground that such acquisition in the view of the trustees was necessary in order to ensure the future profitable operation of the mill.

Archibald v. Hartley (1852), 21 L.J. Ch. 399

In finding that a will which empowered the trustees to keep the estate "invested at my decease in or upon any stocks, funds, or securities whatsoever yielding interest [and] to continue in the same state of investment so long as they shall think fit" did not permit the retention by the trustees of a bank deposit with country bankers, Kindersley V.C. stated (p. 400):

The money stands only upon the credit of the bankers or upon their solvency. Therefore, in fact, there is no security taken. It is true that the money yields interest, but that does not make it a security. It is personal estate due from the bankers, yielding interest, but not personal estate invested on any security. The term 'investment' implies investment for a given term, but that cannot be applied to a balance in the bankers' hands, using it in a technical or popular sense.

Administrative Policy

2012 Ruling 2011-0429611R3 - Variation of Trust Indenture

underline;">: Overview. An open end (as described in s. 108(2)(a)) mutual fund trust (the Trust), whose units (the Units) trade on an exchange, wishes to qualify as a closed-end mutual fund trust under s. 108(2)(b), in order that it can issue (non-retractable) "Preferred Units."

Voting Units

In addition to its ordinary Units, Trust is authorized to issue Special Voting Units which do not have any legal or beneficial interest in the assets of Trust but which carry one vote each. They can only be issued in connection with the issuance of Exchangeable Securities, and none currently are outstanding.

Subsidiaries

Trust is the sole limited partner of Limited Partnership and Limited Partnership 2. Limited Partnership is the sole shareholder of USCo, which has issued preferred shares in connection with electing to be a [REIT]. The fair market value of Trust's investments (directly or through the Limited Partnerships) in any one corporation or debtor does not exceed X% of its assets, and from time to time it lends to Limited Partnership The amount of such loans will not exceed X% of its assets.

Proposed transactions

Although redacted, apparently Trust is amending its Unit terms to make them non-retractable and is eliminating the Special Voting Units from what it is authorized to issue – as well as authorizing the issuance of the Preferred Units. "The purpose of removing the Special Voting Units is to ensure that Trust can satisfy the criteria under subparagraph 108(2)(b)(vi) of the Act."

Opinions

- For purposes of s. 108(2)(b)(iii) and (v): Trust's pro rata share of each property held by the Limited Partnerships shall be treated as held by Trust; and Limited Partnership interests held by Trust, and any loans to them, shall be disregarded;

- Trust's income from its Limited Partnership interests shall be treated as though derived from, or from the disposition of, the partnership property treated as held by Trust by virtue of 1. above.

- Trust would fail to satisfy s. 108(2)(b)(v) were it to loan more than 10% of its property to a Limited Partnership.

See also summaries under s. 248(1) - disposition and s. 104(7.1).

2012 Ruling 2011-0410181R3 - Variation of trust indenture

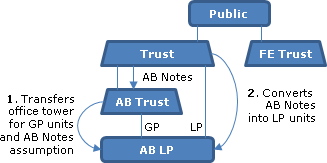

An open-end (as described in s. 108(2)(a)) mutual fund trust (the Trust), whose units (the Units) trade on a stapled basis with a second open-end mutual fund trust (FE Trust), wishes to qualify as a closed-end mutual fund trust under s. 108(2)(b), in order that it can issue (non-retractable) preferred units (see summary under s. 104(7.1)).

The Trust holds promissory notes (the AB Trust Notes) and all the units of AB Trust, which beneficially owns a fully preleased head office complex (the AB Property). The amount of the AB Trust Notes would cause the Trust not to comply with the 10% limitation in s. 108(2)(b)(v).

Accordingly, AB Trust will transfer the AB Property (utilizing the s. 97(2) rollover) to an LP (AB LP) formed by it (as general partner) and the Trust (as limited partner), in consideration for the issuance of GP units and the assumption of the AB Trust Notes, which then will be repaid by AB LP by way of set-off against the subscription price by the Trust for LP units.

Opinions that:

- for purpose of ss. 108(2)(b)(iii) and (v), the Trust's pro rata share of each property held by AB LP shall be treated as held by Trust, and its units of AB LP shall be disregarded; and

- that for the purposes of s. 108(2)(b)(iv), the Trust's income from its interest in AB LP shall be treated as though derived from (or from the disposition of) the partnership property treated (as per above) as held by the Trust.

