Subsection 103(1) - Agreement to share income, etc., so as to reduce or postpone tax otherwise payable

Cases

Signum Communications Inc. v. The Queen, 88 DTC 6427, [1988] 2 CTC 239 (FCTD)

S.103 did not apply to limit a limited partner's share of partnership losses to the amount of capital invested by him. "[W]hen there is a rational, reasonable and normal formula employed in the allocation of the losses, as there was in this case where they were allocated in proportion to the capital contributed, there are no grounds on which the Minister can invoke the provisions of section 103."

See Also

Stephen Stow v. The Queen, 2010 TCC 406, 2010 DTC 1275 [at 3916] .

The taxpayer bought an 80% share of a partnership from his wife's business corporation for $1 million and then reported 80% of the partnership's $7.5 million loss. The minister disputed the loss under ss. 103(1) and (1.1).

Subsection 103(1) applies to agreements where apportionment of income or loss is distorted for tax purposes. There was no such distortion here - the $1 million the taxpayer paid represented 80% of the partnership at the time of purchase, so he was entitled to claim 80% of the loss.

Jones Development Corp. v. The Queen, 2009 DTC 1452, 2009 DTC 1266

Capital gains realized by a partnership, of which the taxpayer was a partner, as a result of land being disposed of by the partnership which had a low cost amount attributable to the partnership acquiring the land from other taxpayers on a rollover basis were not allocable to the taxpayer in light of a clause in the Partnership Agreement that provided that all tax consequences of the transfer of the land to the partnership by a partner were the sole responsibility of that partner.

Penn West Petroleum Ltd. v. The Queen, 2007 DTC 715, 2007 TCC 190

In order to accomplish a sale of two oil and gas properties that were held by a partnership of which the taxpayer was a substantial partner, it was agreed that the purchaser ("Phillip") would become a 5.27% partner of the partnership and, some days later, receive a distribution to it of the two properties in substantial satisfaction of its partnership interest and, pursuant to a clause in the partnership agreement that was amended with this transaction in mind, be allocated 100% of the proceeds of disposition arising under subsection 98(2) to the partnership as a result of the resulting disposition of the two properties (as well as its 5.27% share of the partnership income for the 25 days that it was a member of the partnership).

After "tentatively" indicating his view that partnership income for purposes of section 103 meant income computed using the rules of the Act, so that such income included notional items of income such as deemed proceeds of disposition arising under subsection 98(2), Bowman C.J. went on to find that the allocation of 100% of the proceeds of disposition to Phillips was unreasonable given that the gain on the transferred properties was not attributable to Phillips having rolled assets into the partnership, it was only entitled to 5.27% of the other income of the partnership and it merely joined the partnership (for 25 days) in order to extract the two properties.

XCo Investments Ltd. v. The Queen, 2005 DTC 1731, 2005 TCC 655

A partnership owned by the taxpayers admitted a third party ("Woodward") as a member of the -partnership with a view to selling an apartment building of the partnership and allocating 80% of the resulting gain for tax purposes to Woodward with Woodward also receiving 80% of the net proceeds of sale of the property (which was to be a substantiated lower amount due to the leveraging of the property) and would cease to be a partner.

The allocation of 80% of the income to Woodward was found to be unreasonable given that "Woodwards' contribution was both ephemeral and for all practical purposes risk free". The reasonable treatment of the arrangement under s. 103 would be to treat Woodward's share of the income as the amount of income it actually received.

MacKinlay v. Arthur Young McClelland Moores & Co., [1989] S.TC 898 (HL)

In discussing the nature of a partnership, Lord Oliver stated (p. 900):

"A partner working in the business or undertaking of the partnership is in a very different position from an employee ... If, with the agreement of his partners, he pays himself a 'salary', this merely means that he receives an additional part of the profits before they fall to be divided between the partners in the appropriate proportions. But the 'salary' remains part of the profits."

Administrative Policy

28 October 2014 Memorandum 2014-0529981I7 - Allocation of partnership loss to a former partner

The Taxpayer entered into the "Purchase Agreement" for the purchase of a limited partnership (the "Partnership") with substantial current losses from its partners, principally the "Trust" holding essentially all the LP units. The TSO reduced the Partnership loss allocated at year end to the Taxpayer by allocating a pro rata portion of the loss (based on the days in the year up to the sale) to the Trust.