15 April 2003 T.I. 2002-016767

A mutual fund trust that is not engaged in the business of lending money or guaranteeing loans will not violate the requirements of s. 108(2)(b) and subsection 132(6) of the Act merely by guaranteeing a loan that is contracted by a subsidiary. However, the payment of a fee by the subsidiary with respect to the guarantee might taint the trust.

17 March 2003 T.I. 2001-0095675

Except where a limited partnership interest is a marketable security, the Act will look through a limited partnership to the assets held by the limited partnership in determining whether the 80% test has been met; and the income received by the trust from the limited partnership interest would represent qualifying income for purposes of the 95% test only to the extent that the income allocated on the partnership interest was derived from, or from the disposition of, property described in s. 108(2)(b)(iii) unless the partnership interest was a marketable security. The limited partnership also will be looked through for the purpose of determining whether 10% of the trust's property consisted of securities of any one corporation or debtor.

Where a loan was made to the limited partnership that qualified as a security for purposes of s. 108(2)(b)(v), CCRA would both require that the loan not represent in excess of 10% of the property of the trust (on the basis that under s. 12(1) of the Limited Partnerships Act (Ontario), a limited partnership may for specified purposes be a debtor of a limited partner) and that, on a look through basis, not more than 10% of the trust's property would consist of bonds, securities or shares of any one corporation or debtor.

2001 Ruling 2001 007569 [parking lots]

The operation of parking lots by a REIT will be part of the leasing and managing of its real properties and, therefore, will satisfy the requirements of s. 108(2)(b).

2000 Ruling 2000-002834 -

It had been accepted in a previous ruling that the holding of each of a number of foreign incorporated businesses through a separate Canadian holding company would thereby avoid exceeding the 10% threshold in s. 108(2)(b)(v). The amendment approved the transfer by the Canadian holding companies to a newly-incorporated foreign holding company of all the shares of the foreign companies, so that the resulting structure entailed a series of Canadian holding companies all holding shares of one foreign holding company which, in turn, held the different U.S. operating companies.

12 March 1997 TI 964172

Special warrants are not considered marketable securities.

1997 Ruling 972615 [tests applied cost amounts]

80% and 10% tests were implicitly treated as being based on relative cost amounts.

5 February 1990 TI 5-9434 [bank deposits as cash]

"Cash" for purposes of s. 108(2)(b)(iii) includes bank deposits.

26 January 1994 T.I. 5-940116

In response to a question on whether a foreign exchange forward contract would be considered to be a marketable security, RC indicated that such a determination is a question of fact and that "generally, a particular investment could be considered a marketable security if it can be converted readily into cash and it can easily be traded because a ready group of buyers exists and there is no legal or other impediments to its sale."

13 December 1991 T.I. (Tax Window, No. 11, p. 6, ¶1538)

The activity of buying commodity futures contracts long or short is considered to be investing; and unit trusts which comply with the redemption conditions imposed by the applicable provincial securities commission generally will be considered to satisfy the requirements for a redemption under s. 108(2)(a)(i).

19 April 1990 T.I. (September 1990 Access Letter, ¶1444)

The lending of qualified securities pursuant to a securities lending arrangement as defined in s. 260(1) constitutes an undertaking that is investing of funds of the trust.

6 July 1989 TI 5-8243 [hedging contracts as marketable securities/use of costs rather than FMV]

"We have taken the position that a unit trust may, depending upon the facts, enter into certain hedging contracts on foreign currencies in order to protect that trust from significant fluctuations in such currencies. In such cases, the hedging contracts could be regarded as marketable securities for purposes of subparagraph 108(2)(b)(iii) of the Act.

Further, in determining the percentage 'of its property' for the purposes of paragraph 108(2)(b)(iii) of the Act, it is our view that the 'cost' should normally be used as the unit of measurement. The trust could use 'market' if it so wished provided that it can show it qualified on this basis throughout the taxation year, and that it also used 'market' in respect of the determination under subparagraph 108(2)(b)(v) of the Act."

Articles

Richards, "Real Estate Investment Trust: New Opportunities", Canadian Current Tax, July 1994, p. J. 57.

Brussa, "Creative Use of Mutual Fund Trusts and Royalty Interest as Financing Vehicles", Canadian Petroleum Tax Journal, Spring 1988, p. 35.

K.A. Lahey, "The Taxation of Securities Transactions - II: Recent Legislation", 1980 McGill Law Journal, pp. 46-81, p. 73

Discussion of the meaning of the term "security".

Subsection 108(3) - Income of a trust in certain provisions

See Also

Re Lotzkar (1985), 17 DLR (4th) 539 (BCCA)

Lambert, J.A. stated: "The question of how net income is to be calculated, for a devise of net income, depends, first, on the intention of the devisor, and, if that is not different from accepted methods of determining net income, in accordance with legal and accounting practices, then under those accepted methods."

Carver v. Duncan; Bosanquet v. Allen, [1985] BTC 248 (HL)

Although a settlor may provide that capital expenses shall or may be paid out of income, the settlor cannot alter the capital nature of those expenses. "Similarly, a settlor cannot alter the nature of an income expense by authorizing or directing the trustees to pay that expense out of capital."

Administrative Policy

26 April 2001 T.I. 2001-007684

General discussion.

Subsection 108(5) - Interpretation

Paragraph 108(5)(a)

See Also

Gilhooly v. MNR, [1945] CTC 203 (Ex Ct)

Trust amounts received by the taxpayer that had originated from mining operations were income "derived from" mining. [See also Kemp v. MNR, [1947] CTC 343, 3 DTC 1078]

Archer-Shee v. Baker (1927), 11 TC 749 (HL)

The taxpayer, who under the will of her father was the sole life tenant of the estate, contended that she was taxable in respect of securities held by the trustees in the United States, under Case V, Rule 2, which imposed tax in respect of "possessions out of the United Kingdom, other than stocks, shares or rents" on "the full amount of the actual sums annual receipt in the United Kingdom", rather under Case V, Rule 1, which imposed tax in respect of "stocks, shares or rents in any place out of the United Kingdom" on the income thereon.

It was found that in light of the fact that the estate had been fully administered and that the taxpayer had an equitable right in possession to receive during her life the proceeds of the shares and stocks of which she was tenant for life, she was taxable under Rule 1.

Subsection 108(7) - Interests acquired for consideration

Administrative Policy

11 June 2015 T.I. 2014-0522641E5 F - Usufruct

A father, who has carried on a farming business for a number of years, grants the bare ownership of the property for consideration to his son while retaining rights as the usufructuary. He continues to exploit the farm land and the, subsequently transfers his rights as usfructuary to his son for a stipulated sum. Is the usufruct a personal trust in light of s. 108(7), so that s. 107(2) applies on the termination of such trust?

After noting that under s. 248(3)(a) "the property which is transferred to the son is an interest in a deemed trust," CRA stated (TaxInterpretations translation):

By reason of the consideration which the bare owner must pay to the Usufruct Originator [father], the trust is not a personal trust. Subparagraph (b)(ii) of the definition of personal trust in subsection 248(1) indicates, among other things, that a personal trust is an inter vivos trust in which no beneficial interest was acquired for consideration payable directly or indirectly to any person who has made a contribution to the trust by way of transfer, assignment or other disposition of property. Furthermore, as the bare owner did not transfer, assign or dispose of any property to the deemed trust, we are of the view that paragraph 108(7)(b) cannot apply to deem the beneficial interest of the bare owner to have been acquired for nil consideration.

…[T]he termination of the rights of usufructuary and bare owner trigger the end of the usufruct and, consequently, the end of the trust. There therefore is a disposition of the property held by the trust in favour of the bare owner which results in the application of subsection 107(2.1).

See summaries under s. 73(3) and s. 110.6(1) – qualified farm or fishing property.

19 September 2014 Folio S6-F2-C1

1.3 Sometimes a person who contributes property to a personal trust, is also a beneficiary of the trust. In such situations, subsection 108(7) provides that the person will be deemed not to have acquired their interest in the trust for consideration provided that all other beneficial interests in the trust that were acquired by way of a transfer, assignment, or other disposition of property to the trust, were acquired by persons related to that person. For example, where a husband and wife contribute property to a trust of which the husband, wife and their children are beneficiaries, their interests are deemed not to have been acquired for consideration. However, if a trust is established by contributions from two or more unrelated persons and those unrelated persons are beneficiaries of the trust, their respective interests in the trust would be considered to have been acquired for consideration.

7 January 2004 T.I. 2003-001953

If a trust is established by contributions from two or more unrelated persons and those unrelated persons are beneficiaries of the trust, their respective interests in the trust would be considered to have been acquired for consideration.