In finding that this approach was not justified by s. 103(1) or (1.1), the Directorate quoted with approval a statement at the 1985 CTF Annual Roundtable that "the income or loss of any partner for income tax purposes in respect of a particular year of partnership operations will be his share of the partnership's income or loss allocated to him pursuant to the partnership agreement, notwithstanding the fact that he may not have been a partner throughout the whole of the fiscal period of the partnership," and then stated:

the allocation made to the Taxpayer for the fiscal year in question does not appear to be unreasonable in the circumstances as the Taxpayer continued to be a partner in the Partnership in subsequent years.

2 December 2014 CTF Roundtable, Q5

Does CRA accept the streaming of certain types of income (e.g., interest income) to a particular partner of a partnership where the partnership agreement so provides? CRA responded:

[T]he streaming of certain types of income to a particular partner is not acceptable by virtue of subsection 103(1). [For] example…[a]ssume a partnership is made up of two corporate members. One partner (Partner A) expects to incur losses in excess of its income from the partnership. The second partner (Partner B) expects to earn income from partnership as well as from sources other than the partnership. Partner A and B agree to amend the partnership agreement so that the interest income of the partnership will be allocated to Partner A and the dividend income will be allocated to the Partner B. The dividend income is deductible under subsection 112(1). …

The CRA would seek to apply subsection 103(1) (and may also apply the general anti-avoidance rules…) to the allocation of income under the amended partnership agreement.

10 March 2014 Memorandum 2013-0493971I7 F - Application of section 120.4

X "split" his professional income with a limited liability partnership (SENCRL) of which one of the partners was a trust for the benefit of related minors. After finding that the pre-2014 version of the split income rules in s. 120.4 did not apply in this situation, CRA went on to paraphrase s. 103(1) and state (TaxInterpretations translation):

This could be the basis of an argument given that there do not appear to be valid reasons for the effecting of this structure other than income-splitting.

After also noting that s. 103(1.1) might apply, CRA then stated

the GAAR should not be applied in this case, as subsections 103(1) and (1.1) are of sufficient breadth to override the income-sharing terms agreed between the partners and [SENCRL].

2012 Ruling 2011-0421261R3 - Partnership Allocation

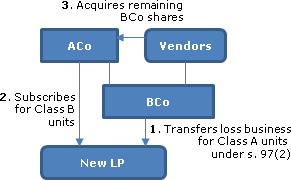

A majority of the shares of BCo (a taxable Canadian corporation) are held by ACo (also a taxable Canadian corporation), while the balance of the shares of BCo are held by arm's length shareholders (the Vendors) with ACo or persons who are related to ACo being obligated to acquire all of the Vendors' shares over a specified period. BCo currently is unprofitable and ACo has been funding it with loans, and the business requires further funding until it becomes profitable.

BCo will transfer its business on a rollover basis to a newly formed subsidiary limited partnership (New LP) in consideration for the assumption of liabilities and the issuance of Class A units; and ACo will fund New LP from time to time in consideration for the issuance of Class B units (which are not described in the letter to have much difference from the Class A units – including equal per-unit allocations of income or loss - except as described below) at a subscription price equal to a valuation of the NAV per Class A unit and Class B unit.

The limited partnership agreement provides that after distributions of accumulated income which have been allocated proportionately to the number of units held

any further distributions may then be credited by the general partner to the capital account of each partner as a return of capital, at the discretion of the general partner.

When BCo becomes a wholly-owned subsidiary of ACo, it may be wound-up into ACo or amalgamated with it.

Ruling that s. 103(1) or (1.1) will not apply.

2011 Memorandum 2011-0422791I7

CRA continues to accept that where a partner has contributed knowledge or know-how to the partnership rather than making a financial contribution, the value of that knowledge or contribution should be taken into account in determining the partner's share of partnership profits.

10 October 2006 Memorandum 2006-016905

Adverse comments on a situation where all the income allocable to one of the two partners of a resource partnership comprised income purportedly attributable to a particular property of the partnership (in order to maximize deduction by that partner of its successored pools).

Income Tax Technical News, No. 30, 21 May 2004

Although there is no impediment to the creation of partnership interests that carry different entitlements to share in the income or other attributes of the partnership, the sharing of these tax attributes is subject to section 103.

25 March 1997 T.I. 963490

The use of a services partnership (the members of which includes inter vivos trusts for the benefit of members of the families of various members of the professional firm) to provide non-professional services to a professional firm may be acceptable, although the examination of a actual arrangement would be necessary to determine whether there is an avoidance of s. 103 of the Act.

2 August 1995 Memorandum 7-951344

S.103(1) or (1.1) likely would apply where a corporation that was carrying on an R&D project formed a general partnership, transferred its assets to the partnership under s. 97(2), the other members of the partnership contributed capital by way of cash and services to finance completion of the project, and losses of the partnership were allocated to all the partners except the corporation until such time as the aggregate losses allocated to the other partners equalled their capital contributions.

Rulings Directorate Discussion and Position Paper on Motion Picture Films and Video Tapes as Tax Shelters, Version 29/3/93 930501 (C.T.O. "Motion Picture Films - C.C.A.")

"Revenue Canada could argue that it is not reasonable to allocate to the limited partners the losses referable to the partnership property for the payout, and in effect, treat the limited partners as owners of the property in that period, when they cease to have any substantial equity interest in the property after payout. This argument would be more persuasive if the sharing of income and losses was changed after payout to provide that the limited partners were entitled to only, say, a 1% interest in the profits and losses of the partnership. However, the more sophisticated agreements provide that the limited partners will share pro rata following the payout of the creditor/partner."

92 C.R. - Q.13

Whether or not a partnership is used for estate-freezing purposes, the allocation of income should recognize the partners' respective capital and non-monetary contributions; otherwise s. 103(1) or (1.1) may apply.

30 November 1991 Round Table (4M0462), Q. 6.1 - Contribution of Knowledge vs. Financial Contribution (C.T.O. September 1994)

A payment made, or a credit made to a partner's 'capital' account, in consideration of its commitment to perform work for the partnership will be considered to be business income for the partner. The Department agrees that the value of the partner's knowledge or know-how should be taken into account in determining the partner's share of the partnership profits.

91 C.R. - Q.4

One of the considerations in determining the reasonableness of profit allocation is any personal use by a partner of partnership property.

17 July 1991 T.I. (Tax Window, No. 6, p. 14, ¶1356)

A minimum return on capital paid to a partner may be considered interest income of the partner even though no deduction is available to the partnership.

Where two partners in a partnership each contribute capital at a minimum rate or a return on capital is paid to only one partner, s. 103 potentially can apply.

90 C.P.T.J. - Q.8

Generally partnership agreements provide for the sharing of profits and losses on the same basis from year to year, and any deviation from this pattern should be supported by valid reasons.

88 C.R. - Q.18

RC will not ordinarily apply s. 103 to challenge an allocation where it is clear that the profits and losses of the partnership are determined solely by open market forces and the allocation to each partner is based on the change in unit value during the period an investor is a partner.

79 C.R. - Q.36

Generally, partnership agreements provide for the sharing of profits and losses on the same basis, and a deviation from this pattern should be supported by valid reasons.

IT-338R, para. 4

RC generally will accept the sharing of profits and losses on a basis which takes into account that one of the partners received his partnership interest in consideration for a "rolling in" of property under s. 97(2).

IT-138R "Computation and Flow-through of Partnership Income"

Salaries paid by a partnership to its members are a method of distributing partnership income. Such distributions are to be allocated as taxable income to the recipient even where doing so results in a taxable loss.

Subsection 103(1.1) - Agreement to share income, etc., in unreasonable proportions

Cases

Fillion v. The Queen, 2004 DTC 6579, 2004 FCA 135

There was no patently unreasonable error in the finding of the Tax Court judge that the individual taxpayer had income of the partnership allocated to him, his wife and two teenage sons on the basis of the minimization of tax burden without objective reference the respective contributions of the family members, so that the Minister's reassessment under s. 103(1.1) was properly affirmed.

See Also

Paajanen v. The Queen, 2011 DTC 1229 [at 1333], 2011 TCC 310

The taxpayers were a married couple. Mrs. Paajanen ran a retail business, and formed a partnership with her sister, whose husband had died and who was facing financial hardship. While Mrs. Paajanen and her sister contributed equal labour to the business, Mrs. Paajanen took only around 15% of the partnership income in many taxation years, and as little as 6.5% in one of the years under review. Mr. Paajanen claimed personal credits based on his wife's reported income. Woods J. allowed the credits, stating that "it would be wrong in my view to state as a general principle that allocations between non-arm's length partners must always be based solely on business criteria." She determined (at para. 24):

In this case, the agreement between Mrs. Paajanen and Mrs. Andet to share income unequally was not at all motivated by tax considerations. There was a modest tax saving to Mr. Paajanen with respect to personal credits, about $1000 per year. It does not make sense that this factor influenced the partners' agreement to share income unequally.

Stephen Stow v. The Queen, 2010 TCC 406, 2010 DTC 1275 [at 3916] .

The taxpayer bought an 80% share of a partnership from his wife's business corporation for $1 million and then reported 80% of the partnership's $7.5 million loss. The minister disputed the loss under ss. 103(1) and (1.1).

Subsection s. 103(1.1) did not apply. The subsection non-exhaustively lists two indicia of reasonableness - capital invested and work performed. The members' respective investment and work supported the 80% allocation to the taxpayer. It was irrelevant that the taxpayer's purchase of the partnership interest was partially motivated by claiming the loss.

Krauss v. The Queen, 2009 DTC 1394 [at 2155], 2009 TCC 597

The taxpayer and her son transferred real estate on a rollover basis to a partnership in consideration for Class A units of the partnership having a redemption value, subject to a price adjustment clause, of approximately $1.25 million for each of them. Several days later, the partnership issued Class C units to a family trust for consideration of $100. In the following taxation year, the partnership earned approximately $343,000, of which approximately $127,000 was allocated to the family trust in respect of the Class C units.

McArthur, J. stated (at para. 58) that:

"To the extent an estate freeze can be effected through a corporate vehicle, if the same economics can be replicated through a partnership, ... an estate freeze could be effected through a partnership."

However, he went on to find that the above transaction did not replicate an acceptable estate freeze transaction as the Class A units were not retractable by their holders and were required to fund ongoing cash requirements in respect of the partnership properties. Furthermore, it was patently unreasonable for the family trust to receive a 126,721% return on its nominal capital investment given that the trust did not make any contribution of services or (more than nominal) capital to the partnership.

Fraser v. The Queen, 97 DTC 1305 (TCC)

The taxpayer borrowed $707,000 from a bank, contributed this sum to a partnership between her, her husband and her sister (but without any increase to the number of units in the partnership held by her), with her sister then withdrawing the same sum from the partnership in order to make a matrimonial settlement with the sister's husband. It was reasonable for the partnership to make special allocations of cash and income to the taxpayer equal to the interest on her loan given that the purpose for her borrowing and contribution of the $707,000 was to facilitate carrying on the partnership business by avoiding lengthy litigation from her sister's estranged husband.

Archbold v. The Queen, [1995] 1 CTC 2872 (TCC)

A partnership between the taxpayer and his wife provided that she was to receive a commission equal to 10% of sales, and 30% of residual profits, with the taxpayer to receive 70% of residual profits and to bear all losses of the partnership. Lamarre Proulx TCJ. accepted the Minister's view that the losses of the partnership instead should be shared for income tax purposes on a 50-50 basis in light of the taxpayer's admission that he would not have entered into the same agreement if he had been directed by business reasons and had been dealing at arm's length, and taking into account that all the capital of the partnership had been provided by the taxpayer. However, the partnership was permitted to deduct the amounts paid to the wife as salary in the computation of its income.

Administrative Policy

10 March 2014 Memorandum 2013-0493971I7 F - Application of section 120.4

X "split" his professional income with a limited liability partnership (SENCRL) of which one of the partners was a trust for the benefit of related minors. After finding that the pre-2014 version of the split income rules in s. 120.4 did not apply in this situation, CRA noted that s. 103(1) could apply, paraphrased s. 103(1.1) and stated (TaxInterpretations translation):

[A]n argument could be made…that the agreed sharing is not reasonable because it does not take into account that that one of the partners, namely the corporation, has taken on all the expenses of the exercise of the profession of around $XX per annum. … [I]t would be appropriate to obtain further facts to support this position. …

[T]he GAAR should not be applied in this case, as subsections 103(1) and (1.1) are of sufficient breadth to override the income-sharing terms agreed between the partners and [SENCRL].

5 October 2012 APFF Round Table, Q. 7, 2012-0454001C6 F [relative partner contribution]: CRA was asked whether, in the determination of the reasonableness of income allocated to one of the partners of a partnership, CRA considers that the importance of the work accomplished by a partner in connection with partnership activities depends on the number of employees of the partnership (with a higher number reducing the relative value of the work effected by the partner). CRA stated (TaxInterpretations translation):

...the number of employees of a partnership is not necessarily a relevant factor in the context of this determination. In effect, we believe that it is preferable to examine the contribution of each partner in the light of the contribution of the other partners in order to determine if the income or losses which are attributed to the partner are reasonable.

80 C.R. - Q.40

RC will challenge income allocation where one spouse neither actively engages in or invests his or her property in the partnership business.